Black Sesame Technologies' 2025 H1 Financial Report: Navigating Profitability Challenges Amidst Growth

![]() 09/01 2025

09/01 2025

![]() 771

771

Produced by ZhiNengZhiXin

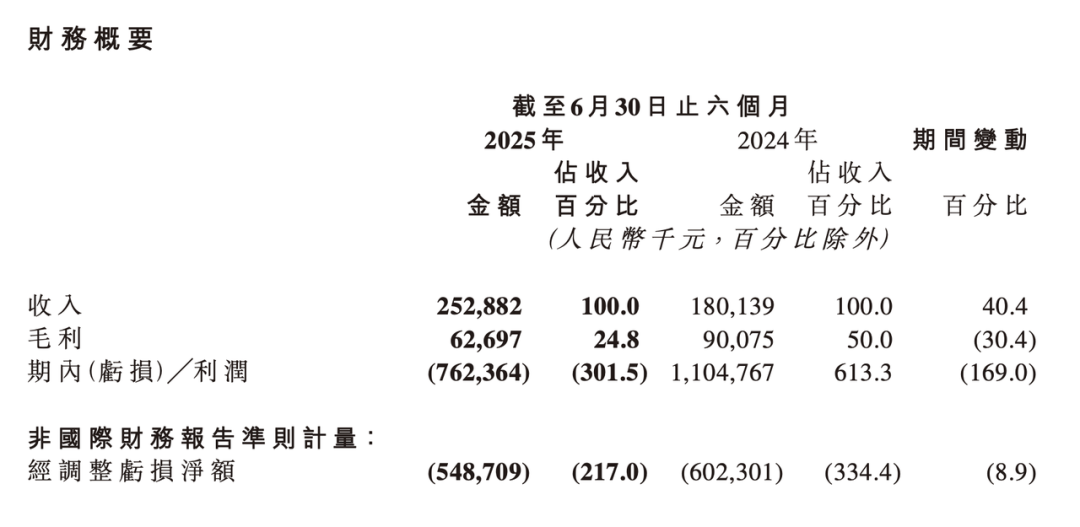

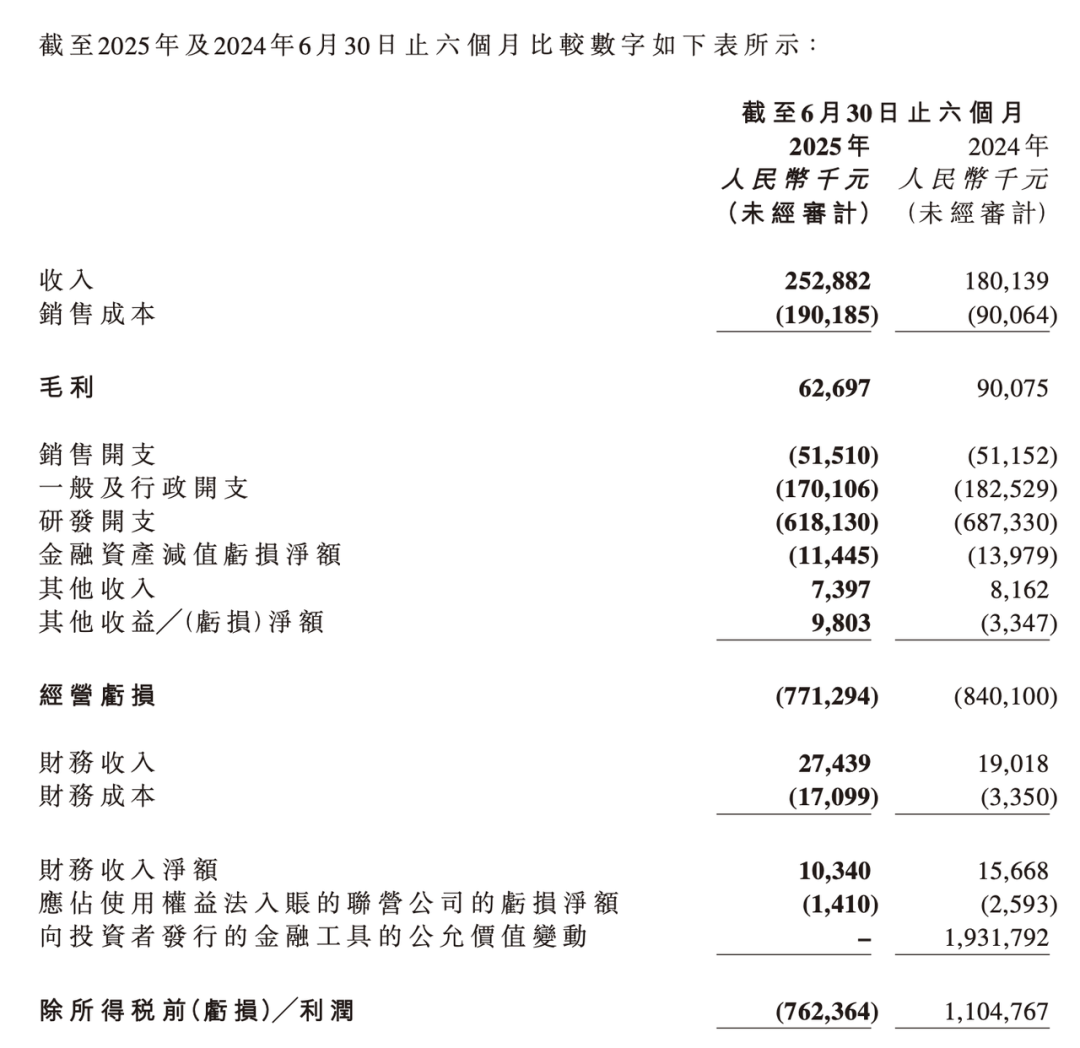

In the first half of 2025, Black Sesame Technologies achieved revenue of RMB 253 million, marking a 40.4% year-on-year increase. This underscores the company's continued growth momentum in the automotive intelligent driving chip industry, along with notable breakthroughs in domestic and international designated projects.

From the financial data, the profitability landscape presents a mixed picture:

◎ Gross profit declined to RMB 62.7 million, a 30.4% year-on-year drop.

◎ Period losses widened to RMB 762 million, with an adjusted net loss of RMB 549 million.

The interplay of high R&D expenditures (RMB 618 million) and continuous business expansion has accentuated the tension between revenue growth and profitability.

Part 1: Financial Data Analysis and Breakdown of Black Sesame Technologies

From a revenue standpoint, Black Sesame Technologies has sustained its rapid expansion trajectory.

Revenue for the first half of 2025 reached RMB 253 million, a 40.4% surge from the corresponding period last year. This growth is attributed to deepened collaborations with mainstream automakers such as Geely, BYD, Dongfeng, and FAW, mass production shipments of the A1000 series chips, and advancements in testing and deployment of the C1200 series chips.

The record number of new overseas designated projects has laid a solid foundation for the company's further international expansion. The rapid revenue growth mirrors the industry's recognition of the company and the accelerating pace of high-order assisted driving chips entering mass production.

However, this revenue growth has not translated into improved profitability.

In the first half of the year, the company's gross profit stood at RMB 62.7 million, a 30.4% year-on-year decrease, with a significant drop in gross margin. The chip industry generally faces pricing pressures. In collaborations with automakers, Black Sesame Technologies has to secure project designations through more competitive pricing and flexible delivery methods, temporarily compressing gross margin space.

The widening period losses further highlight the cost pressures.

In the first half of 2025, the company incurred a net loss of RMB 762 million, a stark contrast to the profit of RMB 1.1 billion recorded in the same period last year. The adjusted net loss was RMB 549 million, which, though narrowed by 8.9% from the RMB 600 million in the previous year's corresponding period, remains at a high level.

The root cause of these losses lies in the high R&D expenses, which totaled RMB 618 million in the first half of the year, exceeding revenue by more than double.

This ratio underscores the company's long-term commitment to R&D but also signals a severe dilution of short-term profitability.

Sales expenses amounted to RMB 51.51 million, while general and administrative expenses reached RMB 170 million, summing up to over RMB 220 million. Coupled with R&D expenditures, the total expense scale significantly outstrips the revenue level, necessitating continuous capital investment to sustain business development. Self-sustaining profitability has yet to be achieved.

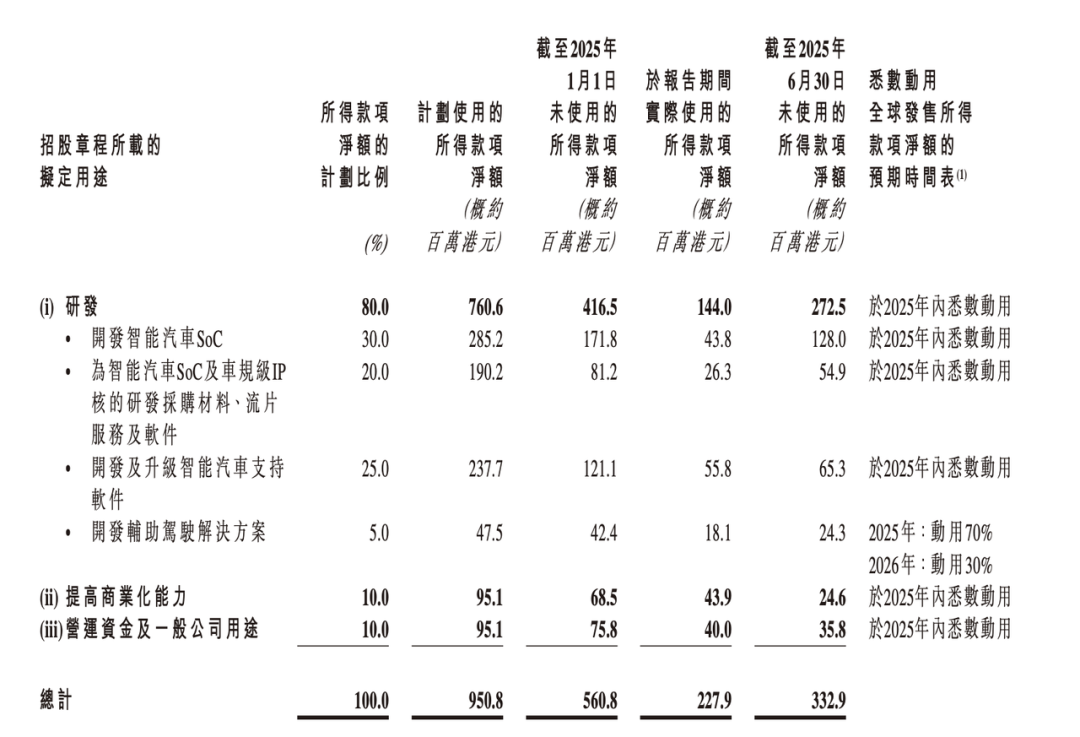

Cash flow and capital reserves remain relatively stable.

As of June 30, 2025, Black Sesame Technologies held cash and cash equivalents of RMB 1.966 billion, providing a cushion for maintaining R&D investment and market expansion in the near term. The company's financial strength also offers room for exploring new business avenues (such as robots and unmanned logistics vehicles) and facilitating acquisitions of low-power AI chip companies.

Part 2: Problems, Challenges, and Possible Solutions

Black Sesame Technologies' challenges stem from both the competitive industry landscape and the company's own expansion path and R&D investment strategy.

◎ Insufficient profitability is a pressing issue for the company.

Despite maintaining rapid revenue growth, the high proportion of R&D and operating expenses persistently pressures profitability. In the realm of intelligent driving chips, continuous R&D investment is almost indispensable, necessitating a balance between the breadth and depth of R&D. This involves maintaining core competitive R&D while moderately controlling investments in non-core projects to ensure resources are concentrated on product lines with the greatest commercialization potential.

◎ The decline in gross margins highlights pricing pressures and a competitive environment.

With competitors like Huawei Hisilicon, Horizon Robotics, NVIDIA, and subsequent self-developed chips from Momenta, automakers hold considerable bargaining power in the procurement process.

Black Sesame Technologies often trades prices for designations and mass production experience, limiting profit margins. To enhance bargaining power, products must excel with differentiated solutions and system-level offerings. For instance, in the C1200 and A2000 series chips, providing not just hardware but also a comprehensive software tool chain and security architecture can bolster customer loyalty and avoid pure price competition.

◎ The uncertainty of new business expansion poses challenges.

Actively entering cross-scenario applications such as robots, unmanned logistics vehicles, and smart imaging has broadened the company's commercialization horizons. However, these markets are still nascent, characterized by limited economies of scale and immature profit models. If these related businesses fail to generate stable revenue in the short term, it will exacerbate the company's capital consumption pressures.

Summary

Black Sesame Technologies' 2025 H1 financial report reveals a story of rapid revenue growth, smooth customer expansion, and accelerated product mass production, recognized for its technological and market prowess in the intelligent driving chip field. However, declining gross margins, widening losses, and excessive R&D investment point to an immature profit model and a pronounced contradiction between expansion and investment.