Unitree's IPO: A Dawn for Primary Markets and a New Benchmark for Secondary Markets

![]() 09/03 2025

09/03 2025

![]() 512

512

Unitree Technology's substantial revenues and years of profitability have significantly impacted the growth of the humanoid robot market. Furthermore, the IPO itself serves as a catalyst for the primary market, signaling exit opportunities and potentially expanding financing scales.

Editor: Di Xintong

Unitree continues to stir up excitement.

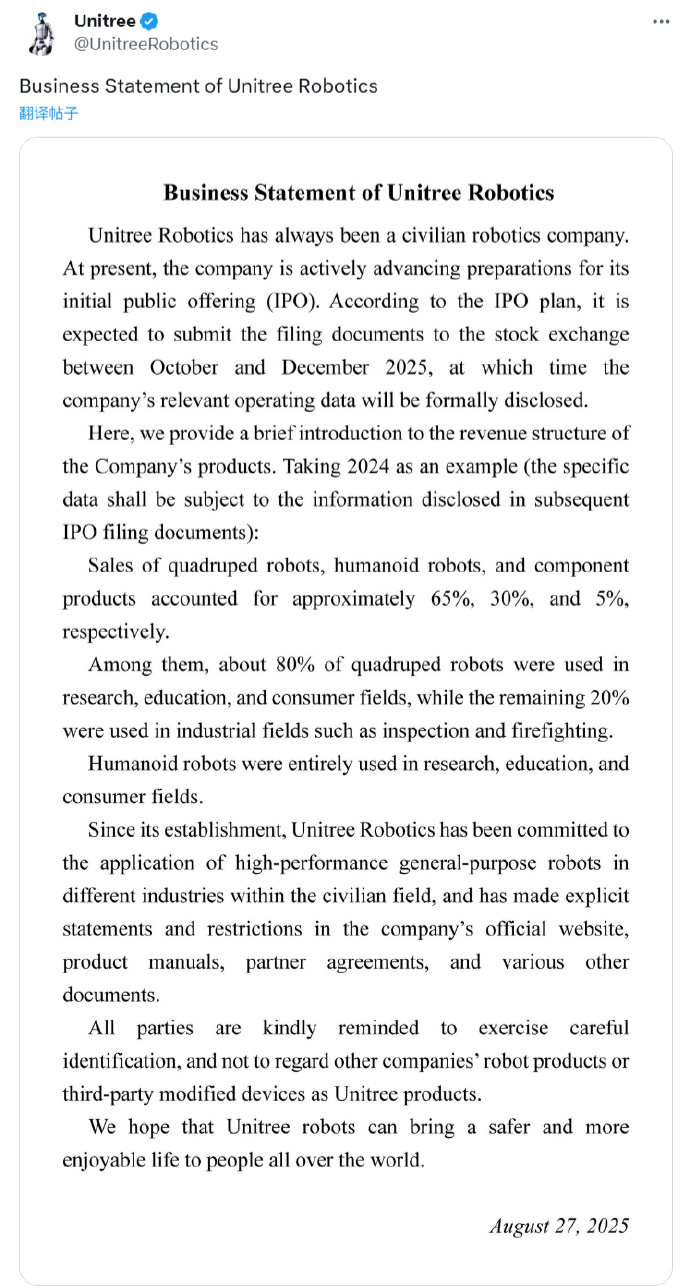

Recently, Unitree Technology officially announced its IPO progress on social media platforms, stating that it is actively preparing for its initial public offering (IPO) and expects to submit listing application documents to the stock exchange between October and December. In terms of valuation, Unitree Technology's post-investment valuation after its latest Series C funding round has reached RMB 12 billion.

Image source: Screenshot

Industry insiders expressed collective surprise at the news, stating that it was "faster than expected." Since Unitree Technology disclosed entering the tutoring period in July, the industry has been closely monitoring its timeline. While this timeline adheres to formal capital market processes, it still arrived sooner than anticipated.

An investor told the Embodied Learning Society, "Unitree Technology's IPO is good news for the industry in every aspect." They noted that Unitree's substantial revenues and consecutive years of profitability have significantly impacted the humanoid robot market. Additionally, the IPO itself acts as a boost for the primary market, signaling exit opportunities and potentially expanding financing scales.

With orders in hand, Unitree can prove that humanoid robots are commercial products rather than experimental items stuck in the proof-of-concept stage. It is anticipated that Unitree will replicate the 'Spring Festival Gala Effect' in the capital market, raising the overall value of the industry. This may be the best gift that Unitree Technology, which is expected to be the first to disclose its prospectus, can offer to the industry.

Consecutive profitability is the starting point; optimizing the revenue structure is the future.

In the announcement, Unitree Technology further disclosed revenue details. Taking 2024 as an example (specific data will be based on information disclosed in subsequent IPO filing documents): sales of quadruped robots, humanoid robots, and component products accounted for approximately 65%, 30%, and 5% of total sales, respectively.

In terms of scenario distribution, 80% of quadruped robot sales are concentrated in the scientific research, education, and consumer sectors, with the remaining 20% entering industrial scenarios such as inspection and firefighting, forming a dual-track layout of 'consumer + industrial.' Humanoid robots, on the other hand, are currently focused entirely on scientific research, education, and consumer fields, with no involvement in industrial or commercial scenarios, leaving room for business expansion.

Image source: Unitree Technology

Previously, multiple investors and the Embodied Learning Society revealed that Unitree Technology's revenue in 2024 was approximately RMB 400 million. Combining this data (note: specific information will be based on official IPO filing documents), it can be calculated that the revenue structure of its core products is clear: quadruped robots contributed RMB 260 million, humanoid robots achieved RMB 120 million, and component business revenue was RMB 20 million.

It is worth noting that Wang Xingxing, founder of Unitree Technology, has mentioned that 'revenue will exceed RMB 1 billion in 2025,' indicating that Unitree Technology is expected to double its revenue scale. From a market dynamics perspective, humanoid robots may be the driving force behind this growth.

Beyond the hundreds of millions in revenue, what is more noteworthy is Unitree Technology's profitability. According to Zhao Nan, an early investor, the company has maintained a profitable state for four consecutive years since 2020. Wallstreetcn exclusively revealed that Unitree's net profit in 2024 approached RMB 100 million. In the context of the robot industry generally facing high R&D investment and long profit cycles, Unitree Technology's profitability stands out, not only due to the high added value of its products and precise market positioning but also reflecting the company's maturity in cost control, supply chain management, and other operational aspects, laying a solid financial foundation for subsequent business expansion.

A deep analysis of the business structure reveals that Unitree Technology has firmly established its market base with quadruped robots. This product line not only serves as the core pillar with a revenue share of 65% but also encompasses 20% of industrial applications. Behind this data is a critical leap from 'technology verification' to 'practical implementation.'

For instance, its quadruped robots can replace humans in high-risk tasks such as high-voltage equipment inspection and line fault detection in power inspection scenarios. In firefighting scenarios, they can carry thermal imagers and gas sensors to enter the core area of the fire scene to transmit data. Such breakthroughs in industrial-grade applications not only enhance the commercial value of the products but also accumulate scenario experience for subsequent expansion into more vertical fields. Foreign media reported that Unitree Technology's quadruped robots have entered hydropower stations, refineries, and archaeological sites in 52 countries.

Although the humanoid robot business has not yet ventured into industrial fields, its 30% revenue share has already highlighted its strong 'technology monetization' capabilities. More noteworthy is the delivery scale: Unitree Technology's humanoid robot deliveries exceeded 1,500 units in 2024, a highly competitive figure in the current humanoid robot industry.

It is important to note that most peer companies still list 'delivery of 1,000 units' as a core goal for 2025. Unitree Technology has taken an early step in delivery capabilities, which not only demonstrates the stability of its supply chain but also reflects market recognition of its technology roadmap, accumulating a user base and data feedback for subsequent entry into commercial scenarios.

From a market position perspective, Unitree Technology has formed a significant monopoly advantage in the quadruped robot field. Data shows that its annual sales of quadruped robots reached 23,700 units in 2024, accounting for approximately 69.75% of the global market share, nearly occupying three-quarters of the global market. Among them, the cumulative shipment of the consumer-grade product G1 exceeded 50,000 units, accounting for more than 60% of the global consumer-grade legged robot market. This absolute market dominance can reduce production costs through economies of scale on the one hand and form technical barriers on the other, with a large amount of user data feeding back into product iterations, further widening the gap with competitors.

However, even with market advantages and profitability, consecutive profitability is only the starting point for Unitree Technology's development. From a long-term perspective, the current revenue structure that is overly dependent on quadruped robots (accounting for 65%) still poses hidden concerns: if future consumer market demand fluctuates, industrial scenario expansion falls short of expectations, or competitors achieve technological breakthroughs in the quadruped robot field, the company's revenue may face significant impacts, making it difficult to build a sustainable competitive advantage.

Therefore, optimizing the revenue structure and creating multiple growth engines have become critical tasks for Unitree Technology to advance to a higher stage.

Wang Xingxing aims to provide shareholders with an answer; who will be the beneficiaries?

Wang Xingxing recently stated that Unitree Technology views going public as a process of learning and growth. "I see going public as the college entrance exam, a phased marker for a company to move towards more mature management and operations." Additionally, Wang Xingxing emphasized that going public is an answer to Unitree's shareholders.

Unitree Technology was established in 2016, during a period when artificial intelligence had not yet been fully implemented and factory intelligence was still in progress. A robot dog project did not seem particularly attractive in commercial narratives, and its funding journey was fraught with difficulties.

The story's turning point came with a RMB 2 million investment from individual investor Yin Fangming, which helped Unitree Technology complete its angel round of funding, taking a 20% stake. Notably, Yin Fangming was the only individual investor in that round. At that time, Yin Fangming was the co-president of roobo, a smart educational companion robot company. According to various sources, Yin Fangming is now an investor and incubator at Galaxy General.

Corporate information disclosure shows that in August 2020, Yin Fangming exited Unitree Technology's shareholder position, with a shareholding percentage of 9.1052% at the time of exit. However, this was only a formal individual exit, and Yin Fangming's presence is still felt through Tianjin Junwan Hongyi Enterprise Management Consulting Partnership (Limited Partnership), which is currently a shareholder of Unitree Technology.

In the second year after Yin Fangming's investment in Unitree, Wang Xingxing welcomed the 'new coal deliverer' - Zhang Peng, founder of Geek Park. He participated in Unitree Technology's angel+ round of funding through Variant Capital, a subsidiary of Geek Park, with Binhe Investment, of which He Xiaopeng was the main contributor, also investing.

It was not until after 2019 that Unitree Technology's funding began to take off. Although some investors still hesitated after receiving Unitree Technology's business plan, stating it was too early, the market had already shown significant improvement. Data showed that the robot dog market size reached hundreds of millions of yuan in 2019. That year, Nianiao released the world's first personal robot product in the form of a quadruped robot to specific customers, and Unitree Technology released its first quadruped robot AlienGo capable of performing backflips.

The 'halo effect' brought about by technological breakthroughs erupted in 2020. This year, Unitree Technology completed its Pre-A and Pre-A+ rounds of funding, with renowned investor Sequoia Capital first appearing on the shareholder list. In subsequent funding rounds, Shunwei Capital of Lei Jun, Dragonball Capital of Wang Xing, Matrix Partners China, and Shenzhen Capital Group also joined.

The latest funding dynamics occurred in June 2025, when Unitree Technology's RMB 700 million Series C funding was officially closed, led by funds under China Mobile, Tencent, Jinqiu Fund, Alibaba, Ant Group, and Geely Capital, with a post-investment valuation reaching RMB 12 billion, a 50% increase from the RMB 8 billion valuation in the Series B funding. A month later, Beijing Capital Airport Holding Co., Ltd. announced that its Beijing Robotics Fund had additionally invested in Unitree Technology.

Within nine years, Unitree Technology has completed a total of ten rounds of funding. Tianyancha data shows that Wang Xingxing holds a 26.97% direct stake and indirectly controls 6.61% through employee shareholding platforms, totaling 33.58%, making him the largest shareholder. Meituan's Hanhai Information Technology ranks second with an 8% stake, followed by Sequoia China with a 6.92% stake through Ningbo Sequoia Kesheng.

Image source: Tianyancha

From an investment return perspective, in this nine-year funding marathon, investors at different stages have reaped differentiated returns. Among them, the biggest individual beneficiary is Yin Fangming, who entered earliest, followed by institutional investors such as Sequoia Capital, which entered during the Pre-A round and continued to follow up on investments, and Shunwei Capital, which entered with tens of millions of dollars in 2021. Additionally, there is Meituan, which entered later but holds a significant shareholding percentage.

Unitree Technology's funding journey is not only a history of the company's growth but also a microcosm of the development of robots in China. From Yin Fangming's 'all-in bet' to the 'collective bet' by institutions such as Sequoia and Shunwei, to the dense entry of industrial capital in the Series C funding round in 2025, each round of funding is not only an injection of funds but also a recognition of Unitree Technology's technological strength and commercialization potential, reflecting the capital market's attitude shift from 'wait-and-see' to 'enthusiastic embrace' towards the legged robot sector.

For Unitree Technology, going public is not only an 'answer' to shareholders but also an important opportunity for the company to achieve standardized management, expand financing channels, and accelerate business expansion. For the robot or embodied intelligence industry, Unitree Technology's IPO is also a boost to the primary market and may lead to the emergence of another 'Cambrian Explosion' in the secondary market.