Unitree Technology Embarks on IPO Journey, But Are Humanoid Robots Still 'Underdeveloped'?

![]() 09/05 2025

09/05 2025

![]() 546

546

"The Dawn of Humanoid Robot Commercialization"

Author | Wei Qiang

Editor | Lu Xucheng

On September 2, Unitree Technology took to social media to announce its active preparations for an Initial Public Offering (IPO), with plans to submit its application between October and December.

This news swiftly sparked excitement within the financial and business media circles—the highly anticipated humanoid robot enterprise is finally set to go public. Unitree Technology had earlier disclosed its Series C funding round in June this year, raising approximately 600 million yuan and achieving a valuation exceeding 12 billion yuan.

Wang Xingxing, the founder of Unitree Technology, revealed in June that the company's revenue had surpassed 1 billion yuan, with a workforce of around 1,000 employees (Nandu reported 415 million yuan in revenue and 324 employees for 2024). The sales distribution among quadruped robots, humanoid robots, and component products stood at 65%, 30%, and 5%, respectively. Quadruped robots found 80% of their applications in research, education, and consumer sectors (520 million yuan) and 20% in industrial sectors such as inspection and firefighting (130 million yuan). Humanoid robots, on the other hand, were entirely deployed in research, education, and consumer sectors (300 million yuan).

Based on these figures, Unitree Technology's revenue from research, education, and consumer sectors reached 820 million yuan, accounting for over 80% of its total revenue.

Just Teaching Aids and Props?

With the advancement of artificial intelligence (AI) and robotics, the state is actively promoting the integration of AI/robotics into primary, secondary, and tertiary education. At this year's Two Sessions, Minister of Education Hua Jinpeng emphasized that AI and robotics present "a significant opportunity for educational reform and development." Local education departments at all levels are encouraging the establishment of AI labs, programming labs, and competitions, driving a surge in demand for educational robots. Additionally, middle-class families are heavily investing in AI and robotics education, further fueling this demand.

A search on Tianyancha by LanSha Finance revealed that Unitree Technology has secured numerous projects from research institutes and universities, with bid amounts ranging from tens of thousands to several million yuan. For instance, on June 27 of this year, it won the China Science and Technology Museum's mobile science popularization facility procurement project for 6.27 million yuan.

According to a report by Zhiyan Consulting, the Chinese educational robot market size was a mere 380 million yuan in 2015, but it soared to approximately 13.24 billion yuan in 2024 and is expected to reach 14.24 billion yuan in 2025.

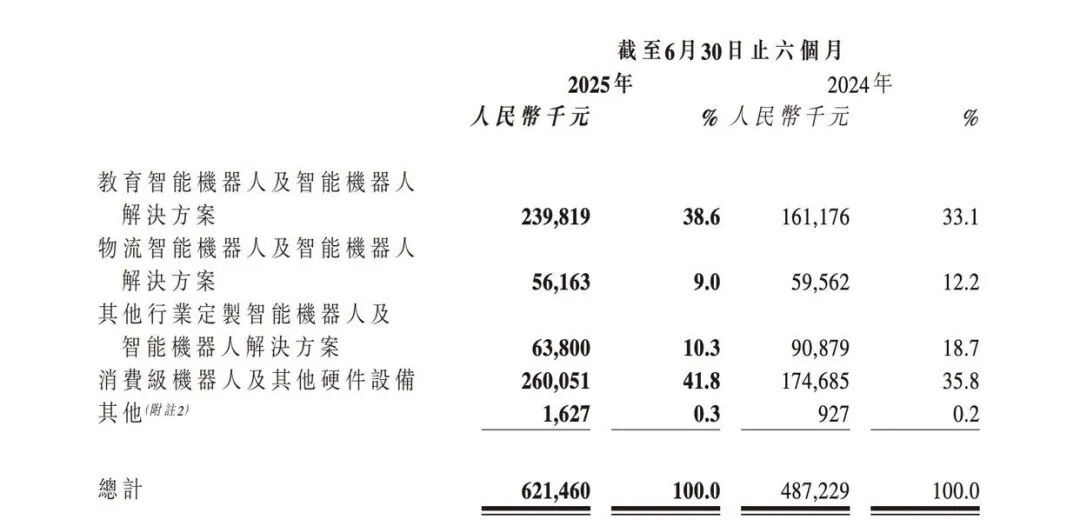

The interim report of another listed humanoid robot company also underscores the market position of humanoid robots in the education sector.

(UBTECH 2025 and 2024 Interim Reports)

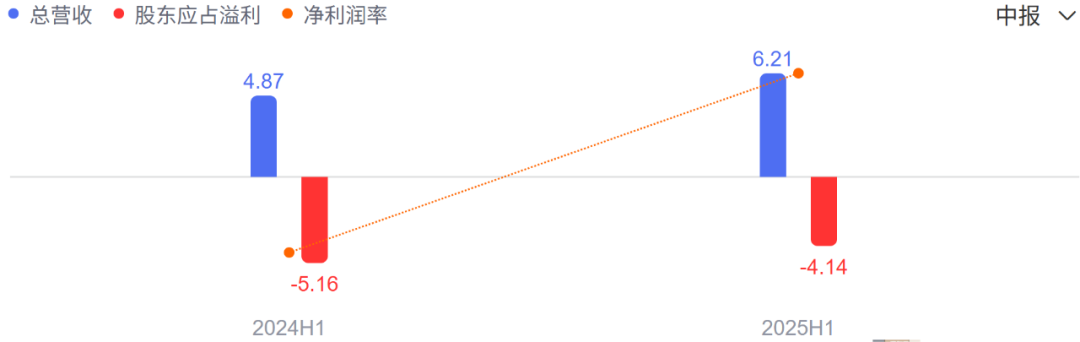

On August 29, UBTECH, known as the "first humanoid robot stock," released its 2025 interim financial report, showing revenue of 621 million yuan, a 27.5% year-on-year increase; a loss of 440 million yuan, an 18.5% reduction year-on-year; and a gross profit of 217 million yuan, a 17.3% year-on-year increase. In UBTECH's interim report, revenue from educational intelligent robots and solutions was 240 million yuan, a 48.8% year-on-year increase, accounting for 38.6% of total revenue (an increase of 5.5% from the same period in 2024).

UBTECH attributed the rapid growth of its educational robot business to the delivery of the "Youth AI and Robotics Innovation Education Base" project in Yixing, Longsheng, and other locations, as well as the launch of the consumer version of its educational robot "Xingzhi Yuan."

Beyond the education sector, demand for display and service robots in the consumer market is also a focal point.

On July 11, China Mobile's procurement and bidding website announced that Zhiyuan Robotics and Unitree Technology had successfully won the bid for the humanoid bipedal robot OEM service procurement project of China Mobile (Hangzhou) Information Technology Co., Ltd. (a wholly-owned subsidiary of China Mobile), with a total order value of 124 million yuan, setting a record for the highest single procurement in the domestic humanoid robot sector at that time.

(UBTECH Financial Report)

UBTECH's revenue from consumer robots and other hardware devices in the first half of the year was 260 million yuan, a 48.9% year-on-year increase, accounting for 41.8% of total revenue (an increase of 6% from the same period in 2024). UBTECH's consumer robots mainly include the PC200 series intelligent pool cleaner, M10 series lawnmower, and C40 series pet litter box, with a significant portion of revenue coming from overseas (UBTECH's overseas revenue in the first half of the year was 209 million yuan, a 29.0% year-on-year increase, accounting for 33.6%).

UBTECH's combined revenue from educational and consumer robots in the first half of 2025 was 500 million yuan, comparable to Unitree Technology's 2025 revenue scale. As of noon on September 4, UBTECH's market value stood at 49 billion Hong Kong dollars. If Unitree Technology goes public in China, given the current enthusiasm of A-share investors for AI and robotics concept stocks, its market value should not be lower than this (around 50 billion yuan).

According to the information disclosed in its IPO tutoring materials, Unitree Technology's equity structure is as follows:

(Source: Unitree Technology tutoring materials)

Based on this estimate, once Unitree Technology successfully goes public, Wang Xingxing's net worth will not be less than 10 billion yuan. Meituan, as the second-largest shareholder, will reap billions of yuan in returns.

Not Adept at Household Chores? Let's Work in Factories

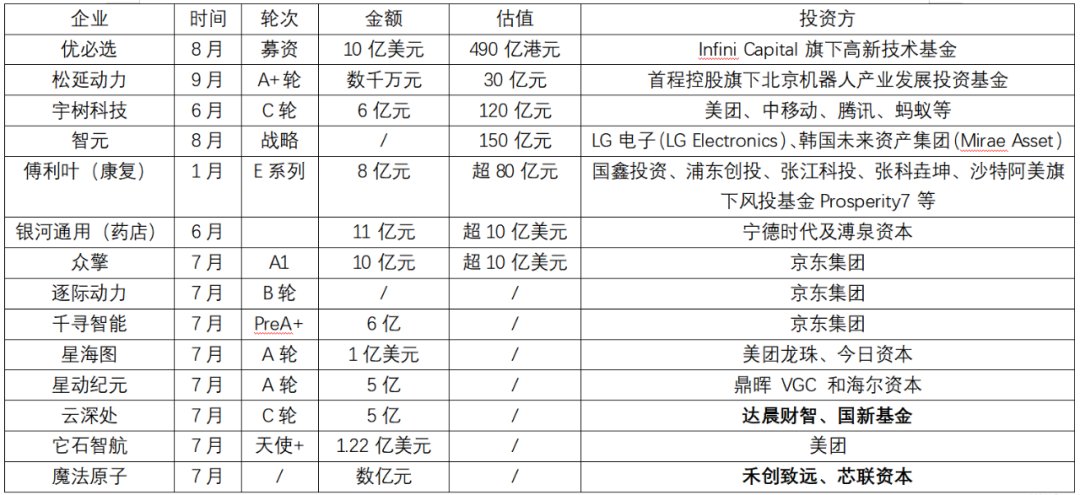

As we enter 2025, AI+robotics has emerged as a favored direction for many investment institutions and leading enterprises, with Meituan, JD.com, and others making substantial investments in humanoid robot companies (see table below). These leading enterprises are not content with humanoid robots merely performing somersaults, running, or dancing, nor do they want humanoid robot products to serve merely as "teaching aids" for research.

(2025 Major Robot Enterprise Financing List, Compiled by LanSha Finance Based on Public Information)

Some of these invested humanoid robot companies have been operating in the healthcare sector for years, such as Fourier Intelligence; others, like Galaxy General, are collaborating with Meituan to build humanoid robot pharmacies (unmanned pharmacies)... They all share a common goal—to integrate humanoid robots into more diverse scenarios (especially B2B scenarios) and achieve true commercialization. This requires overcoming challenges such as generalized environmental adaptation, self-adaptive capabilities, motion control precision and efficiency, and cost control.

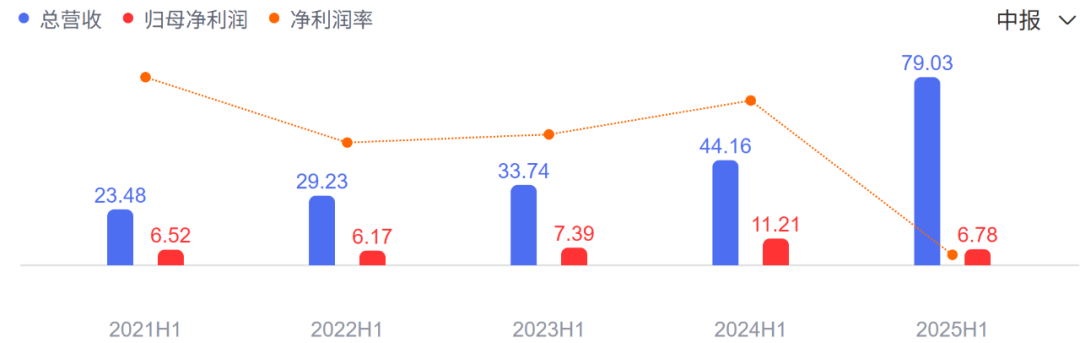

Currently, the mass-market consumer robots available are products like Roborock's robotic vacuum cleaners (which achieved 7.903 billion yuan in revenue and 678 million yuan in profit in the first half of 2025, a 39.55% decline), rather than humanoid robots. Wang Xingxing admitted, "It's not realistic to expect robots to handle household chores in the near future." This is why Unitree Technology showcases the motion capabilities of its humanoid robots in a more entertaining manner, such as through dancing or participating in combat competitions at various exhibitions.

(Roborock's Historical Interim Reports, in Billions of Yuan)

The application of humanoid robots in industrial and enterprise sectors holds more promise due to their ability to reduce costs and improve efficiency, addressing challenges such as labor shortages and rising labor costs caused by China's aging population and declining birth rates.

On August 31, UBTECH announced that it had secured a strategic financing credit line of 1 billion US dollars from Infini Capital's high-tech fund. This is based on the expectation that UBTECH's humanoid robots will be deployed in more diverse scenarios.

In July, UBTECH won a 90.5115 million yuan robot equipment procurement project from Miyi (Shanghai) Automotive Technology Co., Ltd., the largest procurement order for a global humanoid robot company at that time. On the evening of September 3, UBTECH announced that it had secured a 250 million yuan procurement contract for embodied intelligent humanoid robot products and solutions from a well-known domestic enterprise. The contract primarily involves the humanoid robot Walker S2 (equipped with an autonomous hot-swappable battery system), with delivery scheduled to begin this year. UBTECH expects to deliver 500 industrial humanoid robots in 2025.

Another humanoid robot company, Magic Atom, founded and invested in by Roborock (yes, the same company that claims to build the world's fastest car), launched the "Thousand Scenarios Co-Creation" plan in 2025, partnering with 1,000 global partners to create 1,000 land application scenarios. It has already been deployed in medical, retail, tourism, education, manufacturing, and other sectors, especially in factory settings where Magic Atom's robots are used for product inspection, material handling, part picking and placing, and barcode scanning for warehousing.

Conclusion

In June, Morgan Stanley released a report stating that the Chinese humanoid robot market is expected to expand rapidly at a 63% annual growth rate, increasing from 300 million US dollars this year to 3.4 billion US dollars by 2030. By 2030, the number of humanoid robots in China is expected to reach 252,000, and it is projected to increase to 302 million by 2050 (one robot for every five people), accounting for 30% of the global humanoid robot stock (implying nearly 1 billion humanoid robots worldwide).

In the era of artificial intelligence, humanoid robots are undoubtedly the future. Starting as teaching aids and decorative items (for performances and displays), they will gradually penetrate into industrial, enterprise, and household scenarios (beginning in 2025), slowly becoming true partners to humanity. The timeline for this transformation remains to be seen.