The Surge of Chinese Entrepreneurship in Humanoid Robots: How Will It Diverge from the New Car-Making Movement?

![]() 12/26 2025

12/26 2025

![]() 439

439

Produced by Zhineng Technology

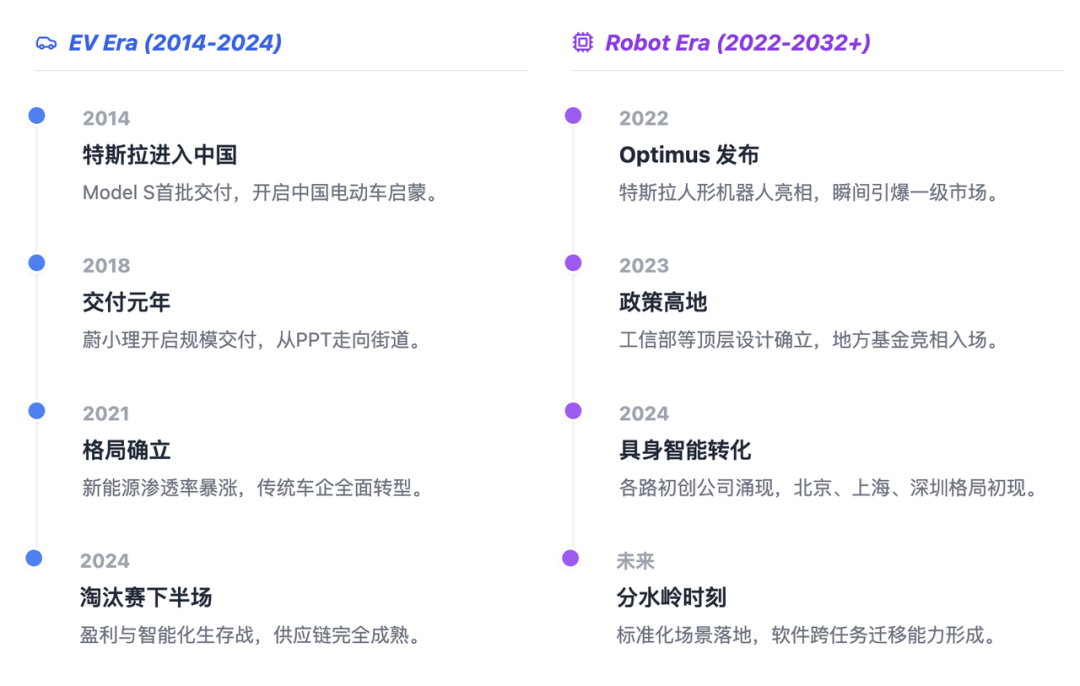

When mapping China's tech industry evolution over the past decade onto a single timeline, the entrepreneurial surges in both the new car-making sector and humanoid robots emerge as transformative shifts, both inspired by Tesla's pioneering spirit. These developments resemble two consecutive 'wagers on innovation' making their sequential debuts.

The new automotive forces have traversed a full cycle, evolving from initial skepticism and heavy capital expenditure to scaling operations and achieving profitability. Meanwhile, robots, which have rapidly gained traction since 2022, have emerged as a new focal point for capital, policy support, and talent from the autonomous driving sector.

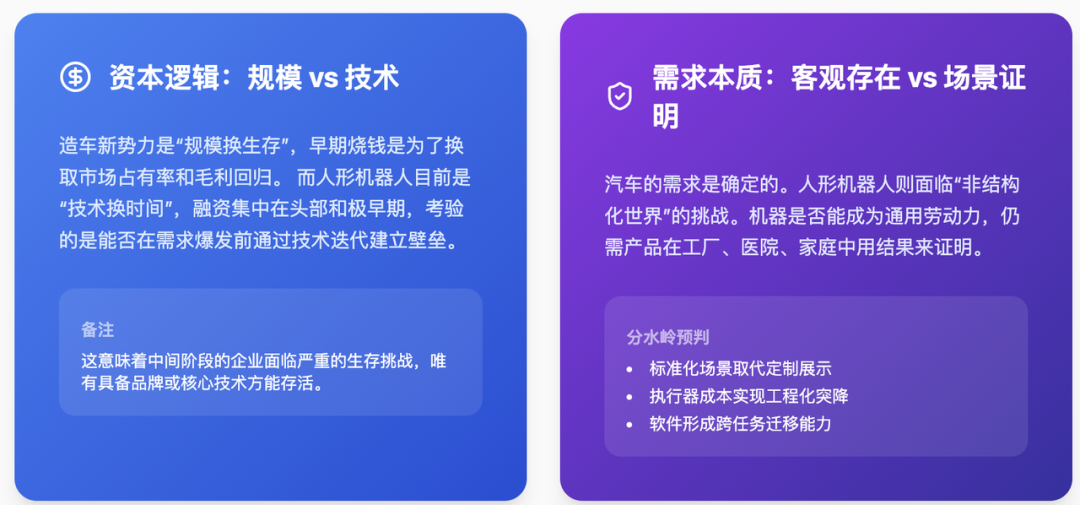

The essence of the new car-making movement lies in 'replacing fuel vehicles,' a goal with a clear, pre-existing market demand. In contrast, humanoid robots aim to explore whether machines can assume general-purpose labor roles. Thus, their market demand and application scenarios require validation through tangible products and measurable outcomes.

With distinct and even more ambitious objectives, humanoid robots share superficial similarities with the new car-making forces but exhibit fundamental differences in technological architecture, industry rhythm, and risk structure.

01

Chinese Cities Cultivate the 'Distinctive Character of Entrepreneurial Robots'

Unlike the concentrated presence of new car-making forces in the Yangtze River Delta and Pearl River Delta regions, China's humanoid robot sector exhibits a 'multi-center' geographical pattern.

Beijing, Shanghai, Shenzhen, and Hangzhou each embody a unique technological ethos, though all initially stem from scientific research translation. This characterization serves merely as a descriptive framework.

◎ Beijing, with its abundance of universities, hosts startups resembling 'robot research institutes.' These teams focus on foundational research in embodied intelligence, particularly the integration of cognitive, perceptual, and control systems.

◎ Shanghai functions more as a 'robot product manager.' Leveraging a mature industrial ecosystem and manufacturing infrastructure, humanoid robot companies in Shanghai prioritize the transition from prototypes to market-ready commodities, emphasizing reliability, maintainability, and scalability. Discussions here often revolve around 'market viability and sustained usability' rather than 'technical feasibility.'

◎ Shenzhen serves as a 'robot hardware factory.' Its dense electronics industry cluster ensures high practicality in product development.

◎ Hangzhou, home to two prominent firms, resembles 'software-defined robots,' emphasizing algorithmic and software-driven innovation.

Humanoid robots inherently span multiple disciplines—AI, mechanics, control systems, materials science, and systems engineering—and their convergence demands a highly pragmatic approach during productization. Startups must prioritize practicality and usability in later development stages.

Reflecting on the new car-making movement, its technological narrative is relatively straightforward: electrification is an inevitable direction, and intelligence serves as the competitive edge. Despite route diversification, the ultimate aim remains enhancing vehicle safety, cost-efficiency, and intelligence. In contrast, humanoid robots operate in a highly unstructured environment, navigating factories, homes, hospitals, and shopping malls—settings characterized by diversity and frequent task variability. Consequently, they must simultaneously address perceptual, decision-making, and execution challenges.

Technological bottlenecks predominantly relate to 'foundational capabilities,' with difficulties concentrated in core components such as actuators, dexterous hands, force control precision, and energy efficiency. No shortcuts exist, and resolving these issues through existing supply chains remains challenging at this stage. Furthermore, as humanoid robot prices decline, structural upgrades necessitate a complete machine overhaul, accelerating the iteration cycle.

02

Market Certainty and Policy Landscape

The humanoid robot boom draws immediate parallels to the new car-making movement in terms of synchronized capital inflows and policy support. Financing patterns, state-owned capital participation, and industrial fund scales closely resemble those observed in the early新能源汽车 (new energy vehicle) sector.

However, market certainty remains asymmetrical.

◎ Demand for new energy vehicles clarified rapidly post-2019, addressing travel costs, policy compliance, and intelligent experiences, with consumers willing to pay a premium.

◎ For humanoid robots, only B2B (business-to-business) demand is relatively clear, such as in industrial manufacturing and select service scenarios; B2C (business-to-consumer) demand remains at the 'intriguing but non-essential' stage.

Humanoid robot companies are essentially 'betting on the future.' Even Tesla, the industry leader, continues to refine its products amid an immature demand landscape, resulting in a less stable business model and a prolonged return on investment. These firms operate in a market where technology is nascent, and demand has yet to crystallize.

At the policy level, humanoid robots have largely replicated the early treatment of new energy vehicles: a clear top-down strategic design, competitive local support, and pilot applications leading the way.

However, policy objectives differ significantly. Humanoid robot policies emphasize 'technological breakthroughs' and 'ecosystem cultivation,' focusing on overcoming key technical hurdles. Consequently, both automotive companies and tech giants are biding their time, waiting for the right moment to enter the market. Once the technological path stabilizes and demand matures, they will seize the opportunity.

The capital logic for new car-making forces revolved around 'scaling for survival,' whereas for humanoid robots, it resembles 'investing in technology for long-term gains.' This explains why current financing for humanoid robots exhibits intense early-stage enthusiasm but struggles in the intermediate phase.

Note: This suggests that early-stage teams hold value, with leading firms like UBTECH and Unitree gaining brand recognition, while intermediate companies face persistent challenges.

The true turning point in the new car-making movement arrived at two junctures: when products achieved 'mainstream acceptance' and when the supply chain and cost curve reached an inflection point.

For humanoid robots, similar milestones may emerge through three events:

◎ The emergence of sustainable, standardized application scenarios, rather than customized demonstrations;

◎ Engineering maturity and significant cost reduction in core actuators and control systems;

◎ Software capabilities enabling true cross-task adaptability.

Only after these milestones can humanoid robots embark on genuine industrial diffusion.

Summary

The entrepreneurial boom in humanoid robots bears superficial resemblance to the new car-making movement. However, humanoid robot startups enjoy more time for 'scientific research' amidst uncertain demand, distinguishing their trajectory from past tech waves.