Titanic Clash: Tencent Yuanbao Treads on WeChat's Toes, Highlighting Tech Titans' AI Traffic Worries

![]() 02/10 2026

02/10 2026

![]() 524

524

It's a battle for dominance—and survival.

"Investors Network" Thread | Wu Wei

On the eve of the 2026 Year of the Horse Spring Festival, the Chinese internet landscape witnessed a rather absurd spectacle. On the morning of February 4, WeChat took decisive action, blocking the red packet sharing links of Tencent's AI product, "Tencent Yuanbao." Users clicking on these links, which had gone viral on Moments, were met with a stark "inducing sharing" violation notice instead of the expected cash rewards.

Dubbed by netizens as "floodwaters breaching the Dragon King's Temple," this incident swiftly triggered a ripple effect in the capital markets. On the same day, Tencent Holdings (00700.HK) shares plummeted by 3.53%, erasing over HK$100 billion in market value. While the outside world perceived it as a clash between Tencent's internal compliance and product departments, a broader perspective reveals it as a concentrated eruption of anxiety over AI traffic across the entire internet industry.

This was no mere marketing blunder. In 2026, as the "Hundred-Model War" intensified, tech behemoths including Tencent, Alibaba (09988.HK), Baidu (09888.HK), and ByteDance were vying to leverage the massive traffic opportunity of the Spring Festival to secure a foothold in the "future operating system."

Crossing the Line: Yuanbao's Aggressive Push and Tencent's "Internal Circulation" Strategy

The saga began with Tencent's fervent quest for an AI large model entry point.

To gain a competitive edge in the AI application race, Tencent's management pinned high hopes on "Yuanbao." At the 2025 annual meeting, Tencent Chairman Ma Huateng expressed his aspiration for Yuanbao to replicate the "Pearl Harbor sneak attack" moment of WeChat red packets. Thus, on February 1, 2026, Tencent Yuanbao launched the "Spring Festival 1 Billion Red Packets" campaign.

Unlike previous straightforward "money-throwing" tactics, Yuanbao implemented a robust viral mechanism this time. Users sharing links with friends and having those friends claim them would receive additional lottery opportunities, with a daily cap exceeding 30 times. This strategy swiftly broke through social barriers, and Yuanbao's links soon inundated WeChat Moments and various group chats.

However, this high-frequency sharing sparked numerous user complaints about "harassment" and "inducing sharing." WeChat faced a dilemma: should it favor its own product and risk accusations of "double standards," or should it uphold the integrity of platform rules?

Ultimately, WeChat chose the latter. On February 4, WeChat officially blocked Yuanbao links, citing interference with the ecological order. Subsequently, Tencent Yuanbao urgently revised its strategy, adopting a more subtle "password red packet" sharing method. Although this incident underscored the transparency of Tencent's internal governance, it also exposed the intense friction between product expansion impulses and platform compliance bottom lines amid the anxiety over large model promotion.

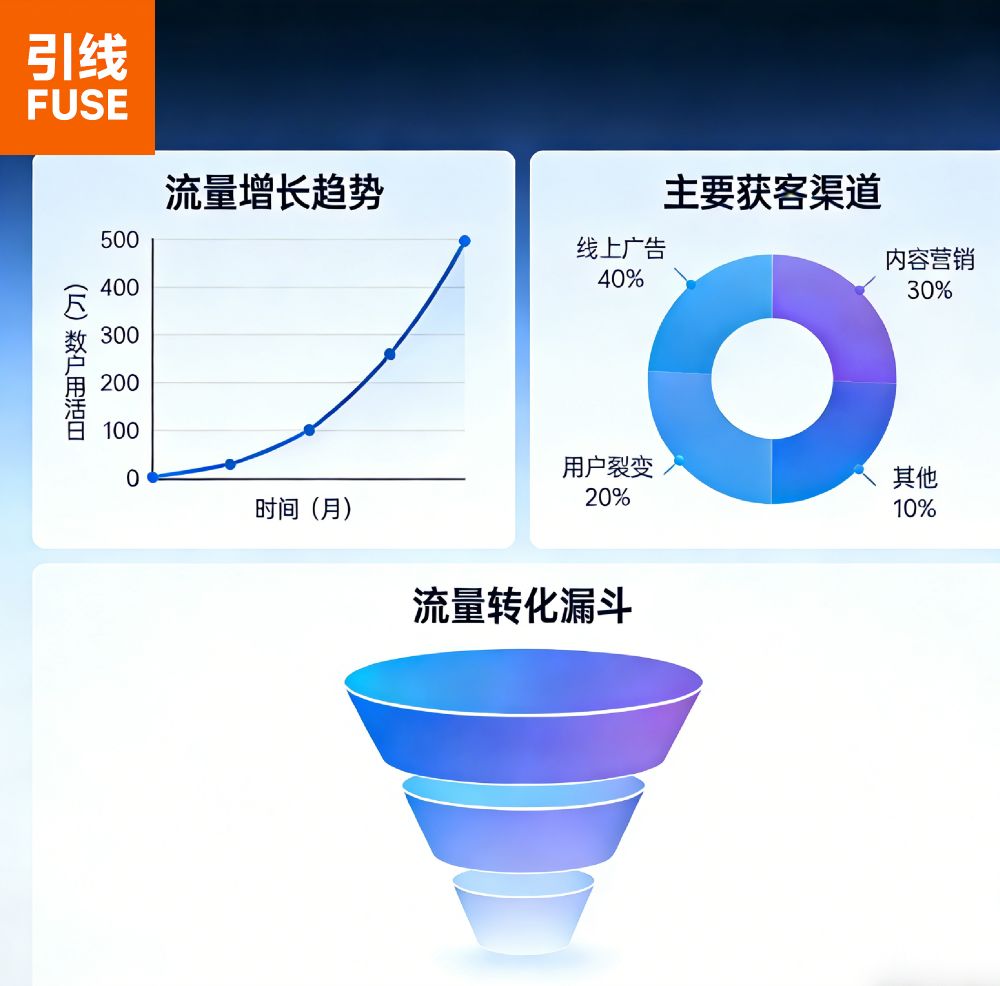

The economic rationale behind Tencent's willingness to risk "internal conflict" within the WeChat ecosystem lies in the escalating costs of public domain traffic.

Currently, the customer acquisition cost (CAC) for a high-quality AI app has skyrocketed. Relying solely on external advertising, a budget of 1 billion yuan might yield only limited user growth. In contrast, WeChat boasts 1.3 billion users, representing a vast "free traffic pool." Through internal viral spread, Tencent is essentially engaging in an "internal circulation" strategy, attempting to convert the massive "social relationship chains" into "AI product strength" at minimal cost.

In fact, beyond using red packets as a "nuclear weapon," Tencent had already begun integrating Yuanbao into the "capillaries" of WeChat through functional integration. First, there was the integration of search and content, with WeChat's "Search" feature now prioritizing AI answers provided by Yuanbao; when reading official account articles, it also offers "AI Key Point Summaries" based on Yuanbao's technology.

Yuanbao is currently the only AI tool that can deeply index the full content of WeChat official accounts, thus building a certain content barrier. Protected by this content moat, Tencent attempts to fend off competition from Baidu and ByteDance through "exclusive data."

Currently, Tencent's strategy can be summarized as "social entry point positioning + exclusive content attraction + office scenario penetration." For Tencent, red packets are meant to achieve a cold start, while deep integration into the ecosystem is the long-term means to retain users.

Battle of the Titans: The 2026 Spring Festival Traffic "Review"

Tencent's traffic anxiety is not an isolated case. The 2026 Spring Festival is widely regarded by the industry as the "first year of large model application explosion," with major vendors' marketing efforts showcasing a deep integration of "bigwig endorsements, emotional penetration, and scenario customization."

After undergoing organizational restructuring, Alibaba urgently needed to demonstrate its commitment to AI strategy to the outside world. Before the Spring Festival, the usually reclusive Jack Ma made an appearance at the Tongyi Lab, a move interpreted by the outside world as the strongest brand endorsement for Alibaba's AI business.

On the product front, Alibaba played the "family card." The Tongyi Qianwen app introduced the "Digital Twin Avatar" feature, allowing users to upload photos to generate digital humans dressed in Tang suits for appearing in New Year greeting videos, with Alipay red packets directly attached below the videos. This approach, blending the traditional "Five Blessings" IP with AI technology, successfully tapped into the emotional needs of family reunions during the Spring Festival while completing a traffic closed loop using Alipay's payment scenarios.

On February 6, Tongyi APP also embarked on a spending spree. The launched "AI Helps Order Milk Tea" campaign caused a nationwide sensation. Due to overwhelming popularity and system mechanism issues, the original experiential activity evolved into a "national free order" frenzy, leading to a surge of users flocking to "take advantage," causing the system to crash at one point.

Faced with an unexpected tidal wave of orders, Tongyi officials chose not to cancel orders but responded generously, "This milk tea is on Tongyi," announcing full coverage of the resulting costs. Tongyi's magnanimous move successfully transformed a potential technical "mishap" into a phenomenal marketing campaign, showcasing the landing potential of AI large models in life service scenarios while winning widespread user acclaim.

Unlike Tencent's "private domain viral spread," ByteDance adhered to a "go big or go home" public domain approach. ByteDance's "Doubao" consistently ranked first in ad placements on Douyin, Toutiao, and external ad alliances.

In terms of content, leveraging its video and voice strengths, Doubao launched the "Voice Catchphrase Red Packets." Users had to catch jokes or memes thrown by the AI through voice to trigger red packet rewards. This highly interactive format significantly lowered users' psychological barriers to using voice dialogue, successfully popularizing AI tools.

For Baidu (09888.HK), this was a "defense" battle for its core business. Baidu implemented the "Search is AI" strategy, directly replacing the first screen of search results with answers from Wenxin Yiyan, leveraging its massive existing user base for in-app conversion.

During the Spring Festival, Baidu chose to combine red packets with traditional culture. In the "AI Couplet Matching" activity, Wenxin Yiyan acted as the "judge," with larger red packets for more neatly matched couplets. This strategy not only avoided direct financial confrontation with Tencent but also enhanced the company's brand social appeal through cooperation with mainstream media.

Faced with the financial might of the tech giants, startups like Kimi (Moonshot AI) demonstrated differentiated competition strategies.

Instead of cash, they distributed "computing power (Tokens)." During the Spring Festival, platforms like Kimi distributed hundreds of millions of free token quotas or premium feature packages.

For office elites and developers who frequently use AI, these "productivity red packets" are more attractive than small cash amounts. Additionally, Kimi's "Long-Text Year-End Summary" and "10,000-Word Travel Guide" features, launched specifically for Spring Festival travelers, precisely targeted high-net-worth office workers, attempting to build a reputation by solving practical pain points.

Final Act: The Technology and Business Logic Behind the Traffic Hunger

Why, in 2026, are large model vendors so frenziedly vying for traffic, even resorting to extreme cases like "banning their own products"? This is not an irrational bubble but an inevitable choice based on technological progress and market laws.

The premise of large-scale marketing is "affordability." Between 2024 and 2025, thanks to MoE (Mixture of Experts) architecture optimization and localization of computing power chips, the inference costs of large models dropped by over 90%. This made "1 billion red packets" economically viable. Instead of burning money idly in labs, it's better to distribute computing resources to users in the form of red packets in exchange for valuable real data.

More critically, data has become a bottleneck for large model evolution. Static data on the internet has been "consumed," and for models to further evolve, they heavily rely on real user feedback data (RLHF). Every dialogue and correction a user makes to claim a red packet is essentially free labeling for the model. Whoever has more users has a faster data flywheel, leading to technological iteration advantages.

Referring to the past two decades of China's internet history, including the "Thousand-Group War," "Ride-Hailing War," and "Hundred-Billion Subsidy War," current AI large models are at the "transition from technological explosion to market harvest" tipping point.

Similar to other internet platforms, AI products are highly "exclusive." The ideal AI is a personal assistant; the more documents a user accumulates and the more personalized the intelligent agent they train on a platform, the higher the migration cost. The current battle is essentially about securing the entry point to users' "second brains."

Looking ahead 12-18 months, the industry is likely to face ruthless shakeouts and differentiation. By then, 90% of general-purpose large model companies may be eliminated, with the market forming an "four pillars and eight columns" oligopoly. Subsequently, the industry may move away from standalone apps, with independent AI app traffic flowing back to super apps like WeChat and DingTalk, and AI gradually becoming infrastructure rather than a standalone entry point.

As user scale peaks, the current "free lunch" will also end. Large models will shift from "free acquisition" to "tiered harvesting," with AI services becoming an "intelligence tax" or "efficiency tax" that office workers must pay.

The Yuanbao red packet incident is just a microcosm of this vast war. It shows the market the anxiety and determination of internet giants in the AI era. In this war with no retreat, Tencent is defending the moat of its social empire, ByteDance is attacking the map of a new world, while Baidu and Alibaba are striving to reshape their genes and business empires. For ordinary users, when the smoke clears, we will have to get used to paying for a smarter but also more expensive AI world. (Produced by Sihui Finance) ■

Source: Investors Network