Smartphone Market Dims in 2026: MediaTek and Qualcomm Search for New Growth Avenues

![]() 02/09 2026

02/09 2026

![]() 381

381

Recently, MediaTek and Qualcomm have unveiled their financial results for the fourth quarter of 2025 and the first quarter of fiscal 2026.

MediaTek reported consolidated revenue of NT$150.188 billion in Q4, marking a 5.7% sequential increase and an 8.8% year-on-year rise, primarily fueled by the volume surge of its flagship SoC, the Dimensity 9500. Qualcomm, on the other hand, achieved revenue of $12.25 billion in Q1 of fiscal 2026 (which concluded on December 28, 2025), showing a 5% year-on-year growth and demonstrating steady performance.

However, both companies have expressed a notably cautious outlook for the smartphone market in 2026. Qualcomm noted, "Despite robust end-user demand, the industry is grappling with severe memory supply shortages, leading some customers to produce fewer smartphones than anticipated." MediaTek was even more forthright, stating that its smartphone business "faces significant challenges" and anticipates a substantial decline in related revenue in the first quarter of 2026.

Such rare pessimistic assessments from two global smartphone SoC giants highlight the gloomy prospects for the smartphone market in 2026.

01

'Memory Shortages Cripple Orders'

From the perspective of the 2025 smartphone market, it was just starting to show signs of recovery.

According to the latest research from Omdia, global smartphone shipments grew by 2% in 2025, reaching 1.25 billion units, the highest level since 2021.

In 2025, Apple set a new annual shipment record, with iPhone shipments increasing by 7% year-on-year to 240.6 million units, maintaining its position as the world's largest smartphone vendor for the third consecutive year. iPhone shipments in the fourth quarter reached an all-time single-quarter high, driving full-year performance, with a 26% year-on-year increase in the Chinese mainland market, primarily driven by strong demand for the iPhone 17 series. Huawei continued its recovery, reclaiming the top spot in the Chinese mainland market for the first time in five years.

However, before they could catch their breath, 2026 dawned with a 'memory crisis.'

"The size of the mobile phone market for the entire fiscal year will hinge on memory availability," concluded Qualcomm CEO Cristiano Amon during the earnings call.

Qualcomm's guidance for the second fiscal quarter indicates that mobile chip revenue is expected to plummet to around $6 billion. In the first fiscal quarter, Qualcomm's mobile chip revenue stood at $7.8 billion, meaning a nearly one-quarter contraction in just a single quarter.

The root cause of this shortage lies in the explosive growth of AI data centers. Amon explained that as memory suppliers redirect manufacturing capacity toward HBM (High Bandwidth Memory) to meet AI data center demands, the resulting industry-wide memory shortage and price hikes may dictate the overall scale of the smartphone industry for the entire fiscal year.

Qualcomm CFO Akash Palkhiwala added that given the current environment, multiple smartphone OEMs are adopting a cautious stance, reducing chipset inventories to align with scaled-back production plans for complete devices.

During the subsequent Q&A session, Amon was even more blunt: "This is entirely about memory. In fact, macroeconomic indicators have been strong, and we see robust smartphone demand... but unfortunately, what we witnessed in Q1 and our guidance for Q2 are entirely constrained by memory availability." He emphasized that DRAM supply and pricing will become the most critical variables for the smartphone industry in the coming quarters. With memory giants continuing to allocate resources to higher-margin HBM production lines, the shortage of regular DRAM is unlikely to abate in the short term.

MediaTek also offered a cautious outlook. During its latest earnings call, CEO Rick Tsai admitted that revenue in the first quarter of 2026 is expected to remain flat or decline by up to 6% sequentially. Based on Q4 2025 revenue of NT$150.18 billion, this implies a Q1 revenue range of NT$141.1 billion to NT$150.2 billion, significantly below market expectations.

He attributed this to "significant challenges" in the smartphone business. Notably, Tsai used unusually negative language: "Revenue from the mobile business in Q1 is expected to decline substantially." Such a statement is rare from MediaTek's management, which tends to be conservative but seldom pessimistic, further confirming that the impact of memory price hikes on smartphone chip demand has exceeded the company's initial estimates.

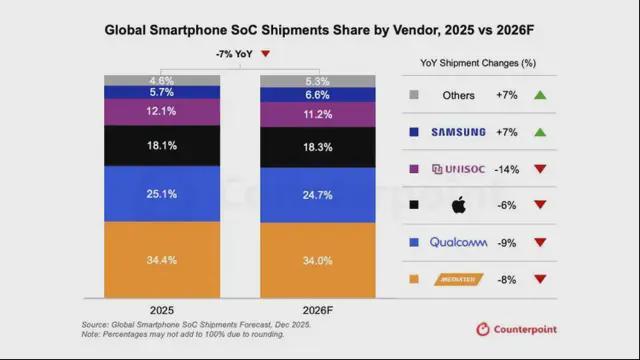

Research institutions' views corroborate the chip vendors' concerns. According to Counterpoint Research's 'Global Smartphone SoC Model Shipments and Revenue Tracker for Q4 2025 (Preliminary Outlook),' the global smartphone SoC market, after several years of growth, is expected to slow in 2026, with shipments projected to decline by 7% year-on-year.

It explicitly mentions that rising memory prices are becoming a major obstacle for the smartphone industry, with the impact likely most pronounced in the sub-$150 price segment. As foundries and memory suppliers increasingly focus on high-margin HBM production to support rapid data center expansion, supply constraints and cost increases are expected to cascade through the low-end smartphone market.

Memory shortages will serve as a watershed moment for the smartphone market in 2026.

SoC suppliers heavily reliant on 4G and entry-level 5G smartphones are expected to face the greatest pressure in 2026. Among them, UNISOC will encounter the most significant challenges, as its customers are concentrated in cost-sensitive markets, making it difficult to absorb soaring BOM costs.

Moreover, judging from the latest financial results, Transsion, one of UNISOC's major customers, reported revenue of RMB 65.568 billion this year, down RMB 3.147 billion from RMB 68.715 billion last year, a 4.58% year-on-year decline. Profitability collapsed: full-year net profit attributable to shareholders was approximately RMB 2.546 billion, down RMB 3.003 billion from the same period last year, a staggering 54.11% plunge, well below the 50% threshold. 2026 will remain challenging for UNISOC.

In 2026, the trend toward high-end smartphones is relatively clear. It is estimated that nearly one-third of smartphones will be priced above $500 by 2026. Qualcomm also believes that demand for high-end and ultra-high-end devices is "exceeding expectations," with significantly stronger elasticity to price increases. Qualcomm CEO Amon stated bluntly that, given memory constraints, "OEMs will prioritize production of high-margin models."

02

Seeking New Growth Avenues

Despite steady overall revenue, both MediaTek and Qualcomm are facing pressure on profitability.

Looking at the data, MediaTek's gross margin declined to 46.1% in Q4 2025, down 2.4 percentage points year-on-year, hitting a 19-quarter low since Q4 2020. Qualcomm's net profit in the first fiscal quarter was $3.004 billion, down 6% year-on-year; adjusted net profit was $3.781 billion, still down 1% year-on-year.

For MediaTek, the gross margin decline primarily stems from changes in its product mix. Despite increased shipments of its flagship chip, the Dimensity 9500, the overall product portfolio saw a higher proportion of lower-margin products, coupled with rising foundry costs, squeezing profit margins. MediaTek stated that this mainly reflects "gross margin changes in certain products," indicating that amid fierce market competition, the company must balance pricing and market share.

Qualcomm's situation is equally concerning. Qualcomm's business is divided into two main segments: semiconductor chip business (QCT) and technology licensing business (QTL), with the semiconductor chip business contributing nearly 90% of revenue. In this quarter, mobile revenue reached $7.8 billion, up just 3.3%, a significant slowdown in growth. The company explained that this was affected by two factors: on one hand, overall smartphone shipments remained in the low single digits; on the other hand, the launch of its flagship new products was brought forward to the previous quarter, leading to some demand being pulled forward.

With the mobile business nearing its ceiling, data centers have become the new consensus for Qualcomm and MediaTek.

MediaTek expects its data center ASIC revenue to exceed $1 billion this year, reach tens of billions by 2027, and potentially account for 20% of total company revenue. Currently, the company is fully advancing subsequent projects, with revenue contributions expected to begin in 2028.

CEO Rick Tsai is increasingly optimistic about market prospects: he expects the global data center ASIC market to reach $70 billion by 2028, up from a previous estimate of $50 billion. Against this backdrop, MediaTek is raising its market share target, originally aiming for 10-15%, but now believing there is "an opportunity to aim higher."

MediaTek's ASIC strategy currently focuses on two key areas: first, securing Google TPU orders; second, collaborating with NVIDIA to produce the N1X and N1 chips.

In the Google TPU project, MediaTek has transitioned from 'shortlisted' to 'deeply integrated.' Since the TPU v7 generation, the company has secured ASIC orders for the low-power v7e, marking its first entry into this top-tier AI chip supply chain; it later secured orders for the next-generation v8e and recently revealed active collaborations with customers on platforms beyond v8e.

Previously, Broadcom handled nearly all of the critical I/O communication modules for Google TPUs. However, MediaTek's proprietary SerDes technology gives it an edge in the ASIC field, enabling efficient transmission by converting parallel data into high-speed serial streams and back into parallel data at the receiving end. Thus, MediaTek has taken a slice of the pie from Broadcom.

This year, NVIDIA also revealed that it is collaborating with MediaTek to develop the N1X and N1 chips. Designed specifically for AI PCs, these chips aim to capture market share from Qualcomm and Intel in the AI PC space. These two SoCs break away from the traditional 'x86 CPU + discrete GPU' configuration, adopting a design that integrates CPU and GPU into a single SoC.

In the data center space, Qualcomm also wants a piece of the action. In October last year, Qualcomm launched two data center AI inference chips, the AI200 and AI250, and announced a partnership with HUMAIN, an AI company under Saudi Arabia's Public Investment Fund, to deploy 200 megawatts of computing power based on Qualcomm's AI200 and AI250 racks starting in 2026, providing AI inference services globally.

Qualcomm CFO Akash Palkhiwala expects data centers to become a "multi-billion-dollar revenue opportunity within a few years." Moreover, during the latest earnings call, he stated that the data center business is expected to generate material revenue starting in 2027.

03

Conclusion

Smartphones are officially advancing to 2nm, but the dividends have yet to materialize, while costs are already mounting.

This September, MediaTek will launch its first 2nm smartphone chip, the Dimensity 9600, using TSMC's 2nm process; Qualcomm will simultaneously release two flagship chips, the Snapdragon 8 Elite Gen 6 and Gen 6 Pro, targeting the mainstream high-end market.

However, the cost of advanced processes is substantial. TSMC's 2nm wafer pricing has reached $30,000 per wafer, and with DRAM and NAND prices continuing to surge, the cost of a single SoC has increased by RMB 300-500. Against a backdrop of weak end-user demand and Chinese OEMs collectively lowering shipment targets, passing these costs downstream is nearly impossible.

Let's see how MediaTek and Qualcomm break through in 2026.