Seven Models Make Debut Together: 2026 New Energy Vehicle Market Segments Further

![]() 02/10 2026

02/10 2026

![]() 566

566

Author / Li Qi

Produced by / Insight Auto

As the Lunar New Year draws near, the automotive market is buzzing with activity. After a brief lull in new car releases, a sudden surge of teasers for upcoming models has emerged.

On February 5th, seven new models, including the XPENG GX, Avatr 06T, and the BMW X5 Year of the Horse Limited Edition, unveiled their official images simultaneously. These vehicles span a wide array of categories, from flagship six-seater SUVs and intelligent shooting brake wagons to rugged pickups and culturally customized limited editions. Notably, a new entrant from Dreame has also joined the race with its cross-industry vehicle manufacturing venture.

This flurry of product teasers is not just a marketing预热 (pre-heating) tactic; it's a strategic move by automakers to navigate the triple challenges of policy, cost, and technology in the 2026 new energy vehicle sector. It signals a deeper industry shift from scale expansion to value-based competition and from technological uniformity to breakthroughs in niche markets, officially launching the 2026 battle for segmented markets in new energy vehicles.

Core Technologies Standardized, Building Competitive Edges

The simultaneous launch of these seven new models reflects automakers' precise market positioning based on consumer demand. Standardizing core technologies has become a common strategy for these models to enhance competitiveness, breaking free from the past dilemma of excessive configuration and internal rivalry.

The XPENG GX, as the brand's new flagship six-seater SUV, targets the premium family market with its length exceeding 5.2 meters. Its extended-range and pure electric dual-power system caters to diverse travel needs. The standard 800V high-voltage architecture and 5C ultra-fast charging technology propel its energy replenishment efficiency to the industry's pinnacle.

The Avatr 06T is deeply integrated with Huawei's ADS 2.0 intelligent driving system, featuring a new-generation LiDAR with over 500 lines. Its unique combination of 'Huawei intelligent driving + shooting brake form' precisely fills a gap in the high-end intelligent wagon market, making intelligence the core of its competitive differentiation.

Volkswagen Anhui's ID. UNIQUE 08 represents a key step in the German brand's localized electric transformation in China. Its blend of an 800V high-voltage platform, a 730km long range, and frameless doors shatters the perception of technological conservatism among joint-venture pure electric models, marking a significant breakthrough for German brands in adapting to the Chinese market.

The Changan Hunter K70 focuses on the niche market of new energy pickups. Its four-wheel-drive system, comprising a 2.0T extended-range engine and front and rear dual motors, delivers a combined power of 260kW. Its 240mm ground clearance enhances off-road capabilities, precisely meeting consumer demand for both urban commuting and challenging road conditions.

The BMW X5 Year of the Horse Limited Edition taps into high-end personalized demand by incorporating Dunhuang culture and the Year of the Horse theme into its design, exploring incremental space in the premium market through localized cultural customization.

Dreame's cross-industry hardcore SUV and pure electric supercar, while drawing attention with their extreme designs, have sparked controversy and lack details on mass-production technology, highlighting the formidable core technology barriers for cross-industry vehicle manufacturing and confirming that complete vehicle manufacturing is not a simple amalgamation of single-point technologies.

Industry Transitions from Price Wars to Value-Based Competition

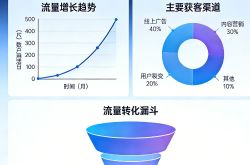

The underlying rationale for automakers' collective teaser campaign stems from the profound restructuring of the 2026 new energy vehicle industry landscape. Companies are actively breaking free from the price war trap and shifting towards value-based competition centered on technology and niche scenarios.

In 2026, the industry faces triple pressures: a halving of purchase tax incentives, the implementation of new battery national standards, and a surge in lithium carbonate prices. Policy rollbacks are compelling the industry to transition from policy-driven to market-driven growth. The new battery standard's stringent threshold of 0.5% weight loss directly eliminates 30% of pseudo-technological solutions, accelerating industry consolidation, with the number of companies expected to plummet by 40% annually.

Against this backdrop, simple price cuts are unsustainable. Automakers are forging sustainable competitive advantages through niche market positioning and breakthroughs in core technologies.

From a strategic standpoint, leading automakers' positioning exhibits three distinct characteristics. First, intelligence has become the core breakthrough point. Avatr's integration with Huawei's ADS and XPENG's adoption of XNGP 5.0 demonstrate that automakers are no longer competing on sensor quantity and computational power but focusing on the real-world experience and scenario generalization capabilities of intelligent driving technologies, aligning with the industry's core trend of emphasizing intelligence and capabilities.

Second, localization and scenario integration are deepening. BMW's incorporation of Dunhuang culture into its model design and Volkswagen Anhui's creation of exclusive gold-badged pure electric models show that automakers are no longer simply importing overseas products but delving into Chinese consumers' cultural needs and travel scenarios. The activation of niche segments like pickups and shooting brakes precisely responds to diverse consumer demands.

Third, the divergence between cross-industry players and established automakers is intensifying. Established companies like XPENG and Changan, with their vehicle manufacturing heritage, are leveraging their technological reserves to cultivate niche markets. Cross-industry players like Dreame, while attracting attention with extreme concepts, face controversy due to their lack of core capabilities in chassis tuning and supply chain integration, confirming the industry rule that 'scenario innovation is the starting point, but core technologies determine success or failure' in cross-industry vehicle manufacturing.

As 800V high-voltage platforms and advanced intelligent driving become standard, and price wars give way to deep exploration of niche markets, the industry's competitive focus is returning to technological innovation and the essence of consumer demand.

In 2026, only by grounding competitiveness in core technologies and orienting strategies towards scenario value can companies achieve precise product and strategic positioning and stand firm amid industry consolidation. Deep cultivation of niche markets will also become the core theme of market competition throughout the year.

END