First-Half Revenue Skyrockets by 67.6%: Horizon Robotics Embarks on a Super Growth Trajectory!

![]() 09/05 2025

09/05 2025

![]() 530

530

While anticipated, Horizon Robotics' performance has truly set the market ablaze.

On August 27, the company unveiled its first-half financial results, showcasing a 67.6% surge in revenue and a 38.6% increase in gross profit. By August, cumulative shipments had officially exceeded 10 million units, positioning Horizon as the inaugural domestic intelligent driving technology firm to achieve this remarkable feat.

Horizon has made significant strides in revenue, profitability, and delivery volumes, setting new benchmarks. Amidst the golden era of China's intelligent driving sector, the company is forging ahead with unparalleled momentum.

[Simultaneous Growth in Volume and Value: The Largest Common Denominator Reaps Maximum Benefits]

Leveraging its robust software-hardware integration capabilities, Horizon has evolved into the acknowledged 'largest common denominator in China's intelligent driving landscape' over the past few years.

To date, the company's Journey series chips have comprehensively penetrated low-, mid-, and high-tier assisted driving scenarios. These chips have been embraced by 27 OEMs (encompassing 42 OEM brands), including all top ten Chinese OEMs. Nearly 400 collaborative models have been empowered, catering to 6 million car owners.

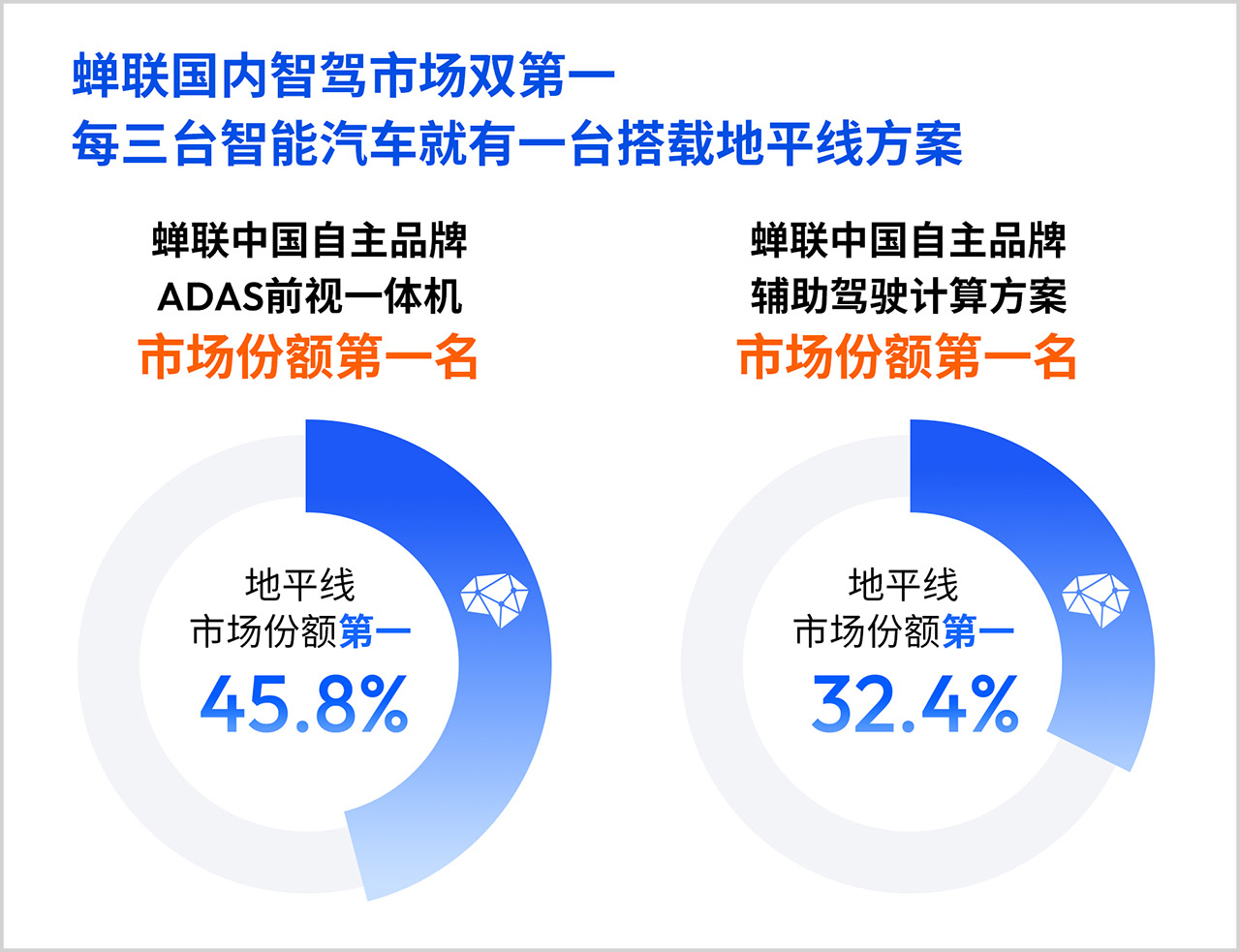

In the market for intelligent assisted driving computing solutions among Chinese autonomous brands, Horizon's market share has soared to 32.4%, securing the top spot for consecutive years. Similarly, in the market for ADAS front-view integrated machines among Chinese autonomous brands, Horizon commands a 45.8% share, also ranking first.

In 2025, BYD pioneered the elevation of intelligent driving standard equipment from basic assisted driving to highway NOA. Subsequently, autonomous brands like Changan, Chery, and Geely followed suit, heralding the dawn of an era of equal access to intelligent driving. Horizon, with its extensive market presence and customer base, emerged as the prime beneficiary.

BYD's 'Divine Eye C' high-tier intelligent driving system, anticipated to have the largest sales volume, will be powered by Horizon's Journey 6 series chips. It will be integrated into popular models such as the second-generation Yuan Plus, Qin L EV, and Seal 05 DM-i. Geely's 'Qianli Haohan' intelligent driving system will prominently feature the H3 level, also equipped with Horizon's Journey 6M. Chery's newly launched Falcon intelligent driving system will primarily utilize Horizon's Journey 6E and 6M in its main Falcon 500 model. Li Auto's new-generation AD Pro intelligent driving system will upgrade from Journey 5 to Journey 6M. Changan's Tianshu Intelligent Driving Plan and Deepal's self-developed DEEPAL AD Pro will also adopt Horizon's Journey 6 in the future. GAC's 'Xingling Zhixing' will similarly incorporate the Journey 6 solution, among others.

As autonomous brands continue to expand their market footprint, Horizon, silently providing underlying technical support, naturally witnesses a surge in demand.

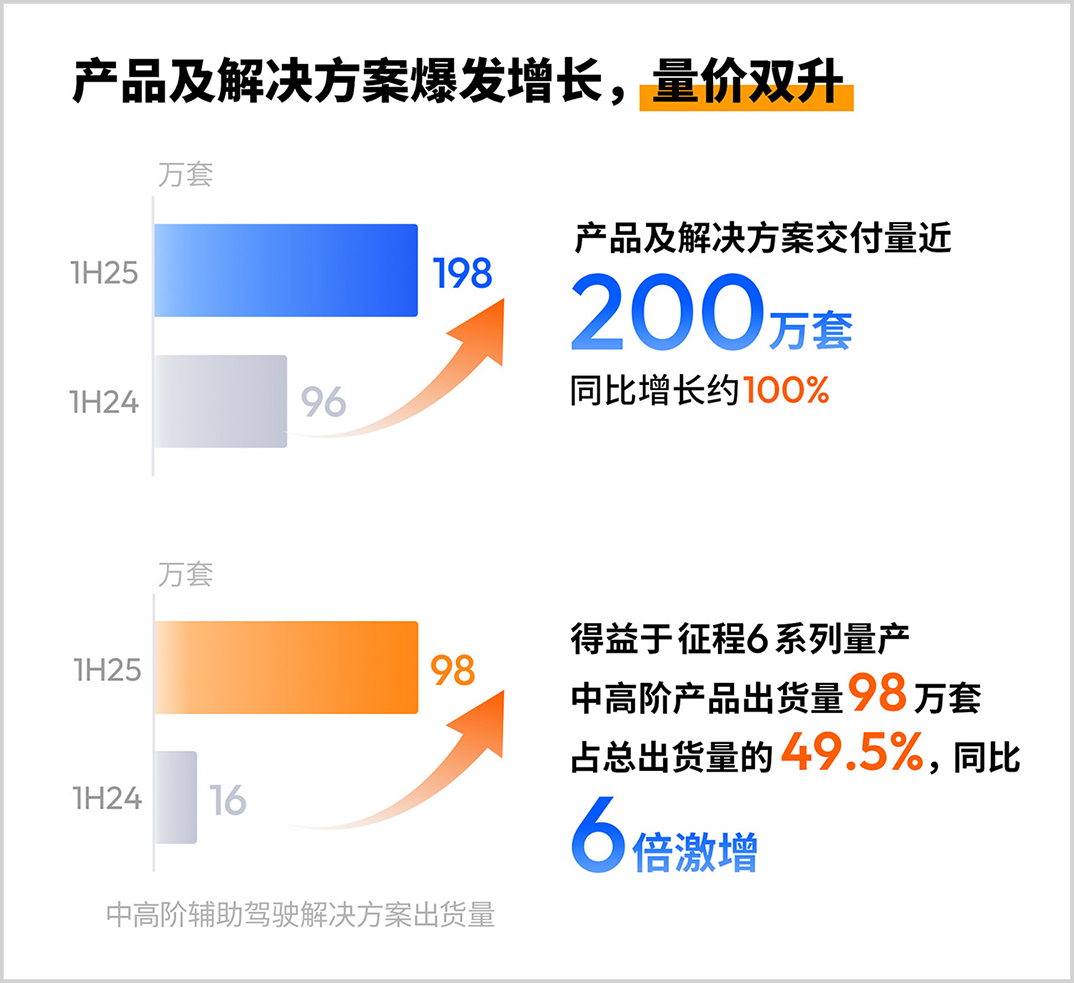

In the first half of this year, Horizon shipped 1.98 million units of its product solutions, doubling from the same period last year. One in every three intelligent vehicles in China is now equipped with Horizon's intelligent driving solution.

In fact, Horizon not only excels in horizontal coverage but also in vertical development, achieving not just quantitative growth but also qualitative enhancement.

From the launch of the first automotive-grade chip, Journey 2, in 2019, to the impending mass production of Journey 6P, Horizon has consistently upgraded its product portfolio. In April this year, Horizon introduced HSD, China's first full-stack developed L2 urban assisted driving system combining software and hardware. This system represents the culmination of Horizon's decade-long endeavor in building a software-hardware integrated technology system and is hailed as the 'Chinese version of FSD'.

As intelligent driving gradually transitions from low-tier to high-tier, Horizon, continuously ascending the technical ladder, has finally found its sweet spot.

In the first half of this year, the company shipped 980,000 units of its mid- to high-tier product solutions (such as those supporting highway NOA functions), a sixfold increase from last year. These now account for nearly 50% of total shipments. This product portfolio upgrade has directly driven up the value per vehicle to 1.7 times that of the same period last year.

With rapid volume growth on one hand and steady price appreciation on the other, Horizon's performance has naturally surged under the multiplicative effect.

From 2021 to 2024, Horizon's revenue skyrocketed from 470 million yuan to 2.38 billion yuan, with a CAGR of 72.2%. The company has repeatedly pushed the envelope of development and has yet to reach its zenith.

[Greater Growth Potential and Stronger Market Penetration]

Previously, high-tier assisted driving functions such as highway NOA and urban NOA were predominantly available in models priced above 200,000 yuan. Data from the Gaogong Intelligent Automobile Research Institute reveals that in 2024, models equipped with highway NOA and above high-tier assisted driving functions accounted for only 8.6% of sales.

The scenario underwent a dramatic transformation in 2025. Driven by domestic OEMs, high-tier intelligent driving rapidly permeated mid- to low-priced models. According to NE Times data, the penetration rate of L2++ and above assisted driving in China was merely 13.53% in the fourth quarter of 2024 but surged to 21.71% in the first half of 2025. Currently, functions such as highway NOA and automatic parking have fully penetrated new models priced below 200,000 yuan. It is anticipated that urban assisted driving functions will gradually extend to new models priced between 150,000 and 200,000 yuan in the second half of the year.

As of 2024, models priced below 200,000 yuan constituted over 70% of the Chinese automotive market. The extension of high-tier intelligent driving to this price segment signifies that the true large-scale development of the entire intelligent driving industry has just commenced.

Based on its own competitiveness and ecological niche, Horizon is well-positioned to secure a larger slice of this burgeoning market.

Firstly, Horizon's market coverage continues to expand outward.

Since the advent of the intelligent electric era, domestic autonomous automotive brands have been making significant inroads in the end market. As the 'largest common denominator in China's intelligent driving sector', Horizon naturally reaps deep benefits from the automotive localization process, a trend likely to persist in the future.

Building on this, Horizon has formulated strategic plans to expand cooperation with joint venture automakers and explore overseas markets. To date, nine domestic joint venture automakers have entered into designated cooperation agreements with Horizon for 30 models. Product solutions based on Journey 6B have also secured model designations from two Japanese automakers in overseas markets. Meanwhile, Horizon has successively forged strategic partnerships with Bosch, Denso, and Continental, expanding the global intelligent assisted driving ecosystem by connecting with top-tier global Tier-1 suppliers.

Secondly, Horizon possesses more comprehensive and robust underlying technological capabilities in the industry.

On one hand, Horizon has deep roots and commands a leading position in terms of scale effects, mass production capabilities, generalized industry know-how, and technological reserves.

Take a simple example: full-stack self-research of chips imposes extremely stringent requirements on capital, talent, and technology. Annual demand below 1 million units hardly renders it economical, weakening the competitiveness of automakers' self-research and third-party mid-to-lower-tier enterprises. In contrast, the comparative advantage of leading companies like Horizon, which has achieved scaled production (with Journey family shipments exceeding 10 million units), becomes increasingly pronounced.

On the other hand, Horizon possesses unique and efficient capabilities in integrating software and hardware. It has successfully transitioned from technological verification to commercial implementation, eliminating the need to start from scratch like latecomers who must build a skyscraper on a blank canvas. Its vast customer base and first-mover advantage enable the company to swiftly integrate resources and respond to frontline demands when market changes occur.

Take HSD as an example. Equipped with Horizon's self-researched Journey 6P chip, boasting a computing power of 560 TOPS and adopting a one-stage end-to-end architecture, the system achieves full urban scenario assisted driving functions. Its seamless experience is on par with FSD and better suited for domestic traffic scenarios. Now, HSD has secured model designations from multiple automakers for over 10 models and is set to commence mass production in the second half of this year. At that juncture, Horizon's market penetration capability is likely to undergo a significant leap.

In the foreseeable future, Horizon will face a dual boost from increased industry prosperity and heightened industrial concentration, inevitably propelling the company to a new development pinnacle.

[Nonlinear Growth and the Davis Double Play]

The development trajectory of the technology industry has never adhered to a smooth, constant-slope line but rather exhibits significant nonlinear characteristics—slow initial growth followed by accelerated advancement after surpassing an inflection point.

Take smartphones, for instance. In the five years preceding 2009, smartphone penetration slowly increased from 3% to 14%. In the following five years, it skyrocketed to nearly 70%.

Similarly, for new energy vehicles, the industry crawled slowly before 2021. From 2021 to 2024, domestic new energy vehicle penetration soared from around 10% to over 50% in just three years.

The intelligent driving industry is no exception. After years of strategic investment and preparation, it is now poised to enter a super monetization cycle with rapidly increasing penetration.

According to estimates by EO Intelligence, the market size for urban NOA is expected to grow by 119.23% year-on-year to 5.7 billion yuan in 2025 and further increase by 450.88% to 31.4 billion yuan in 2026. Meanwhile, the market size for highway NOA is set to double in 2025, reaching 33.8 billion yuan.

Based on these figures, even without considering the α gains from increased industrial concentration, the β dividends released by overall industry expansion alone are sufficient to propel Horizon to unprecedented levels of growth. This will mark a significant milestone and turning point in the company's development history.

Mapping the industrial cycle to the capital market cycle, the market value of an emerging industry or enterprise often undergoes three stages: driven by valuation during the introduction phase, jointly driven by performance and valuation during the growth phase, and driven by performance during the maturity phase. For Horizon, the company has gradually moved beyond the stage of relying solely on valuation. With the market entering explosive growth, it is likely to soon witness a 'Davis Double Play' moment where both valuation and performance drive stock prices.

A market value around the hundred-billion-yuan mark is certainly not the endpoint for Horizon.

Disclaimer

The content in this article concerning listed companies is based on the personal analysis and judgment of the author, derived from information publicly disclosed by the listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions presented in the article do not constitute any investment or other business advice. Market Value Observer does not assume any responsibility for any actions taken based on this article.

——END——