LongCat Large Model Unveiled - Alibaba Springs a Surprise, Leaving Meituan Scrambling for a Response

![]() 09/08 2025

09/08 2025

![]() 684

684

"Meituan is in dire need of a fresh narrative these days."

Author | Wang Zi

Produced by | Jixin

In the post-pandemic era, Taobao has encountered hurdles. Its annual marketing expenditure has soared past 100 billion yuan, aimed at driving traffic, luring new customers, and fostering repeat purchases. Yet, in the realms of local services and instant retail, Meituan once surged ahead, while Douyin is in hot pursuit, seamlessly integrating 'dining, drinking, and entertainment' consumption scenarios into content streams, thereby challenging Meituan's traditional entry logic.

The return of Jiang Fan marked a pivotal moment for Alibaba. This former leader of Taobao and Tmall made a bold comeback, focusing on food delivery subsidies.

For Alibaba, this move transcends mere subsidies; it signifies a strategic shift of funds from external marketing to internal ecosystems, zeroing in on high-frequency consumption scenarios. Food delivery and instant retail have emerged as new gateways for user acquisition.

With the stakes high, Meituan was compelled to act.

Previously, Meituan found itself entangled in a group-buying refund controversy, though its stock price saw a brief 3% rebound.

The unveiling of the LongCat large model at this juncture is akin to adding fuel to the fire, intensifying the battle.

01 Behind the Financial Reports: Meituan's Profits Dwindle, Alibaba Unleashes a 53.1 Billion Yuan Offensive

In late August, Alibaba, Meituan, and JD.com released their Q2 2025 financial reports.

At first glance, all three companies reported revenue growth: Alibaba's revenue reached 247.652 billion yuan, up 2% year-on-year; JD.com's revenue stood at 356.66 billion yuan, up 22.4% year-on-year; Meituan's revenue was 91.841 billion yuan, up 11.7% year-on-year.

However, the reality behind these figures is far from straightforward. The immense consumption of profits and investments has made this 'food delivery war' fiercer than it appears.

From the financial reports, Meituan's Q2 revenue growth remained robust, with double-digit growth indicating a solid user base and order volume. As the core entry point for local services, Meituan's fundamental position remains unchallenged.

But the cost has been exorbitant. Meituan's Q2 net profit plummeted from 11.352 billion yuan in the same period last year to 365 million yuan, a staggering 30-fold decrease. Non-GAAP net profit also fell from 13.606 billion yuan to 1.493 billion yuan, nearly draining Meituan's coffers in this 'money-burning war.' Meanwhile, marketing expenses surged by 51.8% year-on-year to 22.519 billion yuan, much of which was spent on defensive measures rather than proactive expansion.

Coupled with the reputational damage from the group-buying refund controversy, Meituan's moat appears stable, but the difficulty of defense is escalating.

In contrast, Alibaba's strategy is more aggressive. While its Q2 revenue grew by only 2% year-on-year, lagging behind overall growth, its strategic investments in food delivery and instant retail were prominent. Marketing expenses soared to 53.178 billion yuan, up 62.6% year-on-year, with the proportion of revenue rising from 13.4% to 21.5%. The consequence of this approach was a significant decline in profits—Q2 non-GAAP net profit was 33.51 billion yuan, down 17.65% year-on-year.

Even so, Alibaba remains the most profitable of the three, meaning it has greater flexibility in capital reserves and strategic endurance.

More critically, the Q2 financial reports only cover April to June, while Alibaba's 'food delivery subsidy battle' truly intensified in July and August. In other words, the numbers in the financial reports are just the prologue to Alibaba's offensive. The true impact of Alibaba's investments will be revealed in the next quarter's financial report.

Thus, Meituan, which narrowly won, faces sleepless nights.

From Q2 alone, Meituan still leads in revenue performance, seemingly 'narrowly winning.' But a closer look at the three players' results:

Meituan held its growth, narrowly winning, but uneasily;

Alibaba's growth slowed, but it has a higher profit base and stronger financial firepower;

JD.com, though not a core player, successfully disrupted the market by initiating subsidies first.

After waves of controversy, 'LongCat' finally makes its debut. On September 1, 2025, Meituan officially released its first self-developed large model, LongCat-Flash-Chat (Chinese name 'LongCat').

On Xiaohongshu, discussions among Meituan's internal employees about the 'Meituan large model' generally agree that it is a 'gimmick' and 'costly.'

Especially after Meituan's 'group-buying controversy,' morale has been low.

Thus, driven by both defensive considerations against fierce food delivery competition and a proactive search for new growth points, Meituan has officially taken its first step into AI.

Meituan CEO Wang Xing previously stated, 'AI will disrupt all industries. Meituan's strategy is to go on the offensive rather than defend passively.' By the end of 2023, Meituan fully embraced Huawei's Ascend inference cards. Subsequently, Meituan bypassed the NVIDIA ecosystem and launched its self-developed 'LongCat' large model.

In fact, Meituan has planned a 'three-tier' AI strategy: AI empowerment for internal work (AI at Work), front-end products (AI in Products), and building large AI models. LongCat embodies this path: through self-developed large models, Meituan can strengthen local service capabilities such as intelligent customer service, product recommendations, and merchant operations, adding a 'defensive shield' or even new profit growth points for future competition.

Figure: Public statement by Wang Puzhong, CEO of Meituan's Core Local Commerce

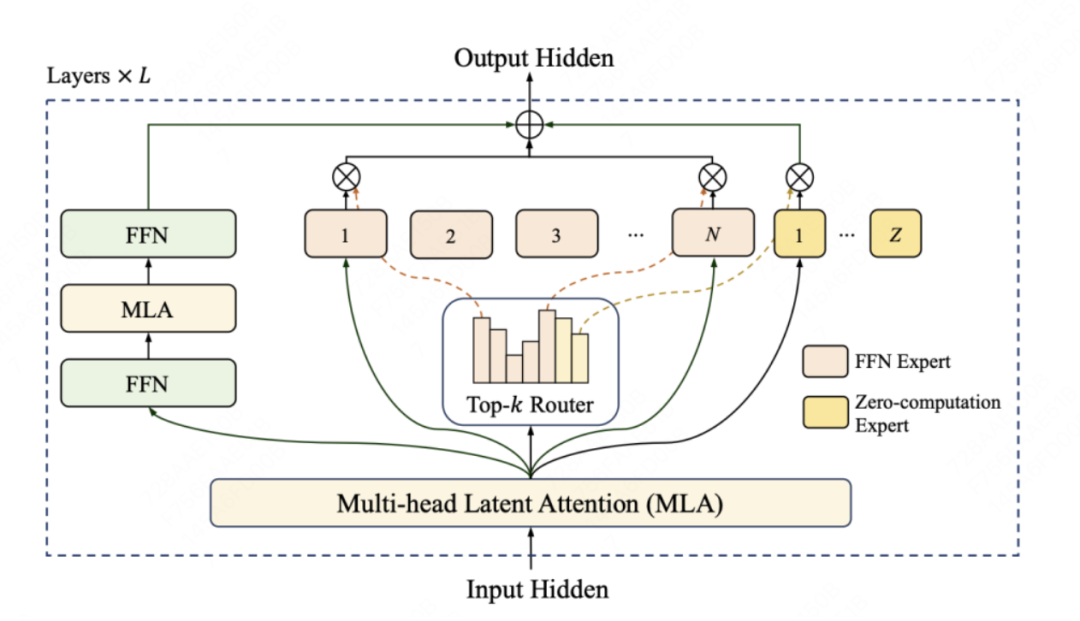

According to Meituan's official analysis, 'LongCat' adopts an innovative Mixture-of-Experts (MoE) architecture, with a total of 560 billion parameters and an average of 2.7 billion active parameters.

Tested to significantly outpace mainstream open-source models in speed, Meituan introduces its 'FastConnect' architecture, enabling model inference speeds exceeding 100 tokens per second. Theoretically, single-token output latency is halved compared to DeepSeek-V3. Actual tests also show that in scenarios outputting around 100 tokens, LongCat's output rate remains stable above 100 tokens/s, excluding first-token delay.

During LongCat model training, ordinary NVIDIA GPUs were not used; instead, it relied on 'tens of thousands of accelerators' (details conveniently undisclosed) and introduced a 'zero-computation expert' strategy in the official technical report to reduce wasteful computation on simple tokens and improve efficiency.

Figure: LongCat-Flash Architecture Diagram

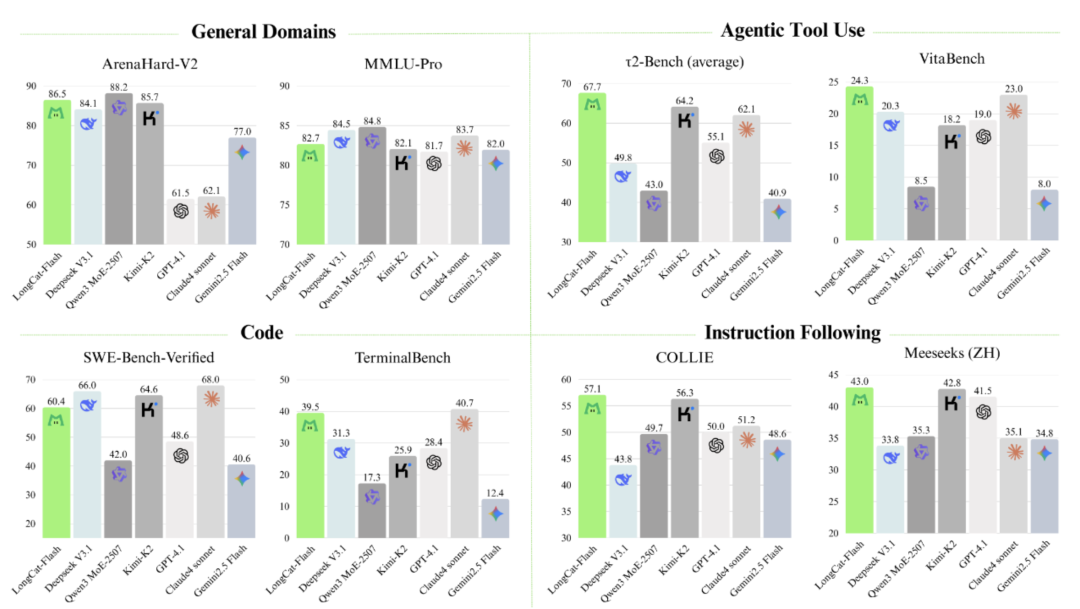

In terms of performance, LongCat slightly lags behind some of the best open-source large models (such as DeepSeek and Qwen3) in basic capabilities like mathematics, programming, and general knowledge. However, its performance on agent tasks is particularly outstanding. Meituan claims this is a result of design choices to address the 'expensive and slow' challenges of large models and move toward practical AI agent capabilities.

Figure: LongCat-Flash Benchmark Test Performance

Currently, LongCat offers a web-based experience and internet search functionality, with potential future expansions into deep reasoning capabilities. To encourage ecosystem participation, Meituan has launched the 'LongCat Developer Program,' providing computational subsidies and offering enterprise-version APIs at 30% below market prices.

Simply put, ordinary users may not care about LongCat's 560 billion parameters. But if it can shorten the wait time for a refund from 2 minutes to 20 seconds, it directly determines whether users will place another order.

Ultimately, the AI competition is not about computational power but about saving a minute in user experience.

02 Increasing Investment in Food Delivery Because WAIMAI Has Two AIs

Figure sourced from Xiaohongshu blogger: GouPitong Painter

In the AI market, the 'small model' trend is rising—developers are launching lightweight models to pursue lower costs and faster responses. Small models address cost issues, while large models push efficiency limits. This 'small and large' combination is becoming the norm in local services and instant retail.

Meituan's approach reflects this trend: although LongCat is a 'behemoth' model, it is designed for rapid deployment within local platforms, supporting complex multi-round dialogues and tool integrations without relying on external APIs that introduce latency and costs. Its high-speed inference capabilities and modular expert architecture enable instant responses in scenarios like 'order dispatching' and 'intelligent customer service queries,' enhancing user experience and operational efficiency while dynamically matching its riders and merchant resources.

It can be said that future competition in food delivery and instant retail will revolve around AI-driven efficiency: small model agents, with their low-cost and low-latency traits, will quickly deploy across business lines; while Alibaba and JD.com will invest in large model infrastructure, building moats with computational power and data.

Some netizens joke, 'Every era has its models, each leading for a few dozen days.'

Can 'LongCat' help Meituan turn the tide? We'll see next quarter.