Tesla Robot Secures 10,000-Unit Order? Musk's Bold Move Pays Off

![]() 09/18 2025

09/18 2025

![]() 597

597

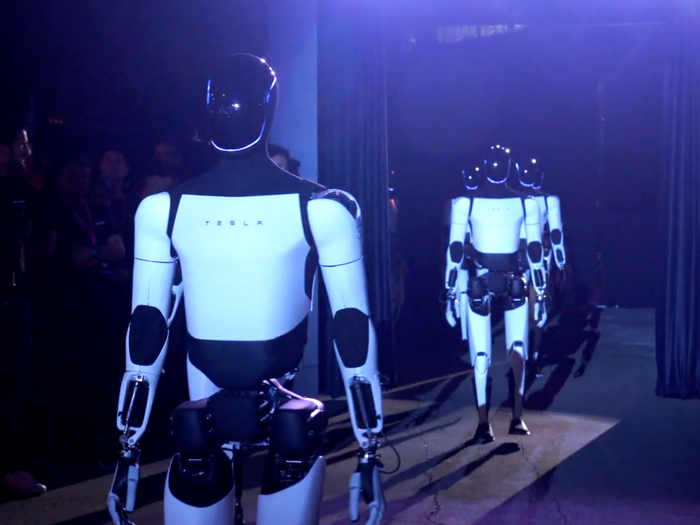

Robots to the Rescue for Tesla

'In the future, about 80% of Tesla's value will come from the Optimus robot,' Musk tweeted.

Image Source: Internet

The tech world is abuzz again. What? Isn't Tesla's value derived from autonomous driving? How did it shift to robots? Musk's thinking seems to be on another level.

Typically, tech companies make grand promises by saying they will lead a trillion-dollar market industry, possess core technologies and ecological barriers in a certain sector, and at most mention ESG and social responsibility. But Musk's promises make even Indian flatbread seem small in comparison.

On September 2, Tesla officially released 'Master Plan Part IV' on the X platform, rewriting the company's grand narrative. It shifts the company's focus from electric vehicles and energy to artificial intelligence and robotics, aiming to create a 'sustainably prosperous' society by integrating AI into the physical world on a massive scale.

The plan outlines five guiding principles:

- Infinite growth: Technological innovation can solve resource shortages and create more economic opportunities.

- Innovation removes limitations: Just as Tesla broke through battery technology bottlenecks through innovation, continuous innovation can overcome seemingly impossible obstacles.

- Technology solves real-world problems: Products like autonomous vehicles and the Optimus robot aim to address real-world issues such as traffic safety, efficiency, and repetitive or dangerous labor.

- Autonomous driving must benefit all humanity: Its development and application should focus on enhancing human well-being.

- Broader adoption drives greater growth: Mass availability of advanced technology products at affordable prices is essential for building a prosperous society.

Image Source: X

This suggests Musk will become a unique tech leader, guiding humanity into a new technological era, with productivity gains far exceeding current levels.

On September 7, Tesla launched a Weibo account named 'Tesla AI' and posted its first message: 'I've been working hard to improve my physique,' showcasing the new version of the Optimus humanoid robot. It seems Tesla's robots also have ambitions for the Chinese market and may establish factories in China after mass production, just like its cars.

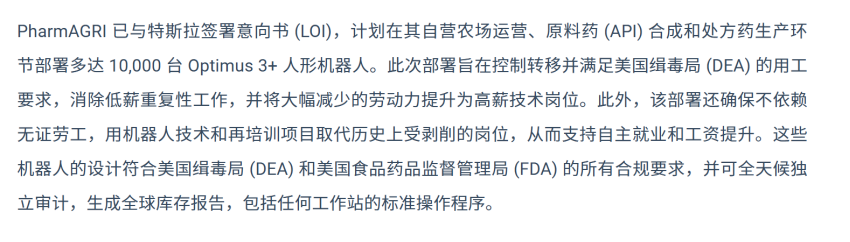

Rumors suggest Tesla has secured orders for 10,000 Optimus robots. According to Chief Business Review's verification, it's not exactly orders, but there is indeed a cooperation intent, with a letter of intent signed.

Why is Musk Betting Big on Robots?

01. Tesla's Automotive Business is Slowing Down

Tesla's Q2 earnings report can be summed up as 'traditional business under pressure, emerging business gaining momentum.' The Q2 report showed a 12% year-over-year decline in total revenue and a 20.7% drop in net profit. Vehicle deliveries fell 13% year-over-year to 384,000 units, the lowest since Q4 2022.

Location: Tesla Showroom (Photo by Wei Ming)

In terms of revenue, Tesla's Q2 total income was $22.496 billion, down 11.8% year-over-year, marking the first double-digit revenue decline in seven years. It rose 16.35% sequentially but fell short of Wall Street's estimated $22.64 billion. The once-profitable carbon credit sales business generated $439 million (about 3.14 billion yuan) this quarter, a 50.67% year-over-year and 26.22% sequential decline. Beyond automotive, power generation and storage also underperformed, with Q2 revenue of $2.789 billion, down 7% year-over-year.

Image Source: CarWale

The electric vehicle business's struggles have directly raised Tesla's forward P/E ratio. Currently, its stock price has surged to about 186 times its forward P/E, compared to the S&P 500 and Magnificent Seven's average of 23-30 times. This suggests many investors are valuing Tesla based on its future potential, essentially betting on Musk's 'performance,' believing he can deliver on at least one or two grand promises.

So, Musk has been unusually focused on work, often working late on robotics, demanding accelerated production. He even stated that about 80% of Tesla's future value would come from the Optimus robot. Whether achievable or not, the capital markets have bought in, with the stock surging 20.36% over the past five trading days, turning a -45% year-to-date decline in April into a +5% gain.

Location: Tesla Showroom, First-Generation Optimus Robot (Photo by Wei Ming)

02. Musk is Desperate, but Investors are Even More So

'Optimus is the greatest product in human history!' Musk declared emphatically at the All-In Summit. He also revealed three breakthroughs for the next-gen Optimus V3: improved hand dexterity, an AI brain, and mass production.

Musk's robotics ambitions are materializing at unprecedented speed. According to the latest production roadmap, Tesla will produce thousands of Optimus robots in 2025, ramp up to 50,000-100,000 units in 2026, and aim for 500,000-1 million units in 2027. This timeline is three years ahead of schedule.

Unsurprisingly, the capital markets reacted strongly. After Musk's mass production announcement, shares of Sanhua Intelligent, Hangzhou Big Science & Technology, and Hanwei Technology hit daily limits. Analysts noted that Chinese companies already possess international competitiveness in precision manufacturing, motors, sensors, and other key areas. The industry expects over 60% of global humanoid robot component orders to go to Chinese suppliers.

While 'Tesla's supply chain' can move ahead, it must avoid overheating. As of July 2025, Tesla's actual Optimus robot production is only in the hundreds, less than a tenth of the planned 5,000 units. Even with the Optimus V3 redesign, achieving 5,000 units this year seems unlikely.

If 'Tesla's supply chain' prices in 100,000 or even 1 million units this year, the outcome could resemble a certain new energy battery giant (new energy battery giant) that priced its P/E ratio to 2060, leading to a sharp correction. During 2023-2024, companies like LD, Inovance Technology, Tuopu Group, and Sanhua Intelligent were frequently hyped as 'Tesla robot concepts,' but many were based on 'market expectations' or 'potential supply chain' roles rather than confirmed orders. Thus, their stock prices are highly volatile, and investment requires caution.

Image Source: YouTube

'Tesla's supply chain' faces similar issues as 'Apple's supply chain' and 'NVIDIA's supply chain': performance and profit margins are controlled by these leaders, who have no shortage of suppliers and constantly evaluate and screen them. Manufacturing capabilities alone are insufficient; suppliers must offer uniqueness to stay in the chain. The 'Tesla supply chain' story is unlikely to be a simple linear growth narrative. Just like Musk himself, it will be full of unpredictability, volatility, and variables.

Epilogue

Of course, mere 'promises' won't convince the board and shareholders. So, Musk recently spent $1 billion to buy 2.57 million Tesla shares. The market reacted swiftly and positively. After the filing, Tesla's stock surged over 8% in pre-market trading, reaching $428 and boosting the company's market cap by about $100 billion.

Location: Tesla Showroom, Model Y L (Photo by Wei Ming)

At critical moments, Musk delivers. Tesla Chair Robyn Denholm, in a media interview, called Musk a 'leader of a generation' and emphasized that retaining him is 'the best way to optimize Tesla's future.'

References:

Musk's Cash Commitment - Source: Wall Street See

Musk Abandons Remote Control? - Source: Robotics Insight

The True Leader in Humanoid Robots? - Source: Silicon Steps Run

Is Tesla Really Abandoning Remote Operation? - Source: Embodied Era