Extended-Range Electric Vehicles (EREVs): Are They Being Sidelined by the Market? Are Li Auto and AITO on the Verge of a Major Shift?

![]() 11/04 2025

11/04 2025

![]() 580

580

In 2019, Li Auto unveiled its first extended-range electric vehicle, the Li Auto ONE.

The introduction of this model sparked a significant debate, attracting both fervent supporters and numerous critics. Proponents lauded the flexible energy replenishment capabilities of extended-range vehicles, which can operate on both gasoline and electricity, offering users convenience and a wider range of choices. Given the current imperfections in the charging station infrastructure, this was seen as the optimal solution.

Critics, however, dismissed extended-range technology as outdated and destined for obsolescence, likening it to "taking off your pants to fart" — an expression implying unnecessary complexity for a simple task.

Despite professional skepticism, the Li Auto ONE resonated with consumers, achieving remarkable sales success. Over 30,000 units were sold in both 2019 and 2020. Subsequently, Li Auto expanded its lineup with the L9 and L8 models, further fueling its growth.

Other automakers took notice and began developing their own extended-range vehicles. In recent years, a surge of new energy vehicle companies, many of which had previously criticized Li Auto's extended-range approach, have entered the market with their own offerings.

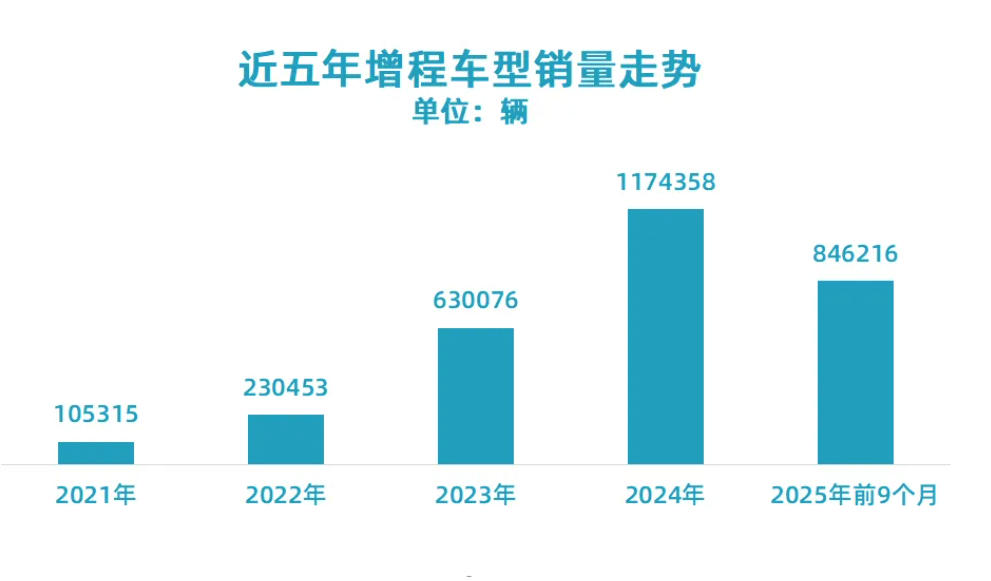

With a flurry of market launches, extended-range electric vehicles have indeed gained popularity. The chart below illustrates the sales trends of extended-range electric vehicles over the past five years.

In 2021, annual sales hovered around 100,000 units. By 2024, this figure had surged to nearly 1.2 million, averaging over 100,000 units per month. From January to September 2025, approximately 850,000 units were sold.

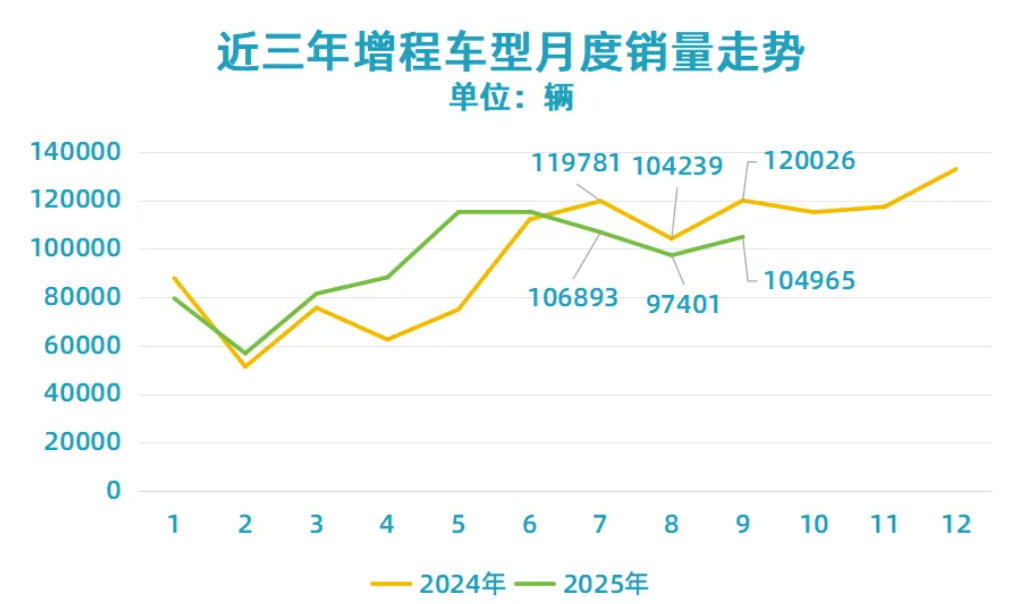

However, by 2025, it became evident that the growth rate had slowed. Specifically, starting in July, year-on-year sales of extended-range electric vehicles declined, falling below the levels of the same period in the previous year.

This trend is not surprising, given the increasing competitive edge of pure electric vehicles, particularly with advancements in battery technology and faster charging speeds. Now, recharging for 500 kilometers of range takes just over 10 minutes, and with the proliferation of charging stations, the convenience factor has significantly improved. Consequently, pure electric vehicles are gaining traction, diminishing the appeal of extended-range models.

In light of these developments, automakers heavily invested in extended-range vehicles must explore transformation strategies. After all, selling extended-range models is becoming increasingly challenging. Persisting solely with extended-range technology would be neither reasonable nor scientifically sound.

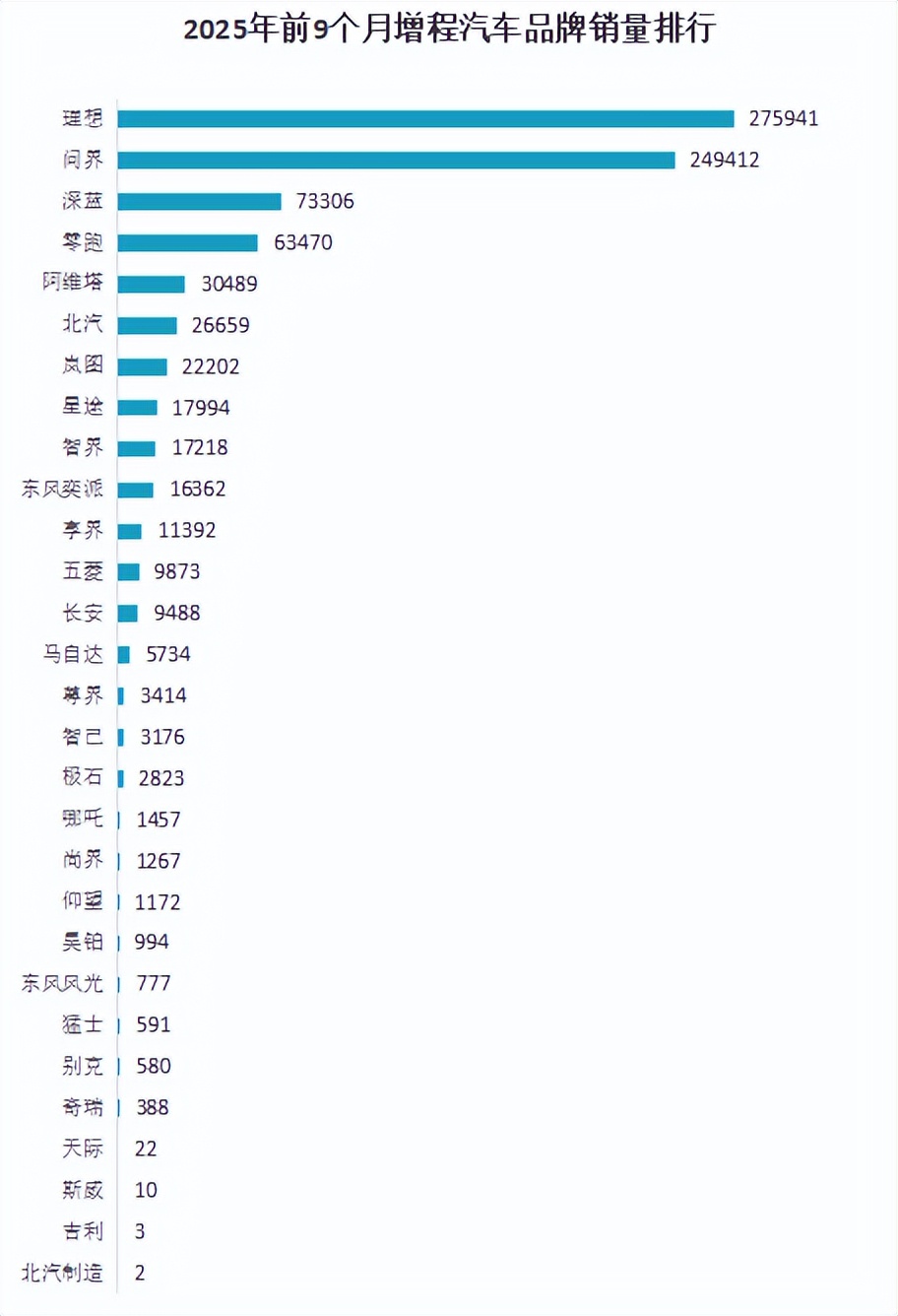

So, who leads the pack in extended-range vehicle sales? Li Auto undoubtedly holds the top spot. As depicted in the chart above, from January to September this year, Li Auto sold approximately 280,000 extended-range vehicles, ranking first. AITO follows closely with around 250,000 units. Seres, Leapmotor, and Avatr round out the top contenders.

The question remains whether extended-range vehicles can regain their rapid growth momentum and which automaker will achieve a swifter transformation.