The "Android Moment" for Autonomous Driving Has Dawned! Is NVIDIA Eyeing the Profitable Robotaxi Market?

![]() 10/29 2025

10/29 2025

![]() 573

573

NVIDIA's Robotaxi Aspirations: Dominating the Market, Not Manufacturing Cars

The global chip behemoth NVIDIA is undergoing a transformation, evolving from a mere supplier to a formidable competitor in the autonomous driving arena.

According to 36Kr, NVIDIA is internally nurturing a Robotaxi project. The crux of its strategy isn't to operate Robotaxis directly but to unveil a "Robotaxi Technology Blueprint" and ultimately forge an open ecosystem akin to the "Android System."

Image Source: NVIDIA

A glance back at the current Robotaxi landscape reveals near-monopolization by the "Closed Full-Stack Model."

Whether it's Waymo's in-house chip development + full-stack algorithms + proprietary fleet, Tesla's vehicle-road coordination with a lightweight approach + data closed-loop system, or Baidu's Apollo platform + enterprise collaboration for operations, the underlying principle is to tightly control core technologies, data, and scenarios internally.

Under this paradigm, automakers venturing into the Robotaxi realm must not only invest billions in algorithm R&D but also tackle chip adaptation, road test data accumulation, and operational qualification applications. These formidable barriers have deterred most entrants.

Amidst these challenges, how should we interpret NVIDIA's strategic move in the Robotaxi sector?

The Chip Titan's Robotaxi Vision: Crafting the Industry's Android

To comprehend NVIDIA's Robotaxi strategy, we must first address a pivotal question: What is the "Android-style ecosystem" it envisions?

In the consumer electronics realm, Android's triumph lies in its blend of bottom-layer standardization and upper-layer personalization: Google furnishes a unified operating system, hardware drivers, and basic APIs, empowering phone manufacturers to concentrate on design, feature refinement, and brand management.

This model not only lowers industry entry barriers but also accelerates technological innovation. Today, Android commands over 80% of the global smartphone market, a testament to openness triumphing over closed systems.

Image Source: NVIDIA

NVIDIA is poised to replicate this logic in the Robotaxi sector, leveraging its existing autonomous driving technology foundation.

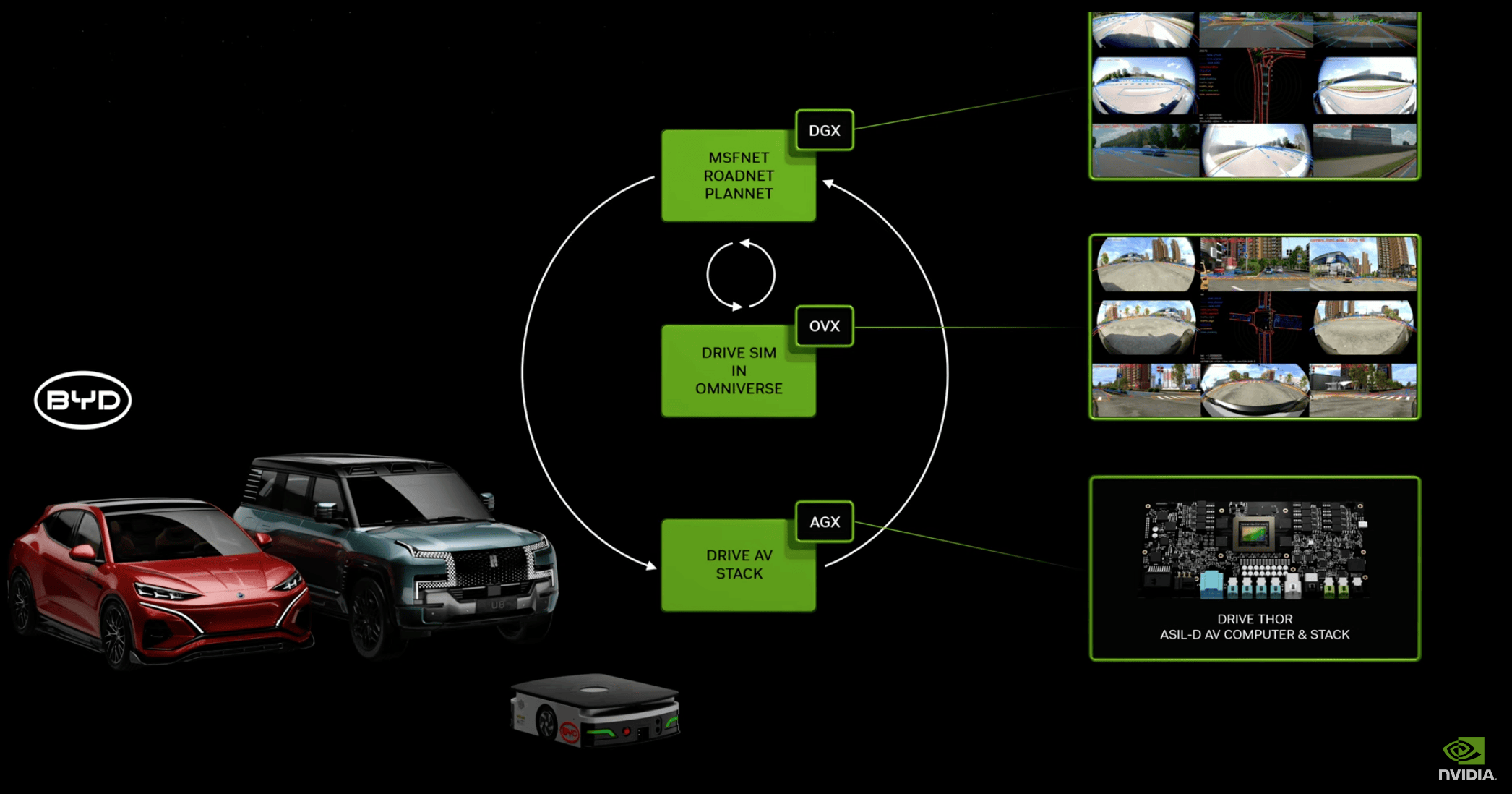

Presently, NVIDIA's Drive ecosystem encompasses chips, operating systems, algorithm frameworks, and development toolchains. Most leading automakers' autonomous driving systems are built upon its chips. The incubated Robotaxi project essentially introduces an "operational scenario adaptation" module, such as fleet scheduling systems and safety driver emergency response protocols, creating a "plug-and-play" technology blueprint.

Following the Android paradigm, Dianchetong predicts NVIDIA's "Robotaxi" may be structured across three tiers:

At the foundational hardware layer, it standardizes chip and sensor driver interfaces. Whether automakers opt for Hesai or RoboSense LiDAR, they can seamlessly adapt to NVIDIA's algorithms, eliminating R&D inefficiencies stemming from hardware incompatibility.

At the core algorithm layer, it provides L4 autonomous driving foundational capabilities, including high-definition map positioning, obstacle recognition, and path planning, while enabling customization via APIs. For instance, enhancing pedestrian recognition in campus settings or optimizing lane-changing logic on highways.

At the upper-layer operational application layer, it opens interfaces for ride-hailing, scheduling, billing, and maintenance. Mobility platforms can swiftly launch Robotaxi services without developing operational systems from scratch, simply by integrating these interfaces.

Jensen Huang, during multiple GTC Conference speeches, emphasized that "Robotaxi is the inaugural commercial application of robotics technology." The underlying message is that NVIDIA's ambition isn't to build a self-driving taxi but to provide the technological bedrock for all players to create their own.

This can be likened to the Android system or Huawei's HarmonyOS Smart Travel. By binding automakers, mobility platforms, and sensor manufacturers through an open ecosystem, NVIDIA ultimately aims to establish the industry consensus that "NVIDIA = Robotaxi."

Breaking Through as a Latecomer: NVIDIA's "Differentiated Arsenal"

Despite its robust technological foundation, NVIDIA faces significant hurdles entering the Robotaxi sector.

The industry has already crystallized into a "bipolar landscape": the U.S. boasts Waymo and Tesla, while China has Baidu, Pony.ai, and others. As a "latecomer," NVIDIA must sidestep direct competition and identify its unique strengths.

NVIDIA's core advantage lies in the synergy between chips and algorithms, directly addressing a critical industry pain point. For small and medium-sized automakers, the primary cost of self-developing L4 autonomous driving isn't algorithm R&D but chip adaptation. Different chips have varying architectures and instruction sets, necessitating substantial R&D investment for each algorithm transplant.

Image Source: NVIDIA

NVIDIA's solution facilitates deep integration between algorithms and chips.

Algorithms optimized for the Orin chip inherently achieve higher computational efficiency than generic chips, akin to how HarmonyOS running on Kirin chips delivers superior performance despite lower specifications. This implies partners can attain better autonomous driving performance at the same hardware cost.

Secondly, NVIDIA's ecosystem integration capabilities can resolve the industry's data silo issue. Under current closed models, automakers are confined to their own road test data. For instance, XPENG's urban NGP data remains inaccessible to NIO, and Waymo's U.S. road data offers no assistance to Chinese automakers. This compels each player to repeatedly accumulate data and refine algorithms.

If NVIDIA assumes the role of facilitator, while safeguarding data privacy, all players can share anonymized feature data. For example, road data encountered by automaker A can be synchronized to automaker B's algorithm model, exponentially accelerating ecosystem-wide iteration.

Of course, this prerequisite is NVIDIA's commitment to a non-operational stance. Only then can automakers collaborate without fear of being "choked," such as having data appropriated or core technologies restricted.

On this front, WeRide, the "pioneer in global Robotaxi IPOs," holds significant authority.

As early as 2017, NVIDIA participated in WeRide's Pre-A round financing as a strategic investor. The 1.7386 million shares (valued at approximately $24.65 million) disclosed in Q4 2024 underscore their eight-year technological collaboration.

In its infancy, WeRide's self-driving taxi fleet already utilized NVIDIA's DRIVE Xavier chips. These chips processed real-time road data, integrating camera and LiDAR information to aid autonomous vehicles in navigation and ensure stable operation.

In March 2024, their collaboration escalated with WeRide launching its autonomous driving software platform, WeRide One, built on NVIDIA's DRIVE Thor platform.

WeRide's positioning validates NVIDIA's entry logic. As an NVIDIA ecosystem participant, WeRide can collaborate with automakers like GAC and Yutong for vehicle customization while connecting with mobility platforms like Didi and Uber for operations. NVIDIA merely provides foundational technology support without interfering in commercial decisions. In essence, it empowers technically without overstepping.

Today, WeRide's operational scenarios serve as a "proving ground" for NVIDIA's Robotaxi ecosystem, heralding the upcoming "three-way battle" era for Robotaxis.

Open vs. Closed: Robotaxi at a New Crossroads

Fundamentally, NVIDIA aims to ignite an "open vs. closed" competition in the Robotaxi industry, potentially acting as a catalyst for industry growth, much like the Android vs. iOS rivalry did for smartphones.

The primary drawback of current closed models is "high R&D costs and sluggish iteration." Open ecosystems can mitigate these costs, enabling small and medium-sized automakers to develop customized Robotaxis at lower expenses using NVIDIA's technology blueprints. This implies more players can enter the market.

For instance, in "campus Robotaxi" scenarios, previously only Baidu, UISEE, and other leading players could offer solutions. By joining NVIDIA's ecosystem, a startup focused on campus mobility can swiftly launch services by optimizing niche features like "low-speed driving and dense pedestrian recognition."

In "logistics Robotaxi" scenarios, freight companies no longer need to self-develop autonomous driving algorithms. By integrating NVIDIA's technology blueprints and adapting cargo scheduling functions, they can deploy driverless freight services. The influx of players in these niche segments will not only expand Robotaxi applications but also pressure incumbents to accelerate technological innovation. After all, when more players offer services at lower costs, the disadvantages of closed models become increasingly evident.

Image Source: NVIDIA

Open ecosystems can also foster technological inclusivity. Currently, Robotaxi operations are concentrated in "first-tier city cores" due to comprehensive high-definition map coverage and simpler road environments.

An open ecosystem enables rapid technological adoption in lower-tier markets. For instance, automakers in third- and fourth-tier cities can leverage NVIDIA's technology blueprints, combined with local road data, to optimize algorithms and introduce Robotaxis to these markets sooner.

However, the competition between open and closed models won't be a zero-sum game but likely a coexistent one. Similar to iOS and Android's long-term coexistence, the Robotaxi industry may witness a parallel landscape: Closed-model players like Waymo and Baidu will focus on "high-margin scenarios," such as premium mobility in first-tier cities, ensuring service quality through "full-stack control."

Meanwhile, NVIDIA's open ecosystem participants will cater to "mass-market scenarios," such as third- and fourth-tier cities, campuses, and logistics, capturing market share through "cost advantages." This competition won't disrupt the industry but instead create a "premium vs. mass-market" synergy, accelerating Robotaxi commercialization.

NVIDIA's foray into the Robotaxi sector may seem like a diversion, but it signals that the autonomous driving industry has reached a pivotal juncture.

In recent years, the industry's focus has been on achieving L4 autonomous driving first. In the coming years, the priority will shift to making L4 autonomous driving accessible to a broader audience. Clearly, NVIDIA has opted for the latter path.

NVIDIA isn't another Waymo but the Google of the Robotaxi industry. By lowering industry barriers through open ecosystems and combining software-hardware integration to counter the single-point advantages of closed giants, NVIDIA faces challenges like standardization, data security, and stakeholder coordination. However, its ecosystem-driven market strategy offers a fresh approach to industry breakthroughs.

Robotaxi, Autonomous Driving, Self-Driving Taxi, Ride-Hailing, NVIDIA

Source: Leitech

Images courtesy of 123RF Royalty-Free Library. Source: Leitech