OpenAI's God-Slaying Gamble: Few Truly Grasp Its Implications

![]() 10/29 2025

10/29 2025

![]() 660

660

This article is written based on publicly available information and serves solely for informational exchange, not constituting any investment advice.

In November 2019, four years before the advent of 2023—the year hailed as the 'first year of large models'—a painting quietly adorned the website of OpenAI LP, the for-profit subsidiary established to explore commercial possibilities. Its impression: 'warm, serene, hazy, yet pulsating with infinite vitality beneath the surface.'

This artwork, which initially stirred little attention, was later interpreted as profound: a 'soft yet unwavering' visual representation of the then-mysterious, fringe AI startup's ultimate goal—Artificial General Intelligence (AGI).

Above the same page, more concise than the image, lay the text defining its soul:

'Our mission is to ensure that artificial general intelligence (AGI) benefits all of humanity, primarily by attempting to build safe AGI and share the benefits with the world.'

'Our mission is to ensure AGI benefits all humanity, primarily by building safe AGI and sharing its gains globally.'

This manifesto, with its pure humanistic idealism, evokes a familiar sense—reminiscent of Mark Zuckerberg's original vision for Facebook in his Harvard dorm room: 'to empower people to share and make the world more open and connected.'

By late autumn 2025, six years had passed since this mission was declared. Looking back, OpenAI's course seems to have strayed little from its initial stars.

Yet, the cost of realizing this dream has surged a hundredfold—a fact Sam Altman and his team make no attempt to conceal. Their public funding proposals openly state:

'We aspire to strengthen our financing capabilities while fulfilling our mission. However, no existing legal framework balances these contradictions. Our solution: create OpenAI LP, a hybrid of for-profit and nonprofit—a 'capped-profit' entity.'

As foreshadowed, OpenAI now operates not with 'billions' but 'trillions' of dollars in capital. By incomplete estimates, the grand chess game OpenAI orchestrates around AI infrastructure involves $1.5 trillion in funding, with the company's latest valuation reaching a staggering $500 billion.

From one perspective, OpenAI mirrors Facebook's growth trajectory—only on a grander scale, aiming to establish absolute authority akin to Apple's in the 'iPhone ecosystem.' The endgame of this gamble is gradually coming into focus.

01

Architectural Reinvention

In spring 2025, OpenAI unveiled a series of meticulously timed announcements, demonstrating how it redesigned its framework to bear both the weight of ideals and the pull of reality.

On April 2, April 15, and May 5 of that year, OpenAI released three waves of deep architectural adjustments on its website. The compact (Chinese for 'tight/compact'; consider 'precise' or 'well-coordinated' for natural English) rhythm and clear intent formed a perfect 'strategic trilogy':

First, a nonprofit announced a carefully considered new mission; next, four nonprofit advisors were appointed to strengthen governance; finally, a new structure named 'Symbiosis' emerged.

These steps revealed OpenAI's ambition to reconcile technological idealism with commercial ambition (Chinese for 'ambition'; 'drive' or 'aspiration' could also fit).

The first two declarations shocked many: the renowned OpenAI began as a pure nonprofit or an idealistic limited-liability company with profit caps.

However, as OpenAI pursued more complex models, external capital became indispensable. After raising billions, management faced shareholder pressure for returns, forcing them to balance commercialization with their original mission.

Yet, adhering to 'benefiting humanity' while satisfying capital's demands strained their 'capped-profit' model. Thus, a transitional step emerged: hiring esteemed nonprofit advisors to reinforce their public image of commitment to public welfare (Chinese for 'public welfare'; 'common good' or 'public interest' could work).

After laying ethical and public foundations, the core declaration arrived: OpenAI's innovation in tech governance—the 'Symbiotic Architecture.' Most notably, OpenAI abandoned its 'capped-profit' transitional model.

Specifically, the new OpenAI structure comprises two distinct yet intertwined branches:

· PBC (Profit Benefit Corporation): Focused on shareholder returns and commercial value, it acts as the 'engine' driving profit in the real world. Its core task: raise 'hundreds of billions to trillions' to build advanced models, reaping commercial gains en route to AGI.

· Nonprofit: The controlling entity and ultimate owner of the PBC. Its mission aligns with the 2019 dream of achieving AGI for humanity, serving as the 'soul' of the new OpenAI. It ensures the ship stays true to its original north star amid commercial seas.

This unique structure stems from OpenAI's fundamental duality: 'achieving AGI's grand mission' versus 'repaying the astronomical capital invested.' Many see OpenAI's architectural revolution as an optimal solution.

Globally, this 'nonprofit controlling a for-profit' hybrid isn't unprecedented—Mozilla being a successful example.

Firefox and related products, developed by the for-profit Mozilla Corporation, generate revenue. This corporation is wholly owned by the nonprofit Mozilla Foundation, whose mission is 'to ensure the Internet is a global public resource for all.'

However, OpenAI's innovation is bolder. Unlike Mozilla, OpenAI operates at unprecedented capital scales and commercial ambitions. This structure lets OpenAI declare both its nonprofit origins and commercial logic without contradiction.

Backed by this robust framework, OpenAI aggressively expanded into computational power and cloud services, partnering with industry leaders to leverage their capabilities, market positions, and resources, accelerating its computational dominance.

With organizational adjustments settled, OpenAI launched an unprecedented era of large-scale computational deployment.

02

Strategic Alliances

Among industry-shaking moves, OpenAI's most strategic lay in its 2025 partnerships with cloud providers and chip manufacturers.

· January 21, 2025: OpenAI announced 'Stargate,' a supercomputing project to build next-gen AI infrastructure.

· May 22, 2025: Launched Stargate UAE, its first international deployment, marking a global expansion milestone.

'Stargate' didn't fade into obscurity. Through cross-industry 'masterstrokes,' the world realized this future vision was built on colossal, physical data centers.

Speculation arose: Could AGI be near?

From July, partnership announcements came rapidly:

· July 22: Stargate partnered with Oracle to develop a 4.5 GW Stargate data center in the U.S., creating jobs, accelerating 'reindustrialization,' and solidifying U.S. AI leadership.

· September 22: OpenAI and NVIDIA announced a strategic partnership to deploy a 10 GW AI data center cluster powered by NVIDIA's top systems, with Phase 1 starting in 2026.

· October 6: AMD and OpenAI announced a multi-year partnership to deploy 6 GW of AMD Instinct GPUs, beginning with 1 GW in 2026 to power OpenAI's next-gen infrastructure.

· October 13: OpenAI and Broadcom announced a multi-year partnership to deploy 10 GW of OpenAI-designed AI accelerators, co-developing next-gen systems and customized Ethernet for scalable, energy-efficient AI infrastructure by 2029.

· October 28: OpenAI signed a new agreement with Microsoft to finalize its for-profit OpenAI Group PBC and recapitalize. Microsoft's post-dilution stake became ~27%, with OpenAI committing to purchase $250 billion in Microsoft Azure cloud services.

These partnerships gathered nearly all global leaders in computational power and cloud services, preparing OpenAI for future demands.

This ecosystem benefits industrial chain (Chinese for 'industrial chain'; 'supply chain' or 'value chain' could fit) participants, including chipmakers, cloud providers, and power/real estate partners.

For firms unable to compete directly with Google, Microsoft, or Meta, collaborating with OpenAI offers a prime opportunity to engage in AI's biggest window of opportunity (Chinese for 'trend/opportunity'; 'boom' or 'wave' could work) and secure a future niche.

Unsurprisingly, interest surged.

03

Ecosystem Dominance

If cross-industry partnerships secured OpenAI's computational foundation, its October developer conference revealed the core reason for its computational hunger and completed its strategic vision.

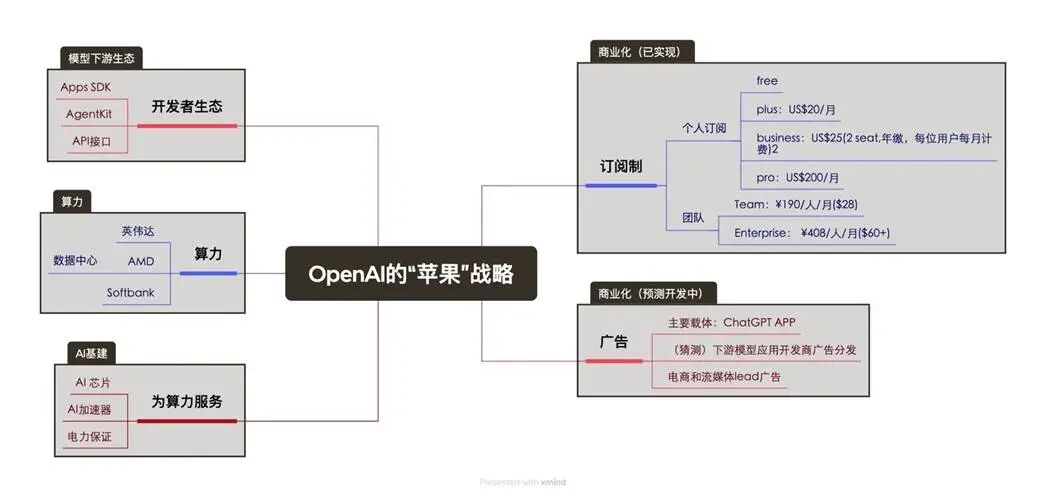

Dubbed the 'AAPL Strategy,' it deeply borrows from Apple's ecosystem model:

In OpenAI's vision, its future AI ecosystem role mirrors Apple's in the 'iPhone ecosystem': the definitive industry leader and value allocator.

Under this blueprint, OpenAI dominates industry computational supply while empowering model developers as 'distributors' of its capabilities, indirectly reaching billions of users and unlocking vast monetization potential.

This emerging chain, dubbed the 'O-Chain,' has clear divisions:

· Upper Upper Stream: Computational supply and energy, handling data center site selection (Chinese for 'site selection'; 'location planning' fits), land, power, construction, and maintenance.

· Upper Stream: Chip designers and manufacturers, producing high-performance GPUs and AI accelerators for model training and inference.

· Midstream (Core): OpenAI itself, providing developers with AI models, toolchains (SDKs), and API services to aggregate global developer resources and indirectly control user ecosystems.

· Downstream: Terminal applications like ChatGPT, Sora, and ImageGen, serving end-users and forming traffic entry points and brand barriers.

Reviewing products from OpenAI's last three developer conferences clarifies its ecosystem strategy. The 2025 conference highlighted two key developer tools: Codex, an AI programming product revolutionizing coding, and advanced models enhancing API performance.

Apart from toolkits for developers, the “Apps in ChatGPT” feature is quietly transforming ChatGPT’s chat-based interface into a powerful “service linker” for C-end users. Triggered in the right context, users can seamlessly open and utilize core functionalities of third-party product websites or apps directly within ChatGPT’s conversation environment.

For example, when ChatGPT references or recommends a course on Coursera while answering a user’s query, and if Coursera has integrated OpenAI’s App SDK, the user can instantly open and access that specific course page within the chat interface—creating a closed loop from information acquisition to service delivery.

We can make a bold assumption: If other integrated apps rely on advertising for monetization, users may encounter targeted ads within ChatGPT when using those apps’ features. If the app operates on a subscription model, ChatGPT could serve as a highly efficient traffic channel, driving premium paid members to the app.

OpenAI officially projects that approximately 30 products will integrate with this service by the end of 2025. Leveraging its massive user base and high-frequency usage scenarios, it is highly likely to trigger a wave of product adoption within the next 1–3 years.

This feature offers unprecedented convenience to users, delivering a “conversation-as-service” experience upgrade. Simultaneously, it provides OpenAI with a bold commercialization path: beyond directly offering services from SDK-integrated products, the answer interface could evolve into a stream of contextually relevant product recommendations or situational ads.

Beyond the high-profile “Apps in ChatGPT” announcement at the developer conference, The Information—a leading tech media outlet—reported that OpenAI is quietly advancing another critical initiative: allowing startups using ChatGPT’s models to let their users log in via ChatGPT accounts to access the startups’ own apps or websites.

If this “unified login” system succeeds, OpenAI will gain unprecedented, granular behavioral data on how users interact with its models—forming the ultimate moat for model iteration and commercial algorithms. For startups, this not only slashes development and maintenance costs for proprietary account systems but also offers a possibility: shifting a portion of their hefty “model usage costs” onto users.

All products unveiled at the conference can be viewed as a highly synergistic combination of “SDK + platform features + model matrix.” Behind this lies OpenAI’s grand ambition to recreate an ecosystem comparable to Apple’s App Store—even hinting at a ultimate goal to disrupt Apple and Google’s current mobile traffic monopolies via iOS and Android, respectively.

OpenAI’s core strategy has firmly shifted from being an early-stage “model technology pioneer” to an “AI ecosystem builder” and “rule setter.”

For developers worldwide, mastering OpenAI’s SDK and powerful models (i.e., computing services) enables rapid construction of intelligent applications. This scenario closely mirrors the “low-barrier, large-market” stage Apple’s App Store once provided for global developers.

To some extent, OpenAI is not only emulating Apple but also replicating Facebook’s successful path of rapid growth through an open platform.

04

Countdown to Monetization

No matter how grand the vision, its transformation from blueprint to enduring legacy—or a cautionary tale—depends on a solid foundation. For a business, that foundation is always healthy, sustainable revenue.

All signs indicate that 2025 will be OpenAI’s most significant year for commercialization. Based on cross-referenced information, after exploring multiple paths, OpenAI will ultimately rely on the age-old internet business of online advertising to fully launch its second revenue growth curve.

According to credible reports, by June 2025, OpenAI’s annual recurring revenue from subscriptions like ChatGPT Plus had already reached approximately $10 billion.

This is an astonishing figure. However, a closer look at its user structure reveals that only 4% of weekly active users are paying customers. This means 96% of free users continue to consume expensive computing resources without generating direct revenue. To convert this vast “traffic ocean” into a “revenue field,” advertising has emerged as the most direct and mature monetization method.

Judging by OpenAI’s key personnel changes and hiring trends in the second half of the year, we believe OpenAI is nearing a public, large-scale rollout of advertising-driven revenue growth. For any company, launching a strategic new business requires the right talent first.

By integrating recent public reports, official announcements, and detailed job postings, we find that OpenAI’s commercialization “warship”—its captain, first mate, navigation charts, and engine room—are all taking shape, entering final debug (Chinese pinyin, meaning “testing and adjustment”) stages.

● Commercial Steersman: Fidji Simo Takes Command

In May 2024, OpenAI made a critical executive appointment: hiring Fidji Simo, one of Meta’s core monetization architects and then-CEO of grocery delivery platform Instacart, as CEO of its Applications Business.

This move is widely seen as the strongest signal yet of OpenAI’s strategic pivot toward advertising.

According to Fidji Simo’s LinkedIn profile, she officially joined OpenAI in August 2024, assuming full responsibility for commercializing applications.

Fidji Simo was chosen as ChatGPT’s “Head of Applications” due to her decade-long tenure at Facebook (now Meta). Her career peak (2011–2021) spanned Facebook’s most critical commercialization phase as it transformed from a social network into a global online advertising empire.

At Facebook, Fidji Simo held roles in product marketing, product management, and eventually became VP of Video, Games, and Monetization. Her experience covers nearly all of Facebook’s key commercialization scenarios: from matured news feed ads to gaming platform explosions, and video product development, launch, and monetization.

She brings precisely the experience needed to build and monetize innovative products from scratch—aligning perfectly with OpenAI’s urgent need to convert cutting-edge technology into scalable revenue.

Additionally, from March 2023 to May 2024, Fidji Simo served as an external expert on OpenAI’s board, gaining deep insight into the company’s strategies and challenges.

● Talent Recruitment: Job Listings Reveal Commercialization Blueprint

To understand a rapidly expanding company’s business progress and strategic priorities, analyzing its official job postings is highly effective.

After statistics (Chinese pinyin, meaning “analyzing”) hundreds of job listings on OpenAI’s website, we found that most new positions are concentrated in departments like “Applied AI Engineering,” “Sales,” “Marketing,” and “Technical Support.”

This clearly indicates the company is urgently and precisely driving its technology from labs to market.

Judging by these job descriptions, OpenAI’s planned advertising system will not be a mere copy of traditional platforms but will deeply integrate its core “Applied AI” capabilities to create an inherently intelligent ad engine.

After reviewing positions most closely tied to business monetization, we can roughly outline OpenAI’s next-stage strategic framework.

From department distribution, job responsibilities, nature ratios, and targeted industries/partners, it is clear OpenAI is advancing on multiple fronts simultaneously:

Accelerating development of its proprietary ad platform, strengthening global marketing efforts, ensuring smooth construction of AI data centers (Stargate), and continuously optimizing models and multimodal capabilities. Its goal is unmistakably to secure absolute dominance—even monopoly—in the AI industry.

This strategy rests on three core pillars:

1. Computing Supremacy: Through unprecedented capital investment, OpenAI aims to stockpile computing resources far exceeding competitors for its model iterations, ad platform operations, and downstream model application enterprises—establishing absolute dominance in future digital-era computing.

2. Diversified Monetization: While advertising is the clear primary path, some enterprise sales and solution-oriented roles suggest OpenAI has not fully abandoned the lucrative enterprise customization market.

3. Technological Leadership: OpenAI continues to advance foundational innovation in more advanced model capabilities, particularly along the AGI path, striving to maintain at least a generational lead—the cornerstone of all its commercial narratives.

It is foreseeable that advertising will serve as OpenAI’s core commercialization engine. Notably, job listings reveal its internal ad platform is also AI-driven at its core.

This suggests OpenAI’s ad system may differ genetically from existing giants like Meta and Google from inception. However, an ad platform deeply integrated with ChatGPT’s conversational and understanding capabilities will undoubtedly offer advertisers a more intelligent and automated experience than current platforms.

We can envision this AI-native ad system potentially achieving end-to-end self-learning and optimization—from ad creative generation and audience targeting to real-time bidding strategies and performance optimization. Advertisers may only need to define marketing objectives and budgets, then monitor whether outcomes meet expectations.

Furthermore, the emergence of commercial infrastructure roles related to online advertising and enterprise market services—such as Payments engineers, Financial Engineering specialists, and Order-to-Cash leads—indicates OpenAI is building a robust, compliant, and scalable backend system for commercialization.

While this system currently primarily supports growing subscription revenues and API businesses, it is equally essential for future large-scale, high-complexity ad operations (e.g., precision ad billing, revenue sharing with developers, fraud prevention).

05

The God-Killing Gamble

Discussions and skepticism about an “AI bubble” have persisted since the current wave began. Typically, after industry warnings about an “AI capital expenditure bubble” reach a crescendo, markets see various “rational” debates attempting to disprove the bubble through metrics like market application speed, user growth, corporate cash flow, or revenue capacity.

Interestingly, OpenAI—at the center of this global debate—remains strikingly calm. Rather than rushing into large-scale, full-spectrum commercialization as mainstream business opinion expects, it has doubled down on deeper, more forward-looking capital investments, showing no signs of slowing its all-in bet on computing infrastructure.

This “unprecedented capital investment” and “all-in on computing” strategy is itself a colossal gamble in business history—betting not just on AGI’s ultimate technical realization but also on the final form of AI-era infrastructure.

If successful, computing will transcend being a mere resource and become OpenAI’s deepest, most insurmountable moat.

From its 2019 mission establishment to its 2025 strategic positioning, OpenAI appears relentlessly committed to its original “AGI computing determinism” path. Despite internal team turmoil, near-disintegration, and Sam Altman’s dramatic boardroom coup, these pale compared to the technological and commercial stakes reshaping humanity.

All this seems to validate one perspective: GPT, not Altman, is OpenAI’s true and eternal protagonist.

Despite mixed reviews for its latest GPT-5 model, OpenAI remains the industry leader with the most active users and the most complete developer ecosystem.

Critically, OpenAI has embraced commercialization earlier and more decisively than any rival. After establishing computing supremacy through alliances and self-investment, the only remaining question is whether its commercial innovations will yield financial returns as dazzling as its technological ambitions.

So, who is Sam Altman: a visionary strategist or a reckless gambler?

Perhaps the answer is neither binary.

He is both history’s greatest gambler, wagering trillions on an uncertain future, and the most ambitious madman laying a global chessboard for the AGI era—attempting to rewrite the world’s operational rules.

Five years from now, when history looks back at winter 2019, will it see the birth of a company, the dawn of a golden age, or the dark moment when a “god-killer” first knocked on heaven’s gates?