Meta: AI Investment 'Racing at Full Throttle', Will Funding and Faith Run Out?

![]() 11/03 2025

11/03 2025

![]() 561

561

Hello everyone, I'm Dolphin Fin!

Meta released its Q3 2025 financial results after the market closed on October 30 (Eastern Time). While the 'shocking' net profit of 2.7 billion may be 'noise,' the performance, especially the trends implied by the revenue and expenditure guidance, is hardly cause for celebration.

Let's break it down:

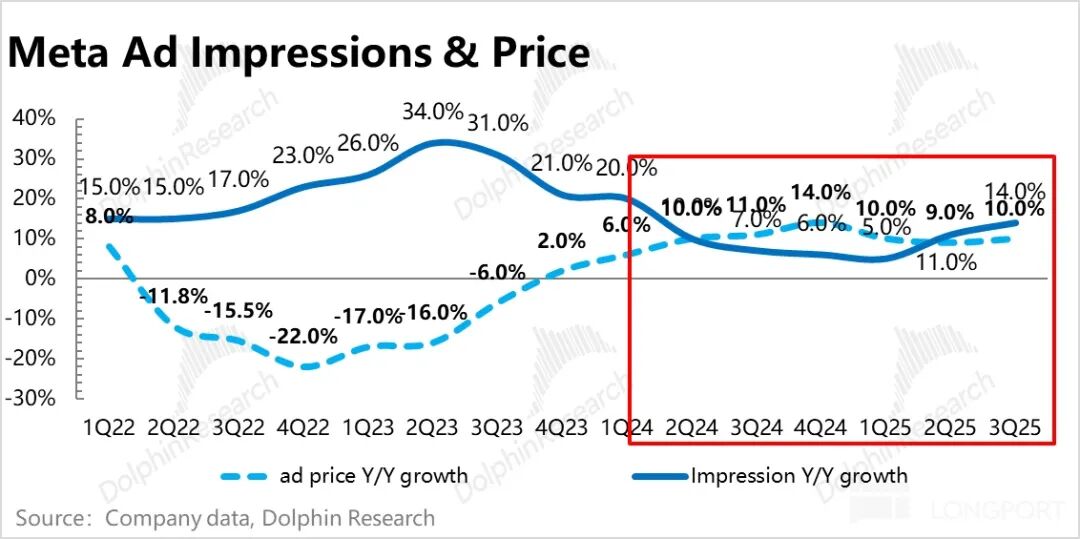

1. Advertising accelerates strongly: Advertising revenue grew by 26%, further accelerating growth. According to advertiser surveys, this was mainly due to increased Reels usage time and improved ROI driven by AI tool Advantage+. Looking at actual volume and price, Q3 continued the trend from Q2, with ad impressions accelerating to 14% growth and price increasing by 10%.

From a regional perspective, the volume growth is primarily attributed to further penetration of Reels among users (mainly on Facebook). Regarding ad prices, in the U.S. market, economic growth has kept prices stable, preventing erosion from lower-priced ads like Reels. In Europe, the strengthening euro has further boosted price growth.

Overall, the advertising sector is thriving.

2. Q4 guidance is 'mediocre': Compared to the continued acceleration in advertising growth in Q2 and Q3, the company provided a Q4 total revenue guidance of $56-59 billion (vs. sell-side expectations of $57.4 billion and buy-side expectations of $58-60 billion), corresponding to a growth range of 16% to 22%.

Since advertising revenue accounts for 98% of Meta's total revenue, this revenue growth guidance is essentially equivalent to advertising growth. In other words, growth is expected to slow in Q4.

Considering that Meta often exceeds the high end of its guidance, even if Meta's revenue reaches the buy-side's highest expectation of $60 billion in Q4, the year-over-year growth would still be 24%, indicating a trend of slowing growth.

Under this revenue growth trend, if both operating and capital expenditures rise sharply, it will result in slowing revenue growth, accelerated investment, and squeezed cash flow, leading to reduced shareholder returns.

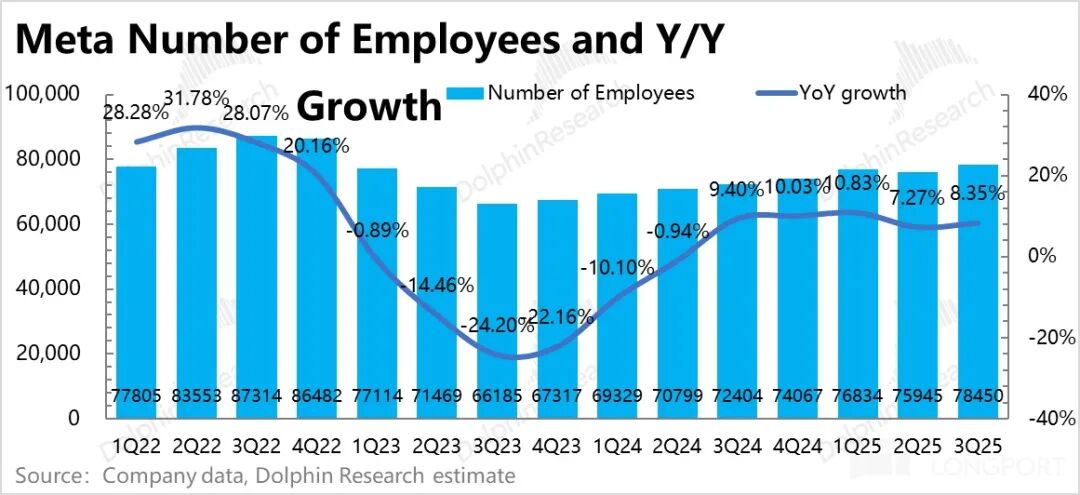

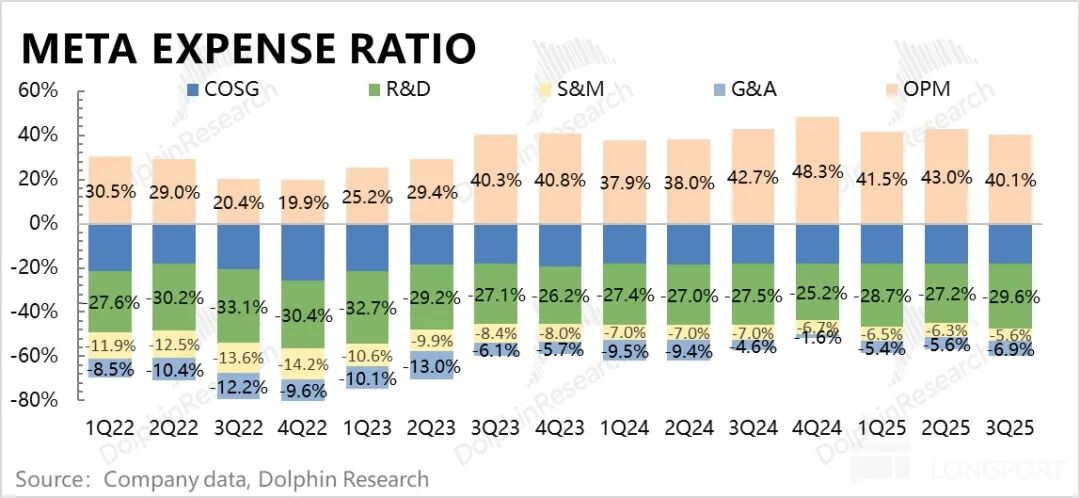

3. Opex surges: Progress in large models has been slow, with AI labs engaging in high-cost recruitment followed by mass layoffs. Combined with high depreciation expenses from rapid growth, this has raised market concerns about uncontrolled spending.

These concerns were validated in Q3: R&D expenses increased by 35% year-over-year, while administrative expenses surged by 88% due to legal costs and high employee salaries, returning to a period of rapid growth.

Q4 expenditure guidance: Based on the company's updated full-year guidance of $116-118 billion (an increase of $2 billion from the previous quarter's lower bound), the implied Q4 cost + operating expenses are expected to rise further to a 38% year-over-year increase. Excluding the $1.55 billion legal expense recorded last year, the year-over-year increase would be 30%, significantly higher than the Q4 revenue guidance range of 16%-22%.

After calculations, the Q4 operating profit margin may be squeezed to around 42%, a sharp decline from the peak margin of 55%. In other words, starting in Q4, the market will truly feel the pressure on Meta's financial statements from its 'reckless' investments.

Ultimately, with both revenue and expenses growing rapidly, Q3 operating profit reached $20.5 billion, up 18% year-over-year. While this exceeded sell-side expectations, buy-side expectations had already been raised due to strong revenue growth, so the actual beat may not be significant.

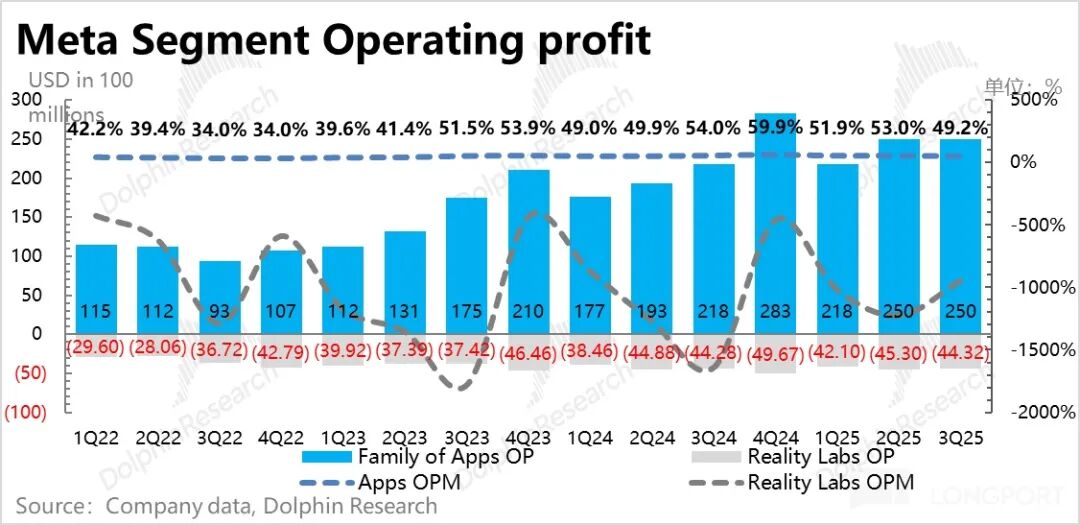

By segment, the core App services business had an operating profit margin of 49%, below sell-side expectations. Meanwhile, the less-watched Reality Labs segment saw a reduction in losses, narrowing to $4.4 billion.

Dolphin Fin cautions that with the persistent AI FOMO (Fear Of Missing Out) mentality next year and high AI investments, the Reality Labs business may become a primary target for cost-cutting, layoffs, and expenditure reductions to reallocate resources to AI. This process will likely see the main App business's profit margin continue to decline while Reality Labs' losses narrow.

4. Will reckless AI investment spook the market? The Q3 results themselves and even the Q4 guidance are not the biggest concerns. The market's primary worry in the Q3 report is the qualitative guidance for 2026. Meta has indeed thrown a 'bomb':

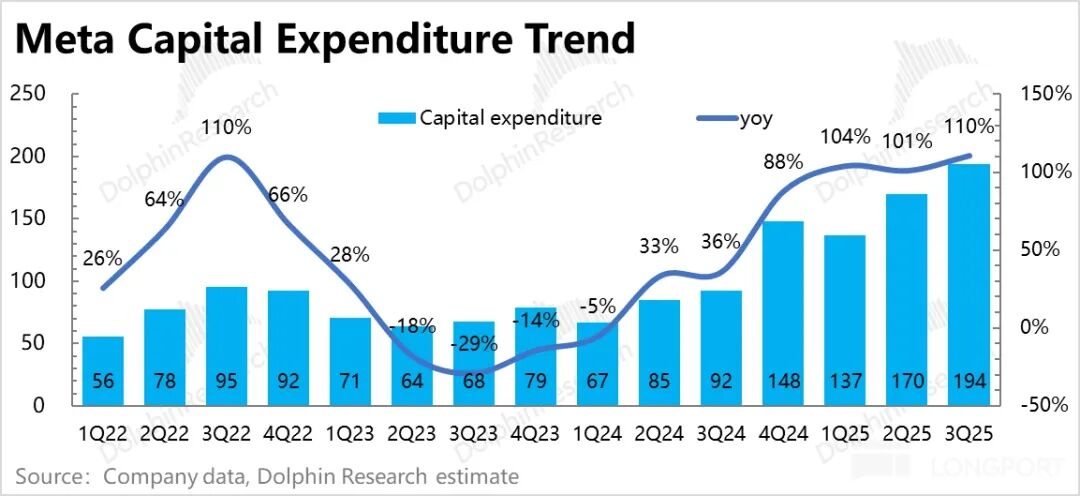

During the Q2 financial results, the capital expenditure guidance was raised from $64-72 billion to $66-72 billion, with the lower bound increased by $2 billion. After actual Q3 capital expenditures reached $19.4 billion, nearly $1 billion above market expectations, Meta directly raised the lower bound from $66 billion to $70 billion, an increase of $4 billion, implying Q4 capital expenditures will further rise to around $21 billion.

Clearly, with Blackwell's product ramp-up, Meta has fully opened the floodgates for capital expenditures. Looking ahead to 2026, while Meta has not provided specific total expenditure figures, the qualitative guidance has been very 'aggressive,' already laying the groundwork for a comprehensive quantitative guide next quarter:

a. 2026 capital expenditures: The growth opportunities in 2026 are too enticing. While specific figures for 2026 capital expenditures have not been finalized, the expectation is to 'invest aggressively' through self-built and third-party co-located data centers, with the absolute capital expenditure value expected to be 'notably larger.'

b. 2026 operating expenses: The growth rate in 2026 will be 'significantly faster' than in 2025, primarily due to higher cloud expenses and amortization/depreciation of infrastructure costs, followed by a substantial increase in employee expenses resulting from significant AI and technical talent recruitment in 2025.

5. Cash usage and shareholder returns: At the end of Q3, Meta had $44 billion in cash + short-term investments, down $3 billion from the previous quarter, mainly due to increased PPE investments consuming cash flow.

Free cash flow for the quarter was $10.6 billion, with dividends of $1.2 billion and share repurchases of $3.1 billion. Notably, share repurchases declined significantly from $10 billion in the previous quarter. As of Q3, total shareholder returns for the year reached just over $30 billion, compared to $34 billion in the same period last year. Based on the average for the first three quarters, the shareholder return yield has declined to 2%.

6. Overview of performance metrics

Dolphin Fin's Perspective

Overall, Q3 performance was solid, but the main issue lies in the revenue and expenditure trends implied by the quantitative and qualitative guidance:

a. First, the Q4 revenue growth guidance suggests that Meta's period of high revenue growth is ending, with the growth trend reversing from the accelerated growth seen in the previous two quarters. Growth is expected to slow, or optimistically, stabilize in the 20-25% range in 2026.

b. Against this backdrop, the qualitative guidance for capital and operating expenditures is essentially 'full throttle': The use of terms like 'aggressively,' 'notably,' and 'significantly' in front of investment and expenditure guidance is concerning for investors. The simultaneous use of all three terms is bound to spook the market.

c. Increased investment has led to reduced cash flow: Share repurchases, a major component of shareholder returns, have declined significantly, while stock prices continue to rise, dragging the shareholder return yield down to 2%.

d. With a market cap of $1.89 trillion at the close and operating profit after tax of less than $70 billion in 2025,

These four pieces of information together present a clear contradiction:

2026 will be a period of strict high investment, encompassing further marginal increases in capital expenditures driven by AI FOMO, a high-stakes talent war with soaring salaries, and the sustained high capital growth already established in 2025, which will continue to erode financial performance from late 2025 onwards.

Under these circumstances, it is crucial for Meta to provide a 'WOW' guidance for high revenue growth to the market. However, Meta has not provided guidance for further acceleration in Q4 revenue growth; instead, the growth rate has slowed to (16%-22%). Under such circumstances, the market may optimistically project 2026 growth at around 20-25%.

The result is slowing revenue growth, high investment beginning to erode operating expenses on the financial statements, and capital expenditures continuing to 'surge forward,' directly squeezing the space for shareholder returns.

Thus, 2026 will be a period of mismatched revenue and expenditures for Meta, with profit growth likely in the low double digits or high single digits.

However, Dolphin Fin cautions against overreaction. Thus far, we have emphasized a valuation correction, not a logical one. While the Q3 guidance does confirm market concerns—that Meta's massive investments and talent recruitment will impact performance—this is merely a mismatch in the company's investment and output cycles.

First, the industry remains stable: Despite tariff disruptions, fiscal and monetary easing in the U.S. in 2026 provides an implicit performance safety net for companies like Meta, which rely heavily on advertising revenue and are closely tied to macroeconomic trends.

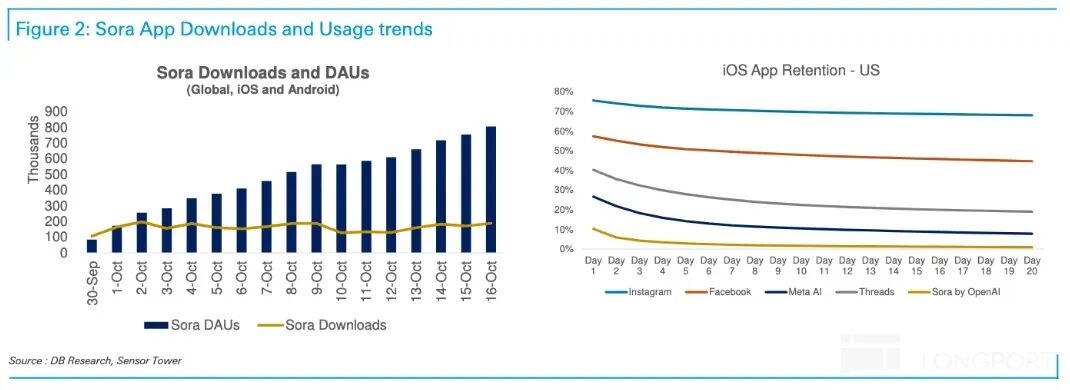

More importantly, in terms of competitive landscape, Dolphin Fin believes the market's concerns about TikTok's return and Sora's emergence are currently overblown. Meta's social entertainment empire remains solid:

a. Sora's emergence seems daunting, but user retention rates have been underwhelming. We believe most users treat Sora as a tool, generating videos on Sora and posting them on their original social platforms. Thus, the initial market reaction was overblown. For Dolphin Fin's commentary, refer to 'OpenAI Aims to Profit, Who Will Suffer?'

b. Regarding TikTok, while the deal is nearing completion (with no substantial obstacles remaining), the migration of TikTok's U.S. data centers to Oracle may limit some frontend functionalities, potentially leading to user attrition. Until this migration is finalized, Dolphin Fin expects the overall impact on Meta to remain manageable.

Therefore, without a repeat of the 2022 pressures on the most critical issues, Meta is unlikely to face a significant crisis. Currently, due to margin pressures, 2026 growth is expected to slow notably (unless Meta AI delivers exceptional performance within a year).

However, if Meta navigates the short-term capacity mismatch in 2026 and OpenAI's consumer products require a longer 'incubation period,' then, beyond 2027, with a long-term perspective, Meta's strong social moat, enhanced by AI, will continue to lead the industry.

A more detailed value analysis has been published in the Changqiao App under 'Dynamic-Research' in an article with the same title.

Detailed Analysis Below

I. Advertising Continues to 'Accelerate'

In Q3, Meta's revenue reached $51.2 billion, accelerating to a 26% year-over-year increase, exceeding the upper bound of guidance. However, since the market had already anticipated strong Q3 revenue growth (third-party tracking platforms indicated a 15% acceleration in ad impressions), it was not entirely unexpected.

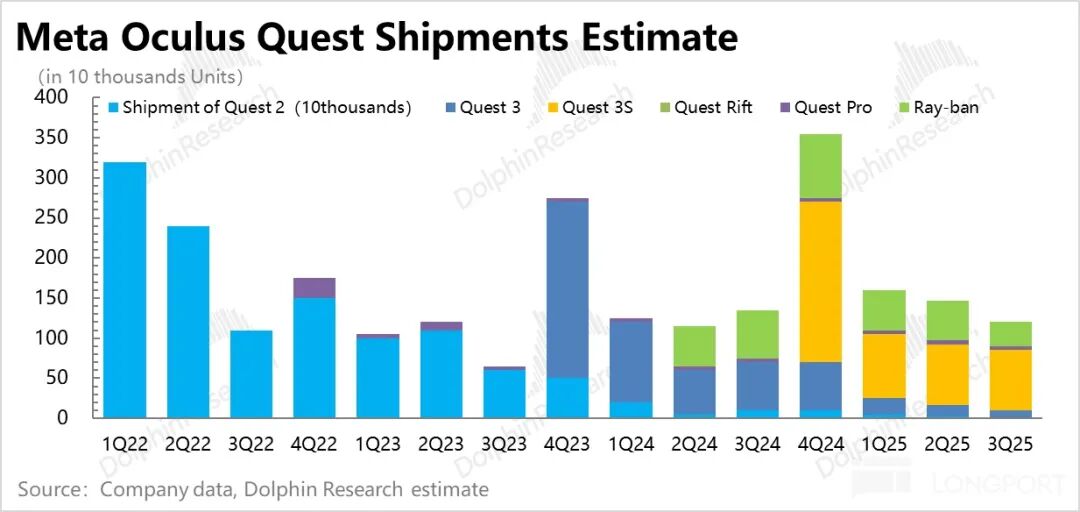

The high growth was primarily driven by Meta's products like Reels, which have solidified user quality metrics such as engagement time and DAU stickiness, propelling the advertising business—which accounts for 98% of revenue—into sustained growth. VR products (Quest 3S and the new Ray-Ban AR smart glasses) only launched in late September and did not contribute to the current period.

Q4 Revenue Guidance: Meta management expects Q4 2025 total revenue to be in the range of $56-59 billion, corresponding to a year-over-year increase of 16%-22%, with currency exchange rates contributing to 1% growth.

This guidance aligns closely with sell-side expectations of $57.3 billion but falls below buy-side expectations of $58-60 billion. Moreover, given the trend from last quarter's guidance of 17-24% growth versus this quarter's 16-22%, there is a risk that actual Q4 revenue growth may slow further.

Breaking it down by segment:

1. Advertising Business: Accelerated Impression Growth Likely Due to Further Reels Penetration

For the advertising business, Dolphin Fin prefers to analyze the current trends in volume and price growth to better understand the macro environment and competitive landscape.

1) Ad Impressions: Reels' Success Continues to Drive Growth

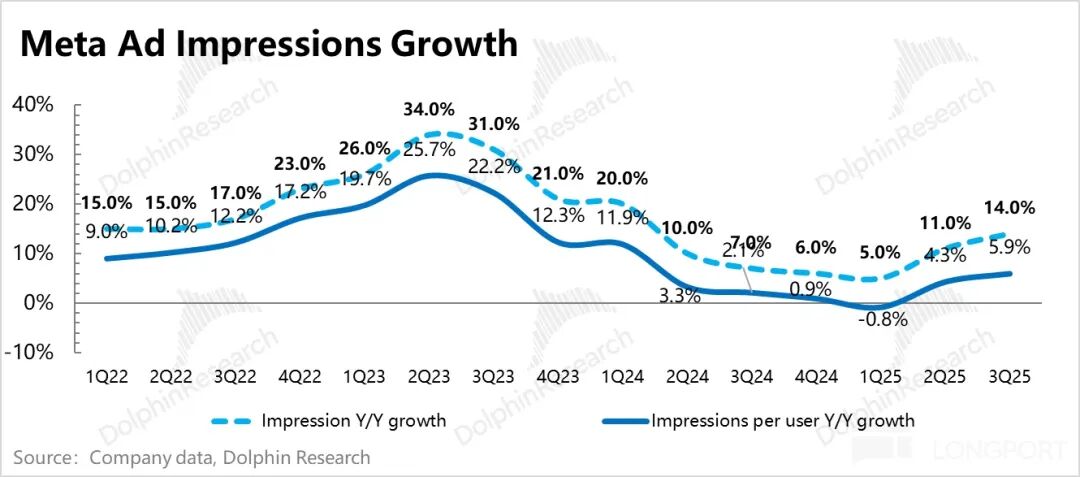

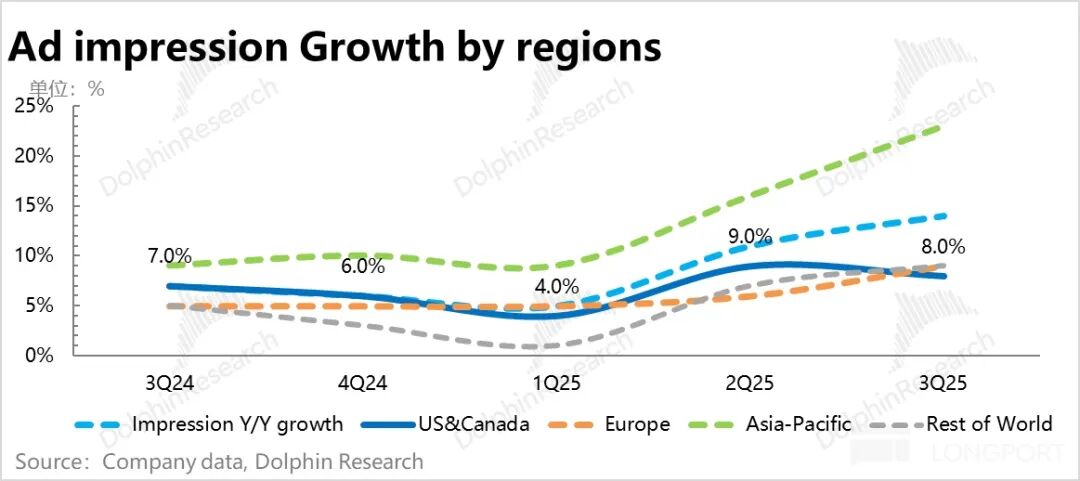

Q3 ad impressions growth accelerated further to 14%.

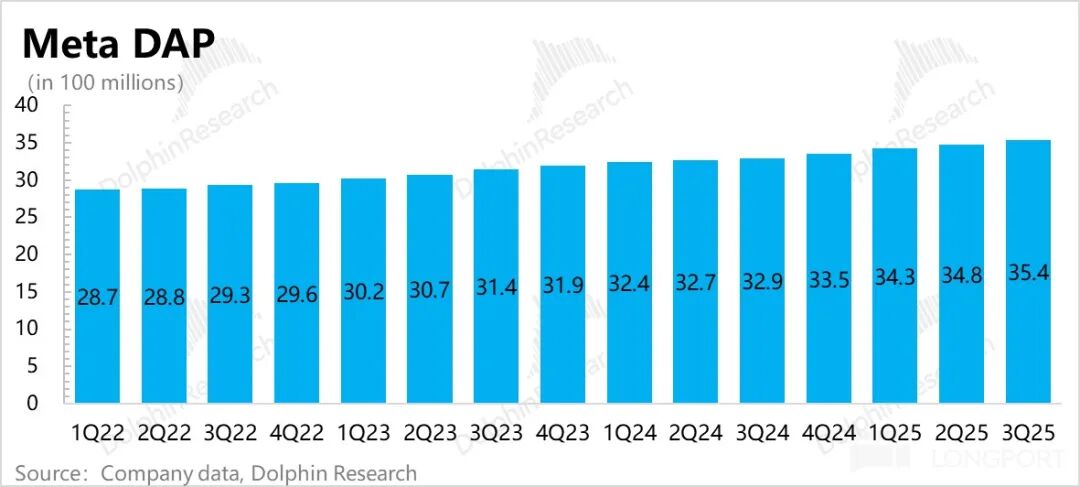

This was partly due to an expanding user base, with DAP (Daily Active People across Meta's app suite) accelerating to a 7.6% year-over-year increase. Additionally, the trend from recent quarters suggests continued acceleration in Reels' ad monetization.

Dolphin Research estimates that the average number of impressions per user increased by 5% year-on-year in the third quarter, particularly achieved amidst continuously rising advertising prices.

From a historical perspective, during periods of stable APP type structure, Meta generally does not deliberately increase its ad fill rate to excessively monetize and degrade user experience when ad prices are rising (due to favorable macro conditions and strong advertiser demand). The company only raises the ad fill rate to boost revenue when ad prices are declining and there is pressure to generate income.

However, the current period is a rare occurrence where both advertising revenue and ad impressions per user are on the rise. Therefore, Dolphin Research believes that the increase is primarily due to the structural rise in the group's average ad fill rate, naturally higher for short-form video ads, following the increase in consumption time of Meta Reels short-form videos.

Nevertheless, the ad load on older platforms is already high. Therefore, Meta will continue to promote the commercialization of WhatsApp and Threads to create new ad inventory.

The growth in DAP (Daily Active People) + increase in ad impressions per DAP drove a 14% year-on-year increase in total impressions in the third quarter, a solid performance. Regionally, the total impressions still clearly demonstrate Meta's control over ad release as an advertising platform:

In Asia, where ad prices barely increased, ad impressions surged by 23% year-on-year. In regions like Europe and the Americas, where ad prices rose by over 10%, ad impressions remained in the high single-digit range (due to the increase in the proportion of Reels ads).

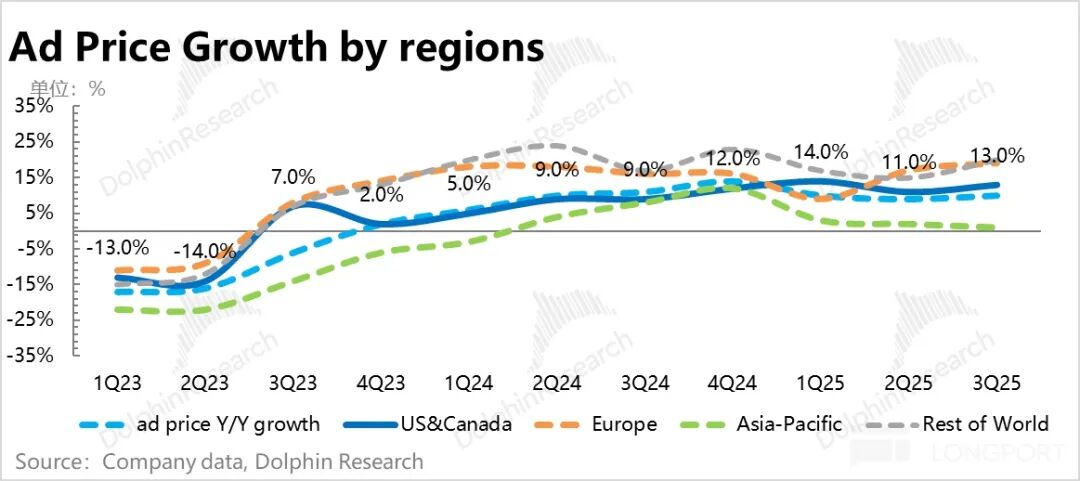

The year-on-year acceleration of comprehensive ad prices in the third quarter increased by one percentage point to 10%. Regionally, it is evident that Europe, benefiting from favorable exchange rates, saw a rapid increase in year-on-year growth to 19%, while ad prices in the United States further rose to 13%.

Dolphin Research believes that behind this volume and price growth, in addition to favorable macro conditions, it is essentially related to TikTok being continuously used as a bargaining tool and unable to develop normally, while Meta has used AI technology during this period to enhance user stickiness and strengthen its ecological barriers. Only with this fundamental background can Meta achieve a true "rise in both volume and price."

From this perspective, Dolphin Research believes that Meta's investment in AI to strengthen its ecological barriers, improve user stickiness and engagement, and enhance the precision of user content recommendations and ad recommendations through AI is entirely justified. Meta does not have long-term logical issues; the problem lies solely in the short-term mismatch between investment and output as Meta pursues its long-term aspirations, leading to pressure on profits and a relatively high valuation.

2. VR: New Product Contributions Expected Next Quarter

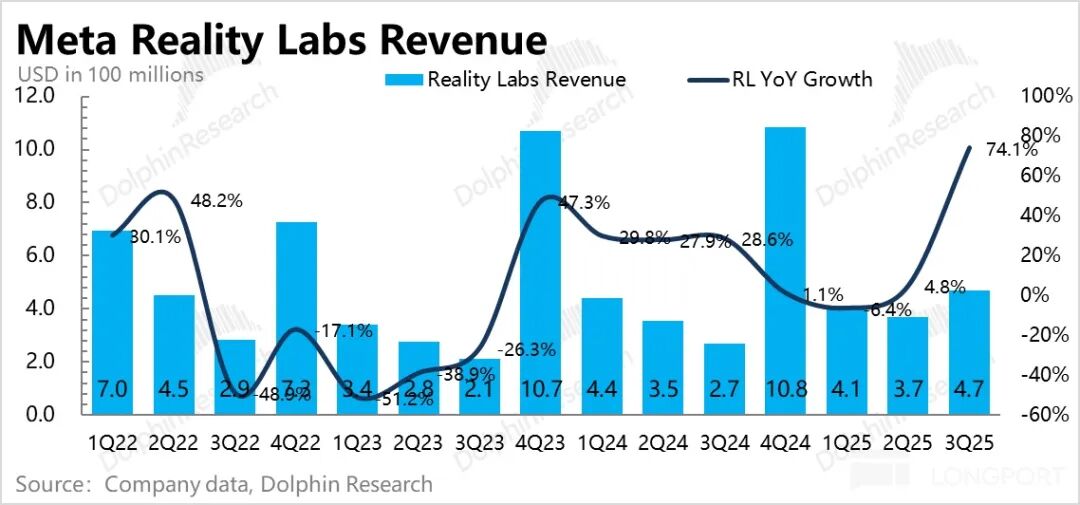

In the third quarter, Reality Labs generated total revenue of $470 million. Honestly, regardless of the growth rate, this revenue volume is essentially a rounding error compared to advertising revenue, or in other words, a Marginal Error. The year-on-year growth of 74% was primarily driven by the Quest 3 and Ray-Ban Meta smart glasses.

The key takeaway from this quarter, in Dolphin Research's view, is the unexpected narrowing of operating losses, with only $4.4 billion in losses. Dolphin Research has already highlighted the need to consider the possibility of short-term cost reduction and efficiency improvement, as well as reduced investment in this long-term, slow-to-materialize, and high-loss business, amidst increased AI investment.

In terms of product lineup, the release of the Quest 3S and the new generation of Ray-Ban smart glasses at the end of the third quarter will boost fourth-quarter performance.

(1) The Quest 3S is a new VR headset that continues the cost-effective style of the Quest 3 (released last year). It allows one-click switching between AR/VR modes and supports interaction between physical and virtual environments. However, its starting price is only $299.99. Simultaneously, the Quest 3's price was reduced by $200 to $499.99. Currently, the Quest 3 remains the best-selling product, with four times the storage space of the Quest 3S under the same basic model.

The overall low-price strategy is correct, as it facilitates faster hardware penetration. However, the VR industry currently lacks high-quality content, so sales are primarily driven by holiday promotions. It is expected to provide some assistance to fourth-quarter performance.

(2) The new version of Ray-Ban Gen3 mainly adds an AR display, a neural interaction wristband, and a custom NPU chip, which quadruples AI computing power and facilitates more AI functional upgrades. For example, the new glasses support real-time subtitle translation, video calls, AI visual recognition, and other AI functions, priced at $399/$799 (the high price may affect sales). It will mainly be launched in the United States in 2025 and expand to other countries like Europe next year.

II. AI FOMO is Strong, Investment is Surging

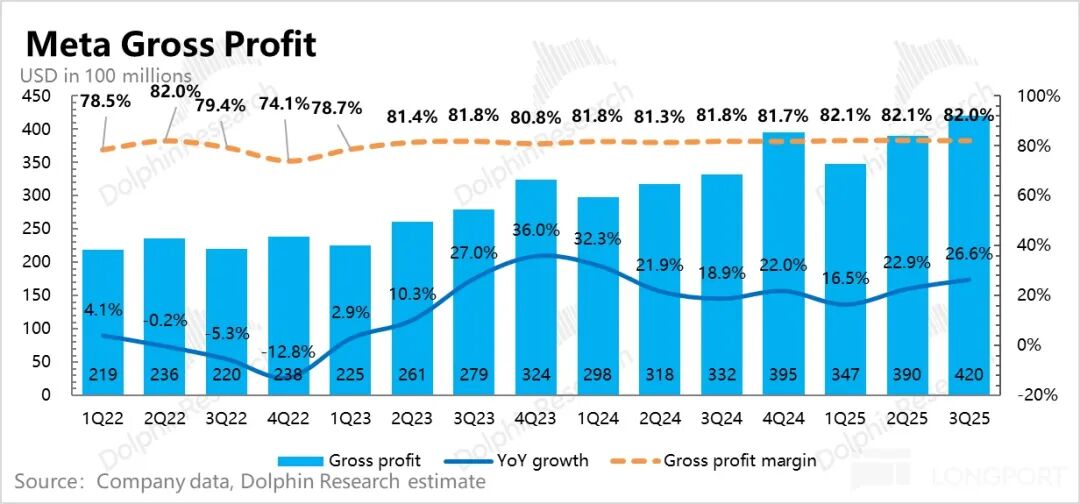

In the third quarter, there was no significant backlash from the depreciation of heavy asset investments, with only a 23% year-on-year increase. Overall costs increased by 25%, so the gross profit margin further improved in the third quarter. However, based on the company's 2026 expenditure guidance and explanations, the situation is expected to reverse in 2026, with the substantial increase in capital expenditures in 2025 beginning to be reflected in the income statement.

The number of employees decreased by nearly 1,000 sequentially in the previous quarter but increased by 2,500 in the third quarter, bringing the total number of employees to 78,500. This partially contributed to the high growth in third-quarter research and development (R&D) and management expenses.

Specifically, R&D expenses increased by 36%, while management expenses surged by 88% due to high legal and personnel costs. Ultimately, although revenue growth was impressive, profit reached $20.5 billion, a year-on-year increase of 18%, which is not particularly dazzling, and the operating profit margin declined to 40%.

In terms of operating profit by business segment, an incremental insight is that the operating profit margin of the high-margin business—advertising from the main APP family + sporadic other revenues—was significantly lower than expected, declining by nearly 4 percentage points sequentially to 49%. Conversely, Reality Labs did not experience the expected increase in losses.

Capital expenditures reached $19.4 billion in the third quarter. After the ramp-up of Blackwell shipments, Meta's Capex increased by $2.4 billion sequentially from the previous quarter. According to guidance, expenditures in the next quarter are expected to reach around $21 billion.

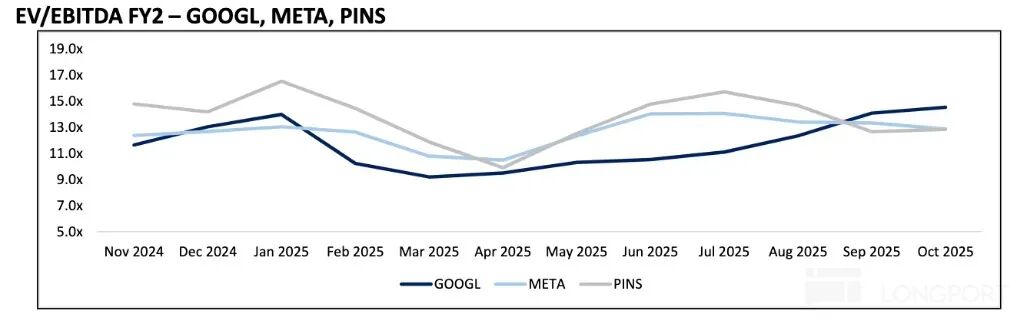

Given that fourth-quarter expenditures are already $21 billion and the company has stated that capital expenditures will significantly increase in 2026, Dolphin Research roughly estimates capital expenditures of $100 billion for 2026. If the company's revenue can maintain a 20% growth rate in 2026, it implies that entering the AI cycle, Meta's capital expenditure intensity (Capex/Revenue) from 2024 to 2026 will follow a steep curve of 24%, 36%, and 42%, indicating a clear trend of a lightweight asset company becoming more capital-intensive.

At such times, if revenue does not accelerate to match, the likelihood of a valuation correction increases.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is for general comprehensive data purposes only, intended for general reading and data reference by users of Dolphin Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information in this report assumes their own risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from using the data in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives for but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report shall not, under any jurisdiction, be regarded or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and data in this report are not intended for or intended to be distributed to jurisdictions where the distribution, publication, provision, or use of such information, tools, and data conflicts with applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliated companies are required to comply with any registration or licensing requirements.

This report merely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reprint, forward, or create any form of copies or replicas in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.