Apple's 'Sincerity' vs. Domestic 'Ecosystem': An Uneven Contest

![]() 11/03 2025

11/03 2025

![]() 701

701

When the iPhone 17 re-entered the Chinese market with a 'more features, lower price' strategy—starting at 5,499 yuan, boasting a 120Hz refresh rate, and offering 256GB of base storage—it nearly shattered consumer perceptions of 'value for money' overnight.

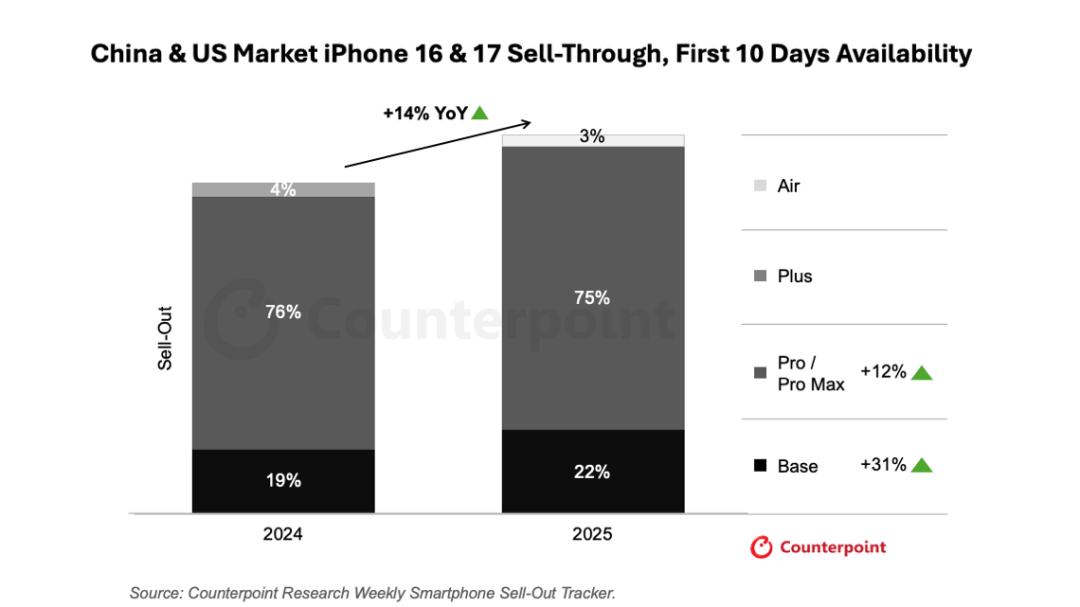

According to market research firm Counterpoint, sales of the iPhone 17 series in China during its first ten days on the market were 14% higher than those of the iPhone 16 series. By mid-October, total activations across all models had neared 4 million units. More surprisingly, the Max version, priced starting at 9,999 yuan, emerged as the best-selling model, accounting for nearly half of all sales.

01

Apple's 'Endurance' Strategy:

Relying Not on AI, But on Authenticity

'The iPhone best suited to be a smartphone 'endurance player' has arrived'—this market assessment accurately captures the iPhone 17's product positioning. Despite Apple showcasing multiple AI features at its launch event, its AI services have yet to be launched in China, leaving the domestic iPhone 17 models not operating at their 'full potential.' Nevertheless, its strong sales remain unaffected.

In reality, system-level AI has yet to become a decisive factor influencing consumer purchasing decisions. On one hand, most smartphone manufacturers lack leading AI large model capabilities, with severe imbalances between R&D investment and output benefits. Even Siri, with its deep technical foundation, has repeatedly delayed updates and delivered underwhelming user experiences. On the other hand, current AI assistant features show significant homogenization; if everyone develops based on third-party models like ChatGPT, forming differentiated competitiveness becomes challenging. Additionally, with on-device AI capabilities still immature, user enthusiasm for trying out AI applications has waned, meaning AI temporarily cannot drive significant sales growth.

Thus, with the iPhone 17 launch, Apple chose to move beyond AI dependency, adopting a more straightforward strategy—'addressing shortcomings and returning to authenticity.'

As one industry observer put it: 'Apple doesn't need AI at all. It just needs to make up for what it owed users in the past, and that will be enough to drive sales.' Steve Jobs once said, 'In Apple's DNA, we believe that technology alone is not enough. Only when technology is combined with humanity and art can it truly move people.'

The iPhone 17, it seems, has found another way to connect with users beyond the AI hype—by returning to the essence of product authenticity.

02

Domestic Players' 'Race to the Forefront' and 'Positioning':

A Contest of Timing

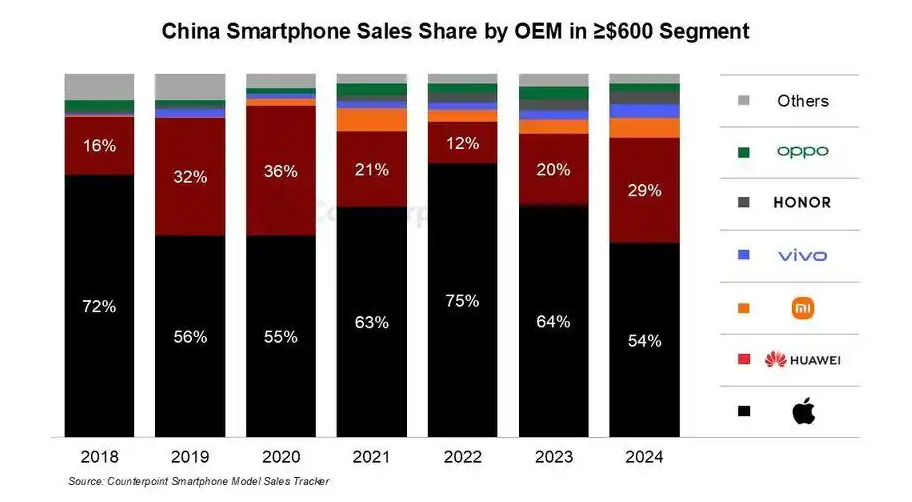

As a tech giant with a market capitalization of approximately $3 trillion, Apple's global influence is undeniable. Since the iPhone 6 series gained popularity in China, Apple has long dominated the domestic high-end smartphone market. At its peak, its market share in the 4,000-yuan-and-above price segment in China once exceeded 80%.

However, in recent years, with the collective rise of domestic smartphone brands, Apple's leading position has begun to face challenges.

A report released by Counterpoint Research in March this year pointed out that China's smartphone market is accelerating its shift toward the high-end segment, with the share of phones priced at $600 and above growing from 11% in 2018 to 28% in 2024. The agency believes Huawei has been the main driver of this trend. Since returning with 5G Kirin chips in 2023, Huawei has quickly regained lost ground, increasing its high-end market share from 20% in 2023 to 29% in 2024, becoming the fastest-growing domestic manufacturer.

This time, with the iPhone 17 making a strong comeback, domestic manufacturers responded quickly and decisively. The industry consensus is clear: whoever can capture user attention around the launch of Apple's new device will gain a larger share of the high-end market.

Thus, Xiaomi not only skipped from '16' to '17' in naming its new device but also moved its launch date to late September, intercepting users before the iPhone 17 went on sale. The Xiaomi 17 series sold over 1 million units in just five days, with the Pro Max version becoming the best-selling model.

Vivo and OPPO chose to compete head-on on pricing, setting their flagship Pro models at 5,999 yuan, directly competing with the standard iPhone 17. Huawei, meanwhile, implemented price cuts of up to 2,000 yuan on models like the Mate X6, attempting to solidify its position in the foldable smartphone market.

03

AI Fails to Become a Barrier; Ecosystem Becomes the Next Battlefield

Beyond keen awareness of 'timing windows,' domestic smartphone manufacturers have also shifted their competitive focus toward deeper ecosystem construction. With AI technology yet to form a decisive barrier, whoever can retain users with more complete scenario experiences will take the initiative in the high-end market tug-of-war.

Xiaomi's breakthrough in the electric vehicle business has elevated its brand, demonstrating the potential of 'cross-industry empowerment.' Counterpoint notes that 'the brand halo effect from high-end electric vehicles is benefiting Xiaomi's smartphone business.' By July 2025, Xiaomi's electric vehicle deliveries had surpassed 300,000 units, setting a new record for the fastest delivery among new energy vehicle startups in just 15 months. This ecological expansion from 'mobile terminals' to 'mobile spaces' has not only enriched user touchpoints but also reshaped Xiaomi's technological image.

Huawei, meanwhile, continues to solidify its technology-driven high-end barriers through a 'human-vehicle-home' full-scenario intelligent layout. Its continued leadership in the foldable smartphone market, in-depth R&D in smart cockpits, and seamless multi-device collaboration under HarmonyOS have jointly constructed a difficult-to-replicate barrier.

Vivo, taking a 'technical depth' approach, has continuously refined its Blue Crystal chip technology stack, establishing software-hardware integration advantages in key areas such as performance scheduling, power control, and on-device AI inference. Its scenario-based innovations, like a customized 'professional mode' for delivery riders and optimized gaming touch controls for players, are building user trust through nuanced experiences.

Ultimately, Apple's 'return to authenticity' and domestic players' 'ecosystem positioning' both respond to the same question: when hardware innovation reaches a plateau, what can truly retain users? The answer may not lie in a single technology but in whether one can build an 'experience ecosystem that users cannot leave.' The key to future success in the high-end market will no longer be an arms race in chip computing power or screen specifications but rather ecosystem openness, service continuity, and precise scenario coverage.

For domestic manufacturers, the real opportunity lies in whether they can take the lead in developing genuine 'Chinese solutions' in areas where Apple has yet to fully exert its strength, such as AI localization and ecological interconnection.

After all, what users ultimately choose is never just a cold device but a lifestyle solution that understands them.