Incredible! The 'Mini BYD' Has Created Quite a Stir!

![]() 11/03 2025

11/03 2025

![]() 527

527

This marks the 1,214th original article from 'New Energy Frontline'. Simply click on 'New Energy Frontline' at the top to follow and 'star' this account. Please note that the article solely reflects the views of 'New Energy Frontline' and does not serve as investment advice. The author does not operate investment groups, charge fees for stock recommendations, or manage client finances.

---------

Leapmotor has recently unveiled its new car, the D19. Its specifications are truly impressive, and more importantly, this remarkable feature likely signals the emergence of a brand-new trend in the new energy vehicle sector.

01 Astonishingly Large Battery

Take a look at its appearance; doesn't it closely resemble the Li Auto L9? (Or perhaps it's similar to the Seres M9, but given that Seres also takes inspiration from Li Auto, saying it looks like the L9 is more accurate.) One has to acknowledge that Leapmotor is truly the 'half-price Li Auto'; the resemblance is striking. While aesthetics are highly subjective, there's no denying that the D19's design aligns with mainstream preferences. As long as the price is reasonable, this level of aesthetic appeal (appearance) is sure to guarantee a certain sales volume.

Now, let's delve into the specifications.

Let's not even get into the details of chips, interior, motor control, etc. Just focusing on the battery alone is mind-boggling!

An 80.3 kWh battery!

What does that signify? Forget about the previously released pure electric models; even among the newly launched models in 2025, there aren't many with a battery capacity exceeding 80.3 kWh. It's safe to assert that 80.3 kWh is firmly the mainstream capacity for this year's new cars, and at least a mid-to-high-end option among the mainstream. It completely outstrips the battery capacities of most pure electric vehicles released before 2025. That's why Leapmotor officially refers to the D19 as the 'hybrid range king.' (However, although the D19 boasts an 80.3 kWh battery, its stated range is only 500 kilometers, significantly less than many pure electric models with the same battery capacity. It's unclear whether this is due to the nature of extended-range vehicles or Leapmotor's technical optimization.)

But let's not overlook the fact that the D19 is an extended-range vehicle. A battery in an extended-range vehicle that's larger than those in most pure electric vehicles blurs the distinction between extended-range and pure electric models.

02 The Drawbacks of Plug-in Hybrids

However, it's not surprising that the battery in an extended-range vehicle is larger than those in most pure electric vehicles. Over the past two years, a notable trend in the new energy vehicle industry has been the increasing battery sizes in hybrid models. The reason is that in practical use, many hybrid vehicle owners find it hard to tolerate switching back to gasoline after experiencing electric driving. Whether it's the driving experience or cost, electric driving far surpasses gasoline. Yet, most hybrid models previously had relatively small batteries, forcing owners to charge frequently, which significantly detracted from the overall experience.

Originally, hybrid vehicles were designed to alleviate range anxiety in pure electric vehicles. But in recent years, as batteries have grown larger and the charging infrastructure has been largely established, range anxiety has significantly diminished. Moreover, the vast majority of people rarely embark on long-distance trips; at most, they do so a few times a year. It's not worth sacrificing daily convenience just to address a few instances of range anxiety. Additionally, because hybrid vehicles have smaller batteries that are charged and discharged more frequently, the batteries tend to degrade faster, further reducing the pure electric range. As a result, hybrid vehicle owners are beginning to regret not opting for pure electric vehicles, and many have made the switch.

Nevertheless, for many people, range anxiety still persists, and hybrid vehicles have unique advantages in specific scenarios. Downstream automakers have responded to this market demand by gradually increasing the range of pure electric models, with batteries getting larger and larger. This has led to the 'phenomenon' of some hybrid models having larger batteries than most pure electric vehicles.

It's almost certain that although Leapmotor officially refers to the D19 as the 'hybrid range king,' this title is unlikely to endure. The Chinese business landscape is fiercely competitive; once a model proves successful, others will follow suit. You can increase battery size, and so can I, and I'll make it even larger than yours.

Extrapolating from this, the batteries in hybrid models will continue to grow, just like those in pure electric models, with pure electric ranges consistently increasing.

However, for hybrid models specifically, there's a limit. As the pure electric range of hybrid vehicles continues to grow, when it reaches a certain point and the lines between hybrid and pure electric models become increasingly indistinct, users will start to question whether they still have range anxiety or whether it's worth buying a hybrid vehicle just to address a few instances of range anxiety. Why not just go for a pure electric vehicle? After all, a hybrid vehicle means having two systems in one car, which is more cumbersome to maintain and more costly.

From this perspective, theoretically, as battery technology gradually advances and the charging infrastructure becomes more mature, range anxiety will become less of a concern. Consequently, the sales of hybrid vehicles will face increasing challenges, and pure electric vehicles will be the future. All manufacturers that currently rely heavily on hybrid vehicle sales will face sales issues if they cannot quickly achieve breakthroughs in pure electric models. This won't take long; it could very well happen within the next two to three years.

03 A Brand-New Trend in New Energy Vehicles

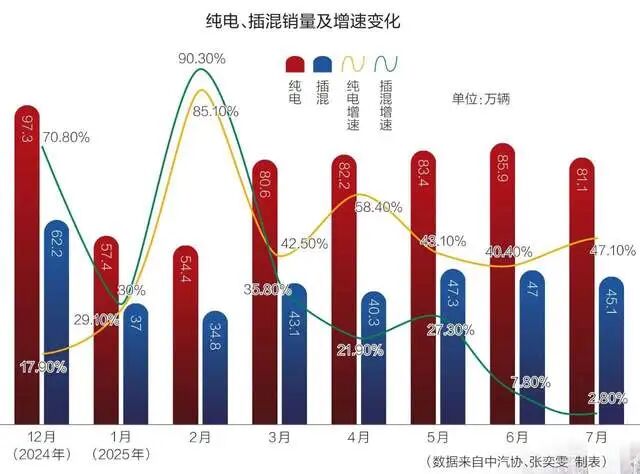

This is not alarmist rhetoric. In fact, the sales proportion of hybrid vehicles has already started to decline this year. As shown in the figure below, both pure electric and plug-in hybrid sales continued to grow rapidly in January and February. In March, the growth rate slowed significantly, but then pure electric sales picked up again. Although the growth rate of pure electric sales also slowed starting in April, it generally stabilized at around 40%, while plug-in hybrid sales showed a consistent downward trend. By September, the retail growth rate of plug-in hybrids had turned negative, while pure electric sales still grew by 26%.

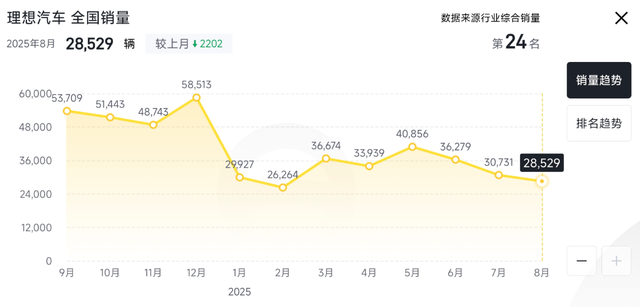

This trend is even more pronounced in Li Auto's sales. From May last year to its worst performance this year, when sales dropped below 30,000, although there were company-specific reasons, it was also largely related to the overall sluggishness of the plug-in hybrid market.

Li Auto is not oblivious to this trend and has been making efforts to focus on pure electric models. Unfortunately, both the Mega and i8 failed to meet the company's expectations. The i6, which represented a last-ditch effort, can be considered a preliminary success, but it still falls short compared to the company's previous successes with the Li One and L series. The sustainability of its subsequent sales remains to be seen.

In fact, BYD's sales performance falling short of expectations this year is also related to this overall trend. Moreover, it's important to note that the impact of this trend is more pronounced for mid-to-low-end models because owners of high-end models are less concerned about costs and are willing to pay more to eliminate range anxiety.

Perhaps in the short term, within the next one to two years, as downstream automakers gradually equip hybrid models with larger batteries, there may be a rebound in the sales growth rate of plug-in hybrid vehicles. However, from a longer-term perspective, pure electric vehicles will ultimately become the mainstream. All manufacturers that currently rely primarily on plug-in hybrid sales will face this challenge. If they cannot quickly prove their capabilities in pure electric models, their future sales prospects will be bleak, and the secondary market is unlikely to provide positive feedback.