Yuanding Intelligence: Analyzing Aiper's Growth Path in the Pool Robot Market

![]() 11/03 2025

11/03 2025

![]() 598

598

Produced by Zhineng Technology

The competitiveness of Chinese consumer electronics in the U.S. and European markets is a fascinating topic blending innovation and export, particularly in the niche yet significant pool robot sector where China has fewer players compared to the abundant presence in Europe and America.

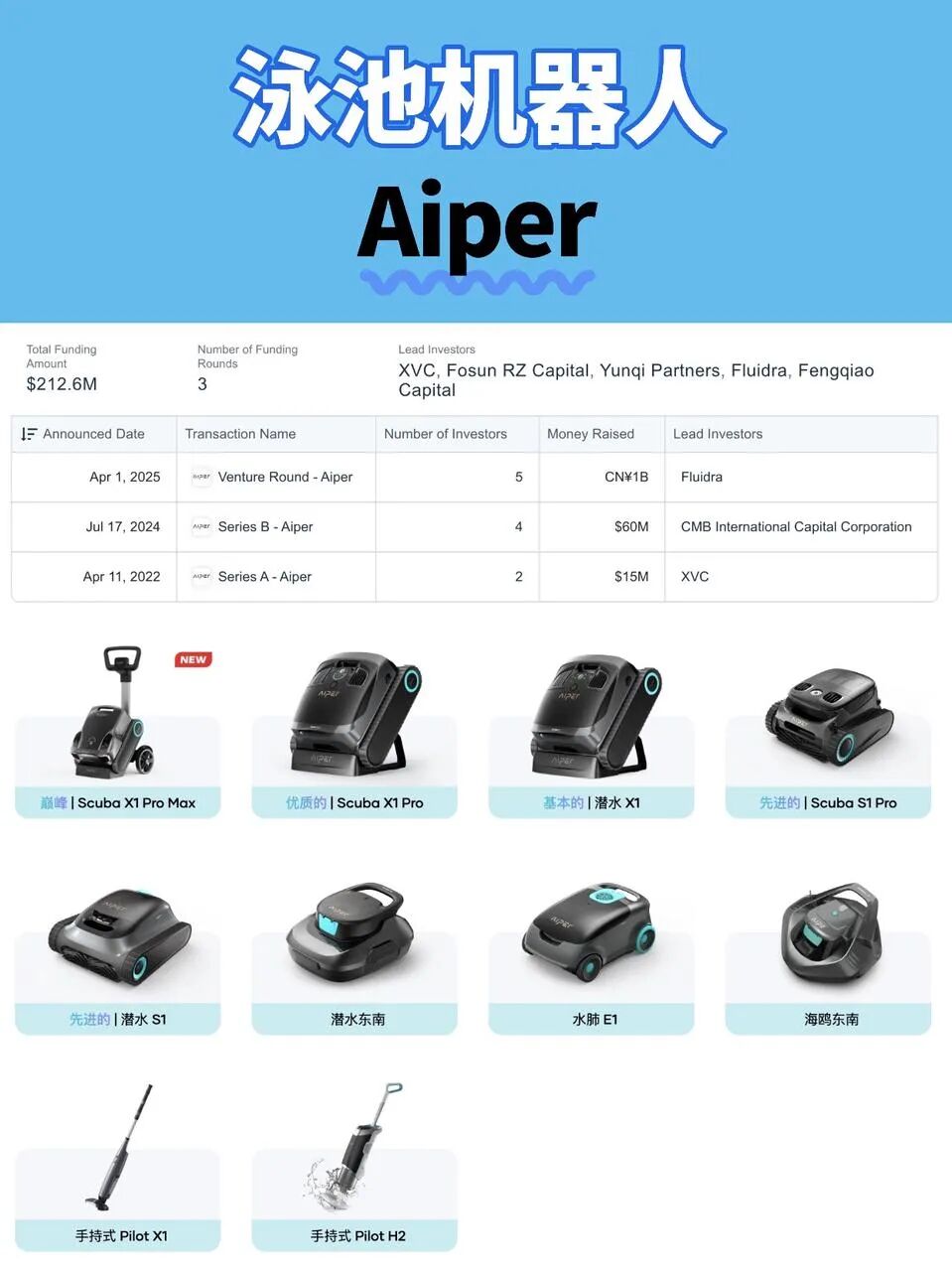

Represented by Shenzhen-based Yuanding Intelligence (brand Aiper), local companies are transitioning from OEM to proprietary brands. Through wireless design, AI navigation, and global channel expansion, they have achieved breakthroughs in annual revenue scale over the past few years.

Aiper completed a strategic investment with pool equipment giant Fluidra in April 2025, with the latter acquiring approximately 27% of Aiper's equity. The two parties will collaborate on channel expansion, product development, and global market penetration.

01

Product and Technology:

Evolution from Wired to Intelligent Wireless

The global private pool inventory stands at approximately 28-30 million units, primarily concentrated in Europe and the United States (accounting for nearly 90% of the total). This reflects the lifestyle preferences of the middle class in developed nations, with 10.6 million pools in the U.S. and 7.542 million in Europe. The number is projected to rise to 36.92 million by 2026.

Above-ground private pools are growing even faster at a rate of 7.57%. Pool maintenance costs are substantial, averaging $3,000-$6,000 annually, with single cleaning sessions costing $100-$300. Given the scarcity and heavy workload of blue-collar workers in these countries, IDC forecasts pool robot sales to remain below 3 million units in 2025, growing to 4 million units by 2029.

The traditional market has been monopolized by giants for a century, including Israel's Maytronics (Dolphin, founded in 1983, with revenue declining 14% to RMB 3.4 billion in 2024), Spain's Fluidra (Zodiac/Polaris, projected revenue of €2.2 billion in 2025), and U.S.-based Hayward/BWT. Their products, primarily wired or battery-powered, suffer from significant drawbacks: heavy and cumbersome equipment, poor self-cleaning capabilities, short battery life, uneven cleaning, and high prices (over $1,000 for premium models).

These established players have been slow to innovate. For instance, Maytronics only introduced its wireless Liberty series in 2023, which relies on physical random collision navigation, leading to redundant cleaning and frequent entrapment.

Chinese brands have identified pain points in the European and American backyard economy and risen to prominence since 2019. By offering innovative solutions, they have created demand that aligns with consumer needs while facing minimal competitive pressure from non-Chinese incumbents.

In the niche pool robot market, traditional brands predominantly feature wired designs and lag in functionality, pricing, and technological updates.

Among the Chinese players, Yuanding Intelligence officially pivoted from portable home energy storage products to pool robots in 2019. Launching the Aiper brand, the company focused on two key dimensions: wireless connectivity and intelligence.

Wang Yang, founder of Yuanding Intelligence, views this as a dual 70% opportunity: 70% market penetration + a brand capturing 70% market share. Among pool cleaning methods, robots account for 25%, while suction/pressure devices make up 25.5%/6.5%, and manual/service methods account for 43%. The advantages of pool robots include comprehensive area scanning, bacterial removal, algae prevention, reduced chemical usage, independent filtration, and energy efficiency.

The early Seagull series adopted a wireless battery pack management system, eliminating power cord constraints, and incorporated path planning to reduce entrapment risks. At IFA Berlin 2023, Aiper unveiled the Surfer S1, a robot focused on surface pool cleaning. Powered primarily by solar panels, it features ultrasonic obstacle avoidance.

From a product definition perspective, cleaning targets are divided into surface (leaf/hair filtration) and submerged areas (walls/lines), with technical hurdles including underwater sensing, communication, propulsion, path planning, energy consumption, intelligent control, positioning, navigation, and stringent waterproofing requirements.

Challenges for sensing sensors include:

◎ Lidar scattering (90% ineffective at distances <0.5m) and visual distortion/particle misidentification/night blindness;

◎ Cumulative errors from inertial drift;

◎ Acoustic ultrasound + inertial systems are applicable, with reflection-based obstacle recognition.

Aiper has developed a "pool environment physical simulation engine" based on real pool data, 3D structural models, and synthetic data. This engine validates robot performance in various environments, resolving approximately 80% of design issues before prototype manufacturing.

At the product design level, high-end models in the Scuba series can identify over twenty types of common pool debris (e.g., leaves, branches) and obstacles (e.g., drains, pool ladders). Combining visual navigation with millimeter-wave radar, the goal is to achieve a global launch by early 2026.

Building on traditional products, Aiper integrates technological characteristics of Chinese consumer electronics, investing in core module R&D: battery management systems, navigation and obstacle avoidance algorithms, wireless communication and control app platforms, and simulation verification systems. Headquartered in Shenzhen with an R&D center in Suzhou, the company has established a robust production and supply chain.

As of 2024, Yuanding Intelligence achieved approximately RMB 1.8 billion in revenue through online channels and RMB 1.2 billion through offline retail, totaling around RMB 3 billion in annual revenue.

Its global operational strategy is clear: rapidly expanding overseas markets through e-commerce channels (including standalone websites and Amazon) while collaborating with mainstream European and American retail chains. The brand has entered over 7,000 stores, including Home Depot, Lowe’s, Walmart, Target, and Costco, with offline sales accounting for over 40% of total revenue.

In terms of pricing, its home models range from $179 to $1,099, catering to diverse user needs.

Once again, China's manufacturing efficiency and innovation capabilities have played a pivotal role. Shenzhen's well-established electronics manufacturing ecosystem enables Aiper to swiftly complete product design, validation, and mass production iterations. From concept to market launch takes only a few months, and its flexible, efficient supply system has propelled wireless pool robots to the forefront in just a few years.

Aiper is expanding its product line from pool robots to a backyard intelligent ecosystem, including lawn mowing robots, smart irrigation systems, and snow removal robots. This ecosystem extension aims to tap into the outdoor smart living market, broadening its product portfolio through backyard automation.

02

Chinese Companies' Encirclement in the Pool Robot Market

Once considered a niche home appliance category, pool robots are emerging as a new frontier in smart hardware.

Since 2025, the global market has continued to heat up, with frequent capital inflows. Chinese brands such as Aiper, Wybot, and Beatbot are gradually replacing traditional European and American giants through product innovation, cost control, and channel operations. The rapid growth of this sector stems from the simultaneous release of rigid demand and technological innovation.

European and American households boast high pool ownership rates, but maintenance costs remain prohibitively high. Traditional brands like Dolphin, Polaris, and Hayward, despite their century-long presence, still rely on outdated wired power sources and random operation modes, lagging in innovation.

Chinese manufacturers have targeted these pain points, leveraging wireless technology, intelligent navigation, and cost-effectiveness.

◎ Aiper's core strategy is clear: build reputation through blockbuster products, establish market dominance by ranking first, and occupy user mindshare with the equation "wireless = Aiper."

◎ Second-tier competitors are closing in. Wangyuan Technology (Wybot) is the most notable rival. Founded in 2005 as an OEM manufacturer, it transitioned to a proprietary brand within three and a half years, increasing its self-operated revenue share from less than 10% to over 80%. In 2024, it captured 19.7% of the global wireless pool robot market.

Wybot focuses on mid-to-low-end products, leveraging cost-effectiveness and a flexible supply chain to penetrate the market. Its gross margin has improved by 15% compared to the OEM era. Wybot was once Aiper's largest OEM manufacturer, but the two companies shifted from collaboration to direct competition after parting ways in 2022, now facing off head-on in the low-end market.

◎ In the high-end segment, Beabot emphasizes lidar navigation and AI algorithms, rapidly expanding with capital and R&D strength.

Xingmai Innovation (Beatbot) has introduced the Aquasense Pro Max, featuring underwater lidar and multi-sensor fusion positioning, aiming to establish a high-end technological barrier. Zhicheng Power (SMOROBOT) and Langyong Future (Dreame) are leveraging their experience in home robots to enter the market, emphasizing premium customized experiences.

◎ Third-tier startups like Delta are tentatively entering the market through crowdfunding and Amazon channels.

The industry competition has been intensified by internal rivalries among Chinese companies, with Chinese brands now accounting for over 40% of global pool robot shipments.

Chinese manufacturers are breaking through key bottlenecks with new sensors and algorithms. Traditional lidar systems suffer from a 90% failure rate underwater due to light scattering, but companies like Beixing Guangfeng have introduced visible light underwater laser systems, extending detection range to 5-10 meters—a significant industry breakthrough.

Aiper's latest Scuba V3 integrates AI algorithms and HydroComm water quality monitoring, enabling simultaneous cleaning and detection to broaden product capabilities.

Channel expansion and marketing are also strengths for Chinese brands.

◎ Aiper adopts a dual-wheel model of "standalone website + Amazon" to establish a direct-to-consumer sales system.

◎ Wybot focuses on North American and European e-commerce, with offline sales accounting for about 40%.

In marketing:

◎ Aiper sponsors the Super Bowl and Grammy Awards to enhance brand recognition.

◎ Wybot is known for its aggressive pricing strategy, offering discounts up to 43% during summer promotions this year.

The decline of traditional giants has created opportunities for Chinese brands.

◎ Maytronics saw a 14% revenue decline in 2024, with its high-end market advantage gradually eroding.

◎ Polaris, Hayward, and others risk further losing competitiveness if they fail to swiftly transition to wireless and intelligent technologies.

Pool robots are evolving from single-function products into crucial nodes of a smart backyard ecosystem. Future products will integrate with lawn mowing, irrigation, and snow removal systems, enabling adaptive task scheduling based on GPS paths and weather algorithms.

Summary

The development of Chinese pool robots in this niche sector holds certain representativeness.