The Intense Rivalry Between WeRide and Pony.ai: Are Self-Driving Taxi Services on the Brink of Profitability?

![]() 11/04 2025

11/04 2025

![]() 635

635

WeRide and Pony.ai, two frontrunners in the self-driving taxi sector, are engaged in a fierce competitive battle.

As both companies approach their listings on the Hong Kong Stock Exchange, their technological rivalry and race for capital have intensified into a highly charged dispute.

Unless any unforeseen events occur, on November 6, two prominent Robotaxi firms will make their simultaneous debut on the Hong Kong Stock Exchange, adding a dramatic twist to the unfolding narrative.

At present, within the Robotaxi landscape, Baidu's Apollo Go, WeRide, and Pony.ai are locked in a three-way competition.

From Blackboard's vantage point, beneath the covert rivalry between these two firms, Robotaxi services are poised for a genuine breakthrough.

“In the latter half of next year,” Pony.ai Vice President Zhang Ning predicted in a media interview, signaling that the era for Robotaxi operations to reach break-even is drawing near.

In September of this year, Baidu's Apollo Go announced that it had achieved break-even in several Chinese cities.

While there is little doubt about the trajectory of Robotaxi services, opinions vary on when the true turning point will materialize.

After a rollercoaster ride of financing booms and busts, the Robotaxi concept has regained momentum this year.

Image Source: AI Generated

In the United States, Waymo has achieved 250,000 weekly Robotaxi services, with Uber and Lyft also expanding their fleet sizes.

Domestically, the competitive landscape (translator note: the term "track" is used metaphorically here to denote the competitive arena) appears promising, yet the competition remains fierce.

Robotaxi concept stocks such as OnTime and Cao Cao Mobility have already gone public, while U.S.-listed Pony.ai and WeRide are set to list in Hong Kong.

Didi Autonomous Driving secured RMB 2 billion in Series D funding; Rongxing QiXing plans to mass-produce consumer-grade Robotaxis by the end of the year; Geely's Qianli Technology aims to offer Robotaxi services in 10 cities.

This is a fiercely contested market, with small-scale business models on the cusp of viability, further fueling competition among players.

01 The Rivalry Between Yu and Liang

Reflecting on numerous high-profile sectors, overt and covert maneuvers among industry giants are inevitable.

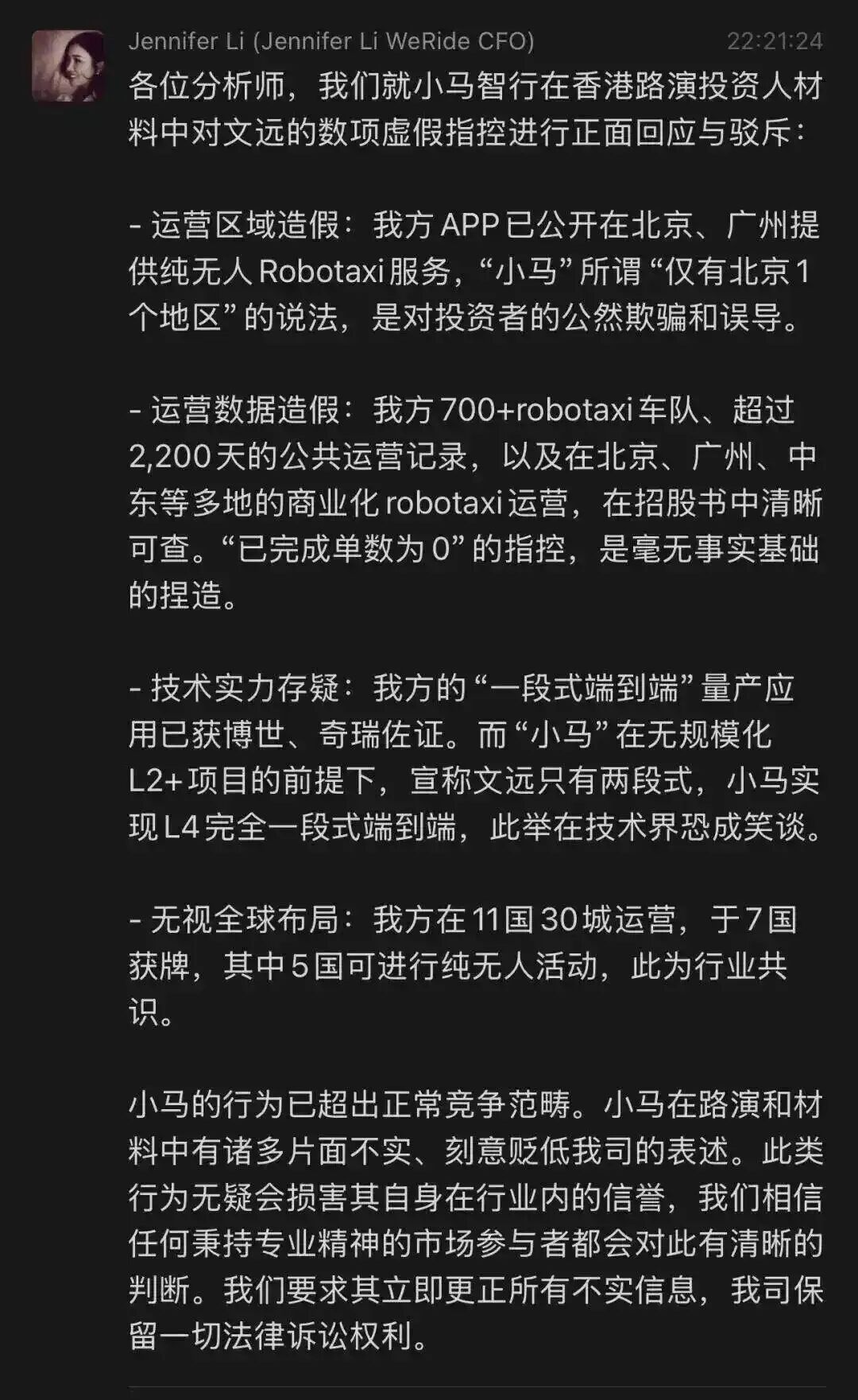

On October 31, media reports revealed that due to Pony.ai mentioning WeRide's data in its roadshow materials, WeRide's CFO Li Xuan retorted, labeling it a "false accusation" and responding directly.

The rebuttal encompassed WeRide's operational areas, order volumes, autonomous driving technology order volumes, global布局, and more.

These are the core Robotaxi metrics that capital markets value most.

Image Source: Internet

Both companies are headquartered in Guangzhou, with founders hailing from Baidu.

However, their market valuations have gradually diverged.

During their U.S. stock market debuts, WeRide's valuation stood at $4.491 billion, while Pony.ai's was $4.188 billion—a close match.

Yet, as of November 3, WeRide's valuation had dropped to $3.337 billion, less than half of Pony.ai's $7.197 billion.

Now, set to list on the same day in Hong Kong, the origin of this rivalry becomes somewhat comprehensible.

According to media reports, Pony.ai plans to go public at HK$139 per share, expecting to raise HK$6.7 billion; WeRide's maximum offering price is HK$35, with a maximum fundraising target of HK$2.8 billion.

This implies that WeRide's fundraising scale in Hong Kong may be less than one-third of Pony.ai's, a critical factor in this capital-intensive industry.

With both companies emerging from the same lineage and now competing on the same stage, the pressure from investors is palpable.

As for who will emerge as the dominant player, only time will tell. After all, in the ever-evolving landscape of cutting-edge technology, a single misstep could lead to the edge of a cliff.

02 Capital-Intensive Investment

The financial situations of both companies can be discerned through their financial reports.

In terms of revenue and profit, their trends appear similar.

In the first half of the year, Pony.ai's total revenue was RMB 254 million, up 43.3% year-on-year, with second-quarter revenue reaching RMB 154 million, a 75.9% increase.

The net loss for the first half was approximately RMB 653 million, up 75.1% year-on-year; the second-quarter net loss was RMB 381.6 million, a 72.5% increase.

The company attributed the expanding loss to increased equipment investment and personnel salaries for the seventh-generation Robotaxi mass production project.

WeRide's total revenue for the first half was RMB 127.2 million, up 60.8% year-on-year;

The adjusted net loss was RMB 595 million, up 88.3% year-on-year; the second-quarter net loss was RMB 406.4 million, affected by rigid expenditures on R&D and administrative fees.

In terms of R&D investment, both companies are closely matched.

Pony.ai's second-quarter R&D expenses were RMB 351.2 million, up 69% year-on-year; WeRide's were RMB 318.9 million, up 50.5% year-on-year.

From these key metrics, despite mentions of "break-even," both companies are still in a phase of burning capital to advance technology and capture market share.

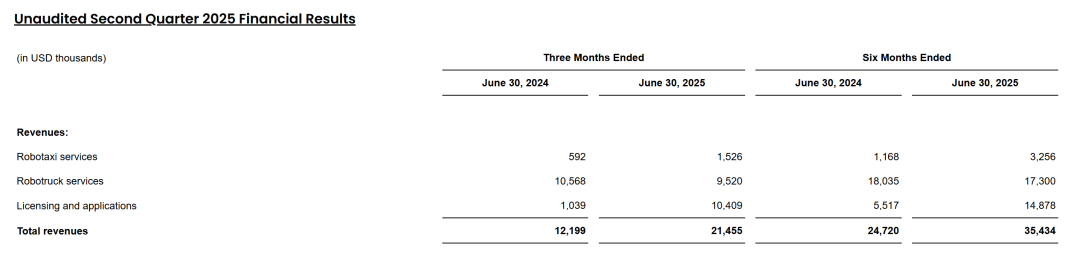

Now, let's examine their Robotaxi businesses.

In the second quarter, Pony.ai's Robotaxi service revenue was RMB 10.9 million, up 157.8% year-on-year, but only 7% of total revenue; Robotruck services reached RMB 68.2 million, down 9% year-on-year; additionally, technology licensing and applications brought in RMB 74.6 million, up ninefold year-on-year.

Image Source: Pony.ai Financial Report

WeRide's second-quarter Robotaxi business revenue was RMB 45.9 million, up 8.3-fold year-on-year, accounting for 36.1% of revenue.

However, since the Robotaxi business is still in its early stages, these stage-based (translator note: "phased" means "stage-based") data should be taken as reference only.

Currently, WeRide has 700 Robotaxis, while Pony.ai has 680.

By the way, Apollo Go has deployed over 1,000 vehicles.

According to industry views, 1,000 vehicles represent the break-even point for operating Robotaxi fleets, while achieving company-wide break-even may require up to 50,000 vehicles.

Evidently, both companies require capital infusion, making financing in Hong Kong urgent to fuel their full-scale commercialization efforts.

03 On the Eve of a Breakthrough?

With AI large models and L2+ autonomous driving accelerating, Robotaxi services are getting closer to large-scale commercial operation.

Didi and GAC Motor's co-developed Robotaxi model will launch by the end of the year, with plans to produce 1,000-2,000 units next year and a vision to operate 1 million Robotaxis by 2030.

Pony.ai CEO Peng Jun predicts that by 2028, they will operate 50,000 vehicles, enabling the company to achieve break-even.

Currently, the main constraints on Robotaxi development are cost, technology, and regulations.

Costs primarily involve vehicle and operational expenses.

Per-vehicle costs are declining; a few years ago, they reached the million-yuan mark, but now Baidu's sixth-generation autonomous vehicle cost has dropped to RMB 204,600.

Currently, Pony.ai's seventh-generation per-vehicle cost has fallen to RMB 270,000, with expectations of a further 30%-40% reduction in the next three years; WeRide anticipates a 20%-30% cost reduction in its next generation.

Image Source: WeRide Official Website

Beyond vehicle costs, operational expenses are substantial.

According to Frost & Sullivan, Robotaxi annual maintenance costs are around RMB 50,000, operational costs about RMB 30,000, and safety redundancy costs between RMB 30,000 and RMB 100,000, while current per-vehicle revenue is only about RMB 60,000.

Barclays predicts that by 2030, Robotaxi per-vehicle costs will drop by over 30%, annual operational costs could fall to RMB 80,000, and per-kilometer costs will decline to RMB 0.7, a roughly 60% reduction from current levels.

Technologically, despite various evolutionary paths, actual road operation still requires in-vehicle or online safety operators ready to take over at any time;

Regulations remain unclear; although multiple countries have issued testing licenses, most are still in the early observational stages.

However, investment banks and research firms predict an enormous market outlook.

Frost & Sullivan forecasts that by 2035, the global Robotaxi market could reach $350 billion, equivalent to the current size of the global gaming industry.

Goldman Sachs predicts that by 2035, China will have 1.9 million Robotaxis, with a market penetration rate of 25% and a market size of $47 billion.

Traditional ride-hailing services generate daily revenues of approximately RMB 200-450, while Robotaxi daily revenues could reach RMB 500.

After all, Robotaxis don't need bathroom breaks, meals, or rest—they're always ready to go.

As for competing to be the first Robotaxi stock, it's hardly surprising anymore.