From mutual accusations to tiered competition! In the self-driving vehicle knockout stage, who will have the last laugh?

![]() 11/05 2025

11/05 2025

![]() 607

607

What will the future of self-driving vehicles hinge on?

Manual labor/Edited by Wage/Produced by Uncle Jiao/Unicorn Observation

As November begins, the self-driving vehicle sector has seen a surge in capital market enthusiasm.

Pony.ai and WeRide, both planning to list on the Hong Kong Stock Exchange on the same day and vying for the title of the "first Hong Kong-listed Robotaxi company," were rocked by a "data fraud" controversy. WeRide accused Pony.ai of fabricating its operational data in roadshow materials, labeling its order volume as "0" and listing only "Beijing (1 city)" as its operational area.

Meanwhile, Baidu's stock price has continued to strengthen, thanks to market recognition of Apollo Go. On November 4th, Baidu's Hong Kong stock opened with a 6% surge, closing nearly 3% higher, and has accumulated a 25% increase over the past three months.

The public clash between WeRide and Pony.ai serves as a mirror, reflecting the true landscape of the self-driving vehicle industry's shift from "wild growth" to a "survival race" after the capital ebb.

As a pioneer in the self-driving vehicle industry, Apollo Go's market recognition has set clear boundaries of strength in this chaotic competition—true leaders always speak through data and safety.

01 "Fraud" storm on the eve of listing

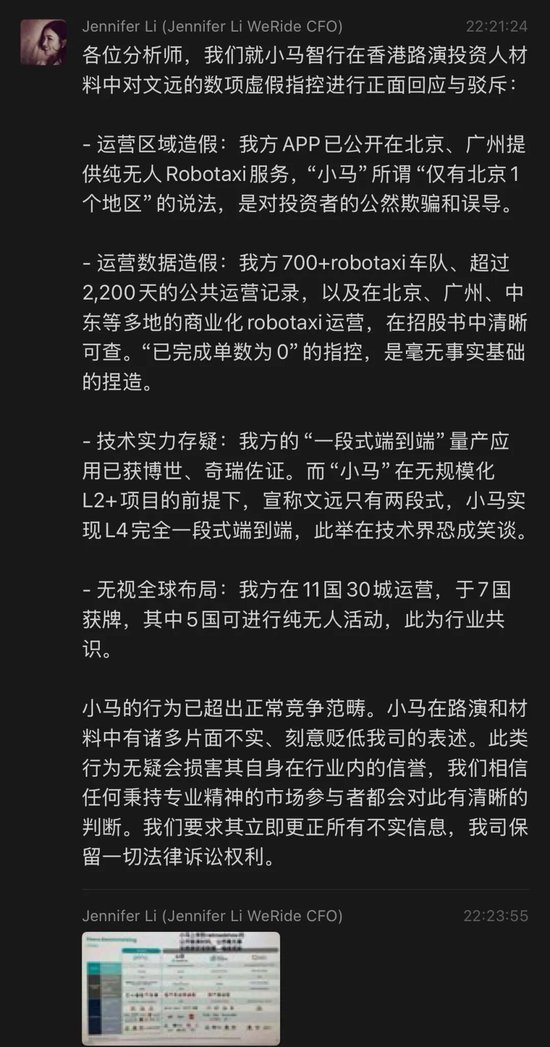

On October 30th, just seven days before the scheduled Hong Kong Stock Exchange listing date for both Pony.ai and WeRide, a lengthy post by WeRide CFO Li Xuan in an analyst group broke the calm of the two self-driving unicorn companies' joint sprint .

Li Xuan accused Pony.ai's roadshow materials for Hong Kong investors of containing multiple false statements about WeRide, with the core dispute focusing on two sets of data: In the dimension of "number of operational cities in China," Pony.ai labeled itself as covering four first-tier cities—Beijing, Shanghai, Guangzhou, and Shenzhen—while WeRide was only marked as "Beijing (1 region)"; in terms of "number of completed orders," WeRide was even labeled as "0."

In her lengthy post, Li Xuan refuted that WeRide provides fully autonomous Robotaxi services in Beijing and Guangzhou, stating that Pony.ai's claim of "only Beijing (1 region)" is a blatant misrepresentation to investors; the "0 orders" claim is entirely inconsistent with WeRide's 2,200-day operational record and multi-region commercialization practices.

Faced with these questions, Pony.ai responded evasively, citing its "quiet period ahead of the listing" and refusing to comment.

It is worth noting that Pony.ai and WeRide have had prior "grievances."

In June of this year, Pony.ai's co-founder and CTO, Lou Tiancheng, proposed the "poker table theory," claiming that only Waymo, Pony.ai, and Baidu possess the capabilities for large-scale and driverless operations globally, with other companies "lagging by two and a half years."

At the time, Li Xuan publicly retorted, listing safety incidents involving Pony.ai and questioning its overseas partnerships as "mere memorandums of understanding lacking actual implementation."

This pre-listing "fraud" controversy is not just an eruption of conflicts between the two companies but also reflects the deeper anxieties within the self-driving vehicle industry.

Over the past few years, fueled by policy incentives and capital enthusiasm, dozens of L4-level companies have emerged domestically. However, as capital ebbs and profitability challenges surface, the industry has shifted from "wild growth" to a "survival race" knockout stage, with many companies already falling by the wayside.

Capital's evaluation criteria for self-driving vehicle companies have also shifted from "technological narratives" to "cost control and profitability expectations." Those who can convince investors of future profitability potential through "data advantages" will gain the upper hand in listings—this is the underlying logic behind Pony.ai's "embellishment" of data and WeRide's fierce counterattack.

02 Global self-driving vehicle industry tiered

From a global perspective, the current self-driving vehicle industry has formed a clear tiered differentiation. This differentiation is not based on companies' self-proclamations but is ranked by "hard metrics" determined by operational data, technological implementation capabilities, and commercialization progress.

Undoubtedly, the first tier is occupied by China's Apollo Go and America's Google Waymo. These two are the only companies globally to have achieved over 100 million kilometers of autonomous driving mileage, forming an absolute lead in operational scale, order volume, and safety.

According to public data, as of October 2025, Apollo Go handles over 250,000 orders per week, all fully autonomous, with a cumulative global order volume exceeding 17 million and a safe driving mileage surpassing 240 million kilometers, making it the world's largest autonomous driving travel service provider.

Although Google Waymo started earlier, its scale has been surpassed by Apollo Go: its operations are limited to five major U.S. cities, with a cumulative order volume of around 10 million and a safe driving mileage of 155 million kilometers.

The common characteristics of these two companies are: deep technological accumulation, with Waymo having 15 years of experience and Apollo Go relying on Baidu's 12 years of autonomous driving technology; stable commercialization scenarios, sufficient capital reserves, and both having formed a positive cycle of "technology-data-scale."

The second tier consists of unicorn companies like Pony.ai and WeRide, which, while having some technological accumulation, face significant gaps compared to the first tier and are under multiple pressures of funding, scale, and profitability.

From core operational data, since its launch in 2022, Pony.ai's Robotaxi has accumulated 1.04 million paid orders, while WeRide has not disclosed its order volume; both are far behind Google Waymo's 10 million and Apollo Go's 17 million.

In terms of safe driving mileage, WeRide has just surpassed 55 million kilometers, while Pony.ai's total mileage is less than 48 million kilometers. After deducting test mileage, the commercial operational mileage is less than 27 million kilometers—only 1/9 of Apollo Go's 240 million kilometers.

The third tier comprises numerous small and medium-sized self-driving vehicle companies, which, relying on single clients or lacking technological barriers, are most vulnerable to elimination in the knockout stage. These companies often lack core algorithm capabilities, relying on external technology licensing, and cannot afford high R&D investment and large-scale operational costs. After the capital ebb, most face the fate of "either being acquired or exiting the market."

It is worth noting that many industry players, such as Tesla, are already eyeing opportunities, which will further intensify competition.

In this brutal competitive landscape, the companies that can have the last laugh must possess three fundamental conditions: first, having autonomous and controllable core technologies, especially scene generalization capabilities underpinned by large models, enabling rapid adaptation to complex environments in different cities and road conditions; second, having stable commercialization scenarios, able to break free from dependence on government subsidies and single clients, forming sustainable cash flows; third, gaining long-term trust from capital, whether through listing financing or backing from giants, must have the capital reserves to support 5-10 years of high R&D investment.

From the current landscape, only the first-tier Apollo Go and Google Waymo meet these conditions.

03 What will the future of self-driving vehicles hinge on?

On November 4th, Baidu's Hong Kong stock opened with a surge exceeding 6%, defying market volatility and strengthening. As of November, Baidu's stock price has continued to rise over the past three months, with a cumulative increase exceeding 25%.

This stock price performance is no coincidence; the core logic driving it is Apollo Go's continuous breakthroughs and data validation in the Robotaxi sector.

Especially after entering the knockout stage, companies' competition is no longer about "storytelling" but focuses on the hard strength (shílì, capabilities) of commercialization self-sufficiency, cost control, and compliance and safety capabilities. Apollo Go has built an insurmountable barrier in these three core capabilities.

Apollo Go's sixth-generation autonomous vehicle reduces costs by 60% compared to the previous generation through hardware iteration and large-scale production, costing around 200,000 yuan, which is only 1/7 of Waymo's autonomous vehicle and achieves the commercialization cost threshold two years earlier than Tesla's Cybercab.

From an industry development trend perspective, the ultimate goal of self-driving vehicles is to eliminate traffic accidents caused by human factors through technology. According to World Health Organization data, 1.24 million people die globally in traffic accidents each year, with human factors such as speeding, drunk driving, and fatigued driving being the main risks.

Among all core capabilities, compliance and safety capabilities are the "lifelines" for self-driving vehicle companies, especially as commercialization progresses and policy regulations become stricter. Any safety incident could be a "fatal blow."

It is worth mentioning that Apollo Go's safety performance not only far surpasses human drivers but also leads globally.

According to public data, Apollo Go's fully autonomous driving mileage has reached 140 million kilometers, with an average of one airbag deployment accident every 10.14 million kilometers driven, and it has never had an accident causing major casualties. In contrast, Google Waymo's fully autonomous driving mileage is around 154 million kilometers, with one airbag deployment accident every 4.54 million kilometers driven; human drivers have an average of one airbag deployment accident every 970,000 kilometers driven. Simply put, Apollo Go's safety is 10.5 times that of human drivers and more than twice that of Waymo.

This advantage stems from Baidu's continuous investment in safety technology: Apollo Go's sixth-generation autonomous vehicle fully applies the "Apollo ADFM large model + hardware products + safety architecture" solution, ensuring vehicle stability and reliability through 10 layers of safety redundancy (such as dual power supplies and dual braking systems) and 6 layers of MRC safety strategies (such as multi-sensor fusion verification). Meanwhile, Apollo ADFM reconstructs autonomous driving based on large model technology, accumulating massive amounts of complex scenario data through large-scale applications in Chinese cities with populations in the tens of millions, further enhancing safety handling capabilities in extreme situations.

Apollo Go's safety advantage has also been recognized by external authoritative institutions. The U.S. magazine Fortune announced its 2025 "Companies That Change the World" list, with Baidu making the list for its influence and safety in the autonomous driving sector through Apollo Go.

Robotaxis are accelerating from science fiction to reality. Behind the capital and technological hype, tech giants and startups are doubling down, vying for entry tickets to this future mobility revolution. Renowned U.S. investor Cathie Wood predicts that by 2030, the self-driving vehicle market could reach $10 trillion, with around 50 million self-driving vehicles globally. After scaling (guīmóhuà, large-scale deployment), the cost per mile for self-driving vehicles could drop from $1.1 to $0.25, spawning a trillion-dollar new market.

In this brutal knockout stage, Apollo Go and Google Waymo have already established their global first-tier status with absolute technological advantages, operational scale, and safety records. Their competition and breakthroughs will also drive the entire self-driving vehicle industry toward a safer future. (The End)