Shopify: Is Imperfection Unacceptable? The Original Sin of High Valuation?

![]() 11/06 2025

11/06 2025

![]() 612

612

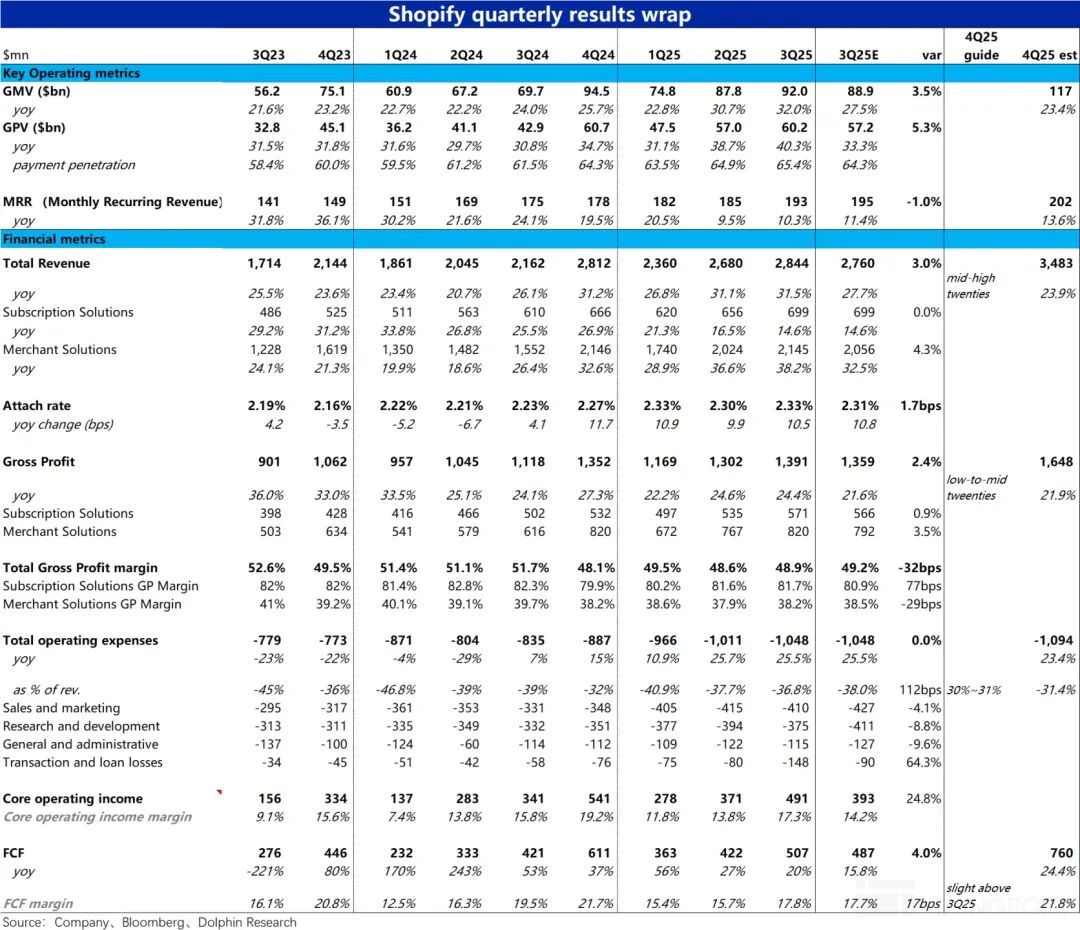

As the most closely watched stock in the current e-commerce AI sector, Shopify (SHOP.US) released its Q3 2025 financial report before the U.S. market open on November 4th. Overall, growth remained quite strong, with GMV acceleration continuing on a high base. However, narrowing gross margins and a return to expense expansion led to a larger year-over-year decline in profit margins, marking a subpar performance. Key details include:

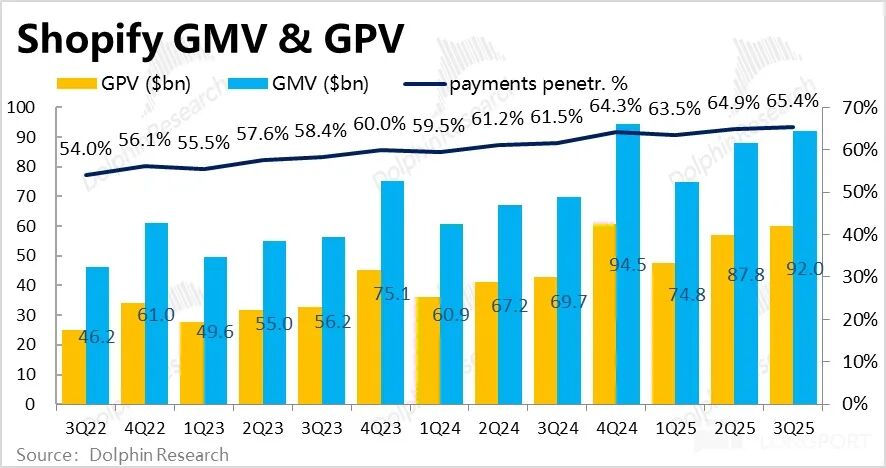

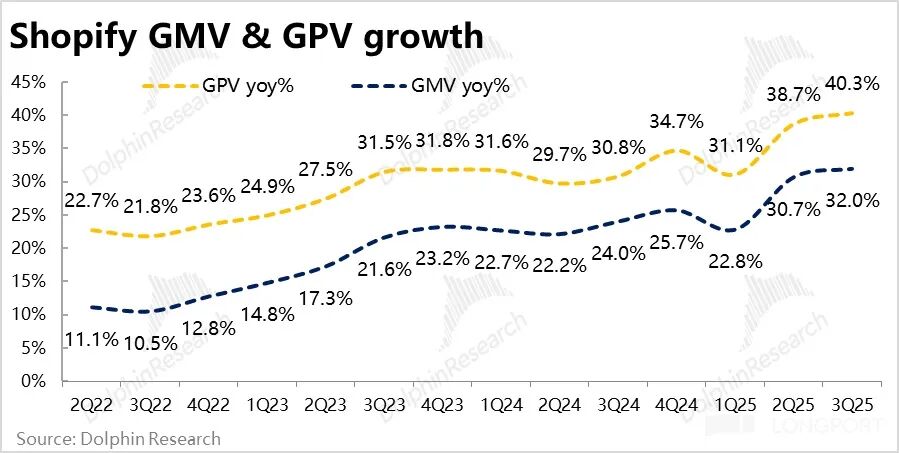

1. Strong GMV Growth Drives All Expectations: Shopify's ecosystem GMV reached $9.2 billion this quarter, up 32% year-over-year, accelerating further from an already strong previous quarter and significantly exceeding expectations. Even excluding favorable currency exchange impacts, growth still improved by 1 percentage point sequentially.

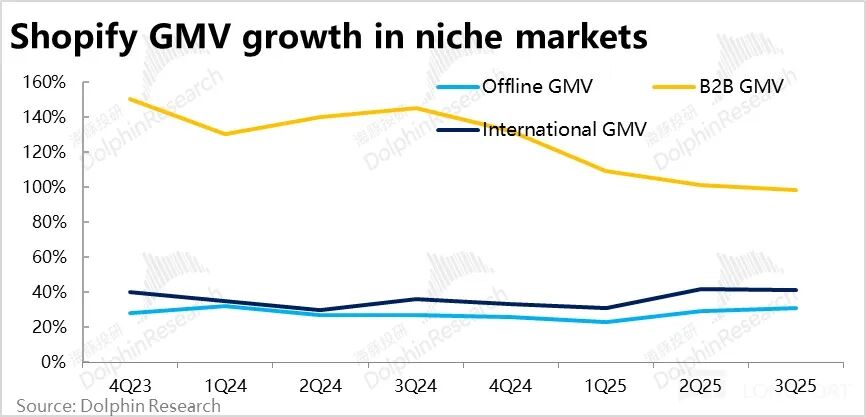

According to disclosures, high growth persisted across three main segments: international markets, offline channels, and B2B operations.

Meanwhile, Shopify Payments' penetration within ecosystem GMV rose 0.5 percentage points sequentially to 65.4%, driving payment volume (GPV) growth to 40%—surpassing GMV growth and beating expectations.

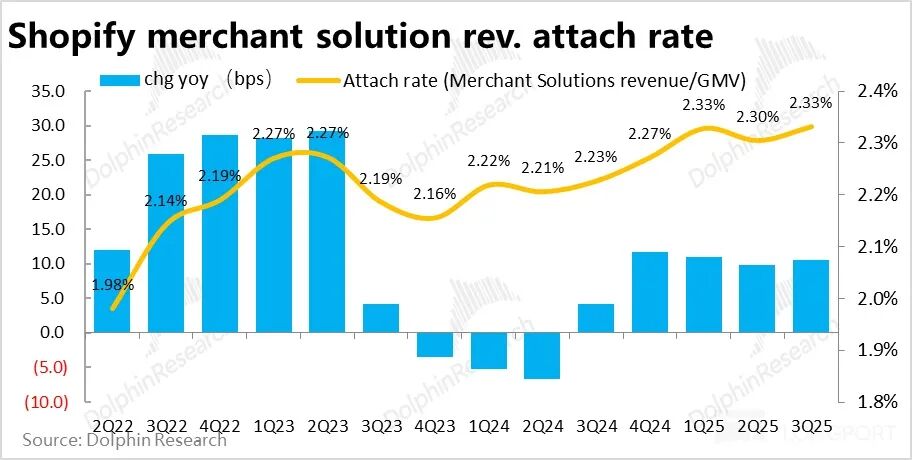

2. Service Monetization Rates Continue Steady Improvement: Calculated as merchant service revenue divided by GMV, the service monetization rate rose approximately 10 basis points year-over-year to 2.33% this quarter (partially attributable to PayPal revenue classification changes and the aforementioned payment penetration increase).

Merchant service revenue thus reached $2.15 billion, surging nearly 39% year-over-year. Combined with strong GMV growth and rising monetization rates, revenue growth accelerated further.

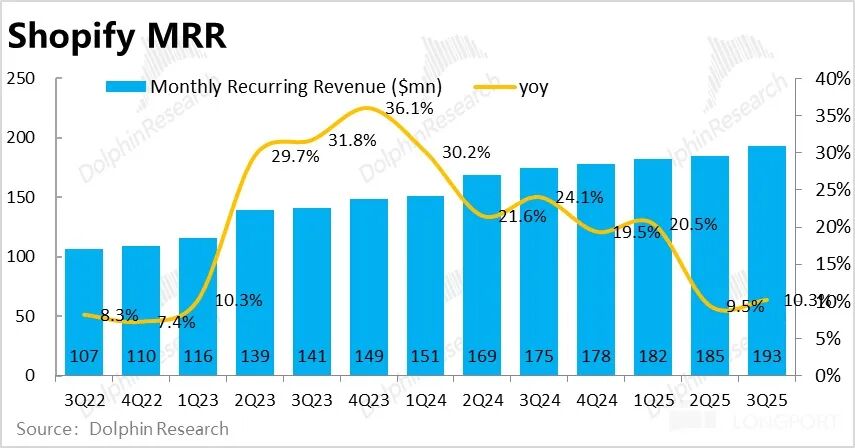

3. Subscription Business Remains 'Stuck in Low Gear': The underlying metric for subscription services—MRR (Monthly Recurring Revenue)—reached $193 million this quarter, up 10.3% year-over-year with sequential improvement but still lingering at low levels, primarily due to free trial impacts. These negative effects were partially offset by growth in higher-tier subscriptions (Plus).

Correspondingly, subscription service revenue grew 14.6% year-over-year, with sequential deceleration of nearly 2 percentage points—remaining weak but largely in line with market expectations.

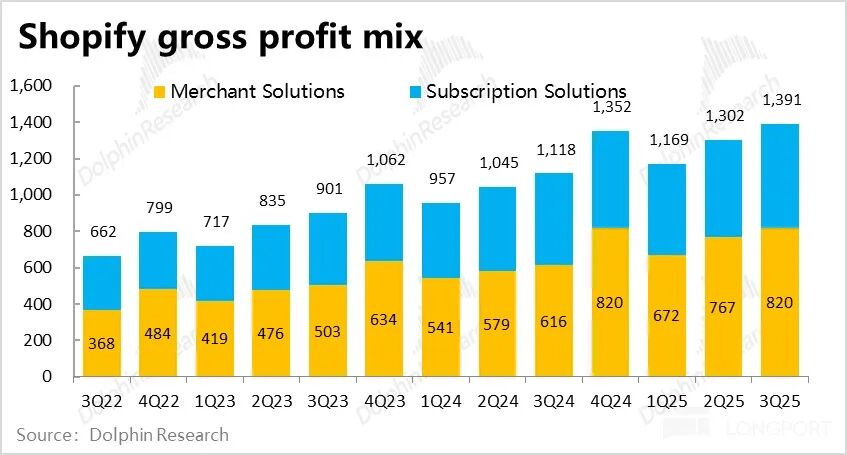

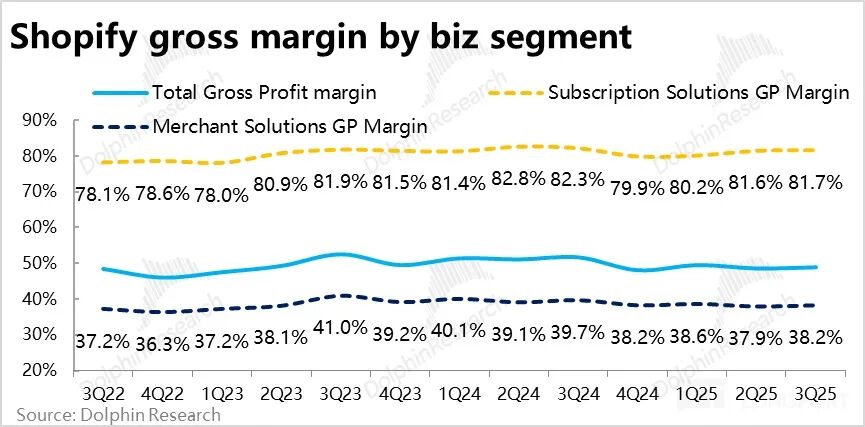

4. Gross Margin Declines Exceed Expectations: Free trial activities in subscriptions and PayPal revenue classification changes (favorable for revenue but negative for margins) caused both subscription and merchant service gross margins to contract year-over-year.

Subscription margins saw a narrowed year-over-year decline of 0.6 percentage points as free trial impacts weakened. However, merchant service margins declined more sharply to 1.5 percentage points, likely due to lower margins in faster-growing international markets and large merchant segments.

Combined with rising low-margin service revenue, overall gross margins contracted approximately 2.8 percentage points year-over-year, missing market expectations. Total gross profit grew only about 24%, lagging revenue growth.

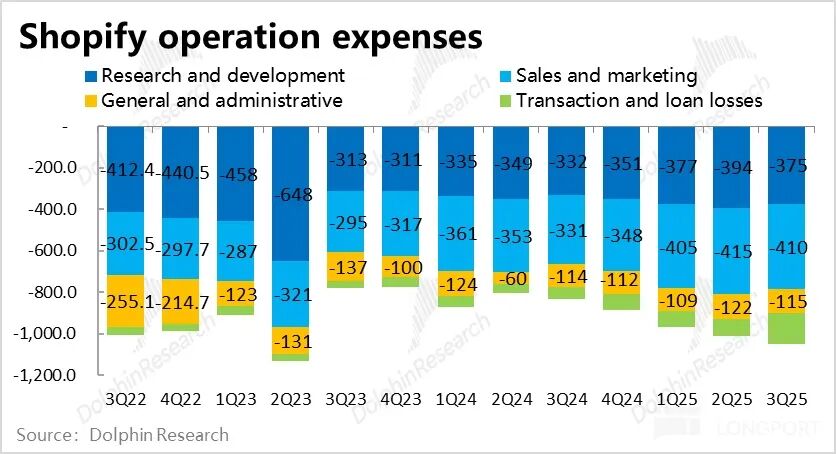

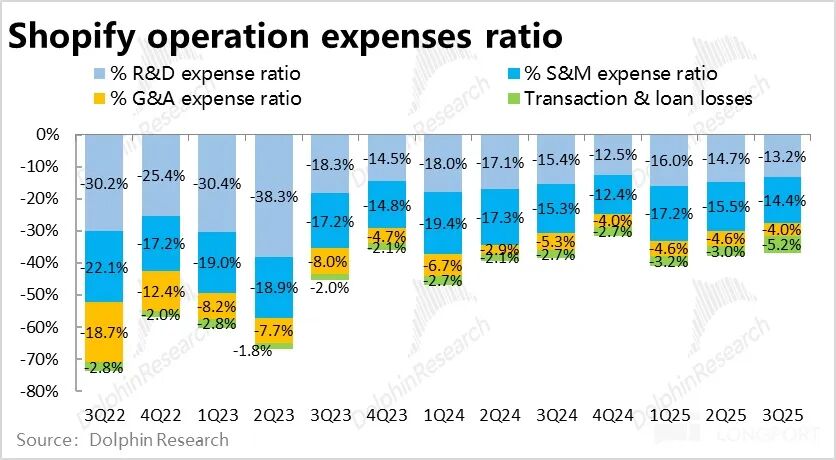

5. Expenses Continue High Growth: Total expenses rose approximately 25.5% year-over-year, maintaining similar growth to the previous quarter. With expense growth outpacing gross profit, this exerted dilution on profit margins.

Specifically, marketing and transaction loss expenses saw higher growth. Marketing expenses surged nearly 24% year-over-year, reflecting more aggressive customer acquisition and new business promotion. Transaction losses exploded 1.5x year-over-year, possibly due to shifting customer demographics or rising macroeconomic bad debt rates.

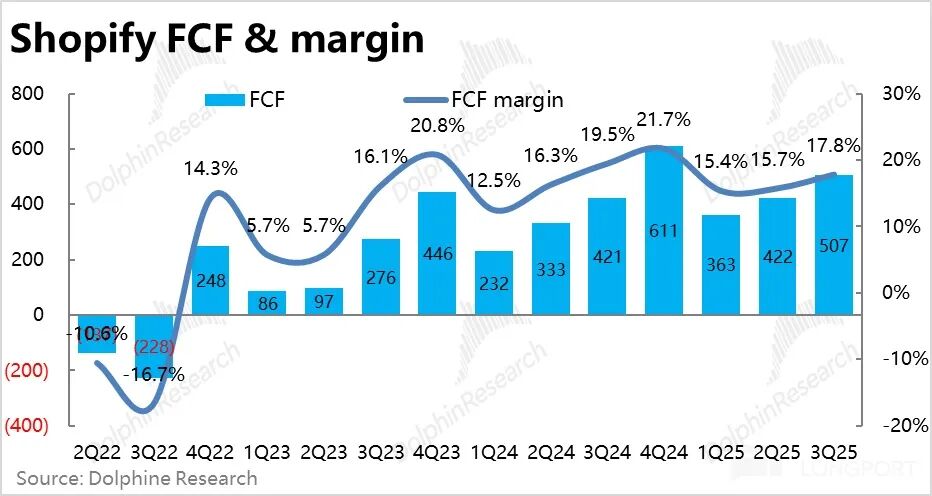

6. Strong Growth, But Also 'Limp' Profits: Narrowing gross margins and high expense growth caused operating margins to contract approximately 1 percentage point year-over-year. Free cash flow (FCF) reached about $510 million, up 20.4% year-over-year but lagging revenue and gross profit growth. The FCF margin of 17.8% contracted 1.6 percentage points year-over-year, with a larger decline than the previous quarter.

Dolphin Research Perspective:

Shopify's performance aligns with a trend observed in some other companies covered by Dolphin—strong revenue and core business metric acceleration, but simultaneous margin compression due to product mix shifts or similar factors, along with reinvested expenses, preventing scale efficiencies from boosting profitability.

This results in accelerating revenue growth but decelerating profit growth—a recurring 'revenue without profit' dilemma, as seen in Shopify's case.

Similarly, guidance suggests next quarter's total revenue will grow 25%-29%, exceeding Bloomberg's 24% consensus, with growth still surprising positively. However, FCF margin guidance suggests only a slight improvement from this quarter's 17.8%, likely remaining below 20%.

This implies a sharper contraction from last year's 21.7%. Next quarter's FCF may grow only around 10% year-over-year under this guidance.

This suggests another quarter of strong growth but worsening profits, amplifying concerns about the 'revenue without profit' dynamic.

Operationally, combining foreign research, key drivers behind Shopify's sustained GMV acceleration include:

1) Penetration into mid-to-large enterprises: Historically serving SMBs with limited self-development capabilities, Shopify has recently made significant progress in acquiring enterprise merchants, driving GMV growth despite lower margins and profitability from larger clients.

2) Overseas expansion, particularly in Europe: Recent launches of Shopify Payments in multiple European small-to-medium countries (expanding coverage from 20+ to 40+) have fueled international growth.

Beyond these tangible progress areas, significant potential from AI and agents in e-commerce remains a key factor driving recent stock outperformance. However, as these capabilities are still early-stage and details of the OpenAI partnership remain undisclosed, a more detailed valuation analysis is available in the Changqiao App's [Dynamic - Research] section under the same article title.

Detailed Review Below

1. GMV Growth Accelerates Sequentially, Remaining Robust

The most critical growth metric—ecosystem GMV—reached $9.2 billion this quarter, up 32% year-over-year, accelerating further from an already strong previous quarter and significantly exceeding expectations. Even excluding favorable currency impacts, GMV growth improved by 1 percentage point sequentially.

Meanwhile, Shopify Payments' penetration within ecosystem GMV rose another 0.5 percentage points sequentially to 65.4%, driving payment volume (GPV) growth to 40%—still outpacing GMV growth.

Both core metrics (GMV and GPV) significantly exceeded market expectations by approximately 3-5 percentage points.

2. MRR Growth Remains Subdued

The core metric for subscription services—MRR (Monthly Recurring Revenue)—reached $193 million this quarter, up 10.3% year-over-year but still at low levels, below Bloomberg's consensus of $195 million, due to the impact of free trials (up to 6 months) rolled out earlier. The company disclosed that negative effects were partially offset by growth in higher-tier subscriptions (Plus), which contributed 35% of recurring subscription revenue this quarter (similar to last quarter).

3. Merchant Service Monetization Rates Continue Steady Rise

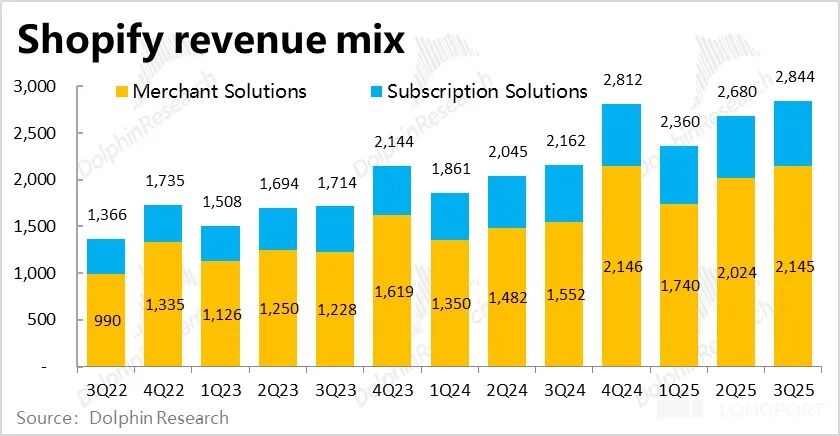

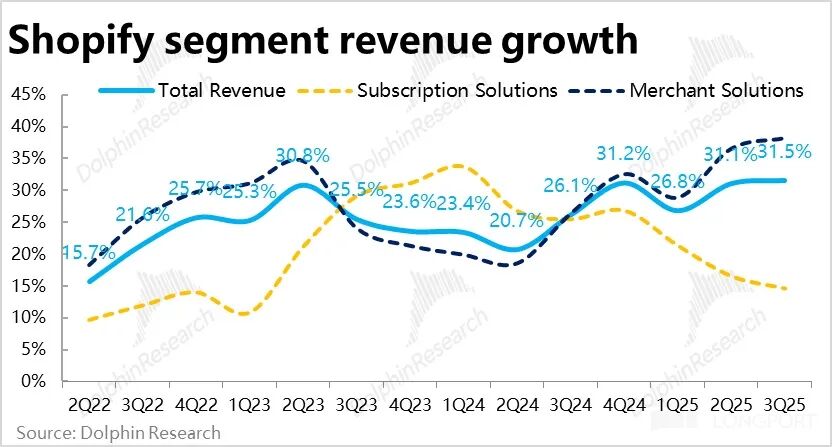

Revenue-wise, with MRR growth remaining relatively weak, subscription service revenue grew 14.6% year-over-year, with sequential deceleration of nearly 2 percentage points—though largely in line with market expectations.

Merchant service revenue, however, reached $2.15 billion, surging nearly 39% year-over-year. Driven by strong GMV growth, revenue acceleration continued. Calculated as merchant service revenue divided by GMV, the monetization rate rose approximately 10 basis points year-over-year to 2.33%, partly due to PayPal revenue classification changes. Over the past four quarters, monetization rates have consistently risen around 10 basis points year-over-year, showing sustained and stable improvement.

Overall, while subscription revenue growth remained lackluster, higher-proportion merchant service revenue accelerated, driving total revenue growth to 31.5%—a slight sequential acceleration of 0.4 percentage points, exceeding market expectations.

4. Gross Margins Remain Under Pressure, Subscription Declines Narrow While Merchant Services Widen

Free trial activities in subscriptions and PayPal revenue classification changes (favorable for revenue but negative for margins) caused both subscription and merchant service gross margins to contract year-over-year.

Subscription margins saw a narrowed year-over-year decline of 0.6 percentage points as free trial impacts weakened. However, merchant service margins declined more sharply to 1.5 percentage points. Dolphin attributes this to lower margins in faster-growing international markets and large merchant segments.

5. Expenses Continue High Growth, Profit Margin Contraction Widens

While gross margins narrowed, operating expenses also grew relatively high, up approximately 25.5% year-over-year—similar to the previous quarter. With expense growth outpacing gross profit, this exerted dilution on profit margins. (As PayPal revenue classification changes do not affect gross profit, comparing against gross profit growth is more objective.)

Specifically, marketing and transaction loss expenses saw higher growth. Marketing expenses surged nearly 24% year-over-year, reflecting more aggressive customer acquisition and new business promotion. Transaction losses exploded 1.5x year-over-year, suggesting rising consumer payment defaults (possibly due to shifting customer demographics or macroeconomic bad debt increases).

Overall, with gross margins contracting and expenses growing high, operating margins contracted approximately 1 percentage point year-over-year. Free cash flow reached about $510 million, up 20.4% year-over-year but lagging revenue and gross profit growth. The FCF margin of 17.8% contracted 1.6 percentage points year-over-year, marking the first such significant decline since 2023.

Similarly, amidst a scenario of sustained and robust business growth acceleration, profit performance has been relatively mediocre, with profit margins actually entering a contractionary trend.

- END -

// Reprint Authorization

This article is an original piece from Dolphin Research. Authorization is required for any reprints.

// Disclaimer and General Disclosure Notice

This report is intended solely for general comprehensive data purposes, designed for general perusal and data reference by users of Dolphin Research and its affiliated entities. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making any investment decisions based on this report. Any individuals making investment decisions using or referring to the content or information mentioned in this report assume full risk. Dolphin Research shall not be held responsible for any direct or indirect liabilities or losses that may arise from the use of the data contained in this report. The information and data presented in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives for, but does not guarantee, the reliability, accuracy, and completeness of the relevant information and data.

The information mentioned or the views expressed in this report shall not, under any jurisdiction, be considered or construed as an offer to sell securities or an invitation to engage in securities transactions, nor shall they constitute advice, solicitations, or recommendations regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for, nor are they intended to be distributed to, individuals or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would contravene applicable laws or regulations or would subject Dolphin Research and/or its subsidiaries or affiliated companies to any registration or licensing requirements in that jurisdiction.

This report solely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual shall (i) produce, copy, replicate, reproduce, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized persons. Dolphin Research reserves all related rights.