Unity: Patience is Key as the Metamorphosis into a Butterfly Progresses

![]() 11/06 2025

11/06 2025

![]() 652

652

Hello everyone, this is Dolphin Research speaking!

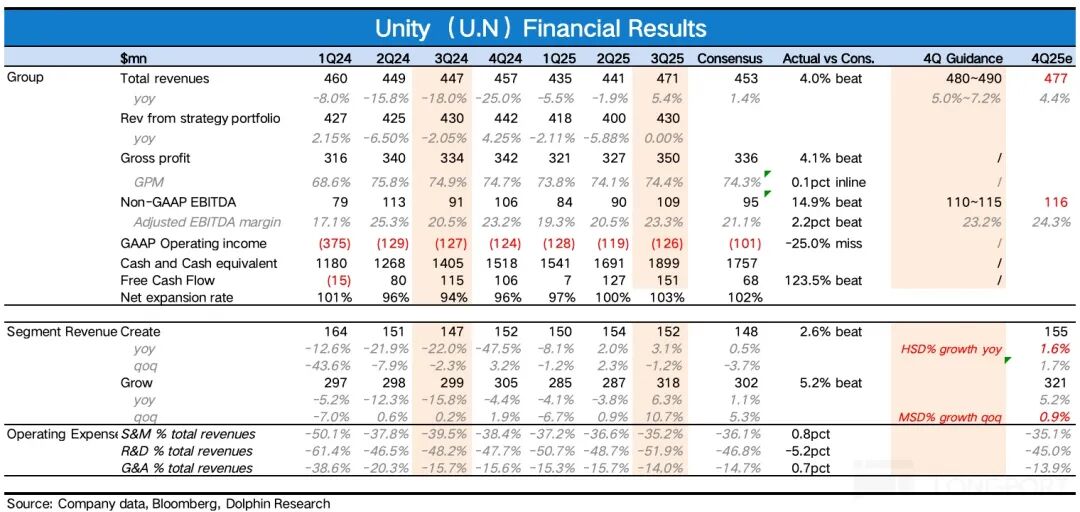

Prior to the market opening on November 5th (Eastern Time), Unity, the premier game engine provider, unveiled its financial results for the third quarter of 2025. The Q3 performance (inclusive of guidance) marginally surpassed sell-side analysts' expectations, maintaining a trajectory of sequential improvement.

Although Unity's transformation pace still lags behind that of its peers, given the management's consistently cautious approach over the past year, it is anticipated that Q4 performance will outperform the given guidance. Consequently, market sentiment, which had been dampened by average channel survey results, can expect some relief.

What truly piqued Dolphin Research's interest were the forward-looking medium- to long-term operational indicators, which finally exhibited a positive growth trend this quarter.

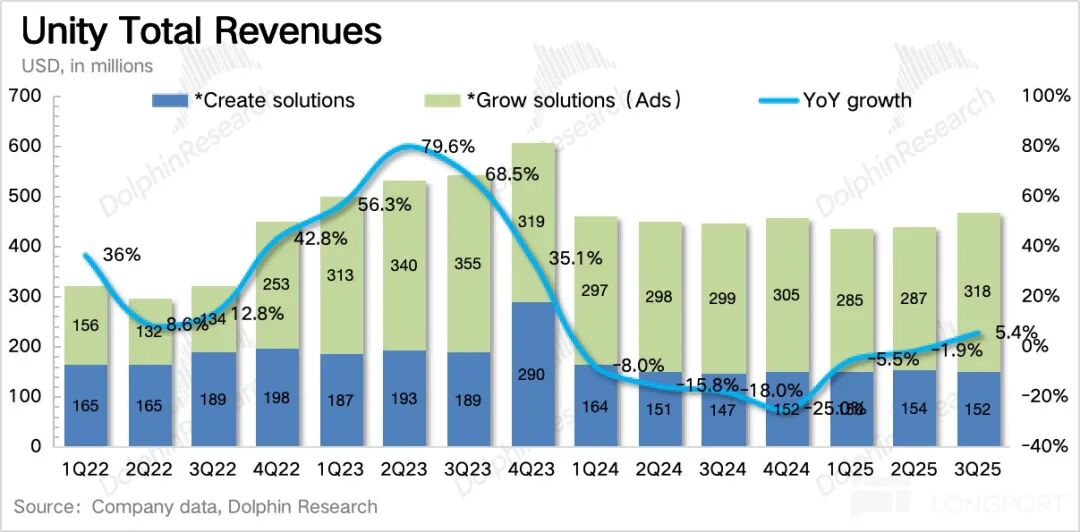

1. Vector Begins to Show Impact: Despite being hindered by negative growth in non-advertising businesses, Grow's revenue in Q3 rose by 6% year-over-year (YoY) and 11% quarter-over-quarter (QoQ). The influence of Vector is becoming increasingly apparent. The Q4 guidance suggests a QoQ growth rate of approximately 5%. Assuming a conservative downward adjustment of 4-5 percentage points by management each time, this still equates to nearly 10% QoQ growth. Although not as explosive as Applovin's performance, it exceeds pre-report expectations.

Previously, market sentiment was relatively cautious due to poor channel survey data in September and October. (After seeing a 10-20% month-over-month (MoM) improvement in Return on Ad Spend (ROAS) in August, Vector's ROAS improvement significantly slowed in September and October due to inadequate algorithm optimization.)

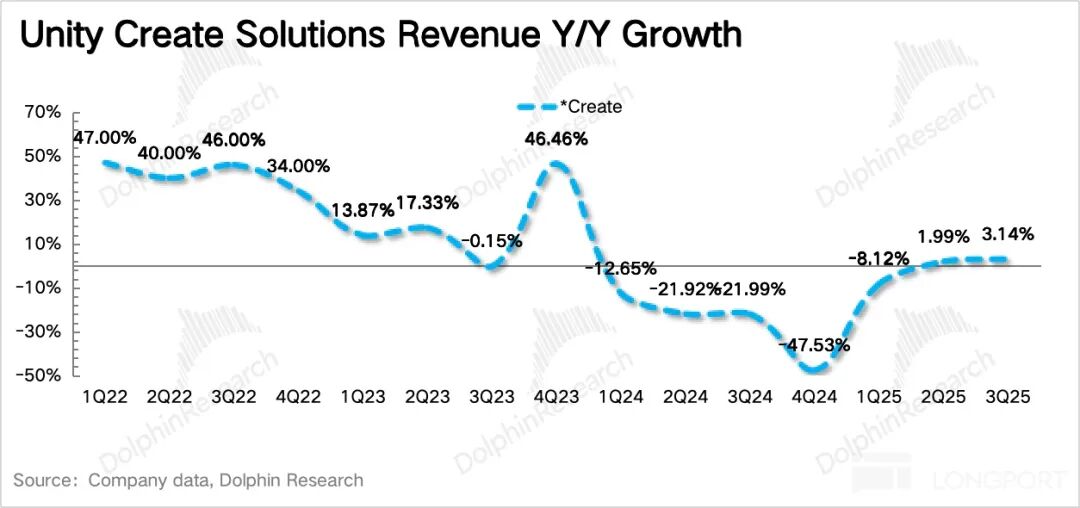

2. Unity 6 Fuels Growth: In Q3, Create's revenue increased by 3% YoY but decreased QoQ. The previous quarter saw a one-time recognition of a $12 million licensing fee from major clients (Tencent, Scopely). Excluding this special circumstance, the QoQ growth rate would have been 7%, indicating clear signs of improvement. The Q4 guidance suggests high single-digit percentage growth, around 7-8%, with an 8% QoQ growth rate.

Dolphin Research believes that this growth is primarily driven by Unity 6, launched in October of the previous year. Unity 6 offers enriched and upgraded engine functionalities at a higher average price. Therefore, even without considering new clients, the migration of existing clients alone contributes to increased engine revenue. According to institutional surveys, over 50% of existing users have already migrated to Unity 6. Based on previous expectations, an additional 20-30% of existing users who intend to migrate are still planning to do so.

3. Operational Indicators: When combining indicators <1-4>, the trend of recovery becomes increasingly evident.

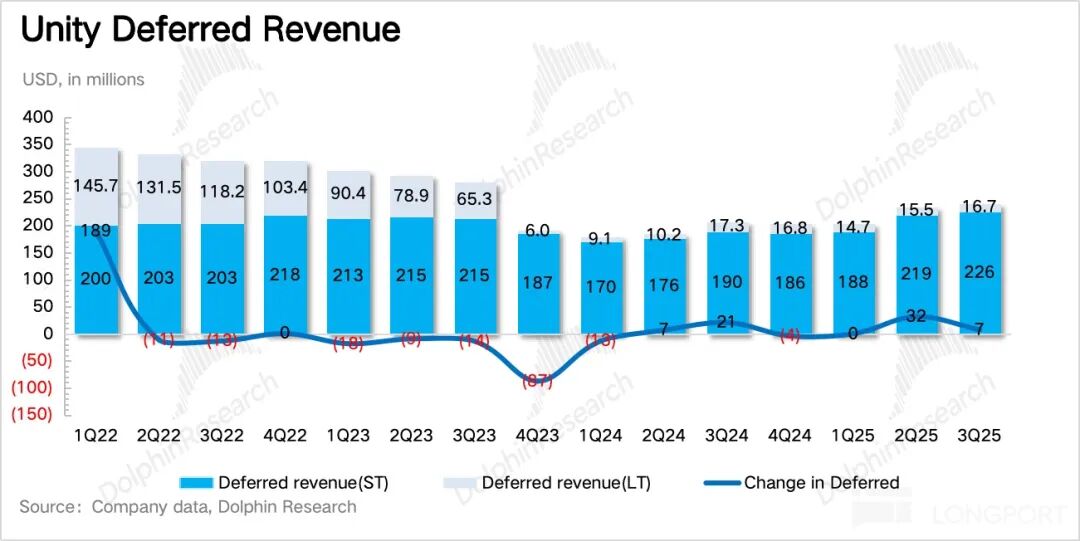

(1) Deferred revenue increased by $7.5 million QoQ, less than the previous quarter, which saw contributions from several medium-to-large clients, such as Tencent and Scopely.

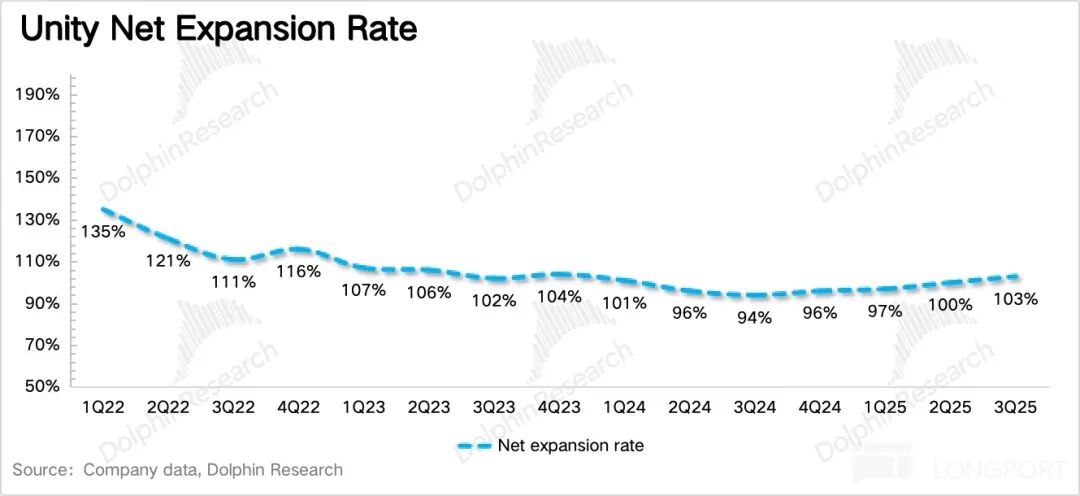

(2) The net expansion rate continued to recover, reaching 103%, finally surpassing the benchmark of 100% after two years.

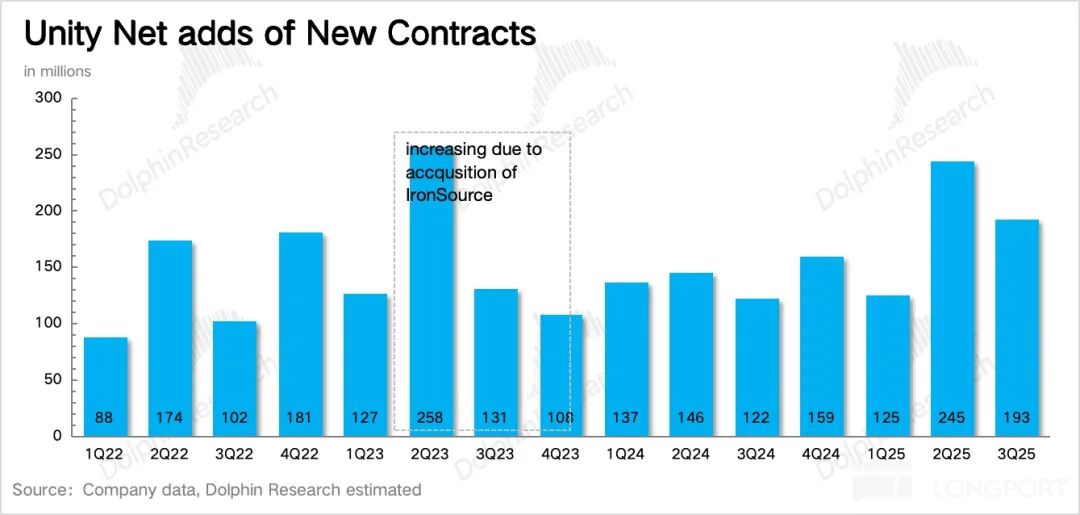

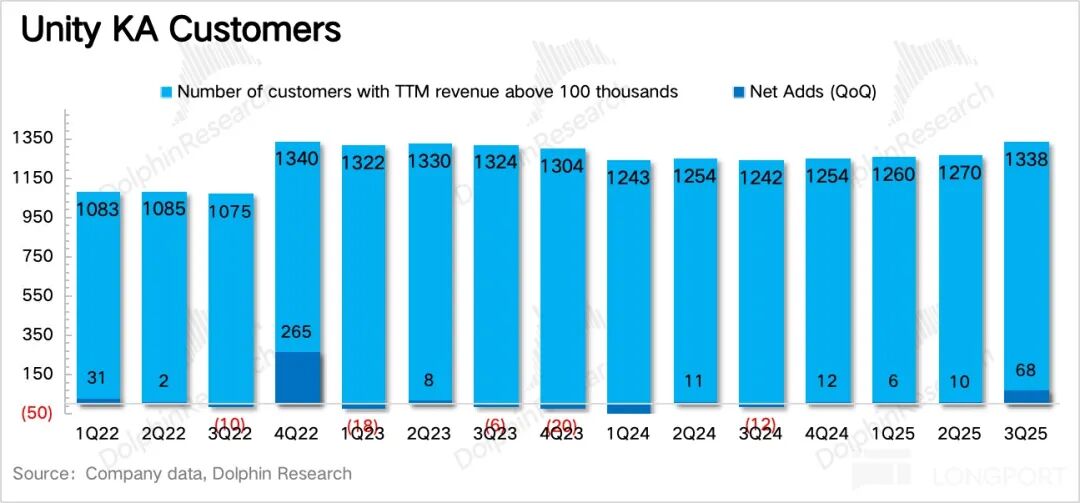

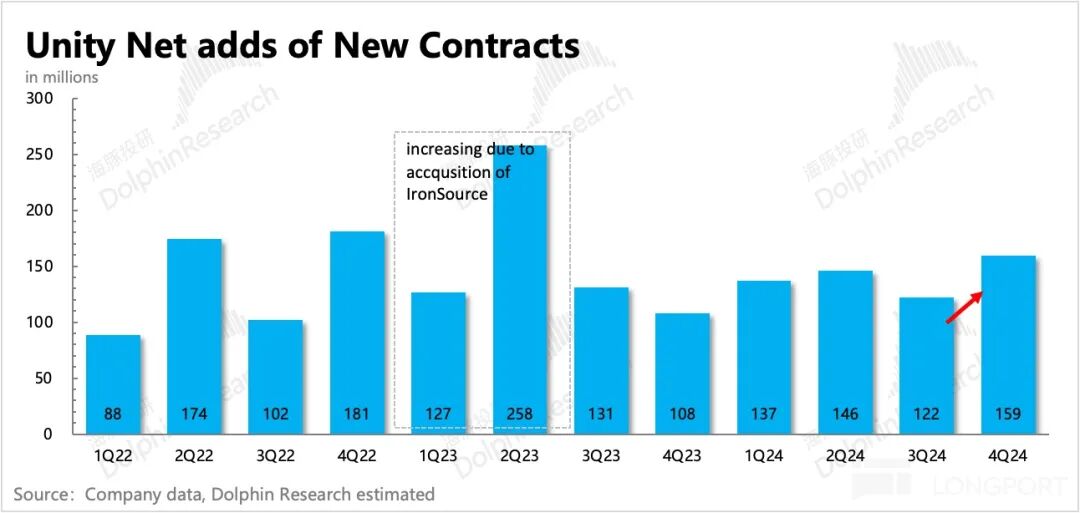

(3) The number of large clients increased by a net of 68 QoQ, a remarkably positive surprise. Excluding new additions from external mergers and acquisitions (M&A), such as the acquisition of ironsource, this net increase harks back to Unity's heyday in 2021. We estimate that, in addition to contract upgrades from existing Unity 6 clients, the main growth comes from advertising clients under Vector.

(4) The remaining contract value significantly increased by $40 million QoQ. Although not as high as last quarter (Tencent), it still represents a rare positive trend.

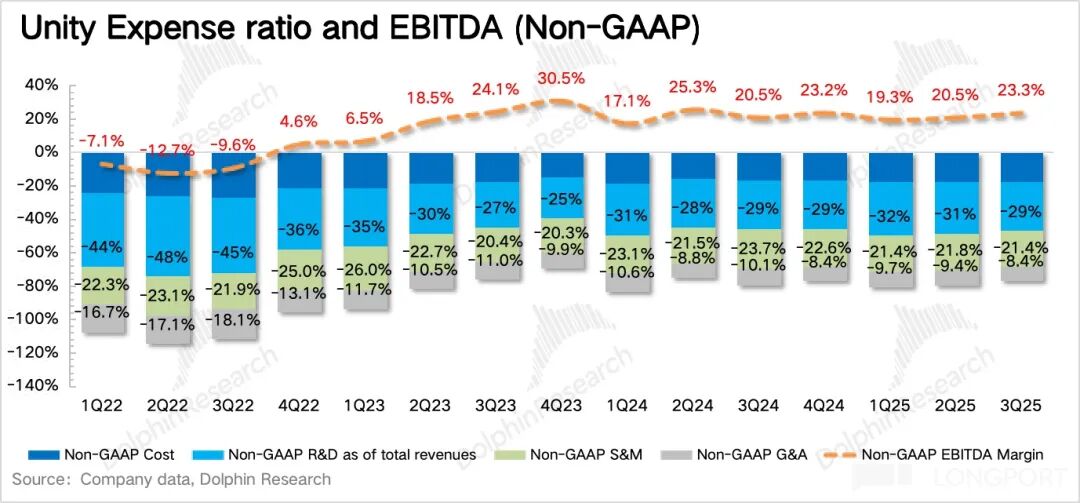

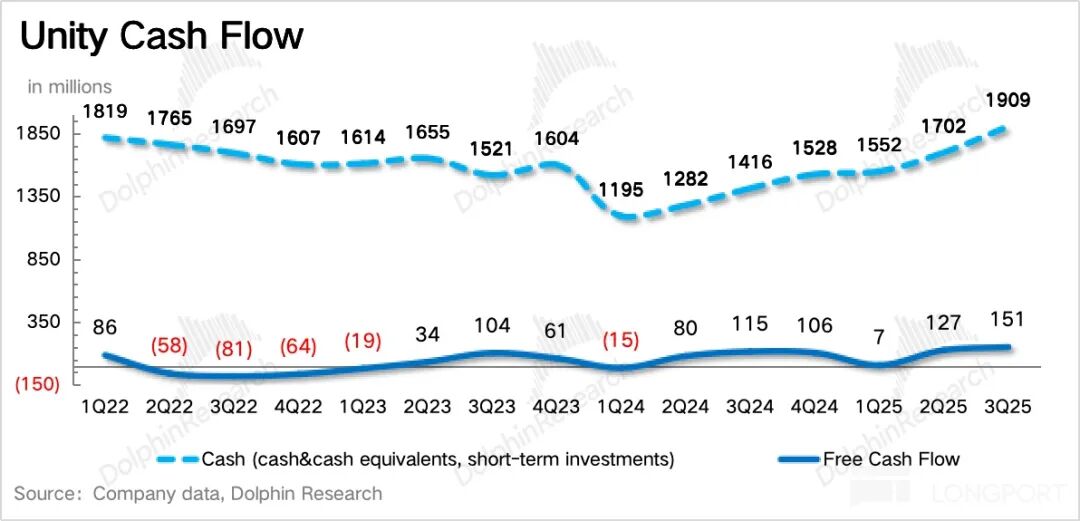

4. Change in Amortization Period for Intangible Assets: Although Unity is in a critical transformation phase and may not be overly stringent on profit requirements, exceeding profitability targets would undoubtedly be favorable. In Q3, Unity achieved just that, with the Non-GAAP EBITDA margin increasing by 3 percentage points QoQ, primarily due to expense optimization. Additionally, benefiting from improvements in the core business, free cash flow reached $150 million, the highest in the company's history.

It is worth mentioning that the significant increase in R&D expenses under GAAP was mainly due to the accelerated amortization of technical assets acquired during the acquisition of Weta (which has since been divested). The amortization period was shortened from 4-7 years to 1-3 years, leading to higher expenses in Q3. However, both the company and the market are currently focusing on Unity's Non-GAAP EBITDA, so this does not affect actual expectations.

5. Overview of Performance Indicators

Dolphin Research's Perspective

The overall Q3 performance was commendable. Although financial indicators only slightly exceeded expectations and may be considered 'inline' for optimistic investors, Dolphin Research is relatively satisfied with the performance of several forward-looking operational indicators, especially the expansion in the number of large clients and the backlog of contracts, which represent medium- to long-term business turning points.

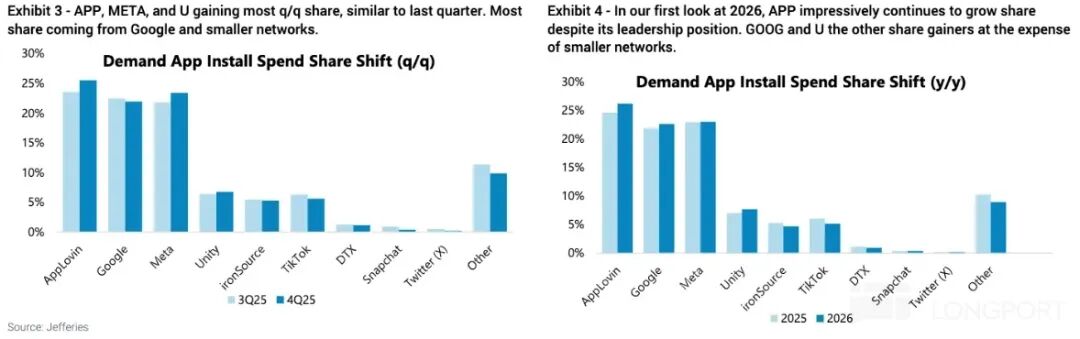

Additionally, the market's primary concern remains Unity's Grow business. Despite ongoing drag from ironSource, the Vector segment appears to be performing well, at least maintaining a positive trend and not as concerning as survey results suggested. Moreover, the overall game application advertising market performed generally in Q3, reflecting Vector's outstanding effectiveness amidst industry challenges.

In Q3, the overall game application advertising market saw moderate performance. Due to continuous increases in advertising bids over the past year, game developers have been transitioning from a pure advertising monetization model (In-App Advertising, or IAA) to a hybrid model (advertising IAA + paid In-App Purchase, or IAP).

During this transition, small and medium-sized platforms with poor conversion rates are prone to further losing market share. In Q3, ironSource's market share slightly declined. Meanwhile, based on the current status of ironSource, advertisers surveyed indicated that their budget allocation to ironSource in 2026 would continue to decrease.

Is There an Impact from Cannibalization by the Vector Advertising System? Although management mentioned on last quarter's earnings call that internal cannibalization was not severe, less than 10%, theoretically, if Vector is truly effective, existing advertisers have no reason not to try it.

The seemingly insignificant impact in Q2 may be merely due to Vector's recent launch in late May. Therefore, Dolphin Research believes that as Vector gradually optimizes, this internal cannibalization process should deepen further.

In addition to internal cannibalization, ironSource itself has issues. Since its acquisition by Unity, integration between the two companies has not been smooth. Coupled with the departure of former ironSource executives and the exit of former Unity management responsible for the acquisition, the integration pace and effectiveness have been further affected. This turbulent process has also diminished the willingness of former ironSource clients to collaborate.

However, the key variable affecting Unity's valuation remains Vector. Since May, Vector's conversion effectiveness has been continuously optimizing, albeit with some twists and turns. For instance, management claimed a 10-20% MoM improvement in ROAS at the beginning of Q3, but when channel surveys reported average data in September and October, the stock price immediately corrected.

Dolphin Research believes that Vector's less smooth upgrade compared to Axon's is due to a lack of user data. Another missing component—a complete ecological industry chain—is currently being addressed by integrating into ironSource's bidding platform to connect with mainstream Demand-Side Platforms (DSPs). Although this falls short of Applovin's full industry chain layout, it is not the biggest issue at present and will only become a higher requirement during subsequent advanced stages.

Moving forward, Unity will primarily leverage engine data to optimize Vector's recommendation algorithms. Unity 6 integrates the Developer Data Framework, which will be available starting from Unity 6.2. This means more in-app user behavior data will be systematically and automatically collected through the engine, transmitted to backend cloud platforms for storage, or used to optimize Vector's algorithms (with client authorization).

Currently, over half of existing clients have switched to Unity 6, with 70-80% indicating their intention to do so in previous surveys. Therefore, 2026 will see the effect of Unity 6's higher pricing, and subsequent focus will be on the penetration of Unity 6.2, which relates to Vector's future optimization pace.

In last quarter's review, Dolphin Research discussed how engine data can improve ad recommendations and targeting (refer back to 'The Wild Roller Coaster: Does Unity Have a 'U' Turning Point?'). Simply put, utilizing engine data ensures normal commercialization while reducing negative user interference from ads, displaying them at more 'appropriate' times based on players' in-game performance and preferences, dynamically pushing different types of incentive ads.

This enhances advertiser retention by improving product experience and potentially increases ad conversion by displaying ads when players are most focused.

This process requires time to accumulate data and train models, making it difficult to reflect quickly in short-term performance, but it is gradually iterating and improving.

From a long-term perspective, Unity's competitive advantage in deeply integrating into client development processes was further strengthened with the release of a cross-platform payment management system (including payment, product pricing, promotional operations, and data statistics) integrated into the Unity engine in late October. This system helps game developers bypass app stores to set up external payment links, potentially laying out a more complete industry chain. By creating a larger and more closed ecosystem, Unity can enhance its competitive barriers and achieve higher monetization.

Currently, Dolphin Research's view remains largely unchanged from last quarter: Unity is suitable for medium- to long-term investment to enjoy enterprise growth. However, due to uncertainties in algorithm optimization pace and effectiveness, as well as the presence of very strong competitors during the same period, a cautious approach dependent on short-term performance is necessary. A more detailed value analysis has been published in the same-titled article in the Changqiao App's 'Dynamic-Research' section.

The following is a detailed analysis:

I. Overview of Unity's Business

Unity incorporated IronSource's operating results in Q1 2023 and adjusted the scope of its segmented business disclosures. Under the new disclosure structure, the business segments have been condensed from the original three (Create, Operate, Strategic Partnerships) to two (Create, Grow).

The new Create solutions encompass not only the original Create products (the main game engine) but also incorporate revenue from Unity Game Service (UGS) previously recognized under Operate. UGS provides a full-chain solution for game companies, covering game development, distribution, user acquisition, and operations. It also includes revenue from the original Strategic Partnerships segment. However, services such as Professional Services and Weta have been gradually phased out since 2023.

The Grow solutions include the advertising business previously under Operate, as well as marketing (mainly Aura, with Luna closed in Q1 2024) and game publishing services (Supersonic) merged from IronSource. Revenue contributions come from seat subscription fees for the main game development engine, ad platform revenue from mediating bids, and game publishing revenue.

II. Further Confirmation of Positive Operational Trends

Unity achieved total revenue of $470 million in Q3, up 5% YoY, slightly exceeding company guidance and market expectations. Last quarter, we stated that Unity's operational turning point was established, and Q3 further confirms this positive trend.

Breaking down the business:

1. In the Create business, core engine subscription revenue maintained double-digit YoY growth, with stable growth compared to each quarter over the past year. Although there was no QoQ growth, this was mainly due to a one-time recognition of long-term engine contract fees from major clients in the previous quarter. Excluding this revenue, the QoQ growth rate would be 7%.

On October 22nd, the company launched a cross-platform payment management system (including payment, product pricing, promotional operations, and data statistics) integrated into the Unity engine, allowing developers to avoid jumping to various third-party platforms for operations. It also helps game developers bypass app store payments, saving some channel fees (mainly from app stores other than Apple).

This targets the $120 billion in-app purchase (IAP) market. Although integrated into Unity 6, Unity may charge a certain take rate based on payment volume. Specific business development prospects can be monitored during the earnings call.

2. Grow: Revenue increased by 3.8% YoY in Q3, primarily benefiting from Vector. The Q4 guidance suggests a QoQ growth rate of around 5%. Assuming a conservative downward adjustment of 4-5 percentage points by management each time, this still translates to nearly 10% QoQ growth. Although not as explosive as Applovin's performance, it exceeds pre-report expectations.

3. Forward-looking indicators continue to show recovery

(1) Deferred revenue increased by $7.5 million QoQ, less than the previous quarter, which saw contributions from several medium-to-large clients, such as Tencent and Scopely.

(2) The net expansion rate continued to recover to 103%, finally surpassing the benchmark of 100% after two years.

(3) The number of major clients saw a net quarter-on-quarter increase of 68, a truly remarkable and beyond-expectation figure. To witness a net increase of this scale, excluding new additions from external mergers and acquisitions like the acquisition of ironsource, one would have to go back to Unity's peak period in 2021. We estimate that, in addition to contract upgrades for Unity 6's existing customers, the main incremental growth comes from advertising clients under Vector.

(4) The remaining contract value experienced a significant quarter-on-quarter increase of $40 million. Although not as high as in the previous quarter (when dealing with Tencent), it still marks a rare positive trend.

Management's Guidance on Short-Term Performance:

Fourth-quarter revenue and adjusted profit largely met expectations. Revenue guidance is projected to be between $480 million and $490 million, representing a year-on-year increase of 5%-7%, slightly surpassing expectations. Adjusted EBITDA is expected to fall between $110 million and $115 million, aligning with expectations.

Considering that the new management's guidance style tends to be conservative, the actual performance may turn out to be even better. However, buyer optimism had been quite high previously, though sentiment has been somewhat dampened over the past month due to the results of channel surveys.

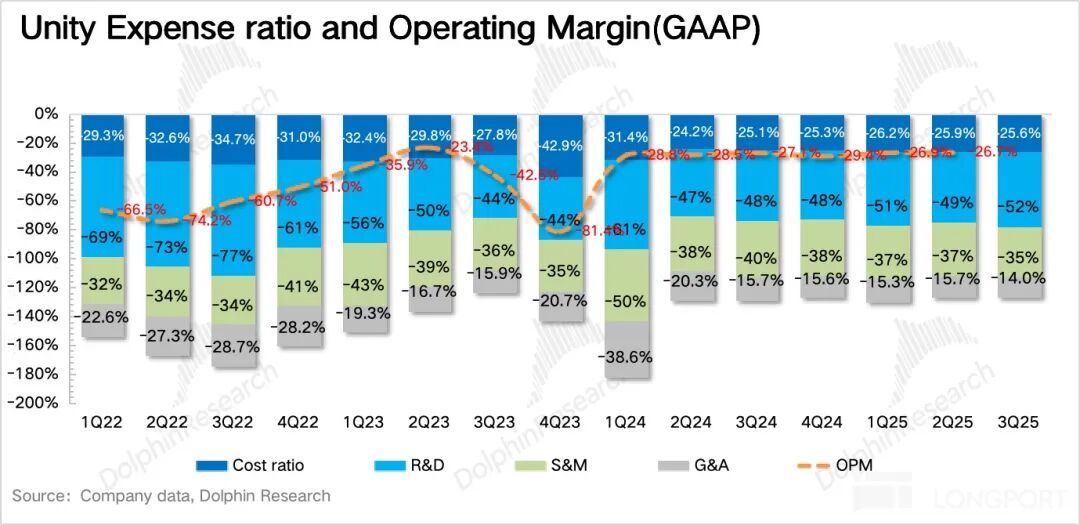

III. Short-Term Expenses Continue to Be Optimized, Except for a Change in Intangible Asset Amortization

The Non-GAAP EBITDA margin increased by 3 percentage points quarter-on-quarter in the third quarter, mainly due to expense optimization. Moreover, benefiting from improvements in the core business, free cash flow reached $150 million, the highest level in the company's history.

It's worth noting that GAAP research and development expenses increased significantly, primarily due to the accelerated amortization of technical assets acquired during the acquisition of Weta (which has since been divested). The amortization period was shortened from the original 4-7 years to 1-3 years, resulting in a substantial increase in expenses for the third quarter. However, both the company and the market are currently focusing on Unity's Non-GAAP EBITDA, so this change does not impact actual expectations.

- END -

// Reprint Authorization

This article is an original work by Dolphin Research. Authorization is required for any reprinting.

// Disclaimer and General Disclosure

This report is solely intended for general comprehensive data purposes, designed for general viewing and data reference by users of Dolphin Research and its affiliated entities. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making any investment decisions based on this report. Any person making investment decisions based on or referring to the content or information mentioned in this report assumes full risk. Dolphin Research shall not be held responsible for any direct or indirect liabilities or losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference only. Dolphin Research strives to ensure, but does not guarantee, the reliability, accuracy, or completeness of the information and data.

The information or views mentioned in this report shall not, under any jurisdiction, be regarded or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, solicitation, or recommendation regarding relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for distribution to, nor are they intended to be used by, persons in jurisdictions where such distribution, publication, provision, or use would contravene applicable laws or regulations or result in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions. Citizens or residents of such jurisdictions are advised accordingly.

This report merely reflects the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and all copyrights are owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized persons. Dolphin Research reserves all related rights.