AMD: Hitching a Ride with OpenAI? Not a "Backup Plan" Get-Out-of-Jail-Free Card

![]() 11/07 2025

11/07 2025

![]() 615

615

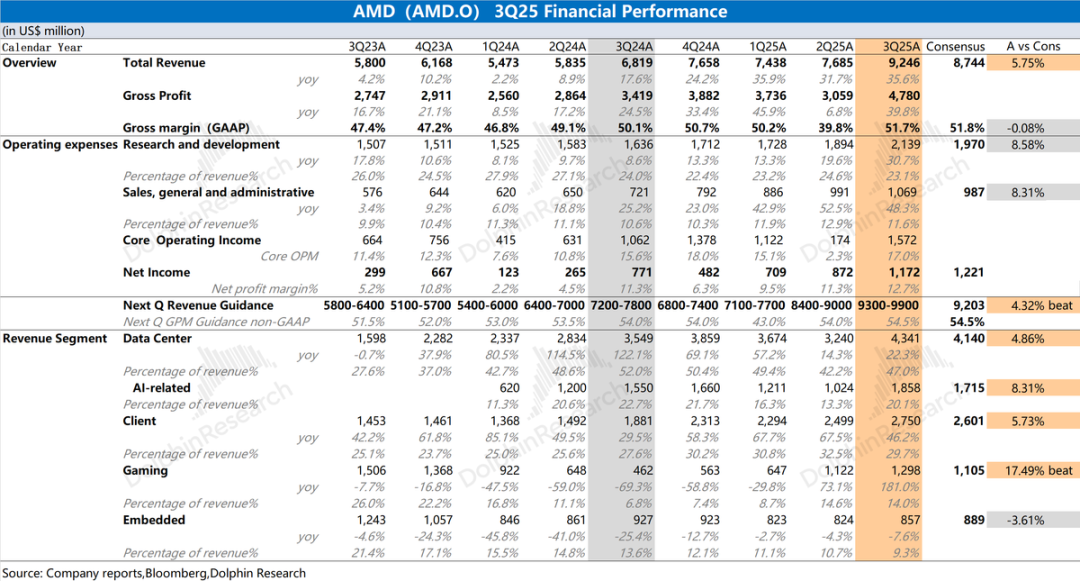

AMD (AMD.O) released its Q3 2025 financial results (as of September 2025) after the U.S. market close on the morning of November 5, 2025 (Beijing Time). Key highlights are as follows:

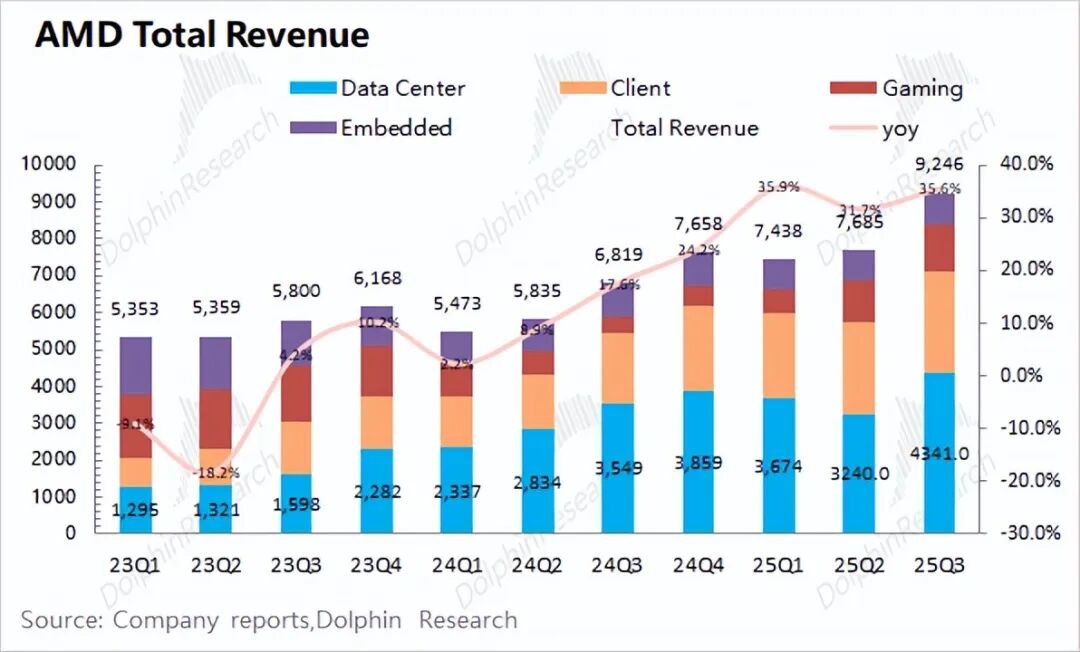

1. Overall Performance: AMD achieved revenue of $9.25 billion in Q3 2025, up 35.6% YoY, surpassing market expectations ($8.74 billion). The YoY revenue growth was primarily driven by the client and gaming businesses, as well as the data center segment.

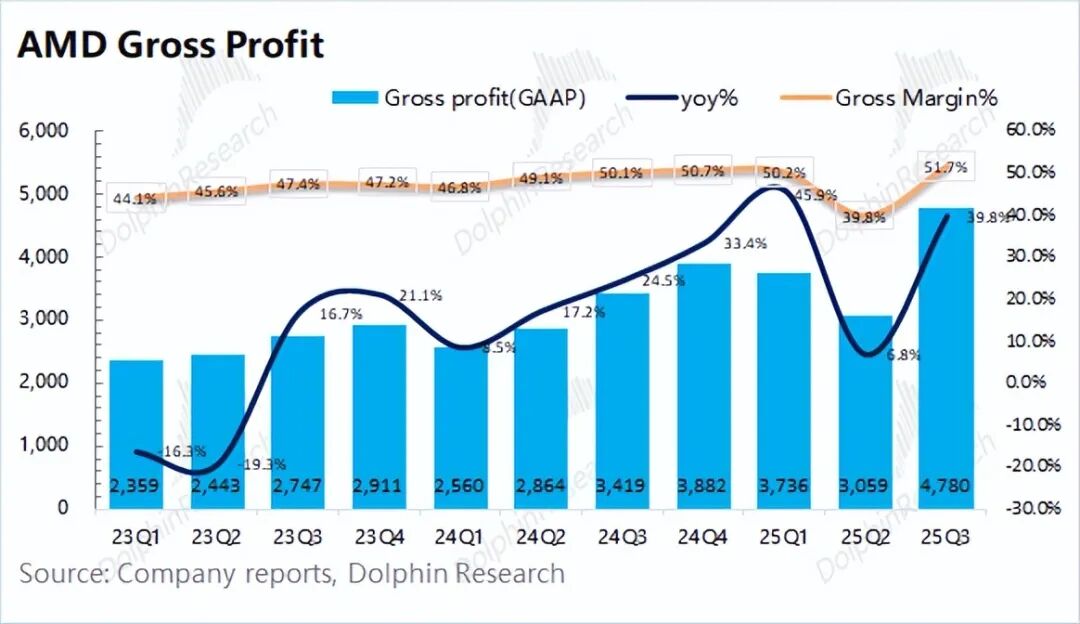

The company's gross margin (GAAP) for the quarter was 51.7%, up 1.6 percentage points YoY. Last quarter's gross margin was impacted by MI308-related inventory write-downs. Excluding this effect, the actual gross margin last quarter was 50.2%, still showing a 1.5 percentage point sequential improvement this quarter, mainly due to enhanced profitability in the client business and product optimizations.

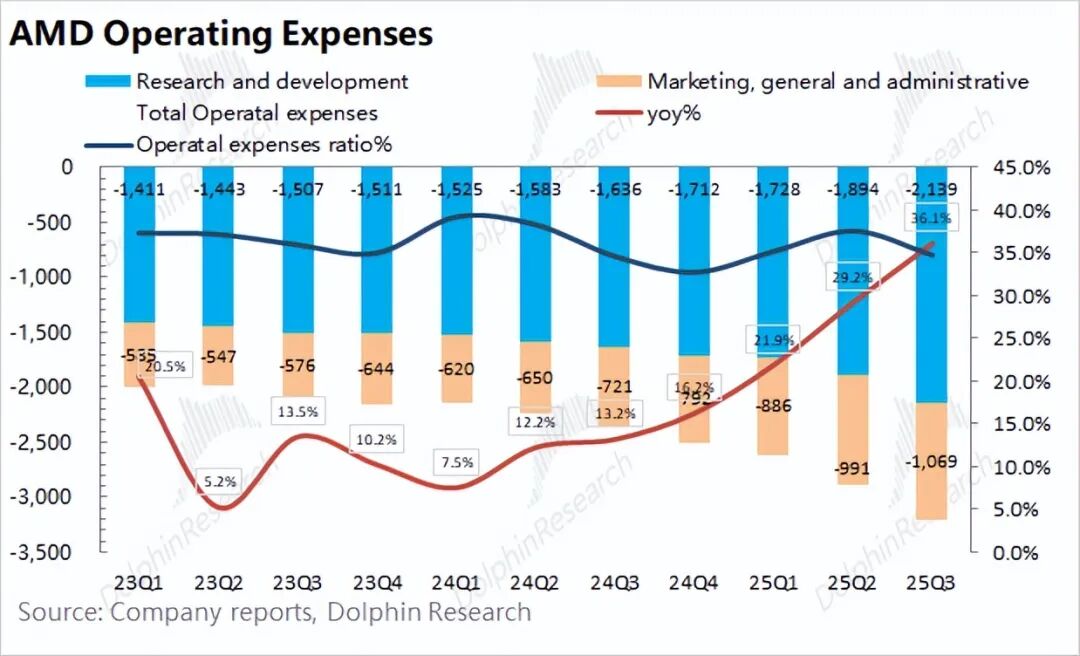

2. Operating Expenses: The company's R&D expenses for the quarter were $2.14 billion, up 30.7% YoY, while selling and administrative expenses were $1.07 billion, up 48.3% YoY. Despite robust revenue growth, core operating expenses also rose. The core operating expense ratio reached 34.7% this quarter, up 0.1 percentage points YoY.

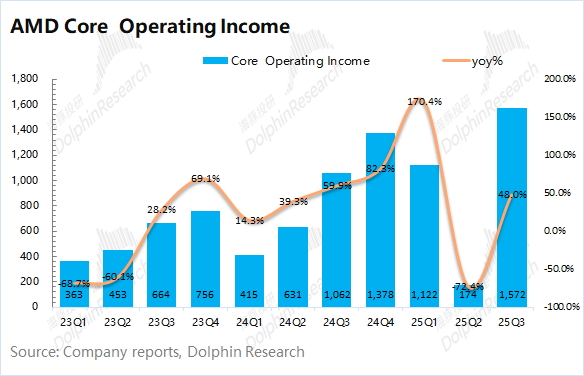

AMD reported a net profit of $1.17 billion this quarter, primarily influenced by non-recurring items. From an operational perspective, the company's core operating profit was $1.57 billion, showing renewed growth, with a core operating profit margin of 17%.

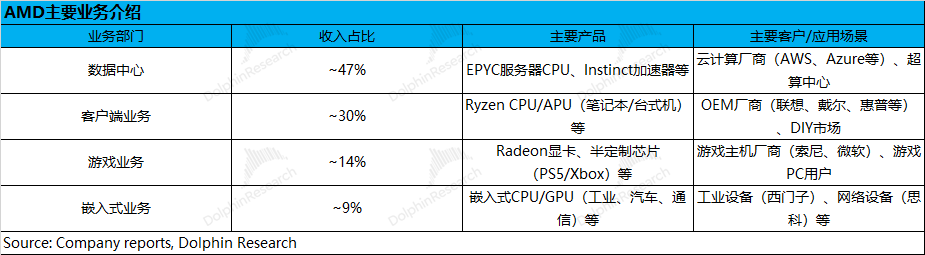

3. Business Segment Breakdown: Driven by growth in data center and client businesses, these two segments accounted for over 70% of total revenue.

1) Client Business Gains Market Share: Revenue grew to $2.75 billion this quarter, up 46.2% YoY. Global PC market shipments rose 10% YoY this quarter, while AMD's client business saw substantial growth, primarily due to continued market share gains in the PC segment.

2) Data Center Awaits New Product Momentum: Revenue reached $4.34 billion this quarter, up 22.3% YoY. The growth in the data center business was mainly driven by increased mass production of the MI355 series and enhanced competitiveness in the server CPU market.

① Server GPU: The current growth in AMD's data center business is primarily driven by the MI355 series. With increased mass production of the MI355 series, the company's AI GPU revenue in the second half of the year is expected to significantly outperform the first half. Following the signing of an order with OpenAI, the market is more focused on the progress of the subsequent MI450, which will drive growth for the company over the next 2-3 years.

② Server CPU: The server CPU business contributed the majority of incremental revenue in the data center segment during the first half of the year, primarily due to increased market share in the server CPU market. According to third-party data, the company's market share in the server CPU segment has risen from 10% to around 20%.

4. AMD's Guidance: For Q4 2025, AMD expects revenue of $9.3-$9.9 billion (market consensus: $9.2 billion), with a midpoint ($9.6 billion) representing a 3.8% sequential increase. The guidance excludes MI308 revenue. The company expects a non-GAAP gross margin of around 54.5% (market consensus: 54.5%).

Dolphin Research's Overall View: The Market Anticipates New Orders More Than Guidance.

AMD's revenue and gross margin this quarter outperformed prior guidance, primarily driven by growth in the data center, client, and gaming businesses. Beyond the data center growth led by the MI355 series, the company's gaming business has also notably rebounded from its lows.

Regarding the data center business, which was the largest contributor to sequential revenue growth this quarter, it benefited from increased mass production of the MI355 series and enhanced competitiveness in server CPUs. The data center business saw an $1.1 billion sequential increase, with Dolphin Research estimating that AI GPUs contributed around $800 million in incremental revenue, while server CPUs also grew.

Combining the company's guidance for next quarter, Dolphin Research expects the client and embedded businesses to grow, while the gaming business may decline due to seasonal factors.

The revenue increment next quarter will still primarily come from the data center segment and MI355 mass production. Dolphin Research estimates that the company's AI GPU revenue could reach around $2.4 billion next quarter, representing a sequential increase of only $600 million, which is slower and only marginally better than market expectations ($2.2-$2.3 billion), falling short of being a "surprise."

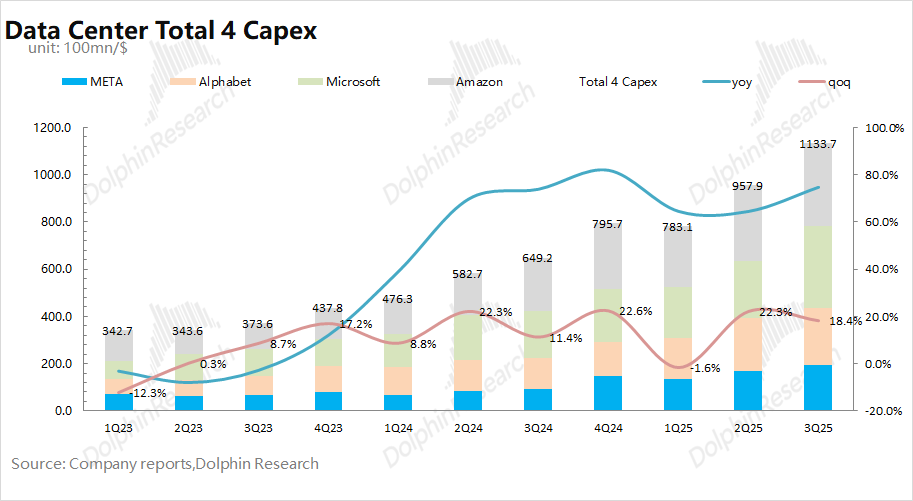

Amidst increasing AI Capex, the market's focus on AMD has shifted from PC market share gains to growth prospects in the data center and AI sectors:

a) Cloud Giants Increase Capex, Sustaining AI Capex Boom

With the mass production of AMD's MI350 series and NVIDIA's GB series, all four major vendors have increased their AI server-related capital investments in the second half of the year. Based on the capital expenditure guidance from these vendors, Dolphin Research expects the combined capital expenditures of the four companies (Meta, Google, Microsoft, and Amazon) in 2025 to exceed $410 billion, representing a 65% YoY increase.

The current AI Capex boom remains the strongest industry support for the company's data center business growth. However, with major vendors having already announced their Q3 capital expenditures and Q4 guidance being even more robust, buyers are likely to have higher expectations. AMD's mere $600 million sequential revenue growth between Q3 and Q4 appears lackluster, indicating that without system-level solutions, cloud vendors remain hesitant.

b) Securing Major Clients and Orders: Boost from OpenAI's Order

Prior to October, OpenAI had already reached agreements with NVIDIA and Oracle, while NVIDIA also began strategic cooperation with Intel in the CPU segment. Amid the "dual" impact of NVIDIA GPUs and Broadcom's custom ASICs, AMD appeared to be gradually marginalized in the AI chip market, with its stock price performing plain ly.

Subsequently, OpenAI and AMD reached a 6GW cooperation agreement, directly driving a more than 20% increase in the company's stock price. Dolphin Research believes that AMD remains a "backup" option for OpenAI, serving as both a contingency plan against NVIDIA and a means to alleviate inference capacity constraints.

Estimating a deployment cost of approximately $50 billion per 1GW, this 6GW agreement roughly corresponds to a $300 billion deployment cost, potentially generating nearly $100 billion in incremental revenue for AMD and providing favorable growth assurance for the next five years (2026-2030).

OpenAI's large order has already driven up the company's stock price. For this financial report and earnings call, the market also expects the company to provide more client and order information to further boost confidence.

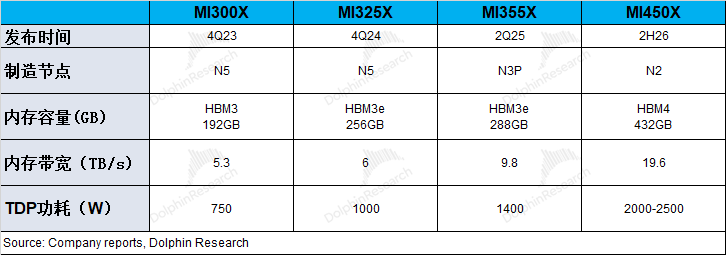

c) MI355 Shipments and MI450 Progress:

The recent growth in the company's data center business is primarily driven by increased mass production of the MI355. Following OpenAI's substantial order for the MI450, the market is more focused on its progress.

Recently, AMD CEO Lisa Su confirmed in an interview that the MI450 will adopt TSMC's 2nm process, feature 432GB of HBM4 memory, and aims to challenge NVIDIA with next year's new product.

Combining factors (a+b+c), the company's data center business is currently enjoying triple support from a "booming industry + major client orders + clear iteration of MI series core products." AMD's stock price climb from "$100 -> $150 -> $200+" has also gradually priced in expectations for these three aspects (AMD's stock price broke above $200 precisely due to OpenAI's order).

Driven by OpenAI's large order and the MI450's mass production in the second half of 2026, the market expects the company to sustain high growth over the next two years. Detailed value analysis has been published in the same name article under the "Dynamic - Research" section of the Longbridge App.

Overall, AMD's short-term performance will still be primarily influenced by the CPU business and MI355 shipments. However, the market's current focus is already on the future growth prospects of the data center segment, including new clients, new orders, and the MI450's mass production progress.

Notably, the company's current high valuation already incorporates expectations for high growth over the next 2-3 years and strong performance of the MI450, skipping over the MI355 and directly pricing in the MI450 in advance.

The MI450 is still essentially a future product, and unlike its predecessors, it leans more toward delivering system-level solutions. In this area, the company lacks historical experience and can only hope to learn from NVIDIA's GB series delivery to improve its own.

Given the current tight liquidity environment, a chip stock with an "option-like" valuation expectation and a secondary market position may struggle to boost investor sentiment with such mediocre results and no official announcement of new major collaborations.

The following is a detailed analysis:

I. Overall Performance: Revenue and Gross Margin Outperform Guidance Expectations

1.1 Revenue

AMD achieved revenue of $9.25 billion in Q3 2025, up 35.6% YoY, surpassing market expectations ($8.74 billion). The company's sequential revenue growth this quarter was primarily driven by the client and gaming businesses, as well as the data center segment, with increased mass production of the MI355 being the main growth driver this quarter.

1.2 Gross Margin

AMD achieved a gross profit of $4.78 billion in Q3 2025, up 39.8% YoY. The gross margin for the quarter was 51.7%, showing a significant recovery.

Last quarter's gross margin was impacted by MI308 inventory write-downs. Excluding this effect, the actual gross margin last quarter was 50.2%. The company's gross margin still improved this quarter, primarily due to enhanced profitability in the client business and a recovery in the gaming business.

1.3 Operating Expenses

AMD's operating expenses for Q3 2025 were $3.208 billion, up 36% YoY. Both R&D expenses and selling and administrative expenses increased by varying degrees.

Breaking down the specific expenses:

1) R&D Expenses: The company's R&D expenses for the quarter were $2.14 billion, up 30.7% YoY. Despite rapid revenue growth, R&D expenses have also continued to rise. The current R&D expense ratio is 23.1%, showing a slight decrease.

2) Selling and Administrative Expenses: The company's selling and administrative expenses for the quarter were $1.07 billion, up 48.3% YoY. Selling expenses are highly correlated with revenue growth, and as revenue growth accelerates, the company's selling investments have also increased.

1.4 Profit

Due to significant deferred expenses from AMD's acquisition of Xilinx, profit erosion is expected to continue for some time. Regarding the actual operating conditions this quarter, Dolphin Research believes that "core operating profit" is a more relevant metric.

Core Operating Profit = Gross Profit - R&D Expenses - Selling and Administrative Expenses

After excluding acquisition-related expenses and other impacts, Dolphin Research estimates that AMD's core operating profit for the quarter was $1.57 billion, continuing to recover. The "sudden decline" in the company's profit last quarter was primarily due to an approximately $800 million impact from MI308 inventory write-downs. Even after adding back the $800 million, the company's core operating profit still improved this quarter, benefiting from increased mass production of the MI355 and a recovery in the client and gaming businesses.