Finally Transforming Losses into Profits, UIBOT Sprints to Become the Pioneer Listed Company Focused on Digital Humans

![]() 11/12 2025

11/12 2025

![]() 400

400

By Daoge

Digital humans capable of speaking, thinking, and even 'displaying emotions' are on the verge of ringing the bell for their Initial Public Offering (IPO).

Yes, you read that correctly. Nanjing UIBOT, which positions itself as 'China's premier provider of virtual digital human agents,' has recently officially submitted its prospectus to the Hong Kong Stock Exchange.

This company is far from being a minor player in the industry.

According to CIC, based on the revenue generated from digital human agent solutions in 2024, UIBOT commands a 32.2% market share in China's digital human agent market, ranking first domestically and second globally. If everything proceeds smoothly, UIBOT will earn the title of 'the inaugural digital human stock listed on the Hong Kong Stock Exchange.'

However, beneath the glamorous facade lies a less glamorous B-side story, as revealed in the prospectus.

01 A 'Tech Veteran' and His Vision of a 'Silicon-Based Civilization'

Sima Huapeng, the founder of UIBOT, is a seasoned tech entrepreneur with a wealth of experience.

Born in 1982, this entrepreneur graduated from Nanjing University of Aeronautics and Astronautics with a degree in Electrical Engineering. As early as 2007, he ventured to Russia to establish Returnil antivirus software, securing investment from VTB Bank. By 2012, he had secured millions of dollars in funding for his Toolwiz series of products.

The turning point came in 2016 when Google's AlphaGo defeated Go champion Lee Sedol, marking the first time a computer program had beaten a professional 9-dan player and bringing artificial intelligence into the public spotlight.

Deeply inspired, Sima Huapeng, with over a decade of technical expertise, was particularly attuned to the technological inflection point of AI. Thus, in 2017, he founded UIBOT, proposing his vision that humans (carbon-based lifeforms) have inherent limitations in repetitive labor, while AI (silicon-based lifeforms) can evolve into 'digital labor,' collaborating harmoniously with humans.

In its early years, AI technology was still in its infancy, and the digital human sector remained relatively stagnant. However, in 2021, the 'metaverse' concept exploded, and virtual humans gained overnight popularity. Sima Huapeng's moment had finally arrived. He seized the opportunity to strengthen AIGC (Artificial Intelligence Generated Content), proposing 'virtual digital humans + AIGC' and offering full-scenario application solutions.

Currently, UIBOT's business portfolio encompasses intelligent voice, digital human video, live streaming, and interaction, providing a comprehensive 'silicon-based labor' solution.

To gain wider recognition, UIBOT ventured into IP creation, launching the 'Great Sima Series IP,' including Silicon-Based Great Sima and Tech Great Sima, amassing 11 million fans across various platforms. Importantly, this content was produced using its own agents, serving as a 'walking advertisement' for the company.

With a compelling narrative, capital naturally followed suit.

Since 2018, top-tier venture capital firms such as Sequoia China, Tencent Investments, 360, and Oceanpine Capital have lined up to invest in UIBOT. To date, the company has completed 10 funding rounds, raising over 1 billion yuan in total.

02 Giants Enter the Arena: How to Achieve the 'Small Goal'?

With substantial funding and the 'industry leader' halo, UIBOT should have been thriving. However, the prospectus reveals a different side of the story for this star enterprise.

Starting with revenue, the company experienced a significant surge, with revenue jumping from 2.23 billion yuan in 2022 to 6.55 billion yuan in 2024, boasting a three-year compound annual growth rate of 71.5%. It continued to grow by 11.2% year-on-year in the first half of 2025.

Despite the impressive growth rate, UIBOT's profitability remains mediocre.

From 2022 to 2024, UIBOT reported adjusted net losses of 46.22 million yuan, 29.41 million yuan, and 35.24 million yuan, respectively. By the first half of 2025, its adjusted net profit under non-IFRS (International Financial Reporting Standards) metrics finally turned positive, reaching 5.29 million yuan.

Where has all the money been invested?

Firstly, on research and development (R&D), a notorious money pit in the tech industry.

Digital human companies must continuously invest in algorithms and product matrices to stay ahead of the competition. Despite having a team of only 97, over 70% are R&D members. From 2022 to 2024, R&D expenditures soared from 75.43 million yuan to 150 million yuan. This significant investment has yielded favorable results, with UIBOT holding 139 global patents as of May 2025.

Secondly, on the high-cost direct sales model.

From 2022 to 2024, direct sales revenue consistently accounted for over 96% of the total, reaching as high as 98.3% in the first half of 2025. While this model favors maintaining strong relationships with major clients, it also entails high sales costs and limits market expansion speed, posing challenges for future scalable growth.

Lastly, on the price-for-volume business model.

UIBOT admits in its prospectus that to establish partnerships with large clients such as commercial banks and telecom operators, it adopts a 'competitive pricing model,' resulting in lower gross margins. This strategy is akin to a high-stakes gamble of 'trading price for volume,' where scaling up comes at the expense of profitability.

While the company has achieved scale, profits have been 'gambled' away, leading to another extreme: UIBOT's heavy reliance on major clients.

From a client perspective, its customer base is highly concentrated in the B-end (business-to-business), covering diverse scenarios such as the internet, hospitals, and schools. In the first half of 2025, revenue from the top five clients accounted for 87.5%, with the largest client (a telecom operator) contributing 64.4%.

Of course, the digital human sector's vast prospects have attracted numerous players.

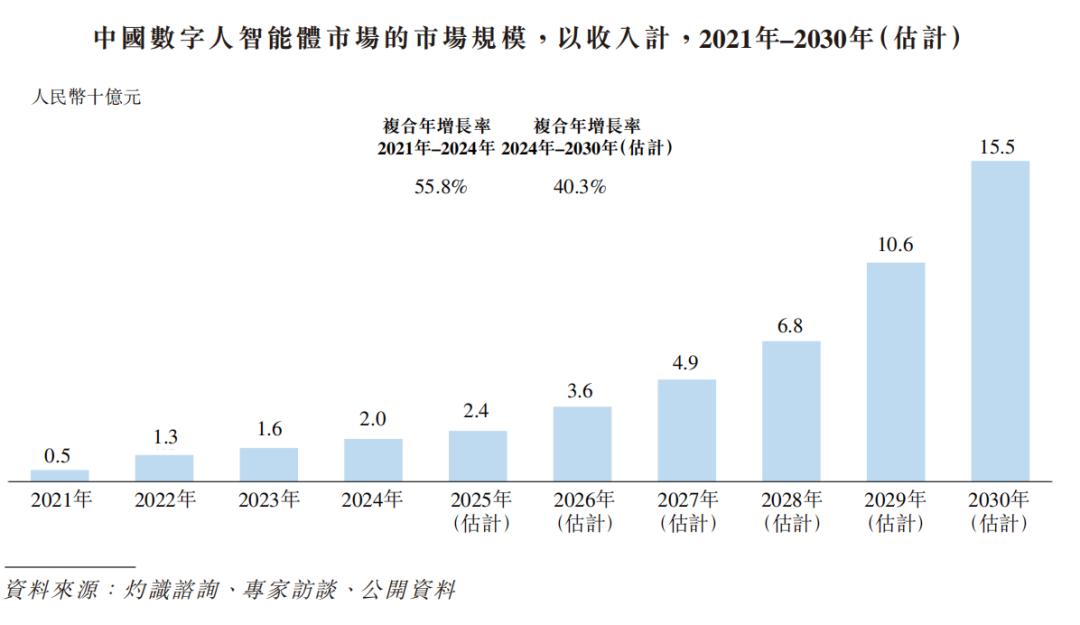

According to an IDC report, China's virtual digital human market size is expected to grow rapidly, reaching 25.05 billion yuan by 2029 with a compound annual growth rate of 43.5%. While tech giants like Baidu, Tencent, and Alibaba lead with their AI large models, smaller players such as Yan Technology, Yunqi Digital, and Lingmou Intelligence are also ramping up their efforts, intensifying UIBOT's competitive pressure.

In 2023, Sima Huapeng stated that upon UIBOT's founding, he set three goals, one of which was to 'provide 100 million silicon-based laborers globally by 2025.' However, UIBOT has only achieved over 80,000 so far, indicating a long road ahead.

UIBOT's current rush to list on the Hong Kong Stock Exchange is, frankly, an urgent need for 'blood transfusion,' using the raised funds to continue investing in R&D, marketing, and global acquisitions to further expand its growth scale.

However, facing the harsh reality of being surrounded by giants, UIBOT must prove to the capital market that it is not just a 'dreamer with a good story' but an AI commercialization pioneer capable of fighting tough battles and achieving self-sustaining growth.

*The cover image is generated by AI