Baidu Wenxin Leads a 4.5 Billion Yuan High-Stakes Bet, But Fails to Create the Next DeepSeek

![]() 02/11 2026

02/11 2026

![]() 362

362

Looking back from the 2026 Spring Festival, the narrative logic of China's internet industry has undergone a fundamental shift. If the 2014 red packet war initiated by WeChat Pay marked the beginning of the mobile payment era, then the current game theory (game/competition) involving over 4.5 billion yuan from Tencent, Alibaba, ByteDance, and Baidu signifies that China's artificial intelligence has officially moved from laboratory parameter tuning to full-scale real-world deployment.

This is not merely a case of old wine in new bottles. In this competition, red packets are no longer just a customer acquisition lure but have become a container for large model capabilities. The tech giants aim to educate users through high-frequency interactions and secure a foothold in future human-computer interaction. However, beneath the 4.5 billion yuan spectacle lie structural risks and divergent paths that will determine who remains after subsidies dry up.

The dividing line for measuring the success of this high-stakes gamble is no longer short-term DAU growth but three core variables: high-frequency penetration (whether AI can transition from temporary interactions to daily productivity), the decline curve of reasoning costs (whether trillion-parameter models can support large-scale deployment with minimal computational consumption), and single-user contribution value (whether users can sustain a commercial closed loop (closed loop) after subsidies end).

01

Baidu Wenxin's 'Architectural Beta Test' and Scenario Mismatch

As the earliest participant, Baidu kicked things off on January 25 with 500 million yuan in red packet benefits. Rather than simple click-to-claim, Baidu deeply integrated red packet gameplay with its AI product, Wenxin Assistant. Users had to experience nearly 200 AI-powered 'Fantastic Life' scenarios to participate in interactions, with rare card collectors eligible for 10,000-yuan grand prizes across four rounds.

Behind this design lies a clear technological rationale. According to Baidu's ERNIE 5.0 Technical Report, the model adopts a native autoregressive architecture supporting unified understanding and generation of text, images, video, and audio. Wenxin Assistant's interactive experiments essentially test the computational efficiency of its trillion-parameter model in multimodal generation.

ERNIE 5.0 introduces a 'Modality-Agnostic Expert Routing' mechanism, where inputs from all modalities share a common expert pool. The massive 'Fantastic Life' scenario generation requests during the Spring Festival served as an extreme stress test for this routing mechanism under high concurrency. Data validated this approach's explosive potential: since the campaign launched, Wenxin Assistant's MAU surged fourfold, image generation grew 50-fold, and video generation increased 40-fold. Baidu aims to train the model's ability to flexibly switch experts across tasks through such intensive multimodal calls, thereby establishing an engineering pathway for a 'unified' model at the architectural level.

Figure caption: Screenshot from Baidu Wenxin's official WeChat account

Figure caption: Screenshot from Baidu Wenxin's official WeChat account

However, within the 'Success Criteria Model,' Baidu's risk lies in the disconnect between technological logic and real-life scenarios. Despite ERNIE 5.0's trillion-parameter MoE (Mixture of Experts) architecture and leading Elastic Training paradigm—which achieves significant decoding acceleration during inference by reducing routing activity—the fantastical scenarios remain low-frequency and non-essential. Baidu's 'high-frequency penetration' performance is unstable, with curiosity-driven traffic likely to vanish once red packets are exhausted. If Baidu cannot transform its trillion-parameter reasoning advantages into high-frequency productivity tools, Wenxin Assistant risks becoming an expensive 'digital toy.'

02

Tongyi Qianwen's Agent Experiment and Engineering Bottlenecks

Alibaba's Tongyi Qianwen is gambling on lifestyle habits. Its 3 billion yuan 'Treat Plan' offers AI-powered order exemptions, directly collision AI with real-world dining, entertainment, and leisure scenarios. This approach reveals the physical limits of AI Agents in handling high-concurrency real-world requests.

Figure caption: Screenshot from Qianwen APP's official WeChat account

Figure caption: Screenshot from Qianwen APP's official WeChat account

Just nine hours after the February 6 launch, orders surpassed 10 million. The sudden surge overwhelmed the system, causing frequent page freezes, failed orders, and payment deadlocks. Qianwen's logic is to complete transactions in one sentence: users say, 'Get me a milk tea,' and the AI automatically matches merchants, products, and confirms orders. This involves not just text generation but complex intent recognition, API calls, and real-time integration with offline fulfillment systems like Ele.me and Taobao Flash Sales.

In the evaluation model, Alibaba comes closest to boosting 'single-user contribution value' by establishing path dependency for 'using AI to solve daily needs.' However, its risk lies in whether the 'reasoning cost decline curve' can offset soaring acquisition costs. The 3 billion yuan in subsidies represents China's most aggressive AI investment to date, but system congestion exposed its Agent scheduling's fragility under extreme peaks.

More critically, the steep costs of trillion-parameter model reasoning, combined with 25-yuan per-order subsidies, create a massive cost sinkhole. If Tongyi Qianwen cannot rapidly reduce per-interaction costs through technical iterations—such as adopting ERNIE 5.0's Elastic Sparsity to minimize activated experts during inference—this 'money-burning' model will prove unsustainable. Once subsidies end, whether users will pay for high reasoning costs becomes Alibaba's stern test.

03

Traffic Giants' Path Dependency and Stockpile Gameplay

Tencent Yuanbao and ByteDance Doubao chose entirely different paths, relying more on traffic inertia than generational breakthroughs in underlying technology.

Tencent leveraged WeChat's 1.3 billion users' social DNA, triggering lucky money drops via keywords. On February 10, Yuanbao upgraded gameplay: users sending 'Yuanbao' in WeChat chats triggered lucky money drops directly into their wallets. This 'parasitic' approach within WeChat's ecosystem drastically lowered user entry barriers. Yuanbao even attempted to create an 'AI version of WeChat Pay,' forcing AI into social chains through group chat interactions and @Yuanbao red packets.

Figure caption: Screenshot from Doubao's official WeChat account

Figure caption: Screenshot from Doubao's official WeChat account

ByteDance's Doubao, as the CCTV Spring Festival Gala's exclusive AI partner, dominated public traffic. It distributed 100,000 tech gift packages and cash red packets on New Year's Eve, rapidly achieving widespread adoption through short videos and livestreams. Doubao's strategy exploited ByteDance's content ecosystem, using 'Doubao Celebrates Lunar New Year' interactions to reach massive audiences instantly.

However, under the 'Success Criteria Model,' this growth—lacking fundamental technological restructuring—faces bottlenecks in boosting 'single-user contribution value.' Tencent Yuanbao, while solving traffic distribution, leaves AI's role in social scenarios ambiguous, acting more as 'atmosphere' than a 'tool.' Doubao, despite broad reach, suffers from random user participation heavily driven by subsidy-chasing. Both currently rely on traffic inertia to grab market share rather than forming irreplaceable technological advantages through AI capabilities. When facing cost-effective, vertically focused competitors, these moats prove shaky.

04

Elastic Computing Becomes a 'Must-Have' for Large Models

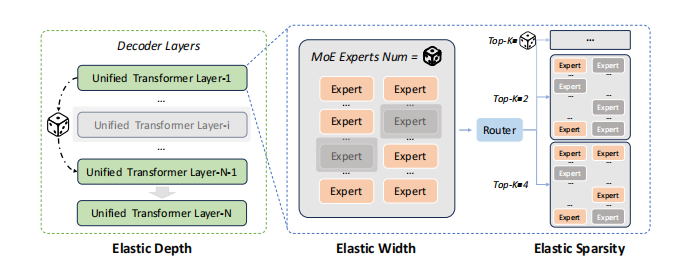

After the flurry of red packets, competition will revert to the cold, hard game theory (game/competition) of engineering execution and computational costs. ERNIE 5.0's technical report reveals an industry consensus: with Moore's Law failure ( failure /no longer applicable), only architectural innovations can support national-scale AI concurrency.

Figure caption: Schematic of ERNIE 5.0's Elastic Training architecture

Figure caption: Schematic of ERNIE 5.0's Elastic Training architecture

The report's 'Elastic Training' paradigm offers a solution to cost challenges. Traditional models are either large and expensive or small and limited. ERNIE 5.0 achieves 'Once-For-All' capability by simultaneously optimizing submodels of varying depths, widths, and sparsity during a single pretraining. This means that during peak traffic like New Year's Eve, the system can dynamically switch to shallower or sparser submodels, sacrificing minimal precision for throughput surges, while reverting to full models for optimal everyday performance.

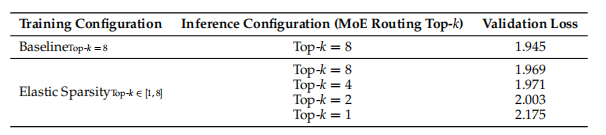

Figure caption: Experimental data shows ERNIE 5.0 achieves extreme model compression with negligible validation loss by reducing Top-k routing to 25% and employing elastic width techniques. The report further notes that this architectural optimization boosts reasoning speed by over 15%.

Figure caption: Experimental data shows ERNIE 5.0 achieves extreme model compression with negligible validation loss by reducing Top-k routing to 25% and employing elastic width techniques. The report further notes that this architectural optimization boosts reasoning speed by over 15%.

Data indicates that reducing inference routing Top-k to 25% can increase decoding speed by over 15% with minimal accuracy loss. Meanwhile, elastic width and depth allow the model to maintain competitive performance while activating only 53.7% of parameters.

This competitive model is essentially a stress test. Each post-crash expansion provides evolutionary benchmarks for China's AI applications. However, the industry must confront a verdict: current model improvements don't solely depend on user base explosions. As one large model practitioner put it, 'Spending heavily to buy traffic for more users' mirrors recommendation system tactics for large model products, which doesn't inherently advance AI data iteration quality. If products can't solve real problems, this prosperity is false.

05

The 'Impossible Trinity' of Commercialization

Long-term success hinges on whether companies can transition from 'marketing gimmicks' to 'efficiency tools' before red packets run out.

Among the three variables in the 'Success Criteria Model,' Alibaba bets on 'high-frequency penetration,' forcing open lifestyle services at high costs; Baidu wagers on 'cost curves,' aiming for architectural elasticity to win the computational game theory (game/competition); Tencent and ByteDance seek optimal AI-traffic integration while maintaining existing territories.

The structural risk behind this game theory (game/competition) is whether AI applications can generate commercial value sufficient to cover costs. A CCTV financial commentator notes that user needs evolve through three stages: 'red packet chasing,' 'study aids,' and 'complex problem-solving.' The current red packet war remains stuck in the first phase. If users revert to traditional search and interaction after claiming red packets, the 4.5 billion yuan will become the internet's most expensive 'ineffective roadshow.'

The industry yearns for a 'DeepSeek moment' reprise. DeepSeek proved that world-class breakthroughs don't rely solely on stacking computational power and capital through intelligent algorithm iterations. This sounds an alarm for all giants: after subsidies end, only products that minimize reasoning costs while solving complex real-world problems will survive cycles.

06

Epilogue

The 2026 Spring Festival battle isn't just about money distributed but about who first seizes future human-computer interaction gateways.

Baidu has advanced technological models but lacks high-frequency usage hooks; Alibaba dominates scenarios but struggles with engineering limits and cost sinkholes; Tencent and ByteDance command traffic but risk getting lost in technological gaps. Red packets will eventually run out. When subsidies fade, products unable to shift from 'red packet chasing' to 'productivity' will become casualties of this coming-of-age ritual. The true victor will convert this 4.5 billion yuan-fueled traffic into core assets that spawn the next 'DeepSeek moment.'

Disclaimer

This content is based on in-depth analysis of corporate announcements, technical patents, and authoritative media reports, aiming to explore technological routes and industrial trends. Product parameters and performance descriptions cited herein derive from official disclosures and represent theoretical analyses based on existing data, not absolute feedback on real-world experiences. Given that tech products (especially new energy vehicles and robots) undergo continuous software/hardware OTA updates, any discrepancies between this data and actual performance should defer to official corporate releases. These views are for reference only and do not constitute investment or purchasing advice.

— THE END —