Two 'Superstar Individual Investors' Team Up: What Do Ge Weidong and Zhang Jianping See in JAC Motors?

![]() 02/11 2026

02/11 2026

![]() 485

485

Who Drove JAC's Five-Year Bull Run Before Zunjie's Breakthrough?

Ge Weidong and Zhang Jianping: Both Targeting the Same Automaker?

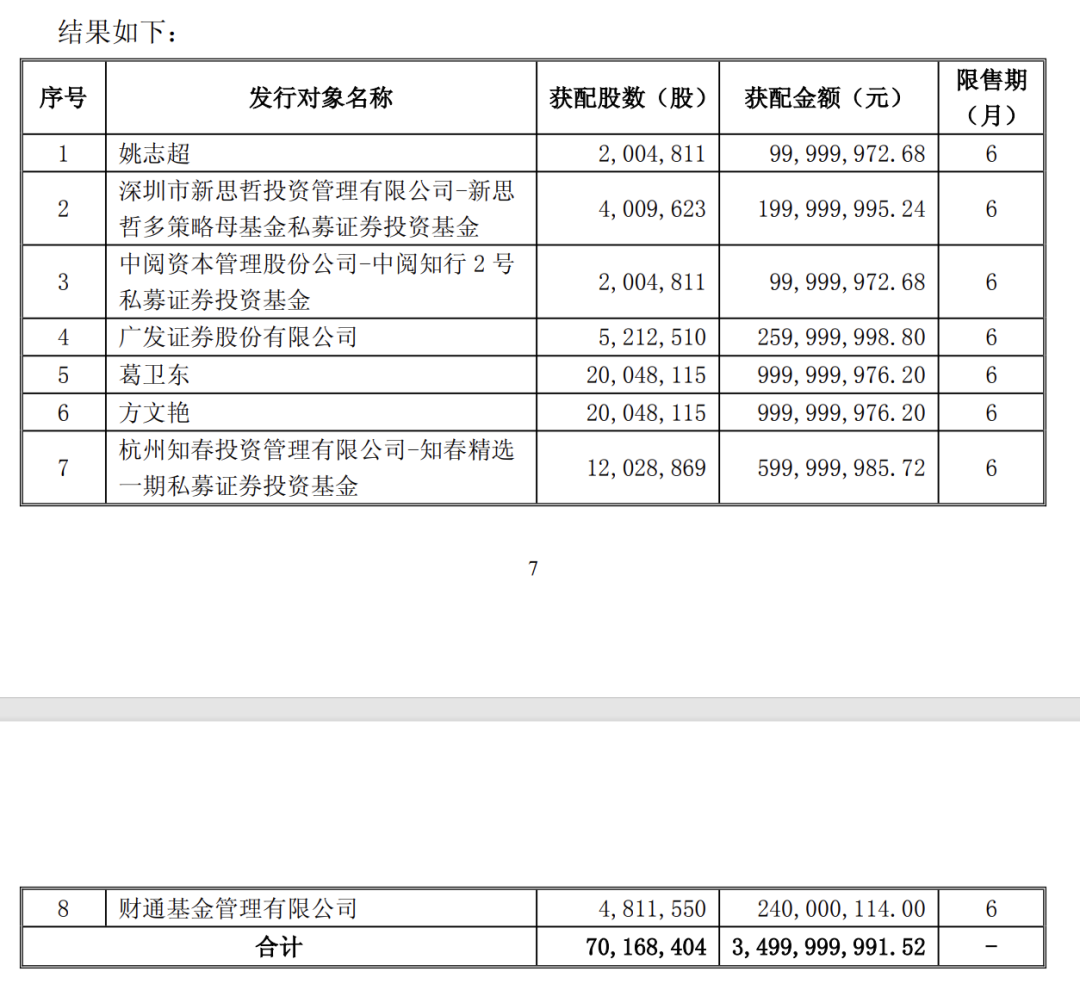

On February 10, JAC Motors unveiled its private placement report, stating that the company issued a total of 70.1684 million shares to eight investors, including Yao Zhichao and Ge Weidong, at a price of 49.88 yuan per share, raising approximately 3.5 billion yuan in total.

Among the subscribers, Ge Weidong invested approximately 1 billion yuan to acquire 20.0481 million shares. Meanwhile, Fang Wenyan also invested 1 billion yuan to acquire 20.0481 million shares. After the issuance, Ge Weidong and Fang Wenyan will be tied as the eighth-largest shareholders of JAC Motors.

According to public records, Fang Wenyan is the wife of superstar individual investor Zhang Jianping. This indicates that two major individual investors have set their sights on JAC Motors simultaneously.

The joint entry of these industry titans often signals strong confidence, especially given Ge Weidong and Zhang's proven investment track records with MetaX and Cambrian Technologies.

So, what is the current fundamental outlook for JAC Motors, a veteran state-owned enterprise in transition? More importantly, are these two top investors betting solely on JAC Motors?

01

'Underperformer' in Financials vs. 'Top Performer' in Valuation

Judging solely by the numbers on the financial statements, JAC Motors' current stock performance seems almost counterintuitive—a commercial enigma.

Certainly, in the eyes of the capital markets, this is a company riddled with contradictions: on one hand, there is the bleak reality of consecutive losses and declining sales; on the other, a market valuation exceeding 120 billion yuan, even surpassing Chang'an Automobile, which sells 3 million vehicles annually (valued at over 110 billion yuan).

The joint entry of Ge Weidong and Zhang Jianping is clearly not driven by the unimpressive financials but by the potential they see to rewrite the company's fate amid the data ruins.

Let's strip away all grand narratives about the future and return to the coldest, most logical analysis.

On January 16, JAC Motors released a Performance Pre-Loss Announcement (performance loss forecast) that once again highlighted the awkward predicament of this veteran automaker.

According to the announcement, the company expects a net loss attributable to shareholders of 1.68 billion yuan for the full year of 2025, with a net loss after non-recurring items reaching as high as 2.47 billion yuan.

For a decades-old state-owned enterprise in the automotive industry, a single year of losses might be dismissed as 'growing pains during strategic transition.' However, when viewed over a longer timeline, a pattern of persistent weakness emerges.

Looking back at JAC Motors' financial history, the last time its net profit after non-recurring items was positive was in the distant year of 2016. At that time, China's new energy vehicle (NEV) market was still on the brink of explosion, with most NEV startups still in the PPT financing stage.

Yet, in the subsequent golden decade of rapid NEV industry growth, where market penetration soared from single digits to over 50%, JAC Motors—one of the earliest domestic adopters of the NEV iEV series—seemed to lose its way in the tidal wave of the times.

Since turning negative in net profit after non-recurring items in 2017, the company has never again achieved sustained profitability through its core business. Even during its peak net profit periods, the scale barely exceeded 1 billion yuan, with most of the time spent struggling near the breakeven line, relying on subsidies and asset disposals to maintain a semblance of financial respectability.

This downturn reached a critical point in 2025.

Annual sales of 384,100 vehicles not only represented a 4.72% year-on-year decline but also marked a new 10-year low. This is a stark contrast: while BYD sold 4.6 million vehicles and Geely and Chery surged ahead in the NEV sector, JAC Motors' core business continued to shrink.

If declining sales are a blow to 'face,' then massive losses from joint ventures strike at the 'heart.'

Before the Huawei storyline fully unfolded, JAC Motors had pinned its hopes for a turnaround on another global giant: Germany's Volkswagen.

Several years ago, JAC's joint venture with Volkswagen was hailed as a benchmark case for 'mixed-ownership reform' in China's auto industry. Markets once envisioned Volkswagen Anhui becoming a steady cash cow for JAC, much like Brilliance BMW was for Brilliance China.

However, reality dealt a harsh blow to this optimism. According to the 2025 performance forecast, one of the core reasons for JAC's massive losses was the recognition of a 1.08 billion yuan investment loss in Volkswagen Anhui. This meant that Volkswagen Anhui not only failed to contribute profits but became a clear bleeding point.

The reason lies in Volkswagen's sluggish pace in electrification. Despite high hopes for Volkswagen Anhui, its products struggled to gain traction in China's hyper-competitive market. High initial R&D investments and fixed costs during the production ramp-up phase, combined with lower-than-expected sales, turned this once-anticipated 'white knight' into a heavy burden on the financial statements.

Thus, JAC Motors appears trapped in a dilemma: its self-owned brands lack blockbusters, while its joint ventures are mired in losses. By traditional value investing logic, such a stock would likely be abandoned by the market.

Yet, on the day after the performance forecast was released, JAC's stock price surged 4.77%, closing above 50 yuan. This paradoxical 'bad news is good news' trend essentially reflects the company's new narrative for investors: JAC is no longer 'struggling' but has embraced its role as a massive 'shell resource'—a vessel waiting to be infused with the soul of a super IP.

And that super IP is Huawei.

If Volkswagen Anhui represented JAC's incomplete self-rescue attempt, Huawei's arrival fundamentally changed the game.

JAC Motors secured the most prestigious and riskiest card in Huawei's Smart Selection vehicle mode—the 'Zunjie' brand. This is not a simple OEM collaboration but a bold leap where JAC completely abandons its past mid-to-low-end path and leverages Huawei to charge into the million-yuan ultra-luxury market.

Market enthusiasm for 'Huawei content' is not unfounded. Recent sales data validate this logic. The debut model of Zunjie, the S800, has achieved 'phenomenal' performance since its launch, shattering the price ceiling never before reached by Chinese automakers.

According to CITIC Construction Investment and other institutions, by the end of 2025, the 10,000th Zunjie S800 had rolled off the production line. In December alone, its deliveries surpassed the combined total of traditional luxury D-segment vehicles like the Mercedes-Benz S-Class, Maybach, BMW 7 Series, and Audi A8.

This marks a historic moment: at the pinnacle of the automotive industry, the million-yuan luxury sedan market had long been dominated by Germany's 'Big Three.' Chinese brands had never established a foothold here until the Zunjie S800 broke this ironclad rule in less than six months. With sales exceeding 15,000 units just four months after launch, this is not merely a sales victory but a reconstruction of brand perception for 'JAC Manufacturing.'

The success of the Zunjie S800 means that JAC Motors, empowered by Huawei, has achieved a 'dimensional strike' in branding. For JAC, this brings not just a blockbuster model but a 'highway' to high-profit margins.

Unlike producing utility vehicles priced at tens of thousands of yuan, million-yuan luxury cars demand extremely high supply chain management and manufacturing craftsmanship—but also offer vastly broader brand premium space. As sales scale up, Zunjie could quickly fill the profit hole left by Volkswagen Anhui and fundamentally transform JAC's earnings structure.

From this perspective, the 2 billion yuan heavy bet by Ge Weidong and Zhang Jianping's families is not a gamble on JAC's dismal 'past' or the uncertain 'present' of Volkswagen Anhui but on a future of 'Chinese Rolls-Royce' or 'Chinese Maybach.'

They likely see the scarcity value of JAC Motors as Huawei's sole ultra-luxury partner. In their eyes, JAC is no longer the state-owned enterprise struggling to sell cars but the exclusive physical carrier of Huawei's top-tier intelligent driving technology and ultra-luxury administrative cabin.

This identity shift justifies a trillion-yuan market cap imagination and overshadows all short-term financial flaws.

After all, in capital markets, nothing is more alluring than a validated growth story with infinite scalability.

02

The 'Base Position' and 'Strategic Gambit' Behind the Billion-Yuan Bet

If the sole reason for these two capital market veterans to bet heavily at this moment was unilateral bullishness on Zunjie's future, it would underestimate the complexity of capital operations. The real script is far more intricate than simple 'value investing.'

Admittedly, the timing of Ge Weidong and Zhang Jianping's entry is intriguing.

To outsiders, this appears to be a high-risk 'catching a falling knife' bet, but a closer look at the details buried in quarterly reports reveals that these super funds did not arrive unexpectedly—this was a premeditated 'stakeout.'

According to Jiemian News, traces of Zhang Jianping's family had already appeared on JAC Motors' shareholder list long before the private placement.

Fang Wenyan's name consistently appeared among JAC's top ten largest tradable shareholders from the Q1 2024 report through the annual report of the same year. Zhang Jianping himself ranked ninth among the largest tradable shareholders in Q3 2024.

Meanwhile, Ge Guilian and Wang Ping, widely regarded as members of Ge Weidong's family, moved in perfect unison. They newly entered JAC's top ten largest tradable shareholders in the H1 2025 and Q3 2025 reports, respectively. By the end of Q3 2025, their holdings stood at 16.6162 million and 23.5017 million shares, with ending position reference values of 896 million yuan and 1.267 billion yuan, respectively.

Subtle clues, far-reaching implications. Beyond direct shareholdings, covert positioning through affiliated institutions is a hallmark tactic of top private capital.

In this private placement, Hangzhou Zhichun Investment's 'Zhichun Elite Phase I' acquired the largest stake in JAC Motors, with an allocation worth nearly 600 million yuan.

Qichacha data shows that Hangzhou Zhichun Investment is 100% owned by Shenzhen Zhichun Enterprise Management Co., Ltd., which counts Zhang Jianping as a 10% shareholder.

More intriguingly, Zhichun Investment's historical operational patterns overlap significantly with Zhang Jianping's family: in past financials of Inspur Information and Sanhua Intelligent Controls, 'Zhichun Elite Phase I' frequently moved in tandem with Fang Wenyan, Fang Deji, Fang Wenjun, and other Zhang family members—a clear sign of coordinated operations.

This string of data paints a clear picture: the so-called 'private placement entry' was merely the tip of the iceberg. These two capital giants had likely completed their quiet position-building in the secondary market long before.

This explains why JAC Motors' stock price defied gravity.

Rewind to 2020, when JAC's stock price bottomed at 4.22 yuan—a forgotten corner of the market. Yet, over the next five years, despite persistent negative net profits after non-recurring items, its stock price soared past 50 yuan, gaining over 10-fold.

Before the Zunjie story fully took shape, during the darkest moments of consecutive losses, who was propping up JAC? The answer likely lies in these superstar individual investors' early 'base positions.'

Thus, it is highly probable that these two tycoons' participation in the high-priced private placement was not a simple initial position but an 'addition' to their massive existing holdings.

This tactic is not uncommon in capital markets: by participating in private placements to lock in chips, they signal strong bullishness to the market, further driving up the stock price and creating additional paper profits for their low-cost base positions.

For early holdings with extremely low costs, the near-50 yuan private placement price may seem expensive, but if it ignites market sentiment and pushes the stock price higher, this capital injection becomes not just an investment but a brilliant 'marketing fee' and strategic lock-up, granting main funds more maneuvering room in the secondary market.

Of course, every coin has two sides. While tycoons participating in high-priced private placements send a strong bullish signal and endorse industrial trends, investors must remain cautious.

Given the likelihood of low-cost base positions, capital maneuvers cannot be ruled out. After all, in the face of multi-fold returns, no capital is absolutely loyal—liquidity is capital's eternal nature.

Ultimately, short-term stock price fluctuations are products of sentiment and capital game theory, which can be manipulated and ignited, but a company's long-term value must return to its fundamentals.

JAC Motors' current trillion-yuan market cap is largely built on extreme optimism about Huawei's empowerment—a generous valuation that prices in the next three to five years of expectations.

However, expectations must eventually meet reality. When the novelty of the Zunjie S800 fades and subsequent model sales data is laid bare, JAC Motors must prove it is no longer the perennial loser relying on asset sales but a modern automaker with genuine self-sustaining capabilities capable of handling million-yuan luxury manufacturing.

This is not just a gamble for Ge Weidong and Zhang Jianping but a make-or-break moment for JAC Motors' fate as a veteran state-owned enterprise.

Capital has the power to either elevate a company to god-like status or bring it crashing down. It is only through consistent, robust performance and an indispensable position within the industry that a company can sustain a valuation in the trillions of yuan across various market cycles.

- END -