“Insolvency” Dilemma Persists, Motovis Rushes for Hong Kong IPO to “Replenish Funds”

![]() 11/12 2025

11/12 2025

![]() 603

603

Recently, Motovis Technology (Shanghai) Co., Ltd. (hereinafter referred to as “Motovis”) filed its application for listing on the Hong Kong Stock Exchange. Despite experiencing rapid revenue growth propelled by increasing sales, the company is still struggling to break free from the loss-making trap. Over three and a half years, it has accumulated losses of approximately 774 million yuan, and its operating cash flow has remained consistently negative.

Securities Star observed that, confronted with consecutive years of losses, Motovis heavily relies on external financing to “replenish funds”. Although redemption liabilities amounting to up to 1.228 billion yuan have been cleared, the past interest expenses of 217 million yuan from these liabilities have severely eaten into its profits. Moreover, Motovis is facing severe challenges, including a high asset-liability ratio and insolvency. Operational risks, such as the growing customer concentration and the overlapping of suppliers and customers, further intensify business uncertainties. Against the backdrop of not having yet developed self-sustaining “hematopoietic” (fund-generating) capabilities, pursuing an IPO in Hong Kong has become a crucial move for Motovis to ease its financial pressure.

01. Average Annual Loss of Approximately 200 Million Yuan, Persistent Negative Cash Flow

According to the prospectus, Motovis, established in August 2015, is an intelligent driving solution provider driven by artificial intelligence innovation. The company offers integrated hardware and software solutions with L0 to L4 intelligent driving functions for OEMs (Original Equipment Manufacturers) and Tier 1 suppliers, facilitating their intelligent transformation and promoting the widespread adoption of intelligent driving.

Data from CIC Consulting shows that, driven by increasingly popular applications and technological advancements, China's intelligent driving industry is witnessing rapid growth. The market for L0 to L2/L2+ intelligent driving solutions expanded from 21.6 billion yuan in 2020 to 91.2 billion yuan in 2024, with a Compound Annual Growth Rate (CAGR) of 43.3%. It is projected to reach 228.1 billion yuan by 2029, with a CAGR of 20.1%.

Motovis's product range includes driving solutions, automated parking solutions, and active safety solutions. Its products have been chosen by OEM customers for 92 vehicle models, with over 3.3 million units delivered.

From 2022 to 2024 and the first half of 2025 (hereinafter referred to as the “reporting period”), Motovis's sales volumes of intelligent driving solutions were 399,400 units, 902,100 units, 1,357,400 units, and 641,500 units, respectively. Benefiting from significant sales growth, Motovis recorded revenues of approximately 118 million yuan, 147 million yuan, 357 million yuan, and 189 million yuan, with year-over-year revenue growth rates of 19.9%, 24.4%, 143.5%, and 76.4%, respectively.

However, despite the robust revenue growth, Motovis has not managed to shake off its loss-making status. During the reporting period, the company's losses were 200 million yuan, 228 million yuan, 233 million yuan, and 112 million yuan, respectively, with an average annual loss of around 200 million yuan. Compared to the 115 million yuan loss in the same period of 2024, the loss narrowed slightly in the first half of this year, but the cumulative loss over three and a half years still approached 774 million yuan.

Motovis stated that its net losses were mainly due to substantial research and development (R&D) expenditures incurred during the reporting period, with R&D spending increasing alongside business growth.

During the reporting period, Motovis's R&D expenditures were 128 million yuan, 143 million yuan, 160 million yuan, and 83.934 million yuan, respectively. As of the end of the first half of this year, the company had 327 employees, including 243 R&D personnel, accounting for 74.3%. Employee benefit expenses constituted the majority of R&D spending, accounting for over 60%.

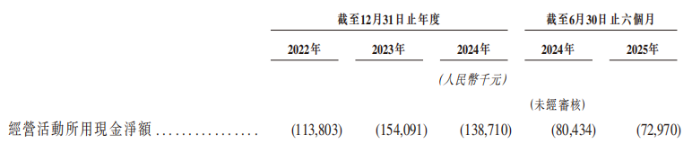

Securities Star noted that insufficient self-sustaining “hematopoietic” capabilities have resulted in persistent negative operating cash flow for Motovis, with figures of -114 million yuan, -154 million yuan, -139 million yuan, and -72.97 million yuan during the reporting period. Motovis explained that the negative operating cash flow was primarily due to pre-tax losses incurred by the company, as it generated substantial operating expenses for providing solutions, conducting R&D, sales and marketing activities, and administrative management.

02. Redemption Liability Interests Eating into Profits, High Asset-Liability Ratio

To meet the funding needs for daily operations and development, Motovis primarily relies on proceeds from business operations, shareholder capital injections, and bank loans to finance its cash requirements. As the company is currently not profitable, its self-generated operating cash flow is insufficient to fully cover its funding needs, making external financing a crucial “fund replenishment” method for Motovis.

According to the prospectus, since 2017, Motovis has completed 12 rounds of financing, including early-stage investments. After 2021, the company entered a period of explosive financing, successively completing eight rounds of financing, including Series B, Series B+, Series C1, etc., mainly concentrated in 2021 and 2022. The company's latest Series D financing in June 2025 valued it at 2.543 billion yuan post-investment, compared to a post-investment valuation of 61 million USD in Series A in July 2017.

Securities Star observed that Motovis issued shares with special rights (including redemption rights) in 2017 and 2025. As of the end of the first half of this year, the redemption liabilities arising from these shares with special rights were 1.228 billion yuan, a 41.3% increase from the end of 2024.

Redemption liabilities refer to redeemable preferred shares issued by the company to investors for past equity investments, with the redemption amount equal to the original investment principal plus simple interest. According to a supplementary agreement entered into in July 2025, all special rights related to redemption liabilities held by Motovis have been terminated.

Although the clearance of redemption liabilities reduces the short-term funding pressure caused by triggering redemption conditions, the previous sustained growth in redemption liability interest expenses continues to significantly eat into profits. During the reporting period, Motovis's interest expenses on redemption liabilities were 56.528 million yuan, 60.38 million yuan, 64.052 million yuan, and 35.587 million yuan, respectively, totaling nearly 217 million yuan.

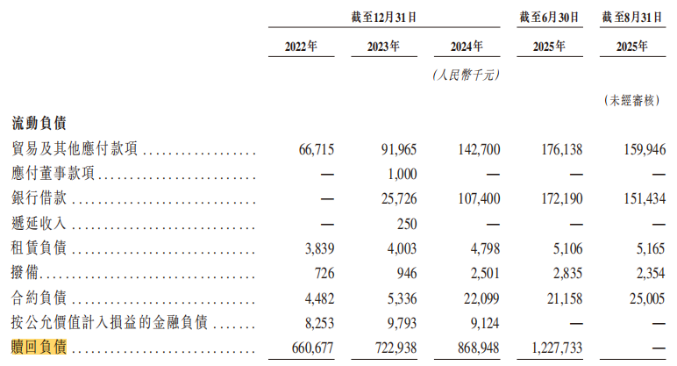

From the current funding perspective, Motovis still faces significant overall funding pressure, with the most direct manifestation being a substantial increase in bank loans. While no bank loans were incurred in 2022, they surged starting in 2023. Bank loans in 2023 and 2024 were 25.726 million yuan and 107 million yuan, respectively, reaching 151 million yuan as of the end of August this year. These loans were primarily used to finance working capital needs, further elevating current liabilities.

During the reporting period, Motovis's asset-liability ratios were 233.26%, 414.12%, 431.17%, and 265.67%, respectively. In reality, the company has fallen into a persistent state of insolvency. As of the end of the first half of this year, its total assets were 606 million yuan, total liabilities were 1.611 billion yuan, and net assets were -1.005 billion yuan.

In summary, Motovis's need for IPO funding on the Hong Kong Stock Exchange appears particularly urgent. According to the prospectus, the company has received approximately 937 million yuan in new registered capital subscription proceeds, with 71% already utilized as of the end of the first half of this year.

03. Growing Customer Concentration Risks, Rising Receivables

The intelligent driving solution market is relatively fragmented, with the top ten market participants accounting for approximately 15.2% of the market share by revenue in 2024. Among them, Motovis ranks eighth, with a market share of approximately 0.4%.

Securities Star observed that the fragmented market exposes Motovis to more competitors, and the risks associated with its customer structure are becoming increasingly prominent. During the reporting period, the company's revenue from its top five customers was 42.007 million yuan, 45.93 million yuan, 187 million yuan, and 124 million yuan, respectively, accounting for 35.6%, 31.3%, 52.3%, and 65.9% of the total revenue for the respective periods. Over three and a half years, the revenue contribution from the top five customers increased by 30 percentage points, indicating growing customer concentration.

Additionally, Motovis relies on a limited number of third-party suppliers for critical hardware components and equipment, including sensors, chips, and other parts, resulting in a high concentration of suppliers. During the reporting period, Motovis's purchases from its top five suppliers were 30.384 million yuan, 54.313 million yuan, 130 million yuan, and 86.268 million yuan, respectively, accounting for 44.5%, 44.2%, 43.5%, and 58.4% of the total purchases at the end of the respective periods.

Notably, Motovis has overlapping customers and suppliers. Among the top five customers during the reporting period, four were also suppliers, with purchases from these companies accounting for 0.1%, 0.9%, 0.3%, and 0.5% of the total purchases, respectively. Among the top five suppliers, five were also customers, with sales from Motovis to these companies accounting for 0.4%, 0.3%, 0.5%, and 0% of the total revenue, respectively.

Motovis mentioned in its prospectus that, according to CIC Consulting, it is common for leading enterprises in the intelligent driving solution industry to operate across multiple segments of the entire value chain, and mutual transactions between upstream and downstream enterprises along the value chain as suppliers and customers are industry norms.

Some enterprises have bidirectional cooperative relationships with Motovis, which may seem to bring them closer and enhance their interconnectedness but also carry higher risks. Any disagreements on pricing or settlement terms between the parties could not only impact Motovis's revenue but also disrupt the supply of critical components, causing dual impacts on the company's operations.

Furthermore, the sustained growth in Motovis's trade and other receivables is particularly noteworthy. During the reporting period, the company's trade and other receivables were 67.316 million yuan, 97.771 million yuan, 138 million yuan, and 161 million yuan, respectively. This growth is primarily attributed to two factors: first, an increase in notes receivable due to higher sales to OEM customers; and second, an increase in prepayments to suppliers for ancillary services related to R&D activities.

(This article was first published on Securities Star, Author | Lu Wenyan)

- End -