MIT Ph.D. Holder Sets Record with $144 Million in Largest-Ever Financing for a Surgical Robot Venture

![]() 11/12 2025

11/12 2025

![]() 567

567

I'm just curious about the recent surge in popularity of surgical robots. Yesterday, Conmedtch secured a whopping $200 million (1.4 billion yuan) in financing, with Hong Kong Investment Company leading the round.

According to Pencil News DATA, this marks the largest domestic surgical robot financing deal of the year (among those already disclosed).

This trend isn't isolated.

In November alone, Agile Medical raised hundreds of millions of yuan; in September, Onto Microprecision did the same, and Deep Medical secured Series A funding... Believe it or not, there have been 31 domestic surgical robot financing events since the start of the year.

What's driving this? Are robots poised to take over hospitals and perform surgeries on the masses in the near future? Today, using Conmedtch's financing as a springboard, let's explore: What's happening in the surgical robot sector?

- 01 -

Founded in 2019 by Ou Guowei, a former Ph.D. student at MIT's School of Mechanical Engineering (where he researched projects like mechanical ankle prostheses), Conmedtch has quickly made waves.

After graduation, Ou joined Intuitive Surgical, a globally renowned surgical robot company, and led projects involving single-port surgical robots and lung biopsy surgical robots.

Conmedtch's flagship product is the Sentire® Laparoscopic Surgical Robot System.

Image Source/Conmedtch Official WeChat Account

What is it? It's a robot that enables minimally invasive surgeries by "remotely controlling a robotic arm with a joystick."

Surgeons sit at a console, manipulating handles, foot pedals, and other controls. The robotic arm, equipped with surgical tools and cameras, operates through small incisions in the patient's body.

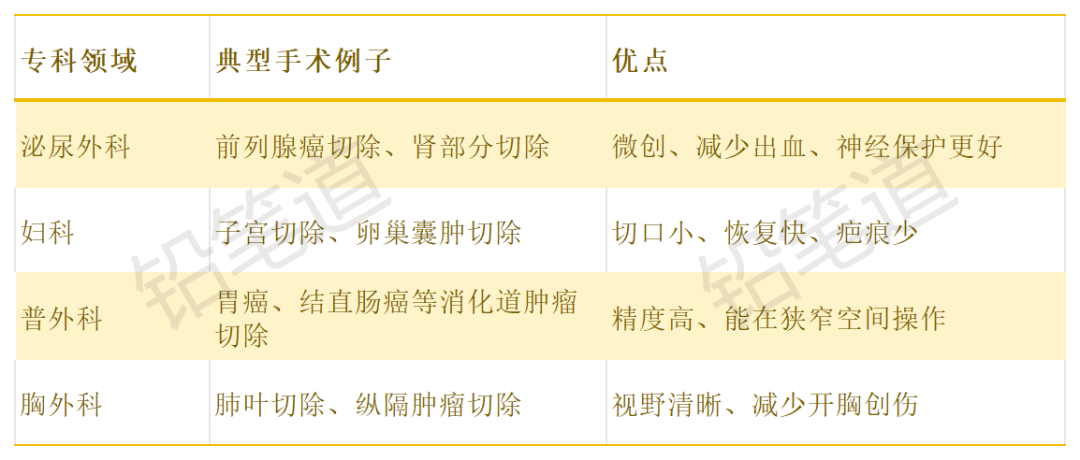

What can it do? It's versatile, suitable for various minimally invasive surgeries (as shown below).

The company's progress has been rapid. Established in September 2019, it completed its proof-of-concept prototype by August the following year.

By November 2023, its robots had begun performing clinical surgeries, with over 100 multi-disciplinary human clinical trials completed across mainland China and Hong Kong.

In July this year, it performed three colorectal surgeries at the University of Portsmouth Hospital in the UK.

In August, it announced a clinical validation in Macau: the world's first autonomous/embodied intelligence platform in robot-assisted surgery. What does this signify? It means the robot, under doctor supervision, can autonomously perform certain actions or make judgments. This indicates it has reached the pre-commercialization validation stage.

Some may wonder: Why isn't it commercialized yet? What's missing? At least two factors: 1. Partial regulatory certifications; 2. Scalable production capabilities.

So, why do hospitals or doctors need Conmedtch's robots?

Firstly, surgical precision and visibility. In traditional laparoscopic surgeries, doctors operate with two long, rigid instruments in a confined pelvic cavity, viewing the surgical site through a two-dimensional screen, with limited hand movements.

Conmedtch's robots, however, can bend and rotate like a human wrist, maneuvering freely in tight spaces. Combined with stereoscopic 3D high-definition vision, doctors can "see" internal structures as if they were there, with a sense of spatial awareness.

Don't believe me? Here's feedback from the University of Portsmouth Hospital team: "Stable dissection and suturing were achieved in these narrow spaces, with all three surgeries completed smoothly without the need to switch to open surgery."

Secondly, affordability: it's not just effective but also cost-effective.

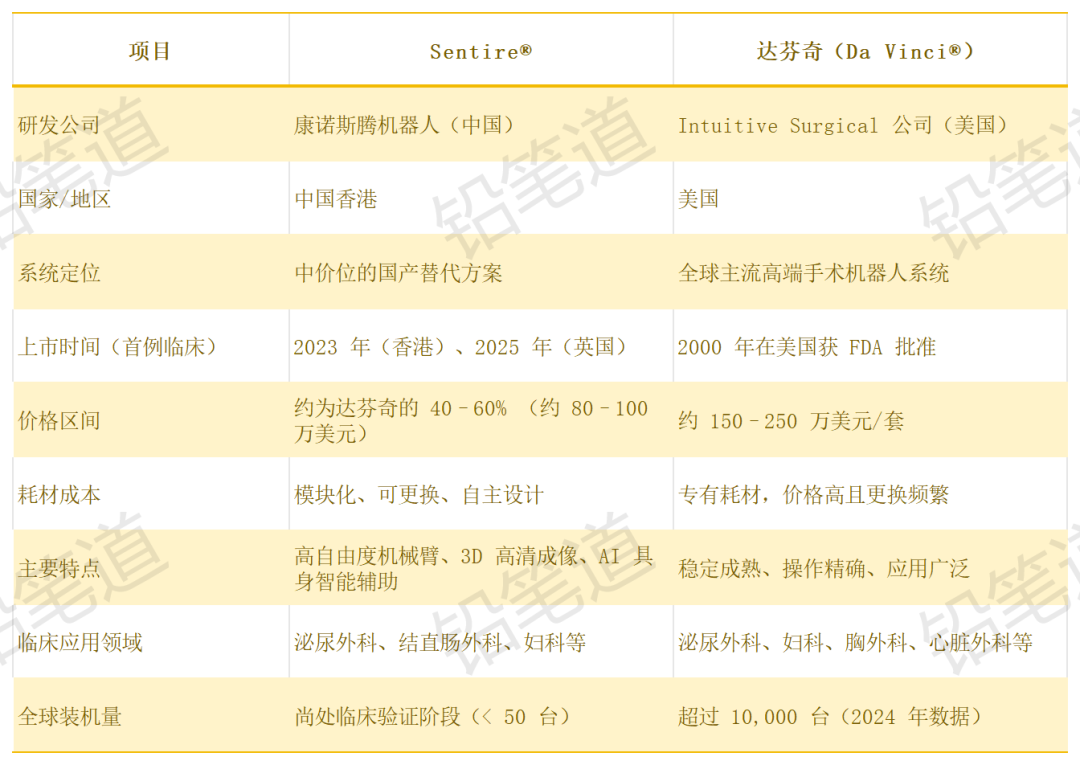

According to the South China Morning Post, Sentire® is positioned as a "mid-priced alternative for domestic substitution," with the whole machine price expected to be 40-60% of Da Vinci's.

One more point: Da Vinci is currently the most widely used and mature surgical robot system globally, partially monopolizing the high-end surgical robot market.

- 02 -

Through Conmedtch's case, we should have a preliminary understanding: surgical robots differ significantly from other types of robots, such as industrial robots, service robots, and humanoid robots.

What do people expect from humanoid robots? They want them to walk, talk, carry water, and transport items, aiming to replace human labor.

What about industrial robots? People don't demand high intelligence from them but require speed, accuracy, stability, and endurance.

Medical robots, however, aim to enhance doctors' capabilities and reduce risks. For example, "cutting" a 1-millimeter safety margin inside the body or suturing a 3-millimeter blood vessel without touching any nerves.

To summarize: industrial robots replace humans, humanoid robots mimic humans, and medical robots amplify humans.

These distinct evolutionary goals make medical robots unique.

For instance, in form, most surgical robots don't pursue a humanoid shape but adopt a robotic arm structure, resembling multiple independent "arms" working around the surgical table. Unlike other robots, they don't seek versatility and flexibility but extreme precision and safety.

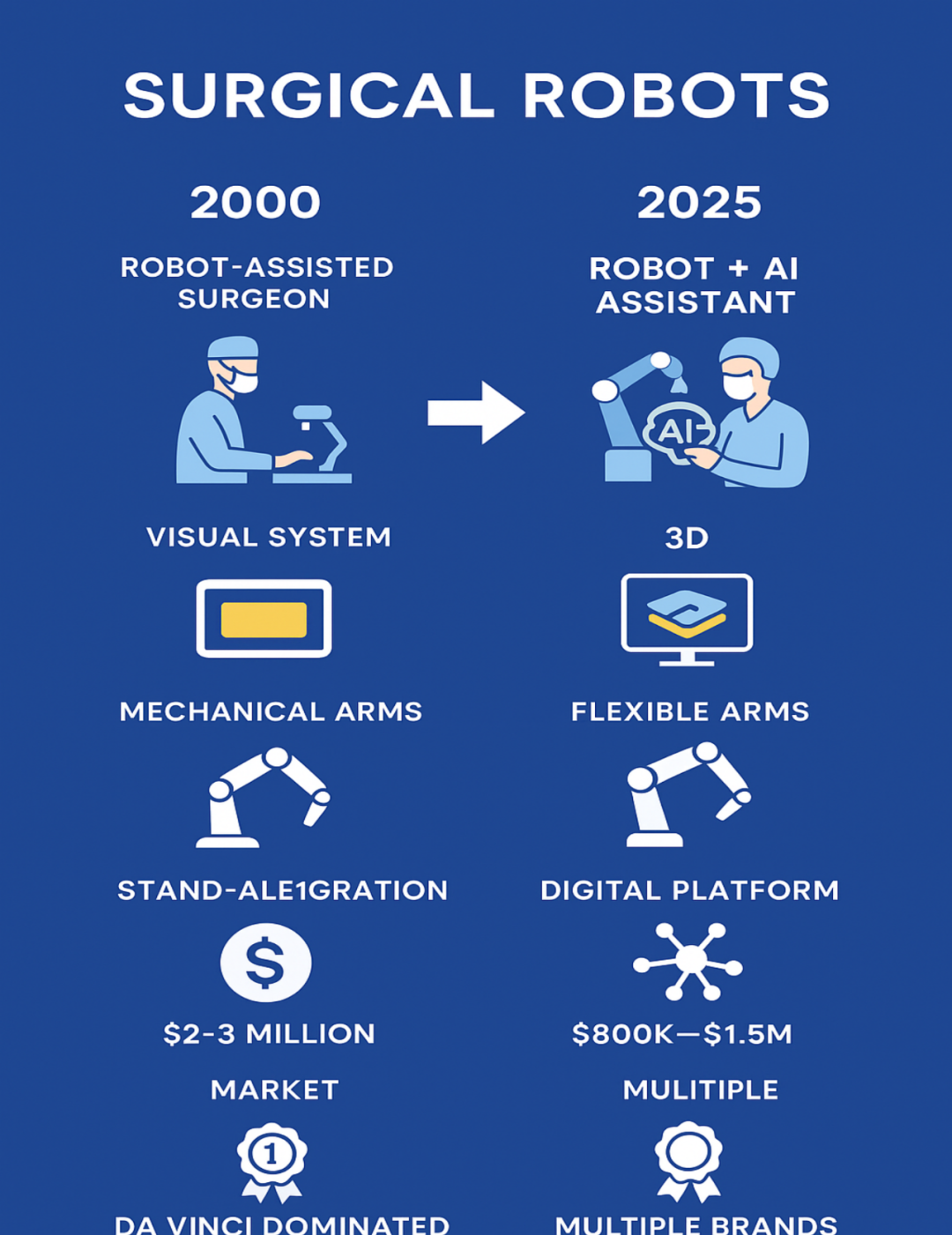

Therefore, in terms of new technology applications, surgical robots aren't as cutting-edge; some technologies even date back 25 years (the Da Vinci system, launched in 2000). They are constrained by extremely high safety and supervision requirements.

Of course, progress has been significant.

Compared to products from 25 years ago, the biggest advancement of current surgical robots is that they were once merely an "extension of the doctor's hand" (100% human-controlled), but now they serve as an "AI assistant," capable of semi-autonomously completing some auxiliary tasks, such as suturing.

Comparison Between Traditional and New Generation Surgical Robots

- 03 -

As mentioned earlier, why are investment institutions so focused on surgical robots? Is it because the sector has reached a tipping point? Is its application stage mature? The answer is: it's in the early application stage, making now a good time for strategic positioning.

Firstly, consider traditional surgical robots like the Da Vinci system, which covers over 300 hospitals in China with around 380 installations.

China has approximately 37,000 hospitals (including public and private), with about 2,500 tertiary hospitals and 10,000 secondary hospitals (National Health Commission data, 2024).

What do these numbers indicate? Even after 20 years of development, traditional surgical robots have a relatively low penetration rate—in tertiary or large private hospitals, surgical robots are an option, not a standard.

Some may ask: If surgical robots have evolved for 20 years and still have such low penetration, is there a demand issue?

A key reason is their high cost. A Da Vinci system costs $1.5-2.5 million, with annual maintenance and consumable costs reaching several million yuan. This high cost presents an opportunity for domestic new players.

Now, consider new-generation robots. New players like Conmedtch are nearing the commercialization stage—we can categorize them as "domestic new players."

Their total installations are low but growing rapidly. Why is the penetration rate of domestic new players low? Several reasons.

One reason is their late start. Most new products only received NMPA (National Medical Products Administration) approval after 2023.

Another reason is the market was previously monopolized by traditional giants.

So, what does the future hold? Here's some data. Domestic surgical robots (including but not limited to Sentire®) are "starting from zero" in county-level/medium-sized hospital markets and growing rapidly.

The penetration rate of domestic surgical robots in county-level hospitals is expected to grow from about 6.5% in 2023 to about 25% in 2030.

So, why are VCs investing boldly now? Because over the past 20 years, they can see not only the development direction of surgical robots but also the development path, from tertiary hospitals to secondary/county-level hospitals, and from domestic to international markets.

Conmedtch predicts that by 2030, there will be approximately 34.23 million new opportunities for minimally invasive surgeries involving domestic surgical robots.

So, it's no exaggeration to say: the spring of domestic surgical robots is just beginning.

This article does not constitute any investment advice.