Can Hesai's Robotics Division Turn the Tide? Is It Still Not Enough?

![]() 11/17 2025

11/17 2025

![]() 587

587

Robotics Division Soars by 1,312%, Yet Stock Price Plummets 11%

In November 2025, Hesai Technology unveiled what appeared to be a flawless quarterly report: not only did it achieve its annual profit target a quarter ahead of schedule, but it also recorded its highest quarterly profit since inception. The burgeoning robotics division demonstrated explosive growth, marking a significant breakthrough beyond the realm of intelligent driving.

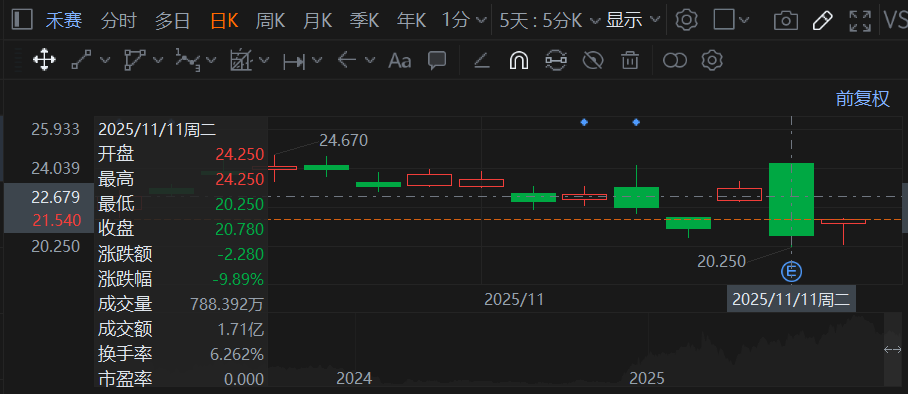

However, the capital market delivered a starkly contrasting verdict—the day following the earnings release, Hesai's Hong Kong-listed shares plummeted over 11% at one point, creating a sharp divergence from its strong fundamentals.

This dramatic market reaction prompts a question: Why does stronger performance intensify market concerns?

01 Market Concerns Behind the Stock Price Plunge

Hesai made its debut on the Hong Kong Stock Exchange in September 2025, emerging as a bona fide new listing. Its stock price skyrocketed to HK$244 on its first trading day—a notably high valuation for the cautious Hong Kong market. Yet, merely two months later, the stock had declined by roughly one-third from its peak.

On November 12, Hesai-W (02525.HK) saw its shares drop over 11% intraday.

On the evening of November 11, when the earnings report was released, Hesai's U.S.-listed shares (HSAI.US) closed down nearly 10%.

Such a sharp correction within a short span reflects not merely a reaction to a single earnings report but a broader lack of investor confidence since its listing.

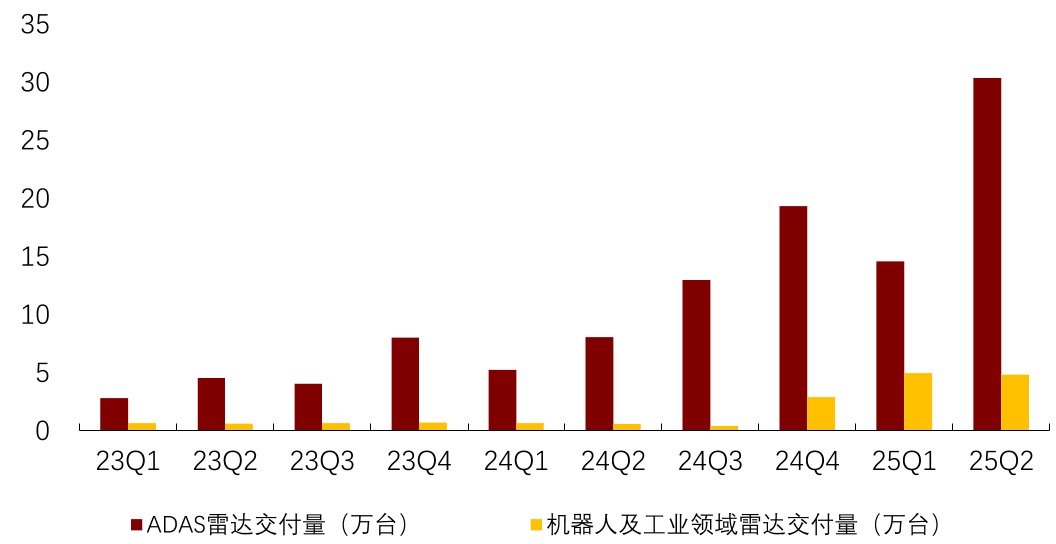

The core concern revolves around the significant deceleration in ADAS LiDAR delivery growth.

While Hesai's overall performance remains robust, quarter-over-quarter data reveals a marked slowdown in ADAS LiDAR delivery growth in Q3, with a mere 25.43% increase.

In contrast, Q2 witnessed ADAS LiDAR shipments reach 303,564 units, surging from 146,087 units in Q1—a 107.8% sequential increase. Investors worry that Hesai's most fundamental ADAS business is losing momentum.

Declining product prices have exacerbated profitability concerns.

As Hesai's low-cost ATX model became the primary driver of shipments, the average LiDAR price dropped to 1,790 yuan in Q3—down 10% sequentially and 52% year-over-year.

While Hesai maintained a healthy 42% gross margin through cost reductions and economies of scale, investors question whether the “volume up, price down” model can sustain profit growth.

Customer concentration risks also warrant attention.

From 2022 to Q1 2025, the top five clients accounted for 53.1%, 67.5%, 59.9%, and 68.3% of revenue, respectively. This heavy reliance on a few clients ties Hesai's performance closely to their operational health and partnerships, concentrating potential risks.

While these concerns weigh on the capital market, Hesai's latest earnings report, particularly its breakthroughs in robotics, offers a fresh perspective for reevaluating its value.

02 Robotics Division Emerges as a Game Changer

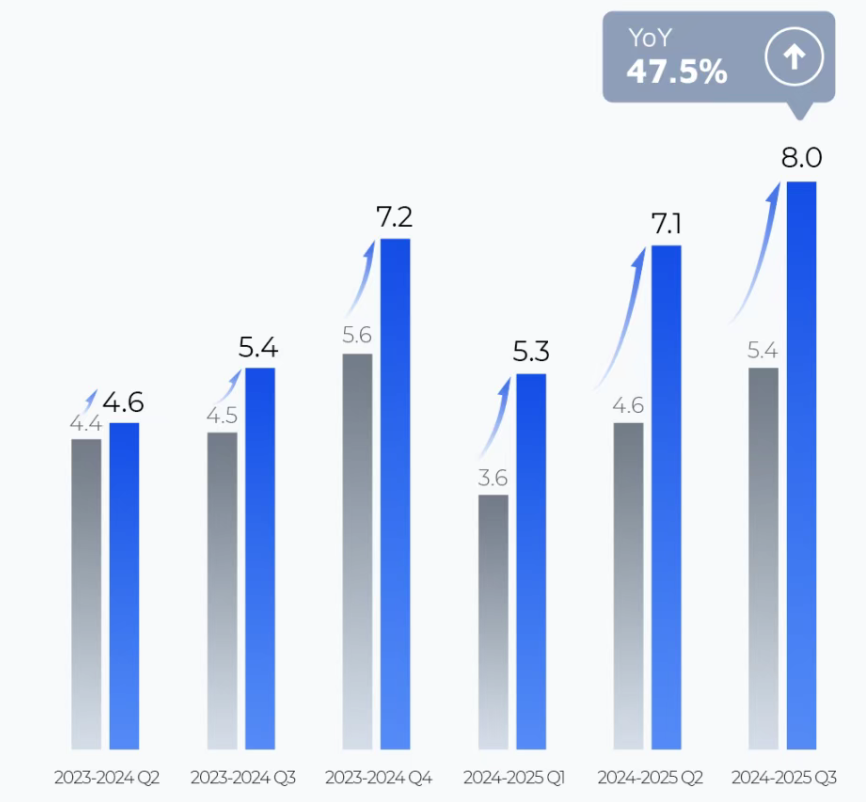

Hesai's Q3 2025 financial data underscores strong revenue and profit growth.

Revenue reached 800 million yuan, up 47.5% year-over-year, marking six consecutive quarters of growth. Net profit hit a record 260 million yuan. LiDAR shipments totaled 441,398 units, up 228.9% year-over-year.

This growth was partly fueled by sustained expansion in its ADAS (Advanced Driver-Assistance Systems) business.

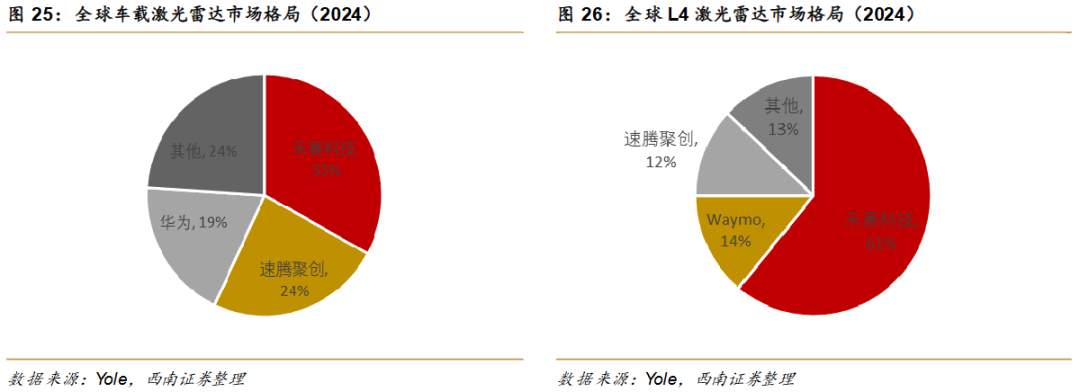

ADAS shipments reached 380,759 units, up 193.1% year-over-year. Hesai disclosed it had ranked first in automotive LiDAR installations for seven straight months, with market share rising to 46% by August 2025—about 1.5 times that of the runner-up.

Meanwhile, the robotics division witnessed explosive growth.

In Q3 2025, robotics LiDAR shipments reached 60,639 units, up 1,311.9% year-over-year. This staggering growth validates robotics as the company's “second growth engine.”

Its success as a new growth driver stems from precise market alignment.

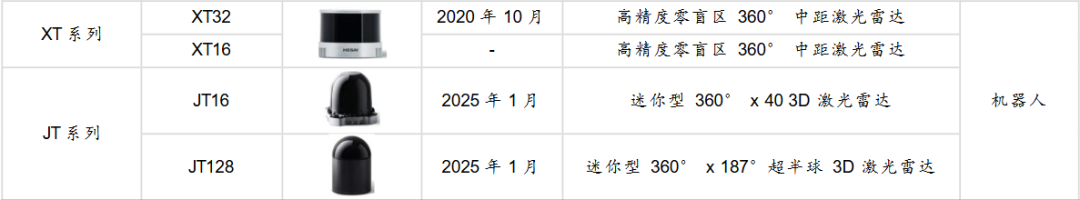

Hesai's JT series mini ultra-hemispherical 3D LiDAR, boasting a 360°x189° field of view and zero-blind-spot perception down to 0 meters, meets mobile robots' demand for precise near-obstacle and overhead space detection.

Since its January launch, the JT series has shipped 100,000 units in five months, with the JT16 model widely used in lawn-mowing robots achieving 100,000 shipments in six months.

Hesai's LiDAR products now serve logistics, lawn-mowing robots, and industrial automation.

Deep partnerships with industry leaders have also fueled scaling (mass-scale) robotics adoption.

JD Logistics announced plans to procure 1 million autonomous vehicles over five years, signaling massive demand. Jiushi Intelligence's third-generation delivery robots utilize four Hesai AT128 LiDARs. Neolix's fleet surpassed 10,000 units in September, leveraging Hesai XT series for “zero-blind-spot” perception in complex scenarios.

Additionally, Hesai led in embodied AI applications.

Unitree's robot dog employs Hesai XT series automotive-grade LiDAR, while Vbot's household robot dog features the JT16. On August 7, Hesai announced a partnership with Starry Dynamics.

03 Why Is Hesai Betting on Robotics?

The LiDAR industry is undergoing profound shifts.

In Q3, China's passenger vehicle LiDAR adoption rate dropped sharply to 19.65% quarter-over-quarter. High-Tech Intelligent Vehicle Research Institute data shows a four-month fluctuation around 10% adoption, indicating a bottleneck in front-end market penetration.

The industry also faces profitability challenges.

Hesai reported a 17.5 million yuan loss in Q1 2025 but turned profitable in Q2 with 44.1 million yuan net profit. RoboSense remained unprofitable, posting a 149 million yuan loss in H1 2025 (narrowing by 44.5%). Huawei did not disclose financial data, while Innovusion accumulated 540 million USD in net losses.

Against this backdrop, robotics emerges as a more promising growth market.

RoboSense CEO Qiu Chunchao noted that robotics offers a 10x larger market than automotive, with explosive growth in consumer and commercial robots like lawn-mowing and delivery models.

For instance, Hesai secured a 300,000-unit LiDAR supply deal with Dreame, while RoboSense won a 1.2 million-unit order from Kumak Technology over three years.

Robotics LiDAR commands higher unit prices and margins than automotive products, offering greater profit potential.

While robotics LiDAR prices fell from 8,700 yuan in 2024 to 4,800 yuan in H1 2025, they remain above automotive LiDAR's “sub-1,000 yuan” era.

For example, RoboSense's robotics revenue growth offset ADAS declines. In H1 2025, robotics revenue surged 184.8% while ADAS fell 17.9%, sustaining 7.7% overall revenue growth.

Moreover, LiDAR technologies for smart cars and robots are highly transferable.

Hesai applied its automotive chip technologies (e.g., fourth-gen self-developed chips) and waveform decoding engines (IPE) to its JT series for robots.

Its large-scale automotive-grade production lines, built to meet stringent standards, can seamlessly switch to robotics LiDAR manufacturing, maximizing R&D and production efficiency.

However, Hesai's robotics division is still in a transitional phase and unlikely to replace ADAS as the core growth engine soon.

In Q3, robotics shipments soared 1,311.9% year-over-year but accounted for just 13.7% of total shipments (60,639 out of 441,398 units). ADAS remains the revenue mainstay.

Meanwhile, Hesai faces competition from RoboSense, Huawei, and others in robotics LiDAR. In H1 2025, Hesai shipped 98,300 robotics LiDAR units (up 7x year-over-year, 17.9% of total), while RoboSense's robotics revenue accounted for 28.2%.

Despite promising prospects, Hesai must address how to elevate robotics' revenue contribution and reduce automotive dependency.04 Conclusion

Hesai's Q3 2025 results reflect the LiDAR industry's collective dilemma: explosive robotics growth coexists with ADAS's declining dominance. This transitional “gap” poses a shared challenge for Hesai and the industry.

Looking ahead, as L3 autonomous driving policies clarify and robotics applications expand, LiDAR demand remains promising. Hesai's success hinges on maintaining ADAS leadership while accelerating robotics' revenue contribution, achieving a true “dual-engine” strategy. This path is challenging but holds the key to industry transformation.

*Image sourced from the internet. Contact for removal if copyrighted.