Baidu Rockets 12% at 2026 Opening: Kunlunxin Files for Listing, Sparking a Valuation Reassessment of the 'AI Silicon Powerhouse'

![]() 01/04 2026

01/04 2026

![]() 418

418

Baidu Kicks Off 2026 with a 12% Surge

On the first trading day after New Year's Day 2026, the Hong Kong stock market delivered a substantial boost to investors: the Hang Seng Index soared by 2.6%, with Baidu Group-SW (09888.HK) emerging as the standout performer, surging by +9% at one point. By 10:50 PM, Baidu's U.S. stock price had climbed 12%, with trading volume on the Hong Kong stock market swelling to nearly HK$4 billion. The catalyst? An A1 form.

On the evening of January 1st, the Hong Kong Stock Exchange's official website disclosed that Kunlunxin Technology had confidentially submitted an application for listing on the main board. Once this news broke, the market's preoccupation with Baidu's 'valuation discount' promptly eased: the AI computing power trajectory shot straight up, and Kunlunxin's long-awaited independent listing had finally arrived.

Client Expansion: Kunlunxin Secures Major Industry Players

After the initial surge of excitement, let's delve into the substance. Why is Kunlunxin's listing such a pivotal event for Baidu? In two succinct words: 'AI deployment + client acquisition.' Today's announcement carries a bold message: 'Batch deliveries have been made to multiple leading internet and operator partners.' In simpler terms: Tencent, ByteDance, Alibaba, and even Meituan are deeply engaged in collaborations with Kunlunxin. I've unearthed two pieces of insider information:

1. In ByteDance's Volcano Engine inference pool for Q3 this year, Kunlunxin's P800 accounted for 18%, trailing only NVIDIA's H20.

2. In Tencent's CSIG (Cloud and Smart Industries Group) procurement in October, Package 3 directly awarded Kunlunxin a 70% share, eclipsing even Tencent's own 'Zixiao' chip.

3. Still skeptical? China Mobile's billion-dollar AI server order for 2025-2026 saw Packages 1, 2, and 3 all secured by Kunlunxin, with official PPTs explicitly stating '70%, 70%, 100% shares.' Operator behemoths prioritize stability, and their willingness to invest in nationwide inference nodes underscores the practicality and implementation of these offerings.

Valuation Anchor: Baidu's AI Deployment Takes Center Stage in Valuation

The market is accustomed to drawing parallels between Kunlunxin and Cambricon and Hygon—yet it's more akin to an 'AI hybrid of TSMC + NVIDIA.' Baidu's internal 30,000-card cluster has successfully launched an 'hourly billing' AI Cloud, which has been externally replicated as the 'Tianchi Super Node':

- Tianchi 256 = 256×P800, supporting billion-parameter models per node;

- Tianchi 512 = 512×M300, capable of training trillion-parameter models per node.

Customers aren't merely purchasing chips; they're acquiring 'optimized, packaged, and PaddlePaddle-compatible' computing time. This business model introduces two pivotal valuation distinctions:

1) Enhanced revenue predictability, as OEMs sign three-year framework agreements, securing future 36-month shipments;

2) More stable gross margins, with integrated chip + server + software delivery achieving 55%–60% margins, significantly surpassing the 40% average for pure chip design firms.

Kunlunxin M100 is slated for an official launch in early 2026, with the M300 planned for early 2027.

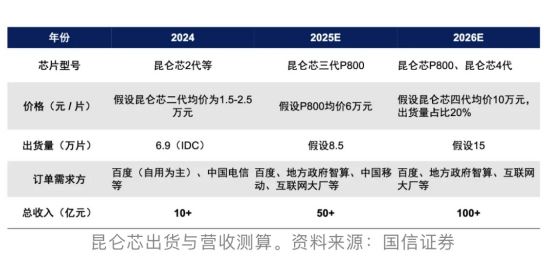

Previous research notes suggest that Kunlunxin's full-year revenue for 2025 is anticipated to be around RMB 5 billion.

Drawing parallels to Moore Threads' listing and today's 70% surge in GPU maker Biren, Kunlunxin's IPO is poised for a significant first-day leap, immediately propelling Baidu's parent company 'negative premium' back into positive territory, with a revaluation potential of at least 30%. Once Kunlunxin is independently priced, Baidu's parent company will, for the first time, possess a horizontally comparable and revenue-explosive internet benchmark for its 'valuation anchor,' thereby unlocking discount repair opportunities.

Baidu's Future Outlook

Over the past decade, Baidu has faced criticism for 'starting early but finishing late.' However, in the AI computing power arms race, it has successfully forged a closed loop of chips—frameworks—models—cloud. Kunlunxin's independent listing in Hong Kong transcends a mere spin-off; it's subjecting the 'silicon powerhouse' to the scrutiny of the public market—enabling global capital to cast votes through orders and valuations. The market's valuation of Baidu has predominantly remained confined within the 'advertising business as the foundation + AI cloud as the increment' framework, adopting a conservative 'zero valuation' stance for ventures like Kunlunxin and Apollo Go.

Personally, I believe that for investors, Kunlunxin's independent listing is tantamount to placing Baidu AI's 'backend intangible assets' on the auction block for public bidding. Over the next twelve months, whether Kunlunxin can incorporate the RMB 8.3 billion revenue forecast into its audit report will determine if Baidu's discount narrative undergoes a complete transformation.

Disclaimer: This article is grounded in the public company attributes of listed entities. Meigang Investigation endeavors to maintain objectivity and fairness in the content and viewpoints presented but does not vouch for their accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute investment advice, and Meigang Investigation bears no responsibility for any actions undertaken based on the utilization of this article.