Alibaba's Alipay: Can 'Tap to Pay' Secure Its Market Position?

![]() 01/06 2026

01/06 2026

![]() 448

448

Recently, while shopping at a supermarket with my mother, I stumbled upon a hidden yet incredibly handy feature of Alipay's Tap to Pay.

My mother always tries to save money for me. Whenever we go shopping or dining out, she insists on footing the bill.

Sometimes, she can be quite headstrong. No matter what I say, she won't budge, and it can get a bit awkward when we both reach for our wallets.

One day, as we were checking out, the cashier informed us about a promotion for Tap to Pay, where users could receive a red envelope for every transaction.

So, I said, "Let me give Alipay's Tap to Pay a try." And sure enough, I saved two yuan.

From that moment on, whenever my mother insisted on paying, I would mention the Tap to Pay promotion and offer to pay to save some money. After that, she stopped arguing with me over the bill.

The competition for who pays was over.

Why did this tactic work so effectively?

Because neither my mother nor my father had set up Alipay. They primarily used WeChat Pay.

There are two main reasons behind their decision not to use Alipay.

The first is financial security concerns.

The community constantly warns about fraud, and many of their friends have fallen victim to scams.

They are aware that scammers are "highly skilled," so using fewer apps linked to their finances means reducing their risk exposure.

The second reason is that WeChat meets their needs sufficiently.

For offline purchases, such as groceries, most vendors only accept WeChat Pay.

For online shopping, they mainly use Pinduoduo, but they haven't even set up Duoduo Pay. Instead, they rely on WeChat's "pay later" option by default.

When Taobao integrated WeChat Pay, I initially thought it wouldn't have a significant impact on business. It seemed more like Alibaba was demonstrating a willingness to embrace interoperability or trying to win favor with Tencent to gain access to WeChat's ecosystem.

Now, I believe there might be a strategic business rationale behind it, similar to how Taobao's web version was upgraded to target new user demographics.

For my parents, the lack of payment method compatibility is a major reason they don't use Taobao.

I'm not suggesting that if Taobao had WeChat Pay, they would immediately start using it.

What I want to highlight is that Taobao's previous lack of support for WeChat Pay prevented them from even considering giving it a try.

My parents' demographic is somewhat representative. They are in their 50s or 60s, have long worked as farmers or migrant workers, adopted smartphones relatively late, struggle to grasp new technologies, and are highly cautious about fraud. So, they stick to WeChat if possible.

It's challenging to pinpoint the exact size of this demographic.

However, what it indicates is that Alipay, as a payment tool, no longer holds the essential, irreplaceable status it once enjoyed.

It's no longer the unavoidable gateway for online transactions. Instead, it's degrading into an ordinary, optional payment method.

Where Does the Anxiety Originate?

This trend didn't emerge overnight. WeChat, as a national social app, has dealt a significant blow to Alipay's dominance.

The competition between the two wasn't entirely fair, but it was somewhat balanced because Alipay was tied to Alibaba's ecosystem.

The war wasn't just between Alipay and WeChat; it was between Tencent and Alibaba.

As long as Alibaba maintained its dominance in e-commerce, Alipay could rely on the Alibaba ecosystem to sustain a significant and stable market share.

However, the reality has unfolded differently. Alibaba no longer holds sway over e-commerce, and its ability to support Alipay has gradually diminished.

Over the past few years, we've witnessed not only Alibaba undergoing comprehensive strategic and organizational reforms but also Alipay making bold adjustments.

Some of these attempts seem to have been influenced by traffic anxiety, such as the aggressive push for video content in lifestyle accounts.

When Alipay introduced this feature, it argued that it was expanding content scenarios based on the platform's existing ecosystem and user behavior.

Thus, it focused on supporting financial and wealth management content, leveraging its years of accumulated experience in financial services.

I have a friend who is a small-time content creator on Bilibili with a few tens of thousands of followers. Before Alipay started offering benefits, life was tough. Since Alipay began promoting videos, he said he could support a small team just from the basic income, which was much better than what Bilibili offered.

Whether this logic holds up is evident by simply opening Alipay and scrolling through a few videos.

Essentially, promoting short videos is still about retaining users, even if the means aren't particularly elegant.

As tool-based apps, both Alipay and Meituan have lackluster average daily usage times.

So, around 2023, both started aggressively developing short videos and gave them top-level access points.

If we dig deeper, Pinduoduo was probably an earlier pioneer in this regard.

With its "watch videos to earn coins" feature, Duoduo Video reportedly achieved impressive daily active users (DAU) and usage times.

The fact that so many platforms have adopted this model proves its effectiveness.

However, from a user's perspective, this clearly doesn't create any value. Instead, it becomes a traffic trap that users try to avoid.

Tap to Pay Isn't the Ultimate Solution

When we compare this to Tap to Pay, the latter seems much more promising.

It focuses on the core payment channel, creating differentiated value by better meeting user needs.

Huang Zheng of Pinduoduo likes to talk about "doing the right thing." Using this term to describe Alipay's Tap to Pay seems fitting.

I heard that last year, when Ant Group was evaluating year-end bonuses, the Tap to Pay project received a performance rating of four, and management praised it.

I've always believed it's an excellent product because the payment path is shorter and more convenient than scanning a code.

Today, Alipay's official account published a post titled "We 'Tap' One Billion Times a Day," announcing that users engage with the "Alipay Tap" feature over one billion times daily.

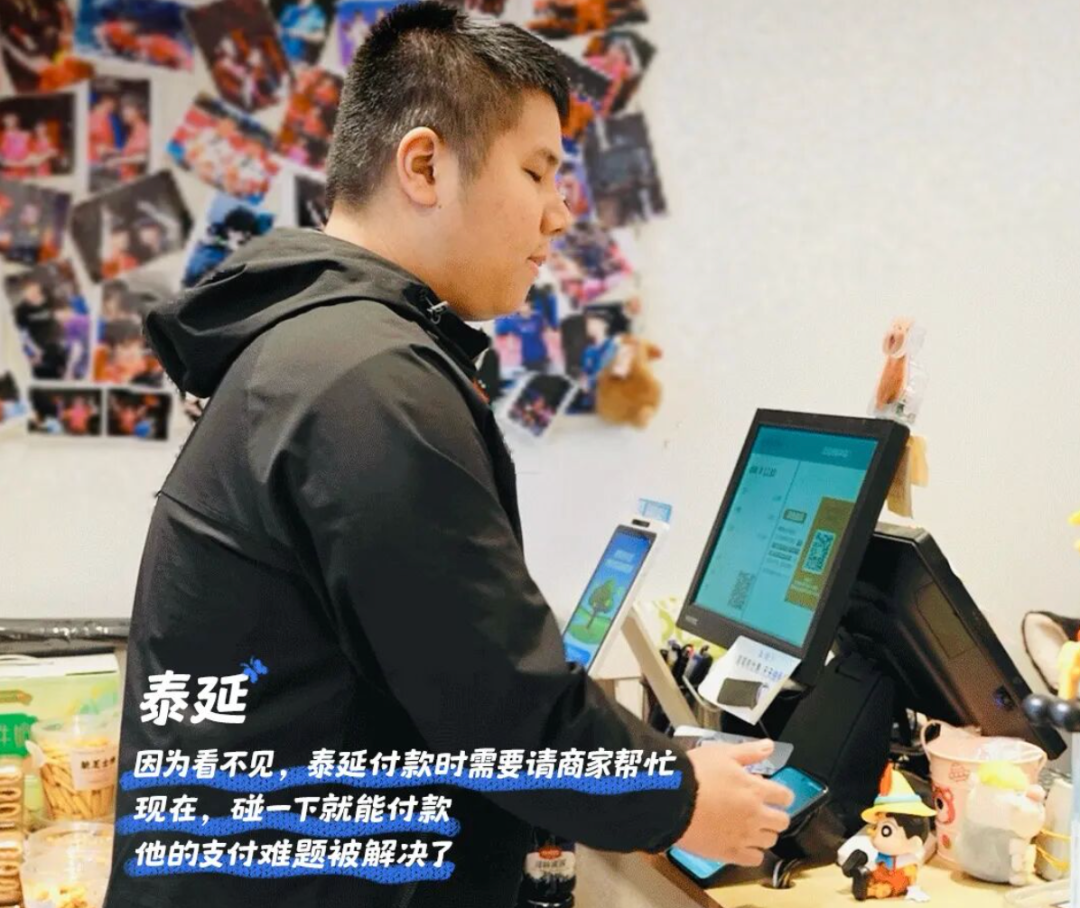

The official post also included a case study about a blind person, highlighting that Tap to Pay is more accessible for visually impaired users compared to scanning a code.

What does a daily transaction volume of one billion times signify?

According to previous media reports, in scenarios where both "Scan to Pay" and "Tap to Pay" are available, 80% of users prefer "Tap to Pay."

After over a year of intense promotion, Tap to Pay devices are now widely available.

Since "Tap to Pay" is used in offline transaction scenarios, we can roughly estimate Alipay's average daily offline transaction volume.

Unfortunately, both Alipay and WeChat Pay are tight-lipped about their business data, making further estimates impossible.

This is understandable.

WeChat Pay leads in market share, so announcing its numbers would be like setting up a target for competitors. There's no need for that.

As for Alipay, its business is under pressure, and the numbers aren't impressive, so there's even less reason to disclose them.

However, it's clear that according to third-party agencies like Analysys, Alipay's market share significantly lags behind WeChat Pay's.

Sheyan Caiguan cited Analysys data, stating that as of the first quarter of 2025, WeChat Pay's market share had reached 59.7%, while Alipay's had dropped to 36.2%.

Another observable aspect is that when promoting Tap to Pay, Alipay offered substantial incentives to both merchants and consumers.

In fact, every once in a while, when I almost forget about Alipay, I become an active user again due to Alipay's red envelopes, merchant reminders, and the desire to contribute to antitrust efforts in a simple way.

Today, Alipay no longer has the capability to counterattack WeChat Pay.

The significant incentives for users and merchants indicate that even maintaining its current position requires considerable effort.

This pressure will persist unless Alipay and Ant Group find new traffic entry points.

On November 18, 2025, Ant Group launched Lingguang, positioned as a general-purpose AI assistant.

This field clearly has the potential to become the next core entry point.

Doubao just announced it has surpassed 100 million DAU, while ChatGPT reported over 800 million weekly active users.

However, the competition in this field is so intense that Tencent Yuanbao spent billions on marketing but only managed to attract a few tens of millions of monthly active users.

Lingguang, along with its sibling Qianwen, which entered the market later, faces an uphill battle to stage a comeback.