Who is the most profitable company in the field of Zhipu AI?

![]() 10/29 2024

10/29 2024

![]() 621

621

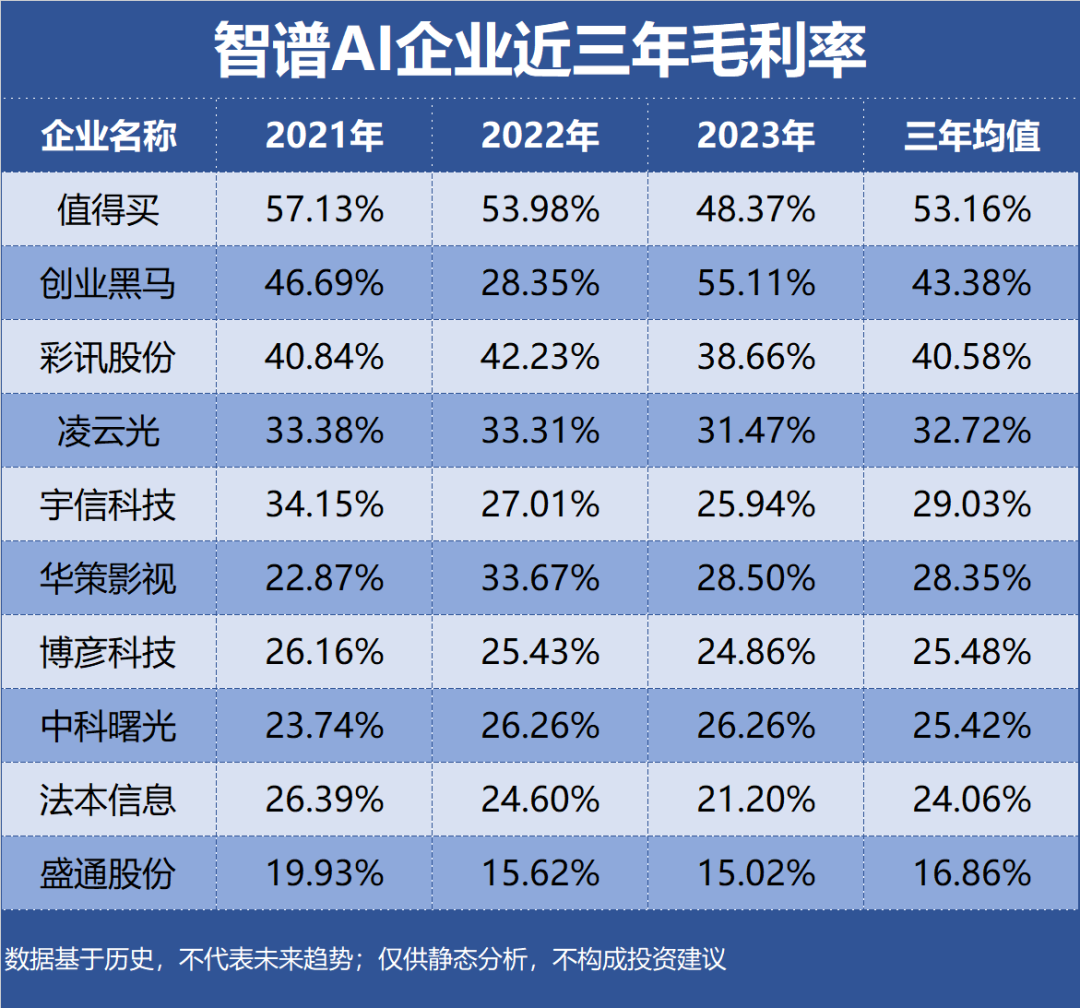

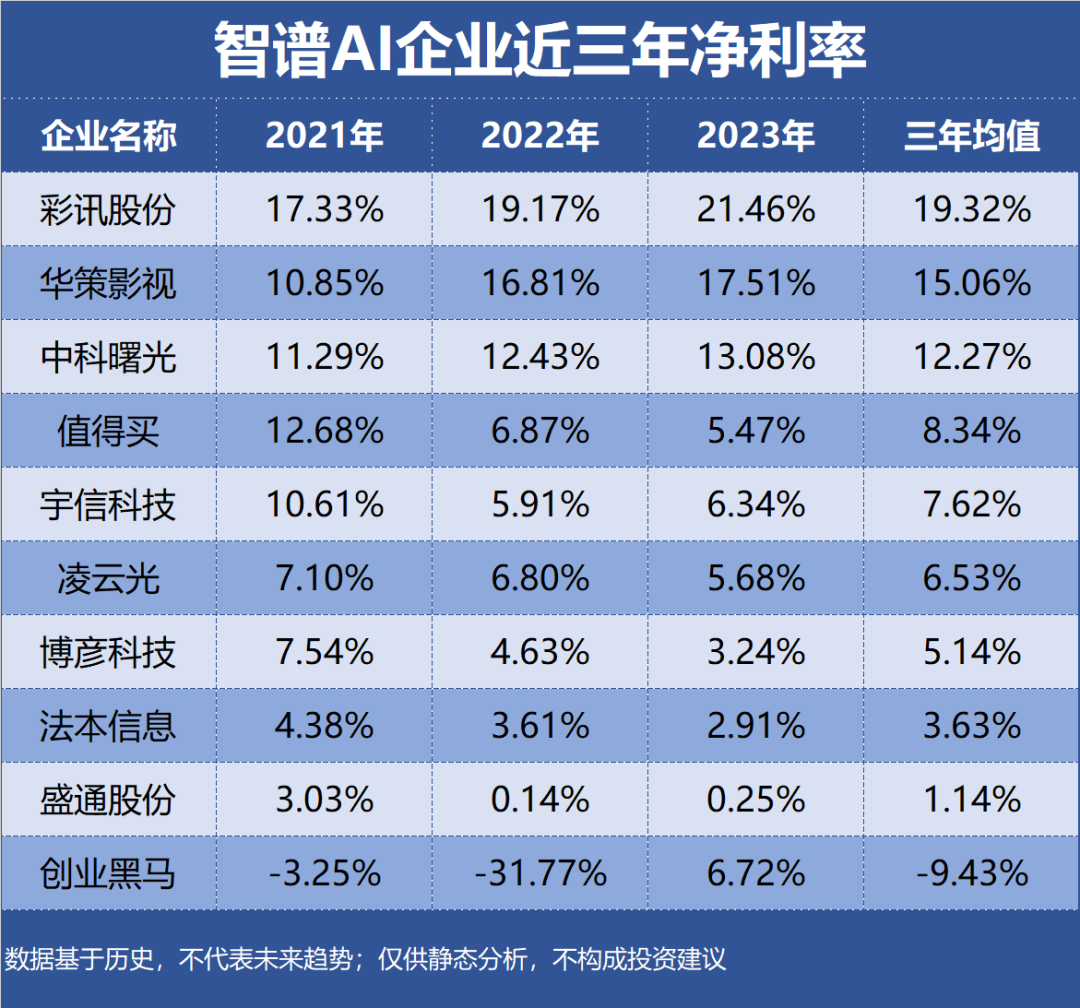

Zhipu AI has launched its autonomous agent AutoGLM, a mobile operation assistant that simulates user clicks on the screen and a browser assistant for web clicks. Currently, it is compatible with eight well-known applications such as WeChat, Taobao, Meituan, and Little Red Book. Profitability is typically measured by the amount and level of corporate earnings over a specific period. The analysis of profitability delves deeper into a company's profit margins. This article, part of the Enterprise Value series focused on "Profitability," selects 26 Zhipu AI enterprises as research samples, using indicators such as Return on Equity (ROE), Gross Margin, and Net Profit Margin for evaluation. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 Most Profitable Zhipu AI Companies:

10th: Shengtong Printing Industry Segment: Printing Profitability: ROE 1.81%, Gross Margin 16.86%, Net Profit Margin 1.14% Earnings Forecast: Highest ROE in the last three years was 4.80%, latest forecast average is 1.42% Main Products: Comprehensive printing services, with publishing printing as the primary source of revenue accounting for 68.28% of total revenue and a gross margin of 11.16% Company Highlight: Shengtong has developed an internal beta version of its "Shengtong Education Learning Assistant" using Zhipu AI's ChatGLM API.

9th: Lingyun Optoelectronics Industry Segment: Other automation equipment Profitability: ROE 7.70%, Gross Margin 32.72%, Net Profit Margin 6.53% Earnings Forecast: ROE has declined consecutively over the last three years to 4.16%, latest forecast average is 4.32% Main Products: Machine vision products, contributing 69.53% of total revenue with a gross margin of 31.82% Company Highlight: In AI large models, Lingyun has invested in Zhipu Huazhang, integrating the ChatGLM large model with knowledge graphs, industrial intelligent manufacturing, and digital human applications.

8th: Huace Film & TV Industry Segment: Film and television animation production Profitability: ROE 5.99%, Gross Margin 28.35%, Net Profit Margin 15.06% Earnings Forecast: ROE has declined consecutively over the last three years to 5.52%, latest forecast average is 6.00% Main Products: Television drama sales, contributing 56.23% of total revenue with a gross margin of 63.37% Company Highlight: Huace Film & TV has invested in Zhipu Huazhang and signed a strategic cooperation agreement to jointly develop AI-generated film and television content and content review vertical models.

7th: Zhidemai Industry Segment: Portal websites Profitability: ROE 6.48%, Gross Margin 53.16%, Net Profit Margin 8.34% Earnings Forecast: ROE has declined consecutively over the last three years to 4.12%, latest forecast average is 5.14% Main Products: Information promotion services, contributing 43.43% of total revenue with a gross margin of 55.90% Company Highlight: In collaboration with Zhipu, Zhidemai provides APIs as developer tools, enabling Zhipu developers to participate in agent creation.

6th: Beyondsoft Industry Segment: IT services Profitability: ROE 8.77%, Gross Margin 25.48%, Net Profit Margin 5.14% Earnings Forecast: ROE has declined consecutively over the last three years to 5.51%, latest forecast average is 5.40% Main Products: R&D engineering, contributing 59.76% of total revenue with a gross margin of 23.04% Company Highlight: Beyondsoft collaborates with major model providers domestically and internationally, including Microsoft, Baidu, Alibaba, iFLYTEK, Zhipu Qingyan, and Baichuan AI, on ecosystem and technology initiatives.

5th: Yuxin Technology Industry Segment: IT services Profitability: ROE 10.17%, Gross Margin 29.03%, Net Profit Margin 7.62% Earnings Forecast: ROE has fluctuated between 6% and 16% over the last three years, latest forecast average is 7.55% Main Products: Software development and services, contributing 81.52% of total revenue with a gross margin of 35.38% Company Highlight: Yuxin Technology has signed a large model cooperation agreement with Zhipu Huazhang, focusing on technological innovation, business synergy, and the joint construction of platforms and ecosystems.

4th: Caixun Industry Segment: IT services Profitability: ROE 10.65%, Gross Margin 40.58%, Net Profit Margin 19.32% Earnings Forecast: ROE has increased consecutively over the last three years to 13.34%, latest forecast average is 10.99% Main Products: Technical services, contributing 78.20% of total revenue with a gross margin of 42.72% Company Highlight: The next-generation intelligent email product demo from Caixun integrates with foundational large models such as Wenxin ERNIE Bot, Baichuan AI, Zhipu ChatGLM, and Kimi, enabling smart email writing, replying, summarizing, and organization.

3rd: Sugon Industry Segment: Other computer equipment Profitability: ROE 10.02%, Gross Margin 25.42%, Net Profit Margin 12.27% Earnings Forecast: ROE has increased consecutively over the last three years to 10.30%, latest forecast average is 10.68% Main Products: IT equipment, contributing 89.74% of total revenue with a gross margin of 24.72% Company Highlight: Sugon collaborates with Zhipu and other AI vendors to provide high-performance computing resources for the industrialization of artificial intelligence.

2nd: CYZONE Industry Segment: Training and education Profitability: ROE -3.29%, Gross Margin 43.38%, Net Profit Margin -9.43% Earnings Forecast: Highest ROE in the last three years was 2.77%, latest forecast average is 9.21% Main Products: Corporate services, contributing 50.94% of total revenue with a gross margin of 57.77% Company Highlight: CYZONE has signed a Strategic Cooperation Agreement with Zhipu Huazhang, focusing on the application and service projects of generative AI large models in digital governance and corporate services.

1st: Faben Information Industry Segment: Vertical application software Profitability: ROE 9.52%, Gross Margin 24.06%, Net Profit Margin 3.63% Earnings Forecast: ROE has declined consecutively over the last three years to 7.37%, latest forecast average is 8.61% Main Products: Development and programming services, contributing 44.58% of total revenue with a gross margin of 19.21% Company Highlight: Faben Information has established ecological collaborations with mainstream large model companies such as Zhipu AI and Alibaba, developing products like FarAI GPTCoder (intelligent assisted programming), FarAI GPTChat (knowledge base), and FarAI GPTRecruit (intelligent recruitment).

ROE, Gross Margin, and Net Profit Margin of the Top 10 Most Profitable Zhipu AI Companies Over the Last Three Years: