Where Will AI Opportunities Lie in 2025? An In-Depth Look at the Top 10 AI Trends

![]() 01/13 2025

01/13 2025

![]() 528

528

Artificial Intelligence (AI) stands as a cornerstone technology within the realm of cutting-edge science and technology. Today, AI permeates the globe, industry, and all sectors alike. Indeed, AI has firmly established itself as the central theme of technological development.

Despite numerous comparisons, ranging from its initial likening to the Internet revolution, to subsequent analogies with the electrical (third industrial) revolution, and now the most ambitious claim: the second revolution of Earth's civilization.

Regardless, the impact and influence of AI are profound, even to the point of being discussed in a science fiction context.

AI is not science fiction; it is, first and foremost, science. It is then a project and, ultimately, becoming an industry.

This signifies that AI not only observes and learns but also predicts—or, more accurately, we stand at the forefront of new advancements and information, at the nexus of industry, academia, and research, summarizing and illustrating the technical trends transitioning from academic research to industrial transformation, presenting them to all.

Access the full "2024 Annual Top 10 AI Trends Report" at the end of this article.

QuantumBit Intelligence's "2024 Annual Top 10 AI Trends Report" analyzes the cutting-edge dynamics and future directions of the AI field. Let's delve into these ten trends together to gain insights into where AI opportunities lie in 2025.

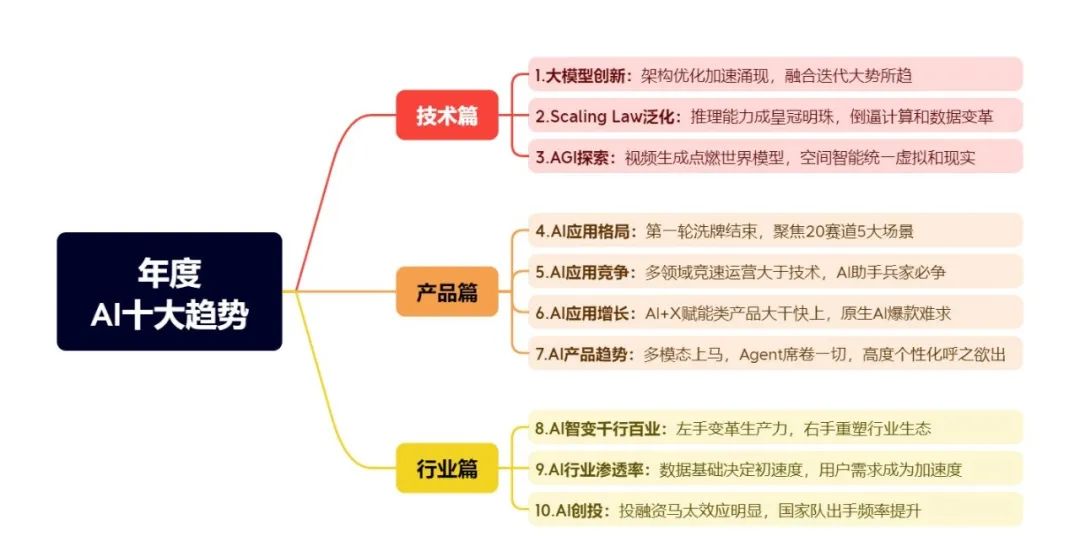

Trend 1: Large Model Innovation: Accelerating Architectural Optimizations, Fusion, and Iteration as the General Trend

Trend 2: Generalization of Scaling Law: Reasoning Ability Becomes the Crown Jewel, Forcing Changes in Computation and Data

Trend 3: AGI Exploration: Video Generation Ignites World Models, Spatial Intelligence Unifies Virtual and Reality

Trend 4: AI Application Landscape: The First Round of Shuffling Ends, Focusing on 20 Tracks and 5 Major Scenarios

Trend 5: AI Application Competition: Multi-Domain Racing with Operations Outweighing Technology, AI Assistants as a Must-Win Battleground

Trend 6: AI Application Growth: AI+X Empowerment Products Moving Quickly, Native AI Blockbusters Hard to Find

Trend 7: AI Products: Multi-modality Takes Off, Agents Sweeping All, High Personalization on the Horizon

Trend 8: AI Transforming Thousands of Industries: Revolutionizing Productivity with One Hand, Reshaping Industry Ecosystems with the Other

Trend 9: AI Industry Penetration: Data Foundation Determines Initial Speed, User Demand Becomes Acceleration

Trend 10: AI Venture Capital: Pronounced Matthew Effect in Investment and Financing, Increased Frequency of State-backed Investments

01 Technological Trends

Trend 1

Large Model Innovation: Accelerating Architectural Optimizations, Fusion, and Iteration as the General Trend

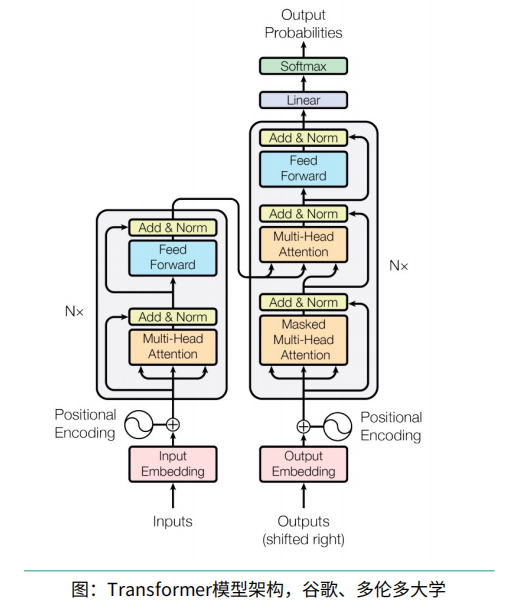

The Transformer architecture is currently the most widely used mainstream model, with the Self-Attention (SA) mechanism at its core. This allows the model to perform parallel computations, directly capturing the association weights between any two positions in a sequence, significantly increasing its capability. However, this also exponentially increases computational demand, complexity, and resource consumption, quickly hitting limits in large-scale tasks.

Since 2024, with the rapid scaling of large model parameters and deep training and deployment, the Transformer's drawbacks have become more pronounced, driving global compute shortages and posing challenges for edge deployment. In search of breakthroughs, innovative exploration of large model architectures has become a trend that cannot be ignored.

Seven years after the introduction of the Transformer architecture with "Attention Is All You Need," the AI industry's reliance on it has sparked debates about obsolescence, reflecting an urgent need for architectural innovation.

Since 2023, models like RWKV and Mamba have sparked heated discussions, and various new architectures have accelerated their emergence. Scholars worldwide are innovatively integrating characteristics of other architectures while retaining Transformer's advantages, challenging its dominance. Hybrid models that draw on various strengths have become the future trend.

Trend 2

Generalization of Scaling Law: Reasoning Ability Becomes the Crown Jewel, Forcing Changes in Computation and Data

In 2020, GPT-3 introduced the first generation of Scaling Law, guiding us to find the optimal solution for model performance among parameters, datasets, and computational volume. In 2024, models with powerful reasoning abilities, like o1, shifted our focus from rapid generation and training to deeper reasoning. Initially, Scaling Law focused on parameter counts, raising concerns about ineffectiveness; but the new Scaling Law has evolved, sparking concerns about multi-card clusters, synthetic data, and optimal compute resource allocation.

Our focus on Scaling Law and its generalization in the current AI era includes:

• Driving the construction of multi-card clusters and high-performance networks under parameter and computational expansion.

• Rational use of synthetic data amidst data depletion.

• Pursuing higher reasoning abilities in large models, with resources倾斜 towards post-training and reasoning computational power.

Trend 3

AGI Exploration: Video Generation Ignites World Models, Spatial Intelligence Unifies Virtual and Reality

In video generation, diffusion models have achieved remarkable results, with DiT (Diffusion Transformer) attracting the most attention. In world models, researchers aim to develop models that simulate and understand the real world, with the ability to emerge with new behaviors and decision-making capabilities through learning. Embodied intelligence, closely related to world models, has moved from concept to implementation, with players focusing on dexterity, control precision, and perception technology.

Spatial intelligence, closely related to both, refers to machines' ability to perceive, reason, and act in three-dimensional space and time, aiming to combine virtual world computation and manipulation with embodied intelligence's ability to reach the real world.

02 Product Trends

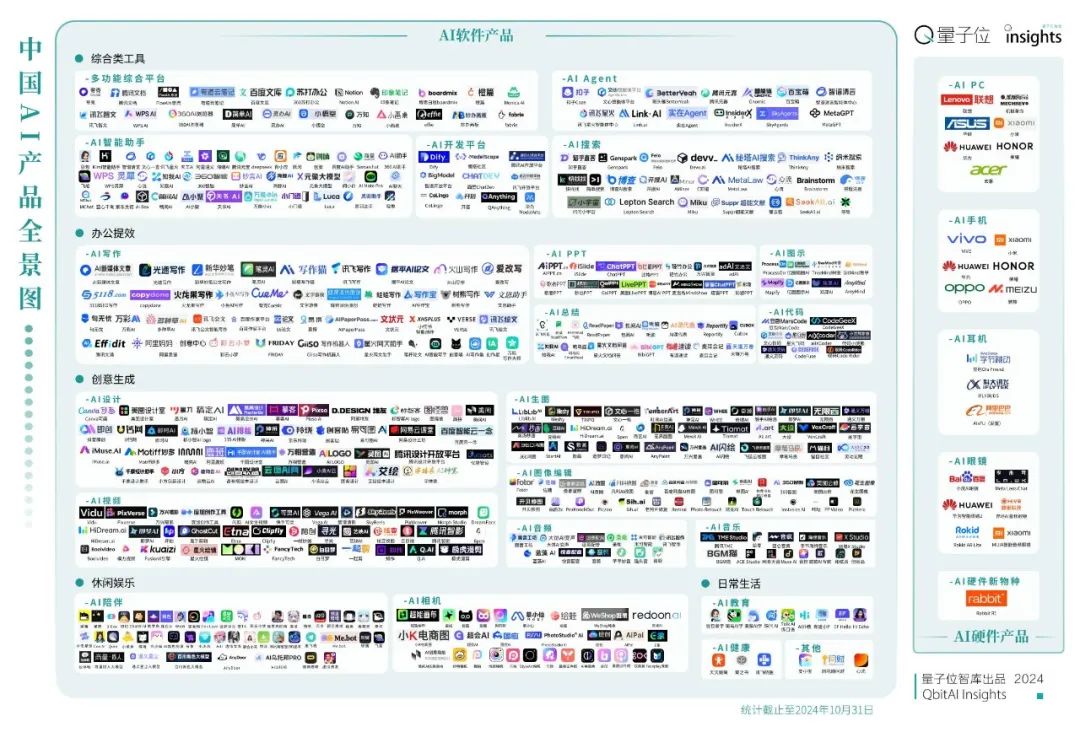

To observe domestic products' current status, QuantumBit Intelligence researched over 400 representative products.

Trend 4

AI Application Landscape: The First Round of Shuffling Ends, Focusing on 20 Tracks and 5 Major Scenarios

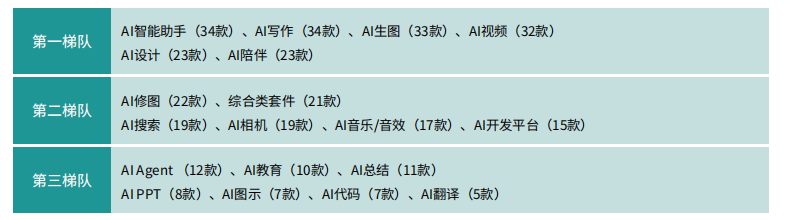

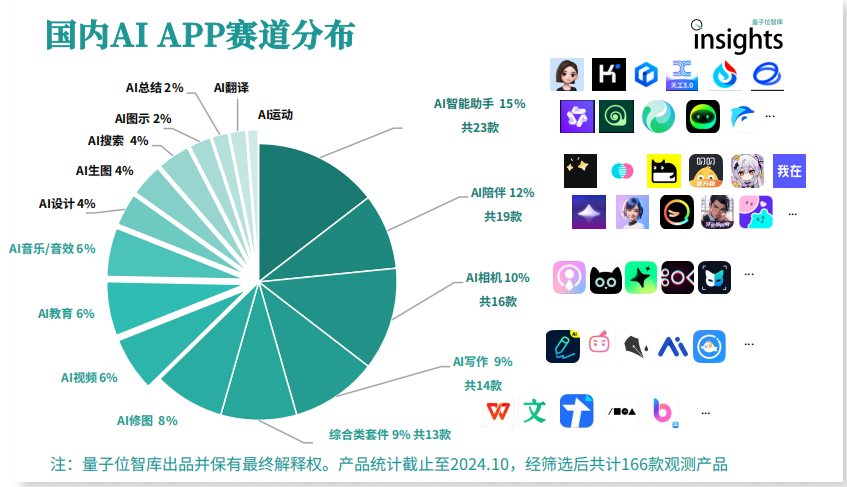

These 400 products can be divided into 20 categories: AI Smart Assistants, AI Companions, AI Cameras, AI Writing, Comprehensive Suites, AI Photo Editing, AI Video, AI Education, AI Music/Sound Effects, AI Design, AI Image Generation, AI Search, AI Diagramming, AI Summarization, and AI Translation. Each category has produced representative products with different development characteristics.

AI Smart Assistants are the most prominent AI native products, reflecting domestic model R&D capabilities. Within this category, Doubao leads. AI Companions, though widely noticed, have weak overall growth, with top products like Xingye and Maoxiang still distant from Killer APPs.

AI Search has become a new business focus, including native AI searches like Mita AI Search and AI-enhanced searches like Nano Search and Quark Browser, as well as business AI searches like Zhihu Direct and Xiaohongshu Da Vinci.

Based on usage scenarios, products can be divided into five categories: all-purpose, work efficiency, creative generation, leisure and entertainment, and daily life, with 65, 105, 125, 43, and 24 products respectively.

Trend 5

AI Application Competition: Multi-Domain Racing with Operations Outweighing Technology, AI Assistants as a Must-Win Battleground

Overall, no mobile app or web product has crossed the Internet era threshold, with a gap of over five times compared to overseas counterparts. Domestic regulatory requirements restrict product performance, leading to poor user experience. Domestic payment loops have not formed, leading to homogenized competition, reducing users' willingness to pay and limiting startups' investment and development, forming a vicious cycle.

Mobile App End

From January to October 2024, 8 mobile apps achieved cumulative new downloads exceeding 10 million: Kimi Smart Assistant and Baidu Brain with over 50 million, WPSOffice with over 20 million, and Tianwen AI, Xingye, Wenxiaoyan, Tencent Docs, and Alibaba Tongyi with over 10 million. Canva's new downloads approached 10 million.

Web End

From January to October 2024, 7 web products had over 10 million new downloads, including 3 multifunction suites and 4 AI Smart Assistants. Globally, 67 web-based AI products have monthly visits exceeding 10 million, with domestic products accounting for about 10%.

Quark, an AI Smart Assistant, has over 70 million total visits, ranking globally within the top 10. ChatGPT leads with over 3.5 billion visits, followed by Bing with over 1.8 billion. The second and third places are office products: Tencent Docs with about 36 million and Baidu Brain with about 28 million.

The top AI native product is Kimi Smart Assistant, with visits around 28 million. Initially positioned as an AI assistant capable of reasoning and deep thinking, it has launched an exploratory version with stronger complex problem-solving abilities. The next three places are also AI Smart Assistants: ERNIE Bot, Doubao, and Tongyi.

Trend 6

AI Application Growth: AI+X Empowerment Products Moving Quickly, Native AI Blockbusters Hard to Find

Currently, AI products include AI native products using AI as the underlying design logic, AI+X products deeply embedding AI functions in existing Internet products, shell-type products based on minor innovations using external APIs, and aggregated site products assembling multiple product/model APIs.

Due to tighter integration with business processes and clear demand identification, AI+X products' overall data performance is significantly better than AI native products, with office software and content platforms as key areas of focus.

For office software, varying degrees of AI writing functions, such as continuation, rewriting, and propositional writing, as well as AI summarization for different topics like papers and novels, have become standard features.

Products like Baidu Brain and WPS AI, providing templates and reference content, have performed more prominently. Since AI results' effectiveness directly affects the product's core user experience, these products emphasize specific function accuracy.

In content platforms, AIGC develops from three directions: AI search based on platform content, AI success functions and templates driving UGC, and content creation tools with further reduced thresholds.

Based on this analysis, QbitAI Think Tank offers three pivotal suggestions for AI-native products: seamless scenario integration, a streamlined user experience, and the fostering of brand trust and promotion.

Trend 7

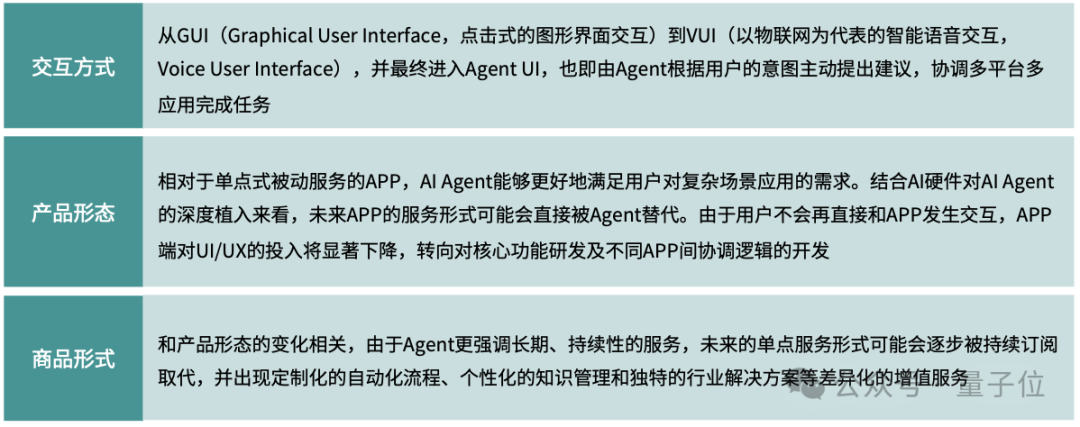

AI Products: Comprehensive Multimodal Deployment, Agents Sweeping Across Sectors, and the Dawn of Highly Personalized Features

With the rapid evolution of models' ability to process image and video data, it is anticipated that by 2025, AI will engage in more sophisticated multimodal interactions, enabling collaboration through various perception channels, including IoT and specific information.

Multimodal input and output render AI interactions more dynamic, frequent, and versatile, significantly elevating the overall standard of AI products.

As intelligent agents that integrate perception, analysis, decision-making, and execution, Agents can proactively offer suggestions, reminders, and personalized execution functions tailored to users' past behaviors and preferences, providing a highly personalized task-handling experience. Their proactive and automated interactions significantly surpass those of current tools.

From a technological and infrastructural standpoint, AI Agents are poised for widespread adoption starting in 2025. QbitAI Think Tank believes that AI Agents will usher in unique interactive styles, product forms, and business models that are distinctively characteristic of the AI 2.0 era.

From personalized recommendations to the direct creation of personalized content, AIGC can profoundly enhance the level of personalization in user experience, aiding products in further improving user satisfaction and achieving differentiated pricing and enhanced service value by boosting user loyalty and migration costs. This holds great significance for products' competitive differentiation.

Currently, high personalization driven by AIGC has made significant strides in fields such as AI education (personalized question banks and teaching schedules), AI companionship (AI personal assistants and virtual partners), and AI marketing (personalized product recommendations and personalized content creation for marketing purposes). Multiple AI smart assistants integrated into hardware devices have also begun to focus their promotional efforts on highly personalized assistant services.

03 Industry Trends

Trend 8: AI Transforms Various Industries: Enhancing Productivity and Reshaping Industry Ecosystems

Currently, AI presents two primary scenarios in industrial applications: AI+ and AI-native.

In the AI+ scenario, AI primarily functions as a productivity tool, permeating various aspects of an industry. In contrast, the AI-native scenario involves industries that develop inherently based on AI technology.

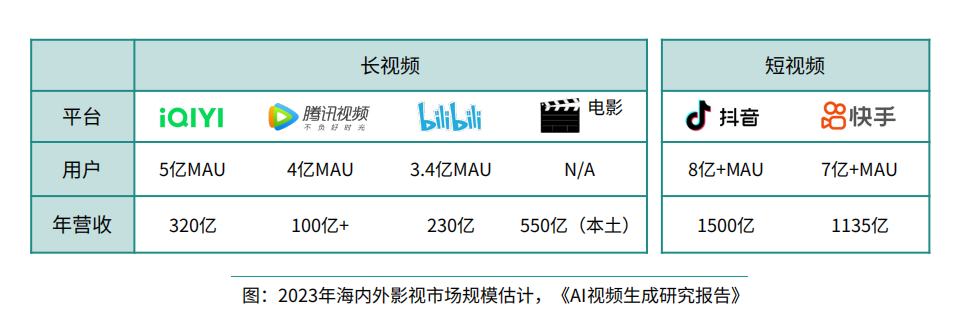

The report explores the implementation effects and industry characteristics of AI in eight scenarios: intelligent driving, embodied intelligence, smart hardware, gaming, film and television, marketing, education, and healthcare.

Trend 9: AI Industry Penetration Rate: Data Foundation Determines Initial Speed, User Demand Accelerates Growth

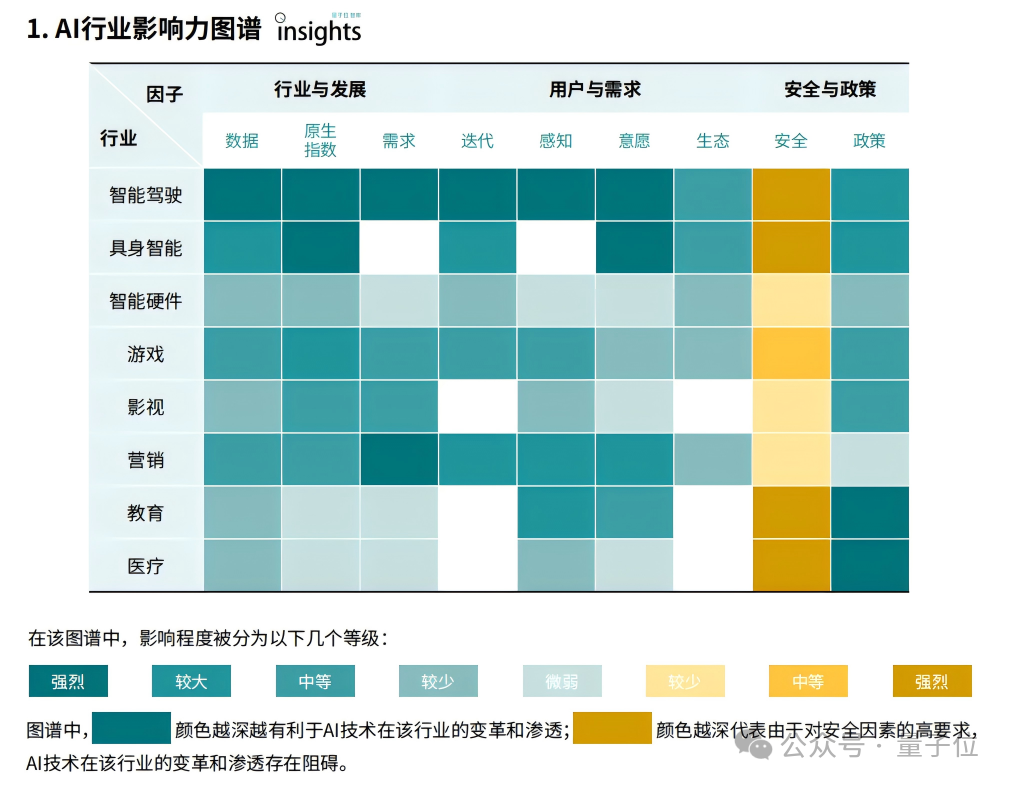

In the report, QbitAI Think Tank summarizes the key factors influencing AI's penetration into industries into three scenarios and nine major factors, decoding the immutable laws governing industry development.

Taking the eight representative industries depicted in the following figure as examples:

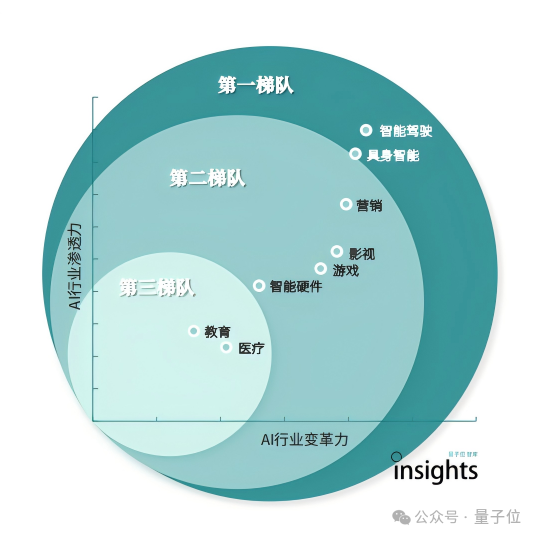

From the AI Industry Influence Map, it is evident that at the current stage, AI's penetration and resulting transformations of various industries exhibit three distinct ecological positions:

The first tier comprises the intelligent driving and embodied intelligence industries, which have stringent demands and strong synergies with AI technology, demonstrating a robust correlation.

The second tier includes the marketing, gaming, film and television, and smart hardware industries. The first three achieve cost reduction and efficiency enhancement in production and deeply integrate workflows through AI technology; the smart hardware industry is expected to drive industry upgrades through AI technology.

The third tier encompasses fundamental industries such as education and healthcare. These industries actively embrace AI technology with policy support while maintaining high standards for security and controllability.

Overall, the penetration and transformative power of AI technology in different industries are influenced by various factors, with the industry's data foundation and user demand emerging as key determinants.

Trend 10: AI Venture Capital: Pronounced Matthew Effect in Investment and Financing, Increased National Team Investment Frequency

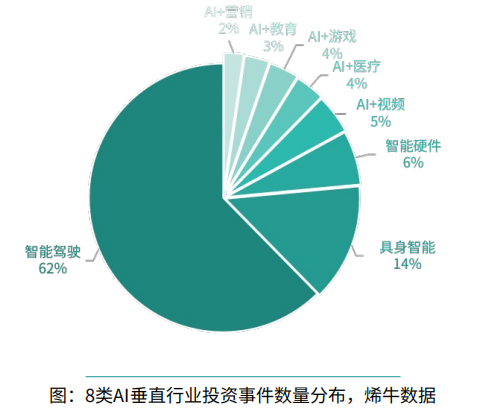

In 2024, amidst a persistent global downturn in venture capital, the AI industry exhibited resilience with countercyclical growth. According to Xiniu Data, from January to November 2024, there were 908 financing events in the domestic AI industry, totaling 76.223 billion yuan. Compared to the same period last year, the number of financing events decreased by 19%, while the total amount increased by 29%.

This shift reflects a return to rational investment in the industry, with institutions becoming more cautious and risk preferences generally becoming more conservative. As a result, fund flows concentrate on hot sectors, preferring larger individual investments in established market-leading startups. Additionally, the rapid evolution and increasing maturity of the AI industry have objectively contributed to the rise in total investment amounts through significant financing events for some star projects. Gao Rong Capital noted that overall AI investment surged this year, with AI remaining the strongest fund-attracting sector globally, and new investment targets emerging from the spin-offs and re-entrepreneurship of AI giant teams.

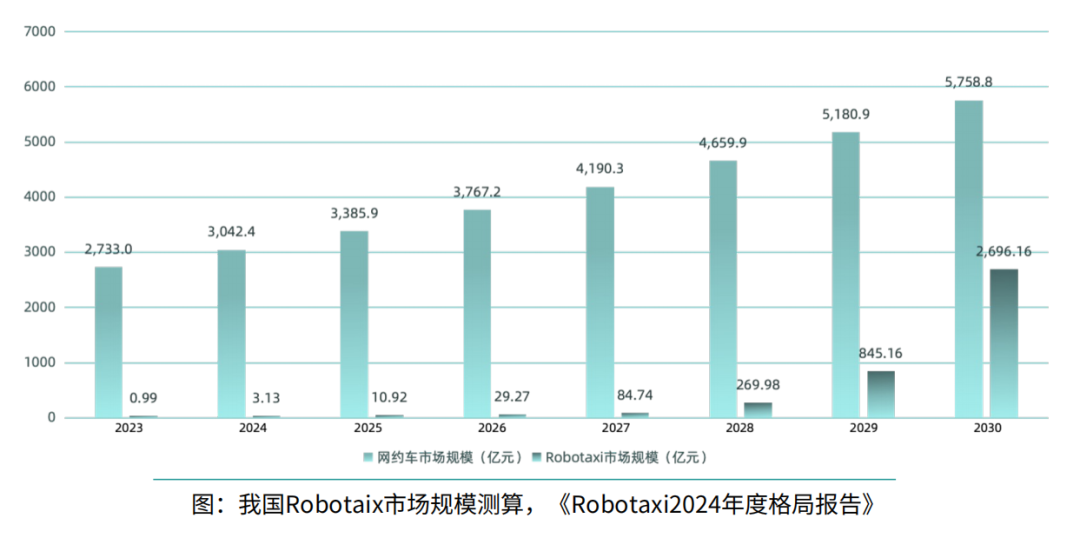

From the perspective of investment and financing in the eight key AI vertical sectors, the intelligent driving sector alone accounts for hundreds of investment events, surpassing the combined total of all other sectors. The total investment amount reaches tens of billions of yuan, dwarfing other sectors in magnitude. This sector is the most mature, with 14 enterprises reaching post-C round financing.

Investment enthusiasm is shifting towards sectors that achieve Technology Product Fit (TPF) later. As AI technology and industry maturity evolve rapidly, institutions are gradually showing stronger investment interest in sectors with greater technical challenges and stronger barriers.

In terms of policy, due to the government's long-standing focus on AI technology and its implementation across various industries, particularly its active promotion of AI-native industries, cities like Beijing, Shanghai, and Wuhan have introduced a series of policies to attract AI-related talent and enterprise set-ups. Simultaneously, the frequent investments by national teams reflect policy encouragement and support.