Behind Roborock's Q1 Net Profit Plunge: Chang Jing's Mindset Shifts

![]() 05/11 2025

05/11 2025

![]() 636

636

By Leon / Edited by cc Sun Congying

Amidst the brutal reshuffling of the new energy vehicle sector, brands such as WM Motor and Aiways have faded into obscurity, while Arcfox and NIO grapple with operational challenges. 'Cross-border car manufacturing' has lost its allure, becoming a quagmire that drains corporate funds and energy. For listed companies, any misstep can plunge them into a performance crisis. As consensus emerges that the new energy vehicle market is a red ocean of fierce survival battles, Roborock's founder, Chang Jing, has bucked the trend by entering the market with Geest Auto. His decision to venture into car manufacturing is exacerbating challenges already faced by Roborock's core business.

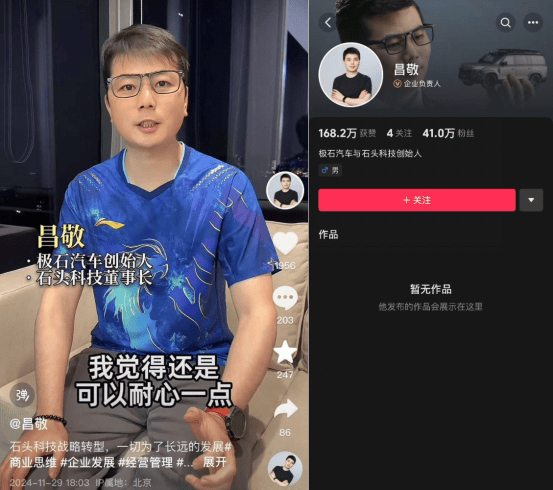

In mid-April 2025, Chang Jing unexpectedly cleared his social media accounts on Weibo and Douyin, sparking immediate public speculation. On April 30, Geest Auto's legal department addressed rumors of the 'founder's departure' and 'corporate bankruptcy', clarifying that it was merely a personal account management decision.

Coincidentally, on the same day, Roborock released its first-quarter 2025 performance report, revealing a significant decline in net profit, directly triggering severe stock price fluctuations. This temporal overlap inevitably fuels speculation about the reasons behind Chang Jing's 'temporary retreat'.

Previously, Chang Jing attempted to reassure Roborock's shareholders through short videos, urging patience. However, these remarks failed to alleviate investor anxiety and instead invited more questions and criticism. Since listing on the STAR Market in February 2020, Roborock's share price has plummeted from over 1,000 yuan to around 200 yuan per share, with its market value significantly shrinking. In the first quarter of 2025, the company's net profit fell sharply by over 30% year-on-year. Against the backdrop of sustained pressure on its core business performance, Chang Jing's persistence in investing in car manufacturing raises doubts among shareholders and investors: Is Roborock's current predicament a temporary developmental hurdle, or a result of the founder diverting attention and resources from the core business to cross-border car manufacturing? This risky venture into cross-border car manufacturing is putting Roborock and its investors through an unprecedented test.

Roborock's Q1 Net Profit Dives, Cash Flow Drops by 118.09%

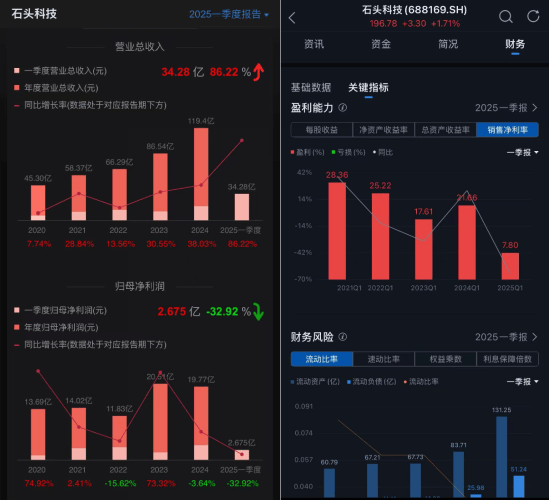

Roborock's first-quarter 2025 performance presented stark contradictions: revenue surged 86.22% year-on-year to 3.428 billion yuan, demonstrating robust market expansion, but net profit attributable to shareholders fell sharply by 32.92% to 267.5 million yuan. The net profit margin on sales plummeted from 21.66% in the same period last year to 7.8%, reflecting a significant deterioration in profit quality. More worryingly, net cash flow from operating activities, a measure of a company's financial health, recorded a negative 42.1867 million yuan, with a year-on-year decline of 118.09%, exposing severe challenges in cash flow management and profit sustainability. This juxtaposition of scale growth and profit contraction casts a shadow over the company's future.

Roborock explained in its report that the decline in net profit was due to increased investments in market expansion and technological research and development, leading to higher sales and R&D expenses. Additionally, to gain market share for new product categories during the introductory phase, sales expenses surged. As the company's sales scale expanded and its channel structure adjusted, inventory increased, resulting in a decline in net cash flow from operating activities.

Financial statements show that Roborock's sales, management, and R&D expenses all increased during the reporting period compared to the same period last year, with R&D investment up 36.90% year-on-year and sales expenses surging by 169.2%, significantly exceeding the current period's net profit.

According to industry insiders speaking to The Wall Street Tech Eye, the surge in Roborock's sales expenses is attributed to increased marketing efforts, particularly in overseas markets, including traffic acquisition and advertising in the North American online market. For example, its robotic arm vacuum cleaner, the main product promoted in the first quarter, was featured in cooperative promotion content on many prominent American technology websites.

Roborock is making concerted efforts both online and offline in the European and American markets, relying on e-commerce platforms like Amazon to expand its market and establish a localized service system. Offline, it is deeply engaged with large retail stores such as Target and Best Buy, deploying over 2,000 experience terminals to further expand its market reach.

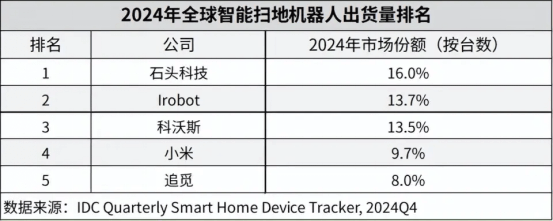

Roborock's aggressive expansion strategy in overseas markets began to materialize in 2024. Financial report data shows that overseas revenue soared to 6.388 billion yuan, accounting for 53.48% of total revenue, with a year-on-year increase of 51.06%. With this rapid growth, the company surpassed iRobot for the first time, securing a 16% market share and ranking first globally. However, behind this rapid market expansion were high costs: the gross profit margin of the overseas business fell sharply by 6.74% year-on-year, exposing the drawbacks of the 'trading profit for market' strategy. This strategy of sacrificing short-term profits for market share directly compressed the company's profit margin, leaving Roborock with the challenging task of balancing market capture and profit protection.

Chang Jing views this as an inevitable stage of development. He once explained in a video: 'Roborock is currently in a favorable position. With our current fundamentals, it won't take long to produce results.' In other words, he endorses this strategy.

Seeking Diversification with 400 Million Yuan, Encountering User Trust Challenges

To diversify business risks and expand its horizons, Roborock invested 400 million yuan in R&D funds to venture into the white goods market. This decision aims to explore new growth avenues through a diversified layout, respond to the slowing growth of the cleaning appliance market, and seek sustainable corporate development paths.

Last November, the company held a high-profile washing machine technology appreciation event, unveiling a series of products including full-size drum washing machines, dryers, wash-dry combo machines, and mini washing machines. Leveraging 'molecular sieve wash-dry' technology and high-level certification from the International Wool Bureau, it targeted the high-end laundry care sector.

Official data shows that during the 2024 Double 11 shopping festival, Roborock ranked first among cleaning appliance brands on AVC Revo and third in wash-dry combo machines. Its 1kg mini washing machine even topped the sales volume chart in the niche market in the third quarter of the same year. However, behind these impressive market performances lies the hidden concern of profitability challenges.

According to the head of Roborock's washing machine business, R&D investment in this category reached 400 million yuan in 2024. The financial report reveals that while other smart electrical appliances achieved revenue of 1.07 billion yuan, their gross profit margin of 33% was far lower than the 52.07% of smart sweeping robots and accessories. High operating costs severely compressed profit margins. Compared to the mature sweeping robot business, the revenue scale of the washing machine segment is only one-tenth of it. It not only requires continuous investment in R&D funds to enhance product competitiveness but also faces fierce competition from traditional white goods giants such as Little Swan, Haier, and Hisense in popular sectors like multi-tub partitioned washing machines. Currently, Roborock has yet to launch similar products, and the actual effects of its diversification transformation remain to be verified.

Notably, the new products encountered a crisis of trust upon market launch. In March this year, a rights protection video posted by Bilibili UP master 'Niu Lilian Menglu' thrust Roborock into the spotlight. The blogger accused Roborock's lingerie washing machine of design defects, displacement, and water leakage during operation, causing damage to other household appliances. Facing consumer compensation claims, Roborock only offered repair or replacement solutions, refusing to bear associated losses. This after-sales controversy not only exposed quality control shortcomings in the new business but also reflected that in the process of diversified expansion, Roborock has yet to establish a brand management and service system commensurate with its business scale. There is still a long way to go before achieving a truly growth-driving diversified synergy.

Founder Pursues Dreams in the Automotive Industry, Share Reduction in Roborock Sparks Controversy

The reputational crisis triggered by the after-sales controversy, coupled with the current unfavorable operating conditions, has put Roborock and its related parties under double pressure. The enterprise's difficulties have also filled shareholders with concerns about its future development prospects.

Roborock's first-quarter 2025 financial report data remains alarming: basic earnings per share plummeted from 2.18 yuan per share in the same period last year to 1.46 yuan per share. Such a significant decline in profitability undoubtedly makes shareholders feel the tangible loss of money. What worries investors even more is the distraction caused by founder Chang Jing's cross-border car manufacturing venture, making the market doubtful about his ability to fully devote himself to Roborock's core business. To make matters worse, the US tariff policy that took effect in April further exacerbated the company's cost pressure. The market is generally concerned that this will continue to compress net profit, thereby impacting share prices more severely. Amid multiple adverse factors, Roborock stands at a crossroads of performance and confidence challenges.

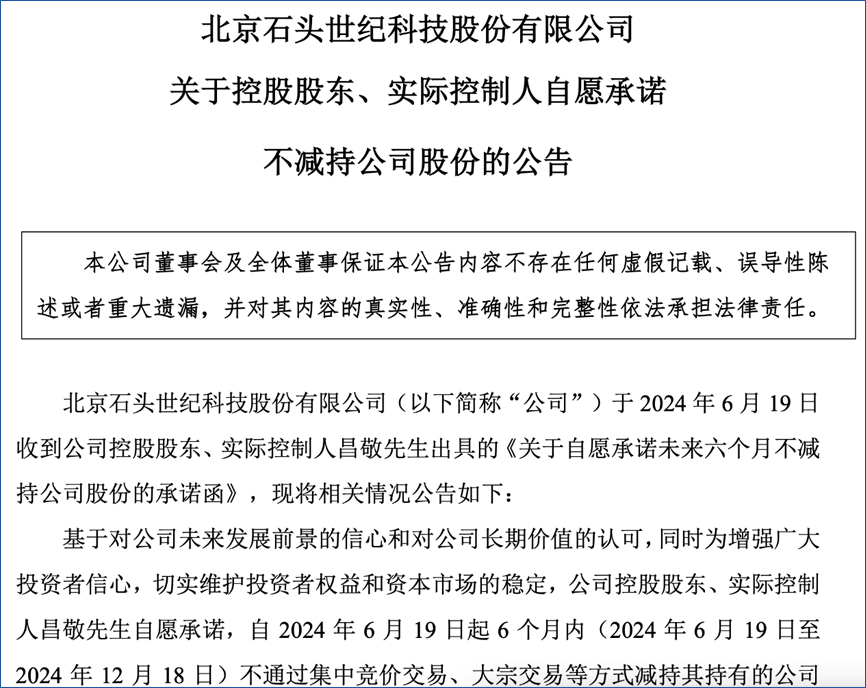

Public information shows that between 2023 and 2024, Chang Jing successively reduced his holdings of Roborock shares through centralized bidding and inquiry methods, realizing a total cash-out of 888 million yuan and reducing his shareholding ratio from 23.15% to 21.03%. This series of capital operations sparked strong reactions in the capital market. Most investors associate his share reduction with cross-border car manufacturing, believing that Chang Jing has shifted his focus to Geest Auto and his attention and investment in Roborock have continued to weaken.

Facing the double impact of the founder's share reduction and business focus shift, anxious shareholders have voiced their concerns: 'Mr. Chang, you can't just play with cars. Manage your Roborock. Investors have been crying for a month.' This anxious and helpless shout encapsulates the sentiments of many shareholders.

In response to market concerns, Roborock announced the launch of its first share repurchase plan in early April this year, intending to use the repurchased shares for employee stock ownership or equity incentives. It attempted to alleviate investor concerns by stabilizing the shareholding structure and boosting team confidence. However, this measure did not completely dispel market doubts. Coincidentally, Chang Jing suddenly cleared his social media accounts, sparking public speculation about his 'departure', further exacerbating market panic and plunging Roborock into a crisis of trust.

Before venturing into car manufacturing, Chang Jing's entrepreneurial journey was smooth, and he was once regarded as a model of Internet entrepreneurship among the post-80s generation. Despite not coming from prestigious universities, relying on his experience at Aoyou, Microsoft, and Tencent, as well as his keen instincts as a product manager, Chang Jing accurately navigated every trend: In the early days of mobile internet, he started his first venture and developed the first beauty app 'Magic Figure Fairy', which became a hit and was acquired by Baidu for $15 million, achieving financial freedom; In 2014, his second venture capitalized on the sweeping robot trend, earning Lei Jun's appreciation and investment, becoming a member of Xiaomi's ecosystem; In 2016, Chang Jing keenly predicted industry trends, launched self-developed LDS lidar + SLAM algorithms, and sought to gradually detach from OEM for Xiaomi, creating his own brand and going overseas, eventually achieving the industry's top position today.

However, Chang Jing's third venture does not seem as fortunate. Geest Auto's operating entity, Shanghai Luoke Intelligent Technology Co., Ltd., was established on January 8, 2021, and has completed six rounds of financing, raising over $4.5 billion (approximately RMB 32.5 billion). Investors include Tencent, IDG Capital, Sequoia Capital, among others, including a round of equity financing led by Tencent and IDG Capital.

Geest Auto's most recent funding round occurred in September 2023, following a $1 billion investment from Weiqiao Group. Since then, no new investors have stepped in. Given the well-known rapid burn rate in the automotive industry, the available funds of over 30 billion yuan may prove insufficient. It is therefore understandable that Chang Jing would seek to offload shares to ease cash flow pressures.

Although both Roborock and Geest Auto are crucial components of Chang Jing's business empire, Roborock, as a listed company, must meet the demands of numerous investors and adhere to regulatory requirements, leaving no room for negligence. Following Chang Jing's second round of share sales, questions emerged in the market. To reassure investors, Roborock promptly issued an announcement titled "Controlling Shareholder and Actual Controller Voluntarily Commit Not to Reduce Company Shares." The announcement clearly stipulates that Chang Jing will not reduce his holdings in the company, including through centralized bidding or block trading, for six months starting from June 19, 2024. This institutional commitment aims to alleviate market concerns about the founder's potential focus on automotive manufacturing at the expense of the core business.

Regarding JiShi Automobile's sales performance, the company's inaugural model, JiShi 01, debuted on August 22, 2023, priced between 299,900 and 359,900 yuan. Manufactured by BAIC, JiShi 01 is positioned as an outdoor luxury SUV equipped with a dual-motor four-wheel-drive extended-range electric system, offering a comprehensive driving range exceeding 1,115 kilometers. JiShi Automobile recently announced that total sales of JiShi 01 have surpassed 10,000 units, with 1,128 units delivered in April 2025, and stressed that "sales will continue to grow monthly throughout 2025."

To put things in perspective, JiShi Automobile achieving sales of over 10,000 units more than a year after its launch is hardly remarkable in the fiercely competitive landscape of new carmakers. Even considering the highest-priced variant, sales amount to only 3.6 billion yuan. In stark contrast, XPeng Motors has sold over 129,000 vehicles from January to April 2025, averaging over 32,000 units per month, according to data from China Automotive Data Research. In terms of sales scale and market performance, XPeng far outstrips JiShi Automobile, highlighting a clear gap between the two companies.

In an interview, Chang Jing acknowledged, "We are now prepared for a long-term battle, primarily focusing on increasing revenue and reducing expenses, exploring ways to boost sales and cut costs across all facets. As long as cash flow remains positive or funds are available in the account, there's nothing to worry about."

Chang Jing's mentioned "increasing revenue" strategy is evident in the expansion of overseas markets. Yan Feng, co-founder and CEO of JiShi Automobile, revealed in an interview last year that "overseas sales accounted for one-third of total sales," with a future goal of half of sales originating from international markets. JiShi Automobile has signed cooperation agreements with dealers from Iraq, Jordan, Oman, and Libya at last year's Guangzhou Auto Show.

Industry insiders perceive Chang Jing as a "product manager-type" founder whose approach differs significantly from most automotive industry pioneers. His low-key and pragmatic style is evident in JiShi Automobile's configurations, constituting one of its advantages. However, the new energy vehicle market has now entered a highly competitive knockout phase. The abrupt dissolution of Jiyue at the end of last year and Nezha Motors' bankruptcy crisis earlier this year underline the market's brutality, continuously compressing JiShi Automobile's survival space.

Currently, Chang Jing faces a critical juncture in business decisions. The new energy vehicle sector is akin to a bottomless "capital black hole," necessitating constant and substantial investments in research and development, production, and channel construction. With sales failing to achieve explosive growth and inadequate self-financing capabilities, the enterprise's survival heavily relies on external funding, echoing NIO's previous capital chain crisis. In the cleaning robot sector where he began, Roborock Technology also confronts severe challenges: To solidify its market position, it must continue to invest significantly in technology research and development and brand building, amidst relentless competition from strong players like iRobot and Ecovacs. This directly pressures the company's profitability at this stage. More critically, as the global cleaning appliance market gradually saturates, Roborock Technology urgently needs to identify new growth avenues for performance, with the looming pressure of transformation.

The multifaceted challenges on both fronts are rigorously testing Chang Jing's strategic decision-making prowess and resource allocation acumen.