Big Models Reignite Cloud Giants' Focus on To G

![]() 06/05 2025

06/05 2025

![]() 766

766

Once dismissed as a marginal business by cloud giants, the government cloud sector has transformed into a lucrative goldmine with the advent of big models like DeepSeek, prompting these giants to refocus on To G services.

Original Tech News AI Tech Team

In October 2019, Microsoft bested competitors like Amazon and Google to secure a $10 billion cloud computing project contract from the US Pentagon. Subsequently, Amazon filed a lawsuit, alleging improper pressure from then-US President Trump due to his bias against Amazon CEO Bezos. Ultimately, following the 2021 US government change, the Pentagon canceled the contract and re-tendered it. As the birthplace of cloud computing and the largest market, the US government cloud has long been a coveted prize for all major players. Around the same time, domestic internet cloud giants like Alibaba and Tencent were also pursuing smart city projects across various regions, with budgets ranging from tens of millions to even hundreds of millions, swiftly enriching their financial reports with data. However, in the execution of government and enterprise projects, the extensive customization requirements and manpower demands made cloud giants feel shortchanged. Coupled with the shift towards cost reduction and efficiency enhancement, government cloud projects were shelved by cloud giants. Today, with the wave of big models ignited by DeepSeek in China, "AI civil servants" are taking up positions in batches. According to relevant data, the DeepSeek big model has been deployed in 72 provincial or municipal government departments across eastern, central, western, and northeastern China, with 39 in the eastern region, accounting for 54%.

Simultaneously, the government sales teams of cloud giants are back in full swing. Relevant personnel noted that it feels like a return to the prosperity of seven or eight years ago. However, the government cloud market, which had momentarily relaxed its frontline, has been encroached upon by Huawei Cloud and several operator clouds that have come from behind. How should cloud giants reclaim their To G focus and regain lost ground?

01

Past "Marginal" Business

Back in 2012, the "Twelfth Five-Year Plan for National E-Government" first proposed the strategy of "prioritizing cloud computing services," thus embarking the domestic government cloud market on a vigorous and large-scale construction phase. According to research statistics from the third-party agency IDC, by 2022, the scale of China's government cloud market reached 50.052 billion yuan, becoming one of the top three racetracks in the cloud computing industry. In 2023, the National Data Administration was officially established, further accelerating the process of domestic cities' overall digital infrastructure construction. It was towards the end of 2023 that Alibaba Cloud began laying off its customized industry solution team for government and enterprise customers. This move is widely believed to be related to the strategic guidance of "prioritizing public cloud and reducing offline projects," forming a stark contrast to the booming situation a few years prior.

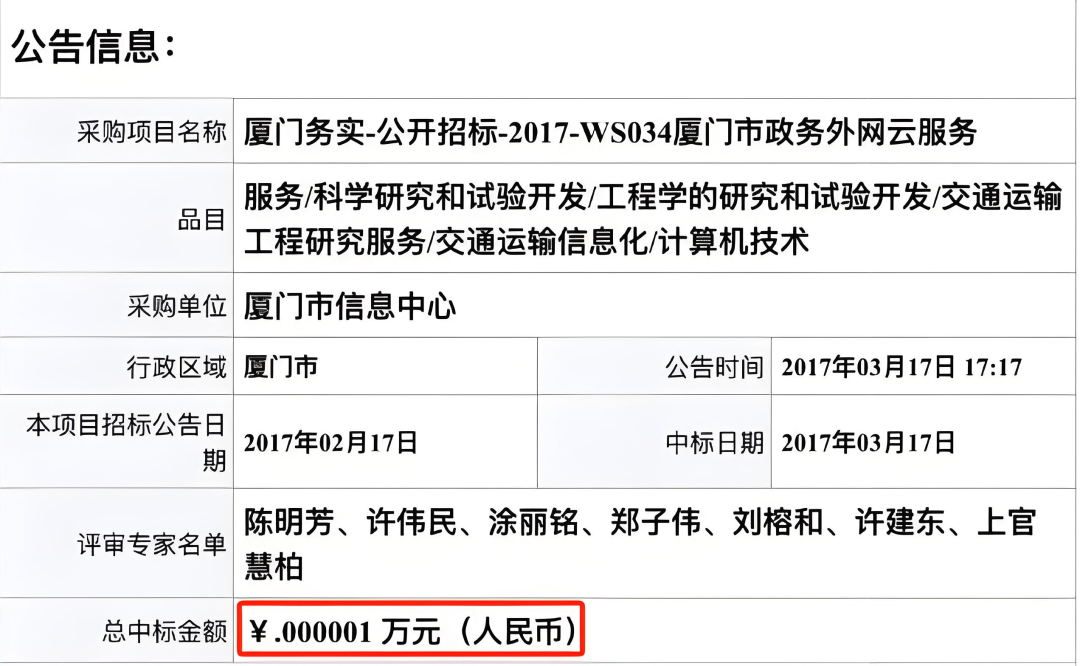

In fact, compared to later internet giants, traditional IT giants are more adept at serving government and enterprise projects. During the digitization process of various industries in China, overseas technology companies like IBM, HP, Dell, and Oracle were also the first to strike gold. However, since Amazon's cloud business AWS defeated IBM in 2013 and won a $600 million contract from the CIA, domestic To C internet giants also began incorporating cloud computing and government and enterprise racetracks into their sphere of influence. Among them, Alibaba, Tencent, and Huawei, along with several major operator clouds, emerged as the main players, with Alibaba Cloud forming a "one superpower and multiple strong powers" pattern. In the fierce competition within the government cloud market, the price bottom line was constantly breached. In 2016, the Wenzhou Municipal Government Office budgeted 1 million yuan for the government cloud platform project, and China Mobile, which participated in the bidding, won the bid at a price of 1 yuan per month; a year later, Tencent Cloud won the bid for the Xiamen Municipal Government Extranet Cloud Service Project for merely 0.01 yuan.

After securing market share regardless of cost, government cloud projects gradually revealed issues such as high customization costs, difficult effect statistics, and long payment collection cycles during implementation, leading to heavy accumulation of contradictions between the parties. In 2019, following a civil judgment by the Wuhan Intermediate People's Court in Hubei Province, the Wuhan Smart City project, which invested nearly 175 million yuan, was abandoned as an unfinished project. As the first smart city project of the international cloud giant Microsoft to land in China, it also failed to materialize. Domestic internet giants soon ushered in the end of the "era of disorderly expansion." Under strategic contraction, the government cloud project, akin to a marginal business, became the first to be cut. In contrast, Huawei, whose mobile phone business was hindered, and operators with stronger backing did not cease their efforts. By 2023, China Telecom (Tianyi Cloud), Huawei Cloud, Alibaba Cloud, China Mobile, Inspur, and others ranked high in China's public cloud market share for government affairs, while Tencent Cloud had faded from the forefront. However, the market potential of the government cloud remains a goldmine waiting to be tapped, but it temporarily does not align with the ambitions of cloud giants.

02

Big Models Revitalize the Government Cloud

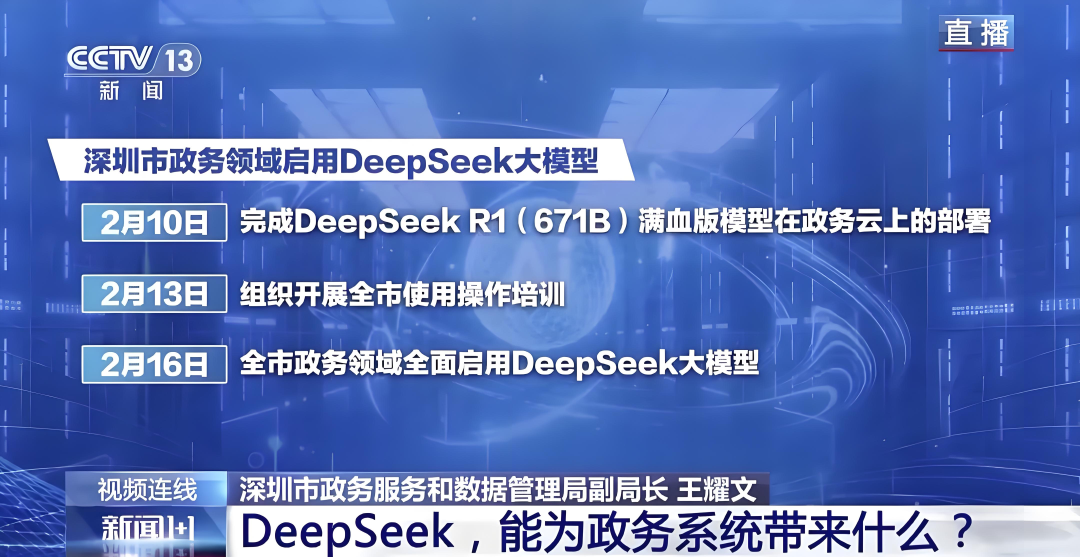

Having lost favor with major companies, the government cloud market, which temporarily simmered down, was unexpectedly reinvigorated by DeepSeek earlier this year. On February 8, Longgang District, Shenzhen, deployed and launched the DeepSeek-R1 full-size (671B) model, while neighboring Futian District went a step further, with the first batch of 70 AI digital employees developed based on DeepSeek officially "taking up positions." Subsequently, Guangdong, Jiangsu, Jiangxi, Inner Mongolia, and other regions announced the completion of the localized deployment of the domestic big model DeepSeek in the government system, covering core scenarios such as policy interpretation, document processing, people's livelihood services, and urban governance. As early as the beginning of 2024, IDC released "Analysis of China's Government Big Model in the Digital Government Application Market, 2024," predicting that by 2027, the application of generative AI in government will expand from task automation to decision support, enhancing citizen service response capabilities by 10% and civil servant productivity by 15%. DeepSeek's stunning debut has obviously accelerated the integration of government cloud and big models. In addition to Tencent Cloud, multiple cloud giants such as Alibaba Cloud, Baidu Cloud, and ByteDance's Volcano Engine have all lowered their profiles and swiftly accessed DeepSeek's open-source model to meet the continuous on-site inquiry demand. This is because government cloud projects have stringent requirements for data security and privacy, and are more inclined towards localized deployments with the technical support of reputable companies.

In fact, generative AI has been popular in China for two years, but there has always been a barrier between it and the government cloud market: large models developed abroad are clearly not suitable for government use; the construction of private cloud computing power platforms is also prohibitively costly. DeepSeek's domestic attributes, open-source model, and cost-effective characteristics just pierced through this final veil. An informed source revealed that the current mainstream choice for government units is to purchase graphics cards or configure stand-alone machines based on existing hardware equipment, with costs ranging from hundreds of thousands to millions of yuan. Taking DeepSeek R1 (671B) as an example, after optimization, the initial cost of stand-alone deployment is only a few hundred thousand to 2 million yuan. For cloud giants, the sudden surge in government and enterprise projects is also like a timely boost. Following multiple rounds of price reductions in the domestic large model market, it entered the pricing "cent era" last year.

On the last day of 2024, Alibaba Cloud announced an over 80% price reduction across the board for its Tongyi Qianwen visual understanding model. With the advent of DeepSeek, a representative of low-cost models, domestic large models in 2025 will continue to be entrenched in price wars. Therefore, the project-based To B and To G markets have become one of the few avenues for recovery. According to information compiled from public channels, as early as 2024, iFLYTEK, Wisdom Spectrum AI, and Baidu had already become frontrunners in the big model To G market. However, thanks to the frenzy of purchasing DeepSeek all-in-one machines, cloud vendors in the mid-tier such as QingCloud, UCloud, and Kingsoft have also witnessed a wave of value reassessment this year. Undoubtedly, the reconstruction of the government cloud market by big models and DeepSeek is still ongoing.

03

From Integration to Being Integrated

It's like a marginal business, unappealing yet regrettable to discard. Cloud giants' retreat from the government cloud was not a complete abandonment but a transformation of business models. At Tencent's internal employee conference at the end of 2022, regarding CSIG's (Cloud and Smart Industries Group) strategy of abandoning the role of integrator and instead becoming integrated with self-developed products, Pony Ma expressed his full support. "Don't let others ridicule us and say that your cloud has been surpassed by Huawei, and you are only the third (and there's nothing you can do about it)."

He encouraged employees to disregard external public opinion: "It doesn't matter! We're not in a hurry, don't get deceived." This may be linked to Li Qiang, the former SAP China general manager, joining Tencent in 2021 as president of the government and enterprise business. He once told Pony Ma that none of the companies that excel in TO B globally have grown large by relying on system integration; the core remains in making products. The popularity of the strategy of being integrated among cloud giants coincides with the rise of operator clouds. First, the state-owned background of major operators like China Telecom provides a natural advantage when bidding for government cloud projects; secondly, the sales network covering large and small administrative regions nationwide also gives operator clouds an edge in sinking markets such as county-level projects. Against this backdrop, operators have replaced the previous role of integrators played by large companies. After securing large government and enterprise orders, they subcontract them to Alibaba Cloud and Tencent Cloud, which have their respective strengths, to achieve complementary advantages and meet each other's needs.

Similar strategies can also be observed in the auto industry. For example, Huawei's strategy of "not building cars personally" and cooperating with other automakers to become Tier 1 (first-tier suppliers). Although it cannot fully enjoy the profits of integrators or OEMs, as a supply chain player, it does not need to bear front-line sales and operating costs. At that time, Huawei, which had lost a significant portion of its cash flow sources in its C-end business, had to seize the opportunity to build cars in this manner.

The transformation of cloud giants from integrators to being integrated is essentially driven by the pressure of cost reduction and efficiency enhancement at the group level. However, the reshaping of the government cloud by big models has once again altered the market landscape. Compared to the highly customized needs of previous government cloud projects, big model products are more versatile and have stronger replicability. Just like the rapid popularity of DeepSeek all-in-one machines, which are essentially hardware servers integrated with open-source large models, they can be debugged, trained, and delivered by both large and small manufacturers within a short period. Alibaba's value increase in the recent fiscal year, apart from defending its traditional e-commerce business, came entirely from the doubling of the valuation of its cloud business bolstered by big models. However, this wave of enthusiasm for the government cloud sparked by DeepSeek also has the potential to swiftly return to rationality, akin to smart cities in the past.

Despite the advancements, there remains a significant chasm between deploying large-scale models and effectively leveraging them. Government departments, being the implementation agents, often find themselves preoccupied with myriad complex tasks. Therefore, cloud giants should consider adopting a more cautious approach when re-entering the To G (Government) sector. Provided they maintain a competitive edge in technology and products, they need not be overly concerned with short-term market ranking fluctuations.

Reference Materials:

- Digital Wisdom Frontline, "Changes in China's Government Cloud Landscape"

- Lei Feng Network, "BAT Cloud Picks Up the 'Chicken Rib': To G Business"

- DoNews, "Frenzy, Rationality, and Future of Buying DeepSeek All-in-One Machines"

- Southern Weekend, "Writing Official Documents, Serving as Customer Service, 'Preventing Return to Poverty': When the Government System is Connected to DeepSeek"