Apple's AI Challenges: Suppliers Grapple with Dilemma of Leaving the 'Apple Chain'

![]() 07/25 2025

07/25 2025

![]() 625

625

Is Apple Headed Towards a Nokia-Like Fate?

This year, the outside world has grown increasingly pessimistic about Apple's future, as it grapples with what is being described as the "biggest AI crisis in history." Behind this crisis lies Apple's undeniable innovation fatigue and aging management. Consequently, Apple's share price has plummeted by approximately 16%, trailing significantly behind Meta's 25% increase and Microsoft's 19% surge.

This panic extends beyond Apple and Wall Street, reaching into the realm of giant Chinese suppliers. Over the past decade, leading suppliers such as Luxshare Precision, GoerTek, and Lens Technology have firmly entrenched themselves in Apple's robust supply chain, thriving on the boundless opportunities offered by Apple's rapid growth and business expansion. However, if Apple falters in the AI era, these heavily reliant suppliers will undoubtedly feel the brunt of the impact.

Escaping the Apple supply chain has long been a strategic imperative and transformational direction for most supplier giants. Yet, in their quest for independence, they find themselves unable to identify the next 'Apple'.

'De-Appleization' and 'De-Chinization'

China has long served as the epicenter of Apple's supply chain, with approximately 50% of Apple's manufacturing partners based in the country. These partners have achieved year-on-year growth fueled by Apple's orders, fostering a mutually beneficial relationship. However, this dependence has gradually evolved into a 'crisis' for both parties, with one side actively pursuing 'de-Appleization' while the other accelerates 'de-Chinization.'

From a proportional standpoint, supplier giants have made initial strides in reducing their 'Apple dependence.' According to financial reports, in 2024, GoerTek's sales to its largest customer accounted for 31.96%, down from 43.38% in 2023. Similarly, Lingyi Intelligence's sales to its largest customer dropped to 22.07% in 2024 from 24.22% in 2023, while Lens Technology's sales to its largest customer declined to 49.45% in 2024 from 57.83% in 2023 and 71% in 2022. Clearly, these companies' reliance on Apple has diminished to varying degrees.

Among them, Lens Technology has made particularly noteworthy progress. From 2022 to 2024, the company's revenue from Apple sharply declined, while the proportion of domestic brand customers swiftly increased from 18% to 41%. Concurrently, export sales fell from 81.94% to 58.63%.

In contrast, Luxshare Precision's 'de-Appleization' efforts have yielded minimal results. In 2022, Luxshare Precision sold products worth 156.83 billion yuan to Apple, accounting for 73.28% of its total sales. This proportion increased to 75.24% in 2023 and stood at 70.73% in 2024, despite a slight decline. Additionally, Sunwoda Electronic's 2024 financial report revealed revenue from the U.S. region amounting to 28.885 billion yuan, constituting 82.20% of total revenue.

In terms of 'de-Appleization,' supplier giants have demonstrated varied performances. Nevertheless, it is undeniable that Apple remains the unchallenged largest customer, dictating that these suppliers' development must continue to closely align with Apple's footsteps. Whatever Apple prioritizes, they must follow suit.

For instance, regarding foldable screens, market news citing supply chain sources indicated that Apple plans to finalize the foldable iPhone supply chain by April this year, with mass production of foldable iPhone components anticipated in the second half of the year. According to Lens Technology's prospectus, a significant portion of the company's fundraising is earmarked to support its major customer, Apple's foldable phone strategy.

In China's market, foldable screen phones are already commonplace, and Apple's belated entry may not yield groundbreaking results. This also poses a risky gamble for suppliers within the Apple supply chain.

Compared to 'de-Appleization,' Apple's 'de-Chinization' process appears fraught with challenges. Last year, Tim Cook visited China and met with representatives from three major suppliers: BYD, Lens Technology, and Longtop Precision. This visit sparked speculation that Apple's industrial chain might be returning to the Chinese mainland, indicating a significant setback in Apple's recent strategy of diversifying its supply chain by shifting orders to India and Vietnam.

Replicating an 'Apple chain' in Southeast Asia may prove far more costly than anticipated.

No Next 'Apple' in the Automotive Industry

After accelerating their 'de-Appleization' efforts, supplier giants in the Apple supply chain have almost unanimously targeted another industry: new energy vehicles.

Since 2015, Lens Technology has been deploying in the new energy vehicle sector, focusing on the research and development and mass production of automotive electronic glass and components, in-vehicle center control screens, dashboards, smart B-pillars, projection displays, and other products. In 2021, Lingyi Intelligence acquired a 'car chain' enterprise for 38 million yuan and purchased a 66.46% stake in Jiangsu Keda this year, a company qualified as a tier-one supplier to multiple automakers.

Luxshare Precision's foray into the automotive industry is even more aggressive. As early as 2012 and 2013, it acquired Fuzhou Yuan Guang and German SuK, respectively entering the automotive electronics and automotive parts fields. Last year, it invested approximately 525 million euros to acquire a 50.1% stake in the renowned German automotive wiring harness manufacturer Leoni and a 100% stake in its wholly-owned subsidiary Leoni K.

With the smartphone market continuously declining and the new energy vehicle industry experiencing unstoppable growth, it is unsurprising that manufacturing giants like Lens Technology have invested in the automotive supply chain. Furthermore, in this round of major changes in the automotive industry, China has emerged as an absolute leader in technology and the market, presenting immense potential across upstream and downstream industrial chains. However, for now, despite the growth in the automotive business, its contribution to these companies remains generally low.

In 2024, Lens Technology's revenue from smart vehicles and cabins, smart head-mounted displays and wearable devices, and other smart terminals amounted to 5.935 billion yuan, 3.488 billion yuan, and 1.408 billion yuan, respectively, with the smart vehicles and cabins business accounting for 8.49% of total revenue. In the first half of 2024, Lingyi Intelligence's automotive segment contributed 5.33% to revenue and did not generate any profit.

Luxshare Precision's revenue from automotive connectivity products and precision components surged from 6.149 billion yuan to 13.758 billion yuan between 2022 and 2024, representing the fastest growth rate. However, compared to the 190.139 billion yuan in revenue from Apple, this figure still appears insignificant.

In the short term, there is considerable growth potential for the automotive business among enterprises in the Apple supply chain. However, in the long run, perhaps no automaker can replicate the wealth-creation myth that Apple achieved.

Simply put, Apple's appeal and influence in the smartphone market allow it to capture the lion's share of profits. Suppliers associated with Apple also enjoy higher-than-industry-average profit margins, with profit scales and company assets increasing significantly within just a few years. In contrast, the new energy vehicle industry is grappling with a price war that has permeated the entire industrial chain, leading to constantly squeezed profits. Additionally, automakers continue to transfer pressure to suppliers, eliciting numerous complaints.

Therefore, even if enterprises in the Apple supply chain successfully enter the electric vehicle supply chain, this money is not easy to earn.

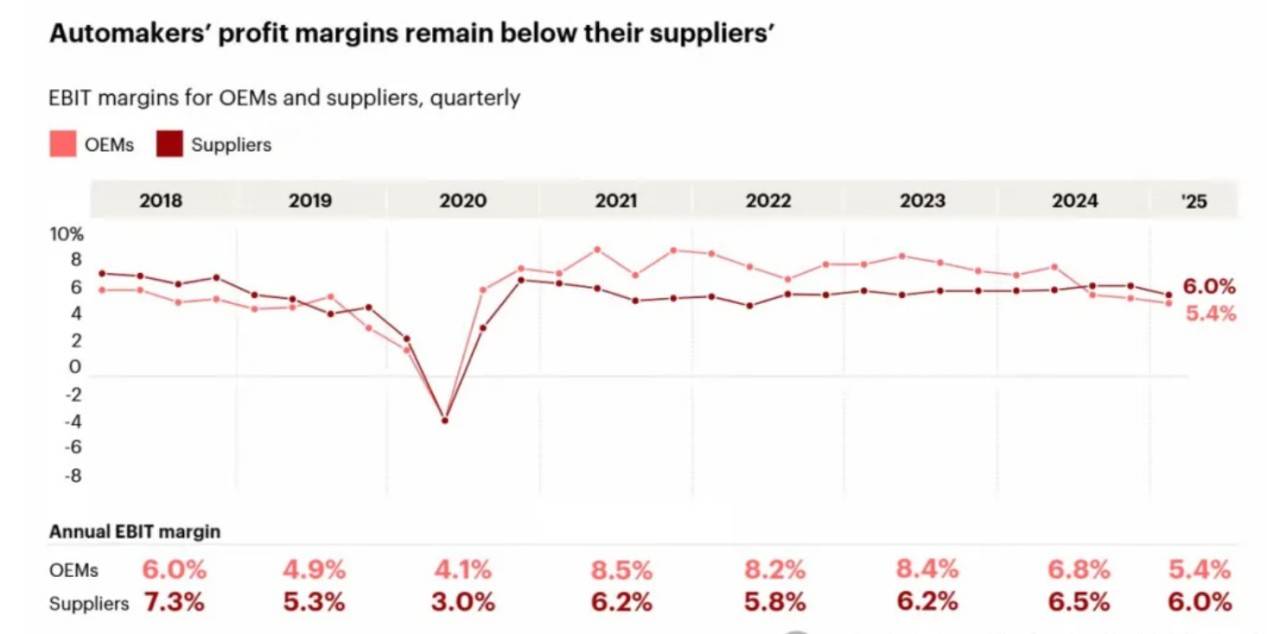

According to Bain & Co., OEM profit margins continued to decline in the first quarter of 2025, falling to 5.4%. This result also marks the third consecutive quarter that supplier profit margins have exceeded those of OEMs, although supplier profit margins are estimated at only 6%.

Of course, the era of high growth and high profits for suppliers in the Apple supply chain is over, which explains the urgency among manufacturing giants to flee.

Taking Luxshare Precision as an example, relevant data shows that in 2015, Luxshare Precision's gross profit margin was as high as 22.88%, with a net profit margin of 11.16%. However, in the subsequent years, both the gross profit margin and net profit margin declined.

In the AI Era, Whose Legs Should Suppliers Hug?

Within the industry, there has long been a pessimistic view about Apple. However, this year, such rhetoric is tinged with greater pessimism and disappointment. Due to multiple setbacks, Apple's lag in AI technology has become an undeniable fact, significantly shaking its leading position in cutting-edge technology. If Apple fails to secure a 'ticket' to the AI era, the giant created by Steve Jobs' innovative prowess will fade into obscurity in the future.

Therefore, in the AI era, suppliers in the 'Apple chain' are diversifying their investments:

GoerTek is betting on AI-driven smart hardware (VR/MR devices and AI glasses). Luxshare Precision's expertise in high-end head-mounted display manufacturing has also transitioned to the AI glasses sector. Lens Technology is deeply involved in the development of humanoid robots and is also deploying in AI/AR glasses.

Among them, GoerTek's transformation has begun to bear fruit. This year, Meta released its third-generation AI glasses, followed by Xiaomi and Huawei. Apple plans to enter the market in 2026. In the 'Hundred Glasses War,' GoerTek has quietly become a core supplier to giants such as Meta and Xiaomi.

In the past two years, the rise of global AI technology has not only represented a technological leap but has also driven the rapid landing and popularization of intelligent terminals such as AI mobile phones, AI PCs, and AI glasses. If the next revolutionary intelligent terminal emerges from these innovations, regardless of who ultimately becomes the 'king,' suppliers who seize the dividends of the AI era will reap substantial rewards.

However, the current challenge lies in the fluctuating wave of smart hardware, from AR/VR devices to AI glasses. Once the initial enthusiasm wanes, it can easily leave a trail of chaos.

Similarly, Foxconn (Hon Hai Precision), deeply intertwined with Apple, has firmly clung to NVIDIA's leg and stands at the forefront of the trend. Compared to consumer-facing enterprises or brands, NVIDIA is the 'giant' operating behind the scenes. In the AI era, NVIDIA was the first to explode. As NVIDIA's 'exclusive foundry' for AI hardware, Foxconn has already secured a slice of the pie.

According to Morgan Stanley's data, nearly 30% of NVIDIA's AI server orders in 2024 went to Foxconn, with GB200 and GB300 foundry shares as high as 40%, almost monopolizing the production of high-end AI hardware. Orders from NVIDIA have also propelled Foxconn's performance back on the fast track. According to published data, Foxconn's revenue reached NT$1.797 trillion (approximately RMB 445.1 billion) in the second quarter of 2025, a year-on-year increase of 15.82%.

With Apple on one hand and NVIDIA on the other, Foxconn can be said to have precisely navigated the right path. Even if Apple declines, NVIDIA will become the next 'pillar.' It may also be the first giant to exit the 'Apple chain.' According to foreign media reports, Foxconn Chairman Liu Yangwei predicts that the company's server business revenue will surpass iPhone business revenue within two years.

Of course, if Foxconn becomes overly reliant on NVIDIA, 'Apple dependence' will merely transform into 'NVIDIA dependence.'

Automotive, smart hardware, humanoid robots... These industries, representing the pinnacle of global technological advancement, naturally demand top-tier manufacturing capabilities. Supplier giants in the Apple supply chain are extending their business reach into these areas, also placing their bets on the future. However, not everyone can identify the next 'Apple,' and perhaps there is no next 'Apple' capable of bringing another radical transformation to the entire electronic consumer market and manufacturing sector.

Dao Zong You Li, formerly known as Wai Dao Dao, is a new media outlet in the internet and technology circle. This article is original and prohibits any form of reprinting without retaining the author's relevant information.