Will 50% of 4S Dealerships Fail to Survive Beyond 2026?

![]() 12/19 2025

12/19 2025

![]() 620

620

If we compare automotive showrooms to the restaurant industry, when 'HiAuto Grand Hotel' announces its closure, many suddenly realize that the days of unlimited coffee and point-based charging are over. Meanwhile, NIO is relocating its 'NIO Houses' to communities, inviting users to take center stage. Any available space becomes a host venue, with the automaker providing staff and operational methods.

One dealership is scaling back, while the other is expanding. However, both indicate the same trend: channels are shifting from 'relationship-driven' to 'business-focused,' transitioning from heavy investment in renovation and welfare to light-touch, asset-light models. Instead of waiting for customers to come to them, stores are now opening right beside users.

In essence, subsidies are dwindling, calculations are becoming more precise, and every cost must be justified by conversion rates. As 'landlords' tighten their belts, calm surfaces hide turbulent undercurrents—many 4S dealerships collapsed in 2025. The claim that 'half won't survive beyond 2026' is not just alarmist rhetoric.

'Even landlords are running out of resources.'

A notable trend in 2025 is HiAuto's expansion of its multi-brand independent network. Reports indicate that ARCFOX (in partnership with BAIC) held a 'dedicated network recruitment conference,' planning to launch dozens of exclusive user centers by the end of the year. This signals a departure from past 'multi-brand co-location' models, requiring each brand to have its own storefront, services, and brand messaging. In late 2023, industry rumors suggested that new 'HiAuto User Centers' would address limitations in mall showrooms and mismatches between expanding model ranges and customer experience—a move now seen as prescient.

The rationale is clear: with an increasing variety of models and wider price bands, 'co-located stores' risk internal competition and dilute premium experiences.

Unlike HiAuto's emphasis on channel independence, NIO is pioneering a more 'community-driven' approach. Users or partners provide venues, while NIO deploys Fellows (sales advisors) without direct investment or formal authorization, extending community engagement into lightweight offline touchpoints.

NIO has systematically cultivated 'user co-creation': from its 'Welfare Partners' platform to the 'Power Partners' charging network, it integrates energy, consumption, and social interaction into an ecosystem where users are both consumers and operators.

Think of it as 'Direct Sales 2.0': brands retain control over pricing and customer experience but with lighter, more community-focused touchpoints. Stores are evolving from transaction hubs to community hotspots.

In contrast to HiAuto's 'network separation,' GAC offers an alternative: integrating channels for its AION and Hyper sub-brands under unified operations. Public data shows GAC aims to establish over 1,000 sales outlets by 2026, covering cities above the fourth tier to enhance service accessibility.

In May, reports emerged that Zeekr would adopt a 'partnership model,' blending direct sales with franchising to accelerate market penetration while maintaining pricing and experience consistency and reducing capital intensity. Zeekr clarified that its partnership models differ from traditional dealerships, with direct sales remaining in first- and second-tier cities.

Whether through network separation, integration, or partnerships, the goal is efficiency. The once-famous 'HiAuto Grand Hotel,' known for its free meals, car washes, and charging services, recently halted promotions and cut free services. Rising service costs demand meticulous management.

Who Will Fall by 2026?

Traditional 4S dealerships are characterized by heavy asset investment and full-service capabilities. New models leverage multi-brand stores, pop-up showrooms, and agency/partnership frameworks, prioritizing 'proximity' to people, needs, and decisions.

For dealers, this means advertising budgets remain, but foot traffic is diverted to mall pop-ups and community stores. One dealer lamented, 'Without digital ads, we decline more slowly; with them, we decline faster.' Rising costs in new media are driving sales expenses higher—a ¥100,000 car may incur over ¥10,000 in acquisition costs.

Manufacturer targets loom as new car prices plummet, while inventory languishes for months. Revenue from maintenance, accident repairs, and financial commissions is dwindling as owners complete services via apps.

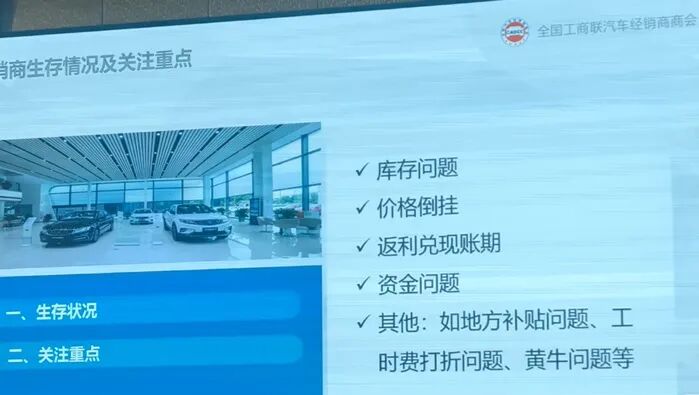

A recent survey by the All-China Federation of Industry and Commerce Automotive Branch highlights severe inventory issues, with some brands stockpiling vehicles for 3–9 months. Additionally, rebate payouts are delayed by up to six months, straining dealer viability.

The China Automobile Dealers Association's 2025 H1 National Dealer Survival Report reveals a 52.6% loss ratio (17.5% break-even, 29.9% profitable), marking the first 'majority loss' scenario and an eight-year high.

In early 2025, Beijing Yuntong Auto Group faced severe liquidity crises, with 4S stores nationwide reporting delayed deliveries, embezzled customer payments, frozen loyalty points, halted after-sales services, closures, and unpaid wages. Once ranked 12th among China's top 100 dealers, Yuntong represented multiple luxury brands...

Yuntong's plight is a microcosm of deeper issues: disruption from new energy vehicles, the ferocity of price wars, and shifting consumer habits expose traditional dealers' unsustainable costs. Today's channel battle hinges not on store size or luxury but on agility in reaching users and efficiency in meeting demands. As old structures crumble, new foundations emerge—with a 50% survival stake resting on every player's shoulders.