AI Cloud Speeds Toward Agent Adoption, with Baidu and Alibaba Emerging as Front-Runners

![]() 12/19 2025

12/19 2025

![]() 628

628

The AI competition landscape has evolved distinctly, shifting from the initial "Thousand-Model Battle" to the dominance of major players, and now to the dual leadership of Baidu and Alibaba. The contours of this market are becoming increasingly defined, with the current Agent competition heralding the true dawn of a productivity-driven era.

The allure of AI Agents among industry giants is undeniable.

On December 18, the ChatGPT app store made its official debut. OpenAI has organized a variety of apps, including PS, Apple Music, and Canva, under categories like 'Featured', 'Lifestyle', and 'Productivity'. Previously, OpenAI had already integrated ChatGPT, Deep Research, and Operator—dubbed the "Three Musketeers"—into a unified ChatGPT intelligent agent, highlighting Agent as a top priority.

This trend is not unique to OpenAI. This year, Microsoft unveiled several tools, such as the GitHub Copilot agent and Azure SRE agent, to bolster development and operations, aiming to establish a comprehensive lifecycle management system for enterprise-level AI models and intelligent agents.

Google is leveraging AI Studio to cater to both B2B and B2C markets, constructing an infrastructure system that spans business activity layers, data integration layers, data control layers, and data layers.

Amazon/Anthropic, through AWS, targets small and medium-sized enterprises, emphasizing computing power sales and convenient deployment, and offering highly practical tools via the Claude model.

In China, Baidu Intelligent Cloud has significantly upgraded its Agent Infra this year, officially launching the new Baidu Qianfan 4.0 version.

By constructing model services, tool services, Agent development services, data services, and Agent operating environments, it is driving the comprehensive evolution of enterprise intelligent agents.

It is clear that Agents have transitioned from a conceptual phase to a competitive infrastructure among industry leaders.

#1

Baidu and Alibaba

Take the Lead

CBINSIGHTS forecasts that AI Agent revenue could soar to $103.6 billion by 2032, with a compound annual growth rate of 44.9%. Gartner and IDC have also consistently indicated in multiple forecasts that after 2035, Agents will evolve into cognitive symbiotic human assistants, with intelligent agents becoming mainstream applications.

This transformation is compelling cloud service providers to overhaul their underlying logic. Traditionally, cloud computing operated on a "rental card" model, with an extensive business approach—typically involving purchasing GPUs, installing them in cabinets, and offering AI computing power services. However, the advent of generative AI has brought about significant changes.

Firstly, the demand for computing power in large-scale model training and inference has surged exponentially, driving GPU prices to unprecedented heights. Relying solely on rental cards is no longer viable due to cost and supply constraints.

Secondly, NVIDIA's dominance in high-end GPUs, TSMC's tight advanced packaging capacity, and global supply chain uncertainties expose cloud providers to the risk of being unable to procure GPUs despite having the financial means.

More crucially, enterprise demand for cloud services has shifted from mere computing power to more comprehensive and quantifiable AI capabilities. On one hand, AI is accelerating the differentiation of application layers, necessitating AI cloud services to offer comprehensive capabilities for creating new intelligent agents. On the other hand, domestic AI applications are evolving from simple to complex data processes. Enterprises are now paying for quantifiable KPIs or direct benefits rather than features. They are beginning to allocate AI resources akin to human resources, demanding more refined and effective services.

The keywords for cloud services have shifted from product-centric to capability-centric, with IaaS, PaaS, and SaaS—terms emphasizing service models—losing popularity, while AI Infra, Agent Infra, and other intelligent agent-related keywords take center stage.

This paradigm shift indicates that the market is entering a new reshuffling phase. At this juncture, AI cloud service providers are not just supporters but ecosystem leaders and industry rule participants—a transformation that no major player can afford to overlook.

Against this backdrop, domestic industry leaders are accelerating their Agent deployments. Besides Baidu, Alibaba Cloud has also embarked on a saturated investment in Agents; Tencent adjusted its organizational structure this week, establishing multiple departments, including the AI Infra Department.

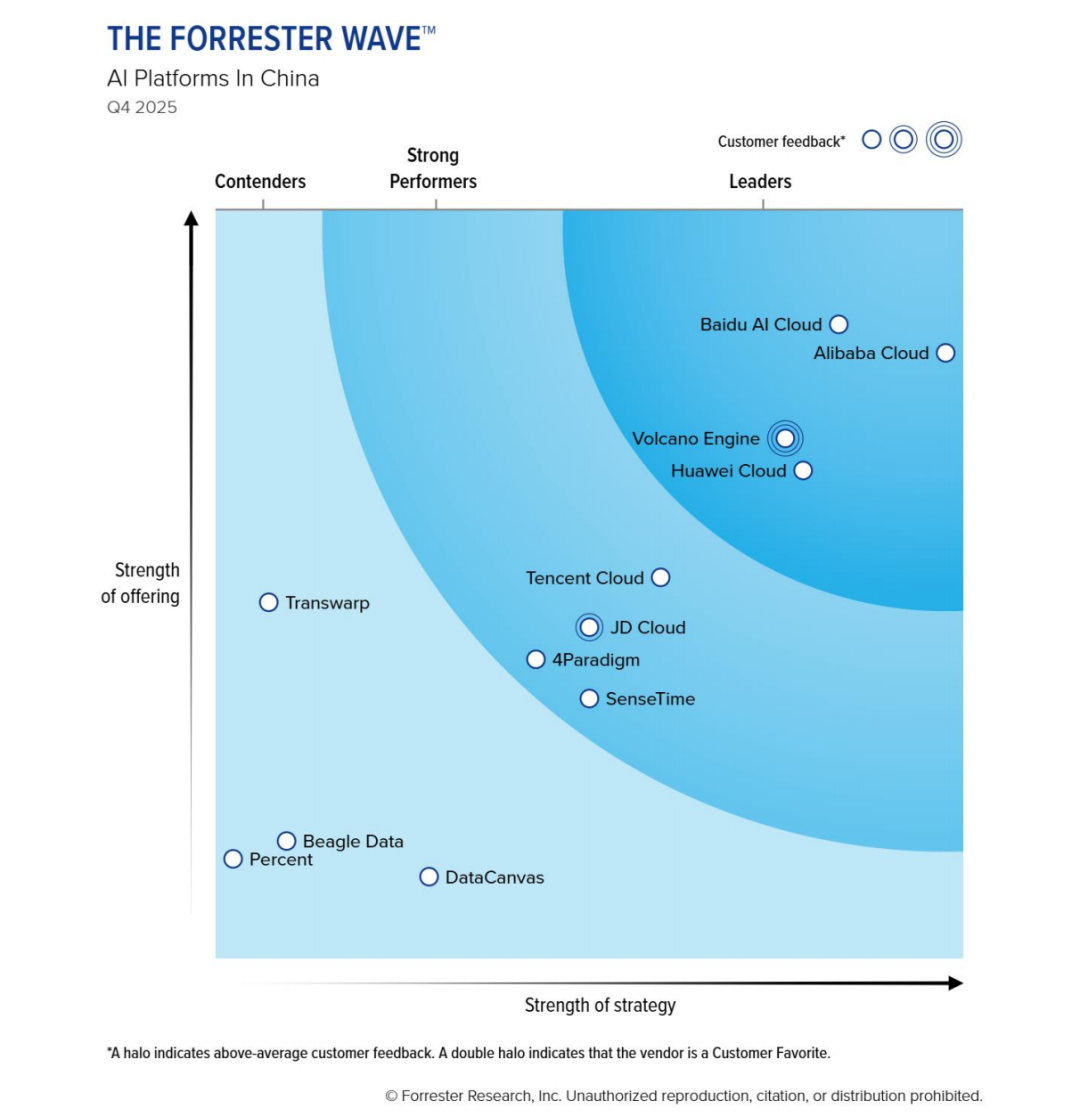

Currently, the market landscape is taking shape. Forrester's latest AI cloud report positions Baidu Intelligent Cloud as an industry leader, ranking first in product capabilities and second in strategic layout, alongside Alibaba Cloud in the TOP 2 of the leader quadrant. Among them, Baidu Intelligent Cloud, which topped the product capabilities ranking, scored full marks in 14 out of 18 product capability assessments, the highest among AI cloud providers.

Combining insights from various third-party reports this year, Baidu and Alibaba have emerged as the top-tier players in the inaugural year of Agent implementation.

The question remains: Why them?

#2

Full-Stack Layout

Redefines 'AI Cloud'

Whether it's Baidu, Alibaba, or other global AI players, full-stack layouts and self-developed ecosystems have become the mainstream approach for Agents.

Take Baidu as an example. It has constructed a complete capability closed loop from chips to applications around AI Infra and Agent Infra.

In the critical computing power domain, Baidu Intelligent Cloud has developed the Kunlun Core + Baige AI Computing Platform, providing enterprises with high-performance and cost-effective computing power support. This year, Baidu unveiled two Kunlun Core products, the M100 and M300, and announced annual updates for the next five years—a rarity among domestic AI chips.

Leveraging these chips, the Baige AI Computing Platform enhances training and inference efficiency across network services, computing power services, inference services, and integrated training-inference services.

Agent Infra offers an enterprise-grade Agent development platform tailored for production scenarios. Baidu Intelligent Cloud's services primarily encompass five dimensions: model services, tool services, Agent development services, data services, and Agent operating environments.

Delving into Baidu Intelligent Cloud's layout reveals a closed-loop system from chips to computing power reserves, large-scale model capabilities, and model-layer applications—all self-developed.

Baidu is not alone in this endeavor. Among foreign industry leaders, Google, currently the most aggressive, also follows a full-stack self-developed route. This year, Google released its self-developed TPU v7 chip, achieving co-evolution across all links—from underlying chips, compilers, model architectures to terminal applications—within the same technological system. Thus, even if Google temporarily trails behind AWS and Azure in market share, its complete and self-contained technological closed loop positions Google Cloud for explosive growth.

The essence of the industry leaders' Agent competition is the struggle for AI ecosystem dominance. Defining the ecosystem hinges not on 'single-point strength' but on ecosystem capabilities and comprehensive strength—the key to Baidu and Alibaba's leadership. Their performance underscores the profound disruption of the industry's competitive model.

#3

Self-Developed Ecosystem

A Comprehensive Competition for Agents

Globally, the competition around Agents has seen AI cloud service providers continuously enhancing their computing power and application capabilities—a contest of self-developed ecosystems.

Computing power is a critical aspect. OpenAI has signed agreements with Microsoft, Google, and Oracle for diversified supply; AWS's self-developed chips cover key areas such as Graviton (general computing), Trainium (training), and Inferentia (inference); Baidu's Kunlun Core 30,000-card cluster can simultaneously support multiple large-scale models with hundreds of billions of parameters, marking a significant milestone in domestic AI computing power clusters.

Beneath computing power, framework and model services are also expanding. Baidu Qianfan now supports full-scenario coverage of over 150 SOTA models, providing precise chain-of-thought control capabilities for both simple and complex scenarios. Microsoft Copilot Studio, Alibaba Cloud BaiLian, and others also leverage giant ecosystems to offer one-stop service platforms.

At the application end, this will likely be the key battleground in the upcoming Agent competition. The launch of the ChatGPT app store signals a new phase for the application layer, which will undergo a comprehensive update based on AI large-scale models, imposing higher demands on the tool capabilities of AI cloud services.

A mature ecosystem facilitates the rapid delivery of highly refined service experiences to enterprises. In this regard, the inherent strengths of industry leaders may translate into traditional advantages. Take Baidu as an example: over the years, Baidu has developed AI Search, Baidu Maps, Baidu Wenku/Netdisk, and Xiaodu smart terminals, covering core scenarios such as web search, data processing, and lifestyle services. These provide strong support for enterprise-level high-frequency needs and, in fact, enhance the capabilities of Baidu Intelligent Cloud.

Li Yanhong once stated, 'When AI capabilities are internalized as a native capability, intelligence ceases to be a cost but becomes productivity.' In just three years, AI has rapidly advanced to the Agent implementation stage, evolving from the initial "Thousand-Model Battle" to major player dominance, and now to the dual leadership of Baidu and Alibaba. The current Agent competition signals the true dawn of a productivity-driven era.