DJI and Insta360 Target Each Other's Core Markets: Renewed Competition in the Smart Imaging Sector

![]() 07/29 2025

07/29 2025

![]() 480

480

The smart imaging device market is set to witness an eagerly anticipated industry clash in 2025, with both participants representing China's high-tech enterprises and stirring up excitement in the market.

Recently, DJI Technology officially announced the launch of its first 360-degree panoramic camera, the Osmo 360, on July 31, with the catchy slogan "One Inch Reveals the Universe".

This move signifies that DJI has completed its full-category portfolio in the smart imaging market, now encompassing aerial photography drones, action cameras, handheld cameras, and panoramic cameras.

Almost simultaneously, Insta360 registered an official Weibo account named "Antigravity", and its drone products were also unveiled on foreign websites.

Notably, after four years of development, Insta360 successfully listed on the STAR Market of the Shanghai Stock Exchange on June 11 this year, with a total market value of approximately RMB 65.6 billion. Its urgent pursuit of growth is evident in its prominent expansion of its business line soon after listing. (For details, see: Insta360 Approved for STAR Market IPO: Four-Year Review Period, Founder Criticizes Competitors)

One is the global leader in drones, and the other is the world's foremost panoramic camera manufacturer. Why are they venturing into each other's core markets?

DJI Expands, Insta360 Counterattacks

DJI and Insta360 have previously been in competition.

In 2019, GoPro, the pioneer of action cameras, faced a development dilemma. Its expensive and overpriced products gradually failed to meet the needs of sports enthusiasts. Seizing this market gap, DJI quickly entered the market with its imaging and stabilization technology accumulated in the consumer drone field, launching the first-generation DJI Osmo Action, which swiftly gained market popularity.

Meanwhile, a Chinese startup, Insta360, was emerging as a rising star in the smart imaging market. Insta360's development strategy was unique; rather than directly competing with GoPro in the action camera market, it pioneered the development of panoramic cameras, introducing the concept of "shoot first, frame later" and solving the issue of slow panoramic video transmission. This successfully made Insta360 the first panoramic camera brand to be listed on the Apple Store, gaining significant fame.

In terms of usage scenarios, action cameras are more focused on sports such as cycling and skiing, emphasizing image clarity and optical stabilization. Panoramic cameras, with their 360-degree fisheye lenses, are more suitable for shooting immersive VR videos, travel Vlogs, and other content. After achieving success in the panoramic camera market, Insta360 planned to go public. Under the pressure of performance, it was natural for the company to leverage its existing technology and supply chain resources to enter the action camera market. Thus, in 2023, Insta360 launched its first action camera, Ace Pro (officially called a "wide-angle camera").

In the subsequent period, DJI and Insta360 competed in the action camera market but did not delve into each other's core areas until DJI took the initiative to disrupt the balance. Last October, the FCC test documents for DJI's first panoramic camera, the Osmo 360, were exposed, with specifications targeting Insta360's flagship product.

Currently, overseas bloggers have already obtained the DJI Osmo 360 and conducted a preliminary comparison with the Insta360 X5. In terms of specifications, the highlight of the DJI Osmo 360 is its 1-inch CMOS, which also supports up to 8K/30fps panoramic video recording. Due to its larger CMOS size, the theoretical image quality is superior to that of the Insta360 X5 (1/1.28-inch CMOS).

Moreover, the overseas standalone price of the DJI Osmo 360 is approximately AUD 759 (approximately RMB 3,580). If the domestic price is equivalent, it is bound to have a significant impact on the sales of the Insta360 X5 (official standard version price of RMB 3,798).

Perhaps unwilling to lose in public opinion, Insta360 swiftly registered the official Weibo account "Antigravity", and spy shots of its drones subsequently leaked. According to sources close to Insta360, the company plans to launch drone products under two brands: its own brand and Antigravity, the latter of which will be co-incubated with a third party. From the leaked photos, both prototypes are quadcopters, but the designs are slightly different, likely targeting different market segments.

Qichacha reveals that Insta360 established Zhuhai Antigravity Technology Co., Ltd. on December 23, 2024, with a registered capital of RMB 50 million, 100% owned by Insta360 Innovation. Simultaneously, Zhuhai Antigravity holds shares in four subsidiaries, each conducting related businesses. On May 21 this year, Zhuhai Antigravity applied for the trademark "Antigravity".

The comprehensive competition between DJI and Insta360 is essentially due to the high overlap of consumer groups for consumer drones, panoramic/action cameras, and a certain degree of commonality in technology and industrial chains, providing innate conditions for vertical development.

Niche Market, Multi-Category Melee

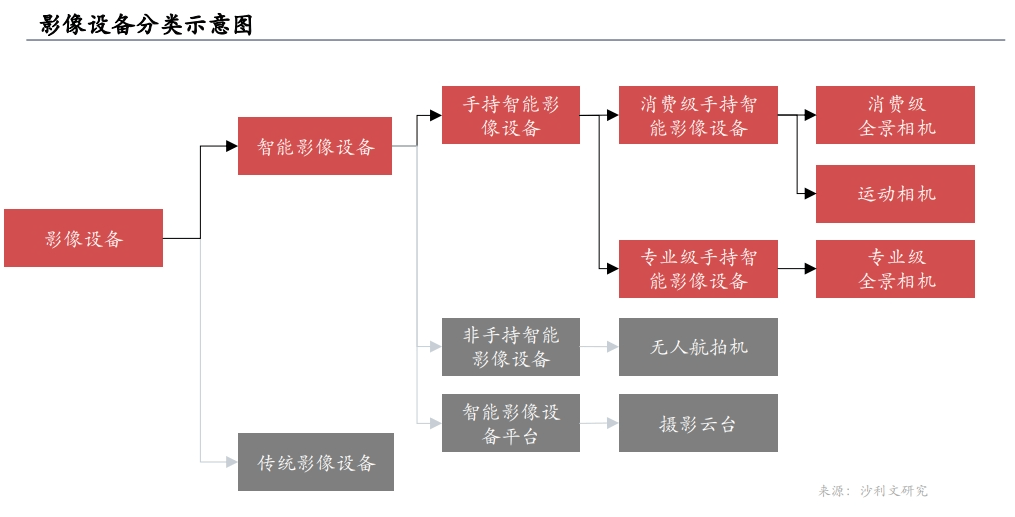

Imaging devices have undergone three revolutions in film, digitization, and product form, ultimately leading to a tripartite confrontation between smartphones, traditional digital cameras, and smart imaging devices. For ordinary consumers, mobile phones can easily handle daily shooting scenarios, making professional cameras and smart imaging devices not rigidly demanded and relatively niche.

In the traditional camera field, the three Japanese manufacturers, Canon, Nikon, and Sony, firmly occupy the DSLR and mirrorless markets, maintaining a stable pattern that has lasted for nearly a decade. Taking Canon as an example, its total imaging business revenue in 2024 was JPY 937.4 billion, of which camera sales amounted to JPY 579.9 billion (approximately RMB 28.13 billion), a year-on-year increase of 6%, indicating a slight recovery in the professional camera market.

Relatively speaking, the technical threshold for the DSLR/mirrorless market is higher, requiring significant resources to develop CMOS sensors, imaging sensors, and lens groups. Therefore, no new players have entered the market since Samsung exited the camera market in 2015. For DJI and Insta360, entering each other's markets is more feasible.

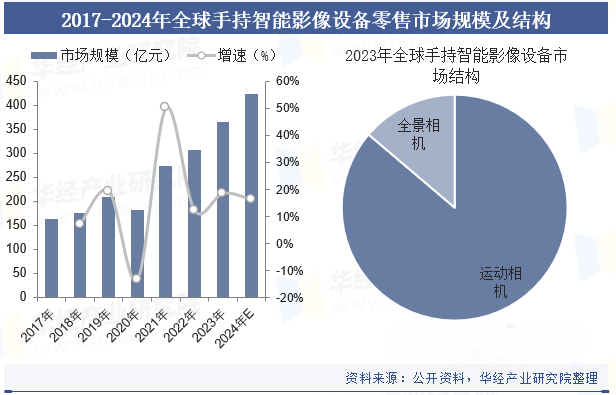

According to the "2024-2029 China Consumer Drone Industry In-depth Research and Investment Opportunities Analysis Report" by China Research and Intelligence, the global consumer drone market size was approximately USD 4.85 billion (approximately RMB 34.8 billion) in 2023, with DJI occupying about 70% of the market share. Additionally, data shows that the global handheld smart imaging device market size was approximately RMB 31.5 billion in 2023, with action cameras accounting for over 85% and panoramic cameras accounting for only 25%, making Insta360's dominant category more niche.

Both drones and action/panoramic cameras share a common trait: low usage frequency, prone to being underutilized. On second-hand trading platforms, a large number of personally idle related products can be found, many of which are described as "almost new" or "only unsealed for trial", reflecting to some extent the growth narrative challenges faced by related companies.

What are Insta360's Chances in the Drone Market?

From a business perspective and market position, Insta360's need to expand into new sectors may be more urgent than DJI's.

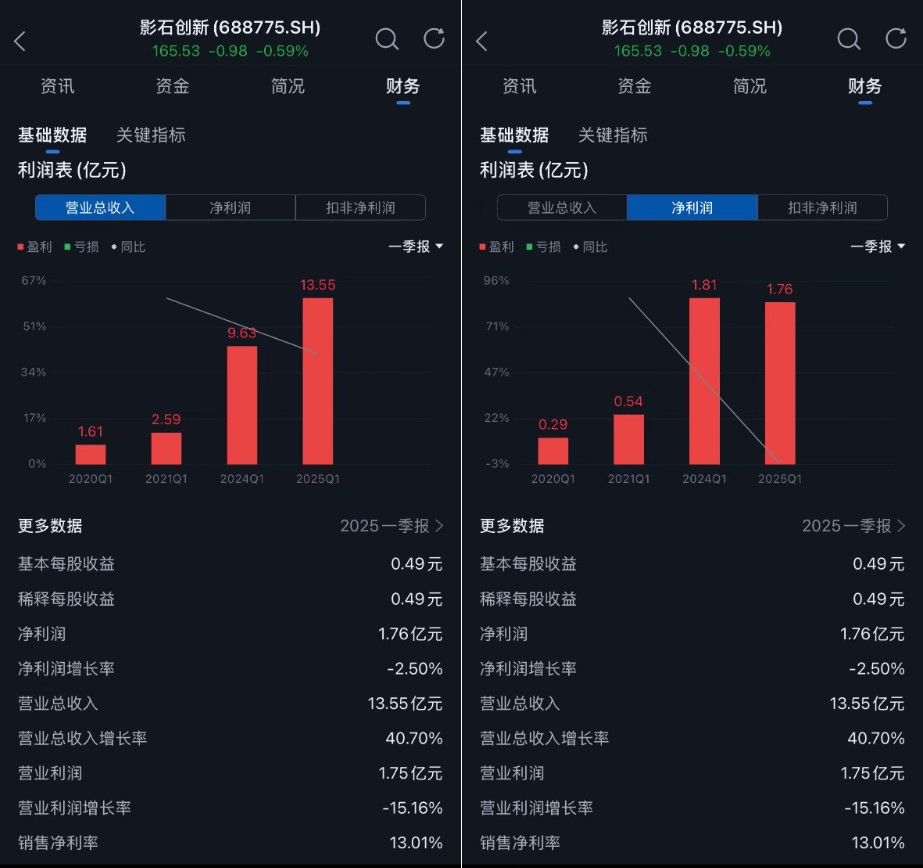

The first-quarter report for 2025 shows that Insta360's revenue was RMB 1.355 billion, a year-on-year increase of 40.70%; net profit attributable to shareholders was RMB 176 million, a year-on-year decrease of 2.50%. Additionally, the growth rate of operating profit decreased by 15.16% year-on-year, which is related to increased market competition and investments in research and development (R&D) and marketing.

After entering the drone market, Insta360's R&D investment is expected to further increase, which may affect financial data in the short term and lower stock price performance. Insta360 stated that as of now, relevant projects are underway and have not had a significant impact on the company's business or performance.

The key to Insta360's market entry lies in whether it can solve pain points that competitors cannot improve. Founder Liu Jingkang mentioned the key to the company's success in an interview - the "Hunter Strategy": entering mature categories and defeating leading companies by discovering unsatisfied needs or providing better solutions. In the panoramic camera field, Insta360 was the first to introduce functions such as "invisible selfie sticks" and AI editing, initially enhancing product competitiveness. However, competitors quickly followed suit with similar functions, indicating that its technological moat is not deep.

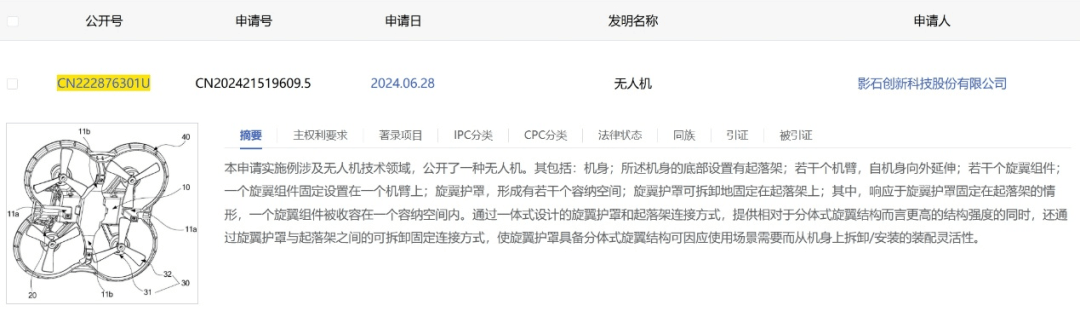

A glimpse of Insta360's drone patents reveals that the patent with public number "CN222876301U" for a "drone" features an integrated rotor guard and landing gear design that achieves higher structural strength and can be flexibly disassembled or installed according to usage scenarios; the patent with public number "CN222808315U" for a "motor arm assembly and drone" optimizes the drone's weight and aerodynamic resistance, contributing to improved endurance. If the patented technologies can effectively translate into enhanced user experience, it will aid Insta360 in expanding its market.

As of July 25, Insta360 Innovation closed at RMB 165.53 per share, a slight decrease of 0.59% from the previous day. Currently, securities institutions mostly rate it as "buy" or "hold". Analysts at Shanghai Securities pointed out that the global panoramic camera compound annual growth rate is expected to be 11.8% from 2023 to 2027, and with its leading market position, Insta360 is expected to achieve revenue growth of over 30% in the next two years. Analysts at Cinda Securities affirmed Insta360's potential for sustained growth by combining sales data from the 618 promotion (GMV exceeding RMB 400 million, a year-on-year increase of 160%).

Finally, let's discuss DJI. As one of China's largest technology unicorn companies, its consumer and industrial drone business segments are globally leading, with an estimated value of RMB 84 billion according to Hurun's "2025 Global Unicorn Index". DJI has been active recently, not only entering the panoramic camera market but also set to release its first robotic vacuum cleaner, ROMO, on August 6, further seeking cross-application of its technologies. DJI's last round of financing was the C+ round in 2018, and it currently appears to have no plans for an IPO.