Exclusive | Xiaomi Expands Direct Store Presence in Morocco, Accelerating AIoT Efforts in Africa

![]() 08/15 2025

08/15 2025

![]() 675

675

Source | YuanSight

Xiaomi is progressively enhancing its footprint in the African market.

Recent media reports suggest that Xiaomi Group has made strategic adjustments in the African market, appointing Liu Shequan as General Manager for Africa. He will report directly to Lin En, General Manager of International Sales. Concurrently, Zou Chengzong was named Head of the East Africa Region, Huang Jinhua became Country Manager for Kenya, Wu Chunhui was appointed Head of Marketing, and Liu Yeqi assumed the role of Head of After-Sales Service. All four report to Liu Shequan.

While the authenticity of these reports remains unconfirmed, Xiaomi's pursuit of international expansion, particularly in Africa, has garnered significant attention in recent years.

YuanSight understands that Xiaomi has made substantial progress in personnel expansion and business layout in Africa. The company has opened direct stores in Morocco and is actively recruiting store managers. Additionally, Xiaomi plans to cultivate 1,000 overseas talents for its AIoT business over the next 3-5 years.

Africa, once a virgin territory, is witnessing a transformation in its market landscape due to the rapid expansion of manufacturers like Xiaomi. Early entrants who once dominated the market now face challenges to their leading positions.

01

Recruitment

Public interest in Xiaomi's entry into Africa began with the strategic planning for the African market announced by Lei Jun a year ago.

In September 2024, at the 8th China-Africa Entrepreneurship Conference, Lei Jun, founder, chairman, and CEO of Xiaomi Group, stated that under various China-Africa cooperation initiatives, Xiaomi has already established operations in 16 African countries, including Egypt, South Africa, Nigeria, Morocco, Algeria, and Kenya. The next step is to increase investment on the African continent.

At that time, Lei Jun revealed that Xiaomi's products had entered more than 100 countries and regions, with Africa being a crucial part of Xiaomi's international market. In 2017, Xiaomi began entering the African market and actively participated in the continent's informatization and digitization processes.

To achieve rapid expansion, a robust local human resource base is essential.

An insider from Xiaomi told YuanSight that the company's mobile phone business in Africa tends to recruit mobile industry professionals with African work experience, such as those who have worked for Transsion, OPPO, vivo, Honor, and other manufacturers.

In contrast, the AIoT business segment seeks candidates with experience in manufacturers like DJI and Anker.

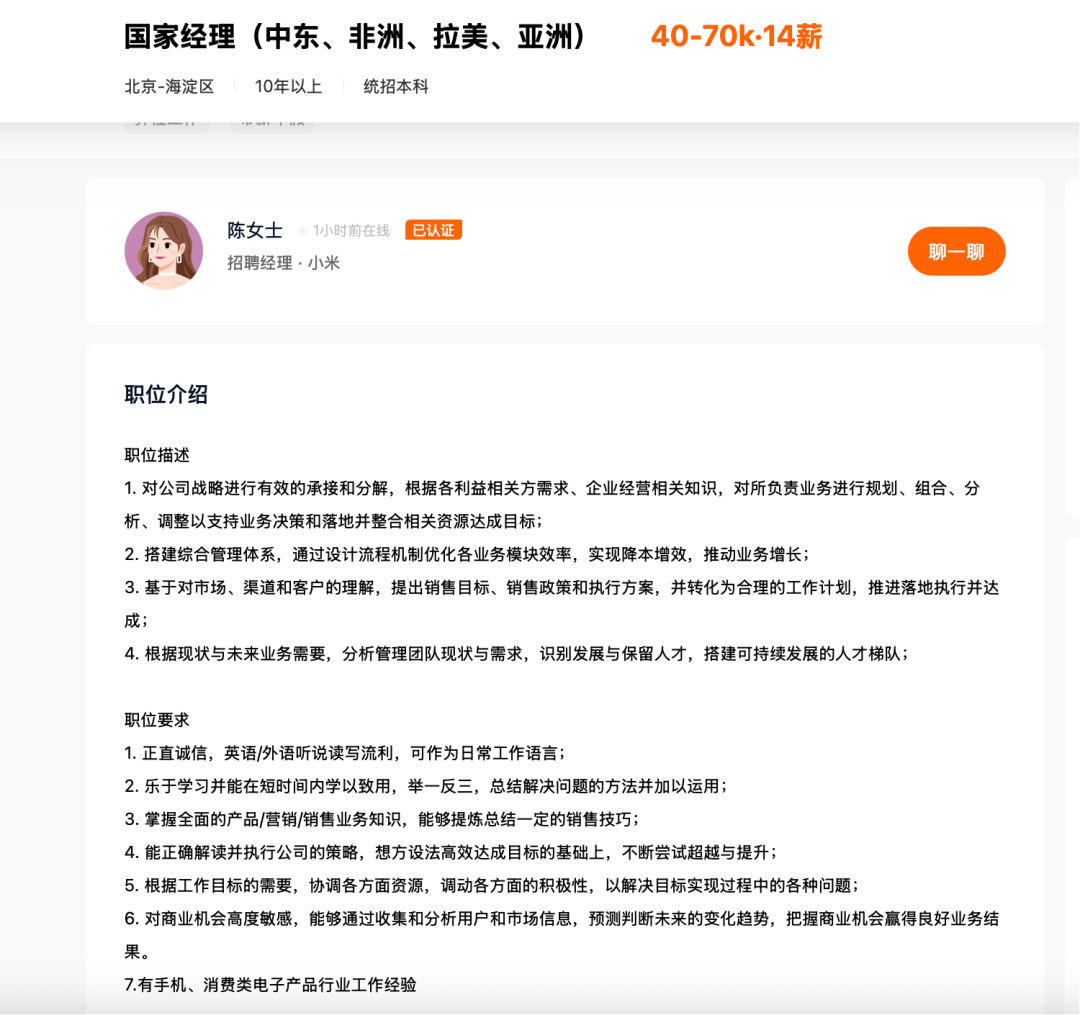

Furthermore, YuanSight has noticed that Xiaomi is currently recruiting for various overseas positions, including country managers and delivery managers, on job platforms, with work locations spanning Africa, the Middle East, and Latin America.

Screenshot from Liepin

With employees who understand local customs, politics, and economics, Xiaomi can further advance its localized operations.

In the past, domestic manufacturers like Xiaomi entered markets such as Africa with strategies similar to those in China, such as partnering with local mature retail chains and operators. In contrast, Transsion relies on a three-tier channel model comprising national distributors, regional wholesalers, and micro-retailers, offering credit, promotion, and localized after-sales services.

Today, brands like Xiaomi are adopting more localized strategies. In recent years, they have also tended to collaborate with local dealers at all levels to jointly establish channels while opening direct stores in Africa.

Simultaneously, Xiaomi has introduced its domestic "Mi Fan Festival" to Africa, fostering a group propagation effect. Additionally, in some African countries, Xiaomi has begun engaging in sports marketing, such as sponsoring teams and matches.

02

AIoT as a New Growth Engine

It's worth noting that in the African market, mid-to-low-end smartphones remain the primary products. Without significant breakthroughs in the high-end market, the African mobile phone market has become a red ocean.

Under these circumstances, the importance of Xiaomi's other core business, AIoT, is becoming increasingly prominent.

Generally speaking, the AIoT business enables interconnection between mobile phones, home appliances, household devices, etc., constructing a vast intelligent ecosystem. In this ecosystem, hardware devices serve as traffic entry points for each other. Users continue to purchase other related products due to the convenience of ecological coordination, thereby being tied to Xiaomi's ecosystem, effectively preventing user churn and reducing customer acquisition costs.

Moreover, seamless device integration and collaboration, daily scenario automation and intelligent linkage, as well as personalized customization across scenarios, significantly enhance the user experience and further strengthen users' loyalty to Xiaomi's ecosystem.

Currently, Xiaomi has made certain strides in the AIoT business in Africa. According to YuanSight, although Xiaomi's sales channels in Africa are still predominantly dealer-based, it has already opened one direct store in Morocco, with another under construction. This operational Moroccan store is Xiaomi's sole direct store in Africa and has begun selling AIoT-related products, including mobile phones, TVs, sweeping robots, wearable devices, etc.

In China, Xiaomi's sales channels for AIoT products are relatively diversified, encompassing online official channels, e-commerce platforms, and offline stores. In Africa, Xiaomi plans to deploy direct stores in African countries, in addition to dealer channels, to sell its products.

Currently, Xiaomi divides its business into two major segments: "Mobile Phone x AIoT" and "Innovative Businesses such as Smart Electric Vehicles." Under the strategy of "Ecosystem Integration of People, Vehicles, and Homes," these two businesses complement each other.

In overseas markets, Xiaomi's ecological layout has made the most substantial progress in Southeast Asia, while Africa lags slightly. The deployment of infrastructure networks such as channels is also crucial for the further overseas expansion of Xiaomi's heavyweight products, including electric vehicles.

In March this year, Lu Weibing, President of Xiaomi Group, disclosed that Xiaomi will establish 10,000 Xiaomi Home stores overseas in the next five years, connecting the entire ecosystem of people, vehicles, and homes. Additionally, 2027 will mark the first year of Xiaomi's electric vehicle exports.

Furthermore, YuanSight understands that Xiaomi aims to cultivate 1,000 overseas talents for the AIoT business in the next 3-5 years.

03

New Dynamics in the African Market

In fact, besides Xiaomi, domestic manufacturers such as OPPO, vivo, and Honor also view the African market as a significant business growth point, further impacting the core competitiveness of Transsion, the "King of Africa".

Financial reports indicate that in 2024, Xiaomi's overseas revenue was 153.3 billion yuan, accounting for 41.9% of total revenue or 46.0% of revenue from the "Mobile Phone x AIoT" segment.

Citing Canalys data, Xiaomi stated that in 2024, it ranked among the top three in smartphone shipments in 56 countries and regions globally and in the top five in 69 countries and regions. Among them, Africa, Southeast Asia, and the Middle East all achieved notable growth in smartphone market share, with market shares increasing by 2.4, 2.0, and 1.5 percentage points year-on-year to 11.3%, 16.1%, and 18.6%, respectively.

Additionally, according to data released by Canalys in May this year, in the first quarter of 2025, the top four smartphone vendors in Africa were Transsion, Samsung, Xiaomi, OPPO, and Honor. Among them, Transsion's shipments declined by 5% year-on-year, while Samsung's increased by 7%, and Xiaomi, OPPO, and Honor grew by 32%, 17%, and 283%, respectively.

Source: Canalys

Canalys analysis suggests that after seven consecutive quarters of growth, Transsion's shipments declined by 5% year-on-year in the first quarter of 2025. One significant reason is that competitors have begun replicating Transsion's three-tier channel model, which once helped Transsion achieve extensive market penetration.

Moreover, Xiaomi's 32% growth is primarily attributed to its outstanding performance in Egypt and Nigeria, as well as increased sales of the Redmi 14C and A series products; OPPO grew by 17% year-on-year through local assembly pilot projects and omnichannel promotion focusing on the A series and Reno series; Honor achieved 283% growth, benefiting from its high-end Magic series products and 5G bundled sales programs in collaboration with MTN and Vodacom, which enhanced brand demand and awareness in the market.

Overall, similar to its path in the Chinese market, Xiaomi's strategic layout in Africa has transcended simple hardware sales. By forming localized teams, improving sales and service networks, and relying on Xiaomi's ecosystem chain enterprises, it continuously introduces diversified intelligent hardware, constructing a more comprehensive market penetration model.

As the leader in the African market, Transsion has a keen sense of crisis. In recent years, it has begun to expand into electric bicycles and AIoT businesses in overseas markets such as Africa. However, compared to other competitors, Transsion also faces challenges in product innovation and ecological collaboration. Responding effectively to Xiaomi's ecological offensive will be crucial for maintaining its leading position.

Additionally, brands like Xiaomi and Transsion need to navigate the numerous uncertainties still present in the African market, which affect its stable development.

Canalys predicts that due to factors such as slow infrastructure development, rising sovereign debt, and macroeconomic instability, the African smartphone market is expected to achieve a modest growth rate of 3% in 2025.

Furthermore, factors such as global trade tensions caused by tariffs, tightening investment flows, substantial investments in infrastructure, limited consumer disposable income, and increasing reliance on financing in the market continue to constrain the stable development of the entire market.

Some images are sourced from the internet. Please inform us for deletion if there is any infringement.