"New Honor"'s Crucial Battle

![]() 08/20 2025

08/20 2025

![]() 640

640

By Xie Zefeng

After more than 1,360 days of independent development from Huawei, Honor is now aiming for an IPO.

According to the official website of the China Securities Regulatory Commission, in the second half of this year, Honor Terminal Co., Ltd. (Honor) registered for IPO tutoring with the Shenzhen Securities Regulatory Bureau, with CITIC Securities serving as the tutoring institution.

If Honor successfully goes public, it will become the only domestic top smartphone manufacturer listed on the A-share market.

The global smartphone industry is currently at a historic turning point: the acceleration of the AI wave is reshaping the consumer electronics landscape. Apple has missed out on the smart car and AGI races, and its market capitalization has been surpassed by NVIDIA, reflecting the industry's transformation.

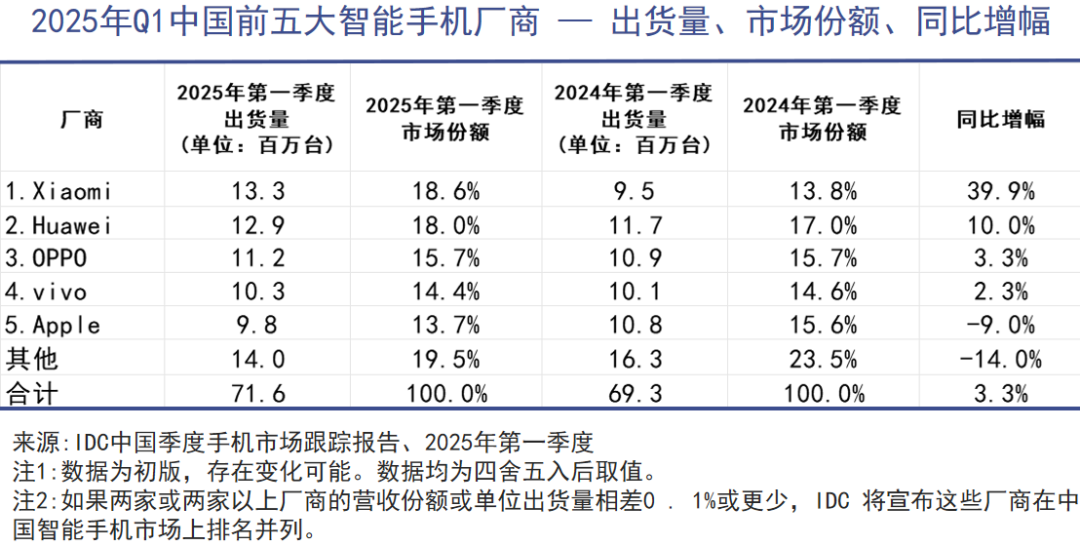

After its independence, Honor briefly topped the domestic mobile phone market as a "Huawei substitute." However, with Huawei's return, equipped with self-developed chips and the HarmonyOS system, Honor has fallen out of the top five in fierce competition.

Currently, Honor's long-time CEO Zhao Ming has announced his resignation, and the new "Alpha Strategy" has just been launched. Facing strong external competitors and the dual challenges of transformation and listing, it is evident that Honor has once again reached a critical juncture in its development history.

This is an in-depth value article from the content team of "Juchao WAVE." Welcome to follow us on multiple platforms.

Flying Solo

Honor's independence marks a significant change in China's mobile phone industry amidst the technological rivalry between China and the United States.

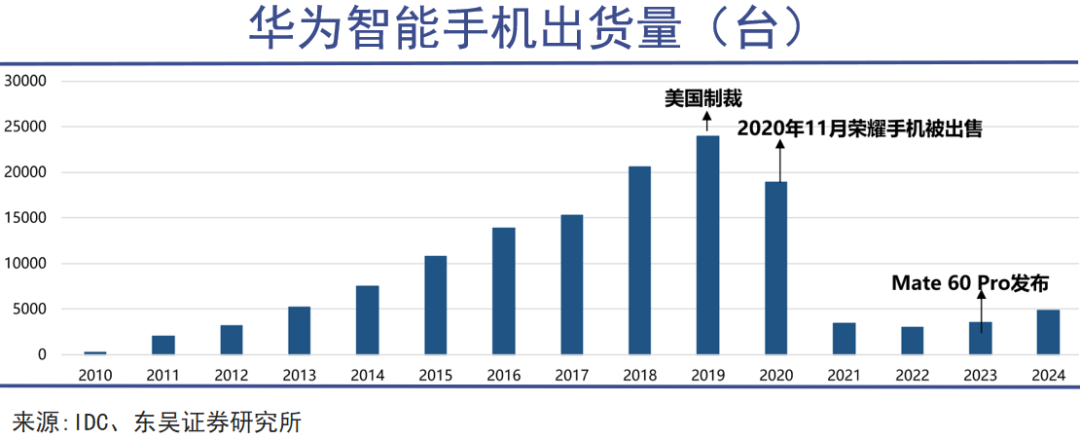

In 2020, Huawei faced multiple rounds of sanctions from the United States, which directly blocked its access to American technology products from third countries, especially TSMC's foundry services, disrupting Huawei's 5G chip research and development. As a result, Huawei's mobile phone shipments plummeted from a peak of 240 million units in 2019 to less than 30 million units in 2022.

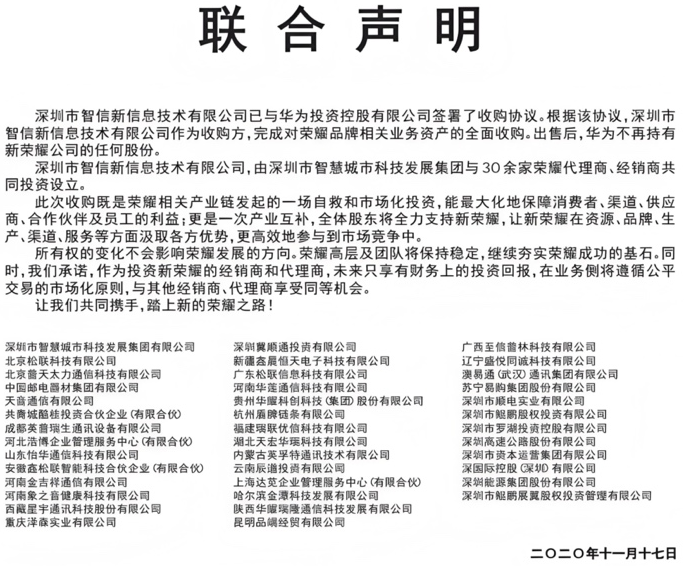

Forced to "amputate to survive," Huawei spun off Honor with a valuation of 260 billion yuan (according to Caixin reports), with Shenzhen Zhixin New Information Technology Co., Ltd. as the buyer. The latter was jointly established by Shenzhen Smart City Development Group and over 30 agents and distributors, including national chain merchants like Tianyin Communications and Suning.com, as well as regional chains such as Beijing Songlian and Shandong Yihua.

As a former sub-brand of Huawei, Honor has long focused on young users and cost-effectiveness. It quickly captured the market with budget smartphones and was a crucial part of Huawei's mobile terminal strategy.

After the spin-off, Ren Zhengfei expressed reluctance but bluntly stated at the farewell meeting that the new Honor should compete directly with Huawei, becoming its strongest global competitor and even "surpassing Huawei."

After Huawei and Honor completely separated, Honor's senior management team remained stable. Key figures from Huawei's mobile phone business, such as Chairman Wan Biao and former President of Honor Business Zhao Ming, joined, along with at least 6,000 former supply chain employees.

These talents inherited Huawei's ideology and management style. Zhao Ming also clearly stated that Huawei is Honor's most respected and anticipated competitor, and Honor aims to become a qualified and excellent competitor of Huawei.

However, winning the turnaround battle without products, factories, or a complete company system was challenging, especially since chips and operating systems needed to be rebuilt from scratch.

"Changing platforms, whether it's imaging capabilities, energy management, or operating systems, basically requires rebuilding the entire system from the ground up," Zhao Ming said in an interview in 2023.

For the new Honor, this was a daunting task. Just 66 days after independence, Honor repaired its relationship with Qualcomm, adopted 7-series chips to ensure supply, and embarked on a "211-day" R&D rush.

On the production side, Honor needed to find new ODMs and invested over one billion yuan in Pingshan, Shenzhen, to build smart production lines for the mass production of Magic flagship and digital series phones. On the channel side, Honor was already deeply bound with agents and distributors in terms of equity, giving it an inherent advantage. On the product side, since Honor was originally Huawei's youth-oriented sub-brand, the most important task was to complete its high-end lineup.

After a series of operations, Honor underwent a rebirth with brand reshaping and strategic reset.

After losing the support of its parent company Huawei, Honor's market share once fell to only 3%. However, it only took four years for Honor to return to the mainstream market from a hastily independent brand, an achievement worthy of being written into China's business history.

Fighting Again

"Some people outside say that Honor is about to die. Of course not, but rather reborn," said Li Jian, the new CEO of Honor who took over from Zhao Ming, at the launch event of the Honor 400 series on May 28. This statement reflects Honor's current situation after five years of independence, filled with the trials and tribulations of "peak-ups-and-downs-fighting again."

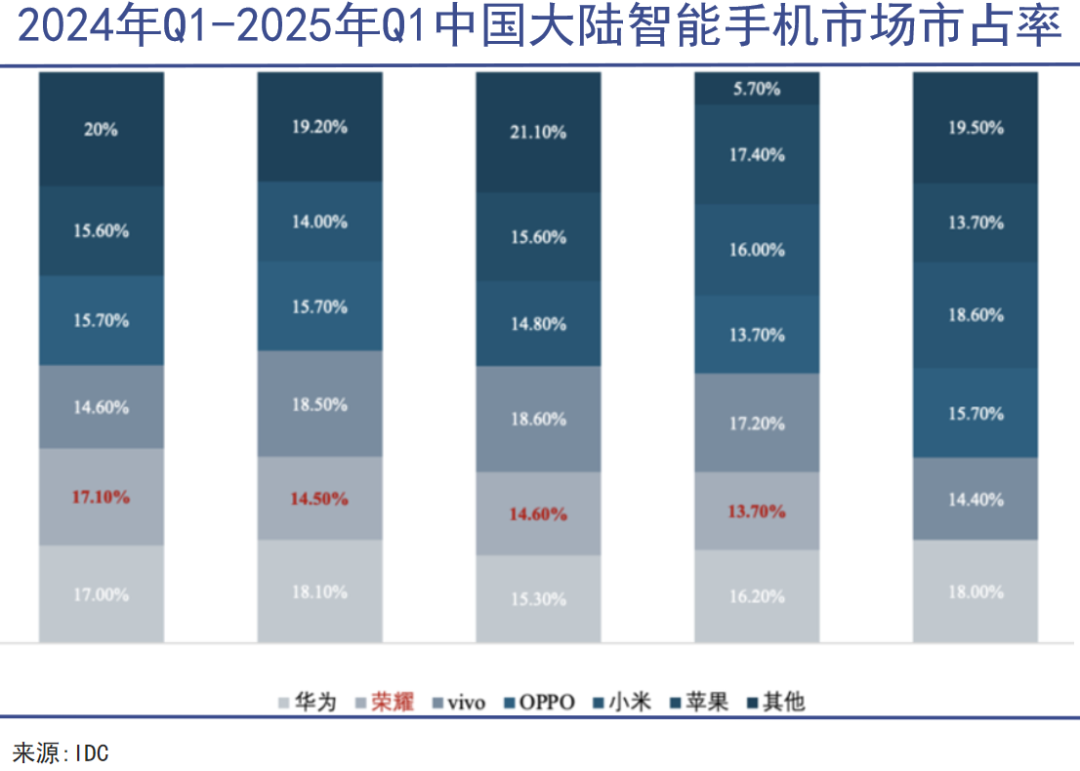

Honor has topped China's mobile phone rankings multiple times, including the second quarter of 2022, the third quarter of 2023, and the first quarter of 2024, with market shares of 19.5%, 19.3%, and 17.1%, respectively.

With Huawei's return, the global smartphone landscape is being reshuffled once again. In particular, the Mate 60 series is equipped with the self-developed Kirin 9000S chip, and the number of pure-blooded HarmonyOS terminal devices has exceeded 10 million, becoming the largest market force after "Android + Qualcomm chips" and Apple's "A-series chips + IOS ecosystem."

Huawei's consumer business has fully recovered. According to IDC data, Huawei's mobile phone market share climbed from 13.7% in the fourth quarter of 2023 to 16.2% in the fourth quarter of last year, while Honor shrank from 16.8% to 13.7% over the same period. By the first quarter of this year, Honor had further fallen out of the top five.

After Huawei's return, Honor has transformed from a "Huawei substitute" to a "Huawei competitor." The continuous loss of market share further confirms that mere imitation and following cannot ultimately make a company a strong independent enterprise.

Source: Public information, Yicai Business School

With strong competitors lurking outside and the departure of senior executives, product updates, and the further elevation of competition thresholds in the AI-reshaped consumer electronics industry, Honor is once again facing questions. The remark that "Honor is almost done" has also begun to reappear at this time.

Upon taking office, Li Jian restructured the organization, focusing on "stabilizing the foundation" and strengthening internal capabilities in 2025 to accumulate capabilities for the future.

Honor has also launched its hottest AI plan. In early March of this year, Li Jian announced the "Alpha Strategy" at the 2025 Mobile World Congress, declaring that Honor was initiating a transformation from a smartphone manufacturer to an AI terminal ecosystem company, with a planned investment of $10 billion over the next five years, an amount equivalent to nearly 80% of its annual revenue (2023).

Clearly, after Zhao Ming led Honor to a turnaround, Li Jian has become the most important decision-maker in its new era.

However, the competition thresholds and scale of smart terminal enterprises have both increased unprecedentedly. The era of AI phones has just begun. Lei Jun previously officially released Xiaomi's self-developed 3nm mobile phone chip Xuanjie O1, while Huawei relies on the Pangu large model to empower its flagship phones. Apple is tied to Alibaba, vivo has launched the BlueHeart large model, and OPPO has stated that "there is no limit to AI investment."

Compared to many manufacturers that focus on tools and applications, Honor has even greater ambitions, proposing to advance technology, industry, and ecology in parallel. It has conducted a round of organizational restructuring, newly establishing departments such as AIOS, AI hardware, and AI platforms. Currently, the number of employees in AI and software departments has reached 2,600.

Honor has also announced its entry into the robotics sector. Although not much information has been disclosed, Li Jian mentioned that "the running speed of Honor robots can reach up to 4 meters per second, breaking industry records."

All indications show that the timing of Honor's listing coincides with a new round of industrial transformation, where the red ocean of the existing market and the blue ocean of AI are intertwined. By telling the story of AI to boost its valuation, it is beneficial for the company's long-term development and capital appreciation.

Sprint

Since its separation from Huawei in 2020, going public has always been the ultimate question Honor must face.

According to previous reports by Caixin, a buyer channel merchant stated that the transaction price for Huawei's spin-off of Honor was approximately 260 billion yuan. Such a huge investment amount determines that the only way for investors to recoup their costs is through listing.

Honor has previously inadvertently revealed its listing plans, and Zhao Ming has also repeatedly stated in interviews that Honor will initiate the listing process in a timely manner.

According to Tianyancha, in the past five years, Honor has completed five rounds of financing. After the initial strategic investor Shenzhen Zhixin, it has continuously received investments from operators, supply chains, channel partners, and investment institutions, including China Mobile and China Telecom, BOE, a leading semiconductor display company, and large state-owned investment enterprises such as CICC Capital and Guoxin Holding.

Currently, Honor has as many as 23 shareholders, with Shenzhen state-owned assets still holding the largest share.

In November 2023, Wu Hui, the former chairman of Shenzhen Water Group, succeeded Wan Biao, a former Huawei executive, as the chairman of Honor. According to some media reports, one of Wu Hui's primary tasks after taking office is to promote Honor's listing, reflecting the shareholders' will.

According to rumors, in the Pre-IPO round of financing at the end of 2024, investors valued Honor at 200 billion yuan, a 23% reduction from the valuation when it left Huawei.

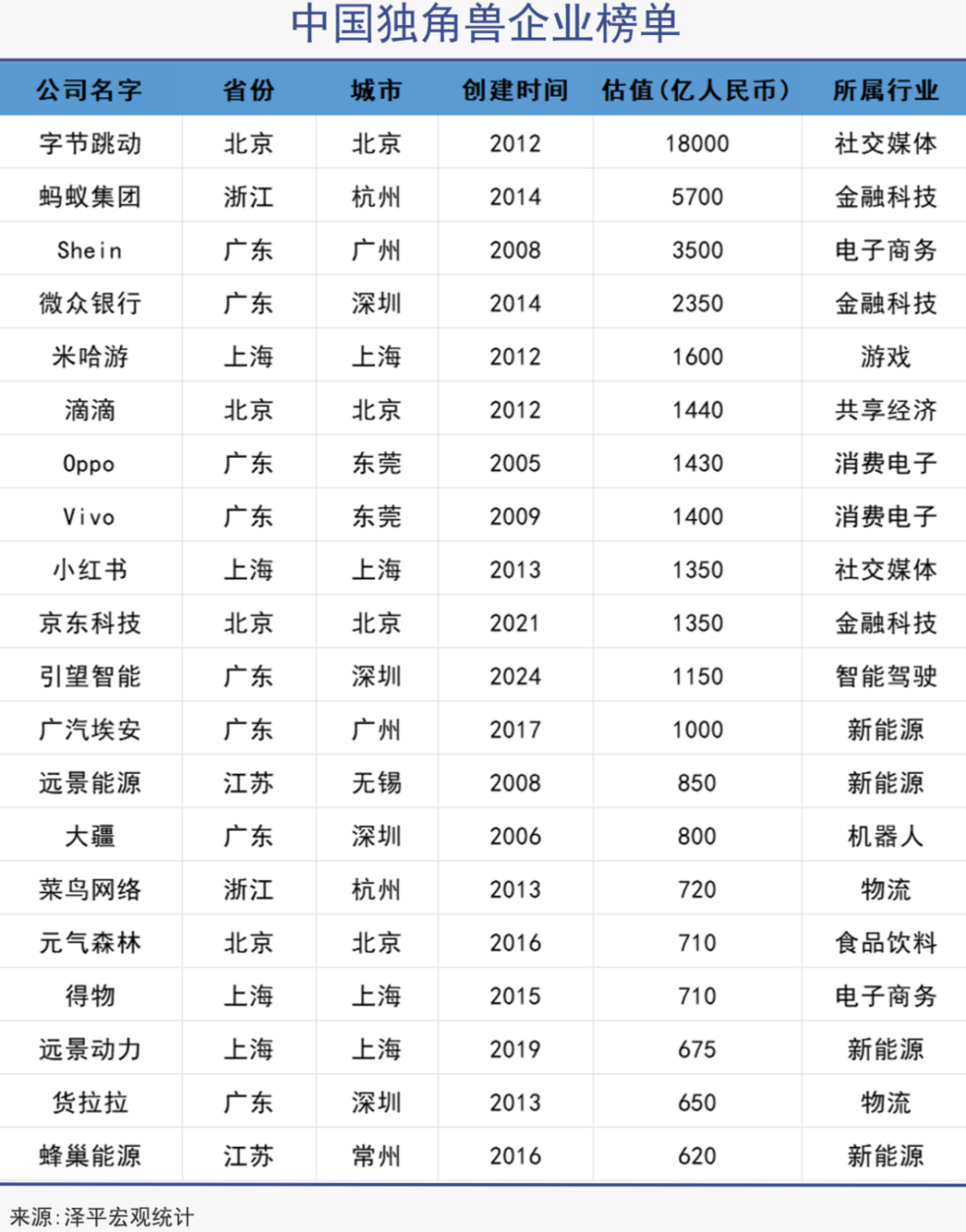

Based on this figure, Honor's valuation is approximately 1/7 that of Xiaomi (Xiaomi's business includes new energy vehicles and other hardware products), more than double that of Transsion Holdings. OPPO and vivo have not yet gone public. According to the "2025 China Unicorn Rankings," OPPO is valued at 143 billion yuan, and vivo at 140 billion yuan.

It can be seen that such a valuation is not low for Honor.

However, in the current AI race, Xiaomi has self-developed mobile phone chips, plus the imagination provided by "car-phone integration." Geely has acquired Meizu and is building an "integrated sky-ground" intelligent travel ecosystem with the help of the Spacetime Internet satellite system. Huawei has powerful ICT technology and large model empowerment, with deep integration between smart cars and mobile terminals.

In comparison, although Honor is also developing self-research radio frequency chips, silicon-carbon anode batteries, and other technologies, its core components are still subject to others, and its software and hardware systems need to be rebuilt.

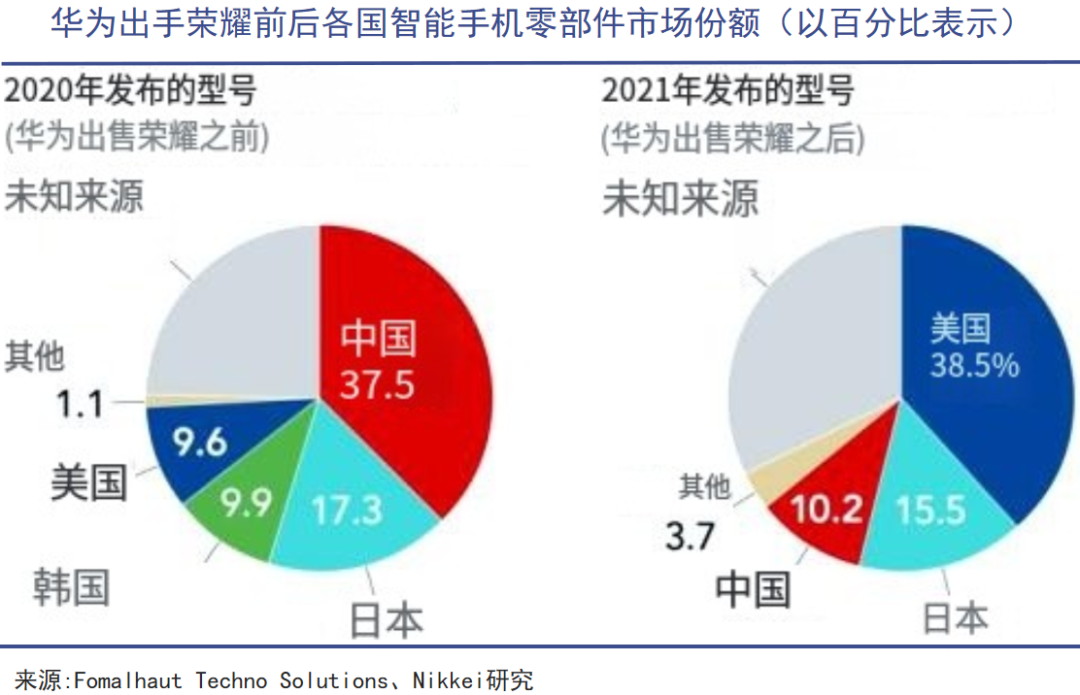

Nikkei Asian Review once disclosed that according to in-depth teardowns by research companies, the proportion of components manufactured by American companies in the Honor X30 has significantly increased from the original 9.6% to 38.5% compared to the Huawei Honor 30S before flying solo.

After disassembling the Magic 5, an institution also found that its core components are still supplied by Micron, Qualcomm, Sony, Samsung, Toshiba, and NXP, with only the screen adopting a Deep Tianma OLED screen.

The current Honor is already a giant ship bound by major shareholders, distributors, suppliers, and investment institutions, and going public is an inevitable result driven by the common interests of multiple parties. However, with significant executive turmoil, declining sales, and an AI story yet to be fulfilled, the difficulty of revitalizing Honor is no less than that of its second startup years ago.

Final Thoughts

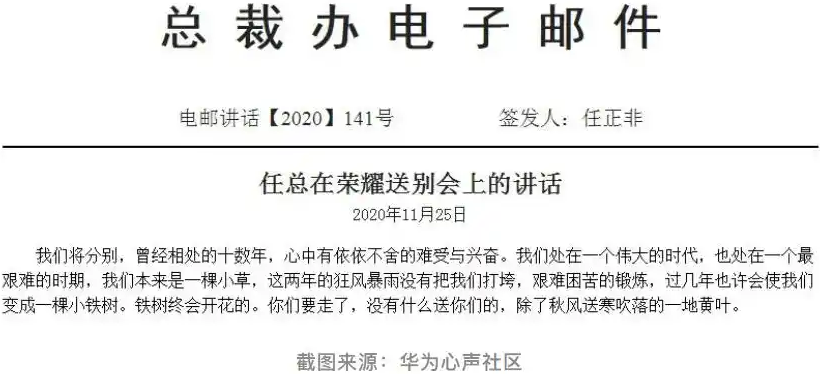

In 2020, Ren Zhengfei said at the Honor farewell meeting:

Following its "separation" from Huawei, Honor must sever all ties completely, viewing Huawei as a genuine competitor. "You may wield 'foreign guns' and 'foreign cannons', but we have our new 'Hanyang rifles' and 'broadswords and spears'. The outcome of this battle remains uncertain. We will not extend any courtesies. If any of your competitors manage to curse and defeat Huawei, they shall be hailed as heroes. Do not hinder them."

Upon Huawei's return, Honor appeared somewhat overwhelmed. Despite possessing "foreign guns" and "foreign cannons," it failed to emerge as a genuine rival to Huawei and even began to trail behind Xiaomi, OV, and Apple.

After emerging victorious from a legendary struggle for survival, Honor now faces an even more brutal round of combat.