Lei Jun Sets Sights on Africa's Potential Growth

![]() 08/21 2025

08/21 2025

![]() 687

687

Original: Shenmou Finance and Economics (chutou0325)

A quiet crisis is brewing for Xiaomi's smartphone business.

On August 19, Xiaomi released its Q2 2025 financial report. In stark contrast to the rapid progress of its automotive business, smartphone revenue amounted to 45.5 billion yuan, a decrease of 1 billion yuan compared to the same period last year, despite a 4.5 percentage point increase in market share for phones priced between 4000-5000 yuan.

How can we interpret this paradox: an increase in market share for high-end smartphones, yet a decline in overall revenue?

The mid-to-low-end market is eroding.

Early signs were evident: In the first quarter of 2024, Xiaomi ranked first in the Indian market, but in the same period of 2025, it fell to fourth place with only 13% market share.

With its fundamentals shaken, Xiaomi has now set its sights on the distant African continent.

As early as August 13, Xiaomi appointed several senior executives to focus on the African market. In response, Lei Jun declared, "We must increase investment in the African market!"

Xiaomi, renowned for its cost-effective strategy, is entering Africa in a bid for self-redemption, a move that naturally attracts significant attention from the outside world.

01 Encountering "Tough Competitors" in the African Mobile Phone Market

Xiaomi's interest in Africa is not new.

As early as November 2015, Xiaomi announced the sale of the Redmi 2 and Xiaomi 4 in South Africa, Nigeria, and Kenya. However, instead of establishing direct sales channels, Xiaomi partnered with a distributor named Mobile in Africa. This large enterprise excels in the online market but lacks precision marketing for user groups in lower-tier markets. Consequently, Xiaomi's reliance on the fragmented supply model of large distributors did not lead to large-scale localization in the region.

In January 2019, Xiaomi officially established its Africa Regional Department. This time, Xiaomi adopted a "ground-level strategy," primarily promoting low-priced series of its sub-brand—Redmi digital series and A series.

From 2020 to 2023, Xiaomi focused on promoting the Redmi series with long battery life and large batteries in the African region.

In September 2024, Lei Jun stated at the 8th China-Africa Entrepreneur Conference that Xiaomi had conducted business in 16 African countries, including Egypt, South Africa, Nigeria, Morocco, Algeria, and Kenya.

Through the "ground-level strategy," cooperation with local distributors at various levels, and the opening of direct stores, Xiaomi's approach has become increasingly localized, significantly increasing its coverage in second- and third-tier cities and township areas.

However, it should be noted that Africa also has a "king of mobile phones" with strong localization capabilities—TECNO.

TECNO, a mobile phone enterprise from Shenzhen, China, has been deeply rooted in Africa for over 15 years. While other international brands were still focused on high-end markets to refine their brand image, TECNO had already penetrated the most grassroots markets in Africa. Advertisements and sales points are ubiquitous in urban-rural fringe areas, towns, and remote villages, building an impenetrable sales network for TECNO.

Its three major mobile phone brands, TECNO, itel, and Infinix, cater to different consumer groups in Africa. The successively launched black beauty algorithms and "four SIM cards, four standby" phones have won the favor of African consumers.

The 2024 financial report shows that TECNO achieved annual operating revenue of 68.715 billion yuan, a year-on-year increase of 10.31%; net profit reached 5.549 billion yuan, a slight year-on-year increase of 0.22%, with mobile phone revenue accounting for over 90%.

By region, in 2024, TECNO Holding's African market contributed revenue of 22.719 billion yuan (accounting for 35.95%), while revenue from other regions such as Asia amounted to 44.737 billion yuan, a year-on-year increase of 13.96%.

To accelerate diversification, TECNO also established a mobility division in 2024 to explore the two-wheeled electric vehicle market, attempting to transform from a "mobile phone manufacturer" to an "African smart life service provider" to further bind local user needs.

TECNO's high emphasis on the African market has allowed it to consistently rank first in the market for consecutive years. According to data from analysis firm Canalys, in the first quarter of 2025, TECNO's shipments in the African market reached 9 million units, accounting for 47% of the market share.

Therefore, it will not be easy for Xiaomi to shake the fundamentals of TECNO, which has a vast lower-tier market.

In addition to TECNO, Samsung also dominates the high-end market in Africa. Although Samsung has not launched personalized products based on the special needs of locals, its strong brand effect still attracts many consumers to pay for its products. In the first quarter of 2025, Samsung accounted for 21% of the market share, ranking second only to TECNO.

OPPO, ranked fourth, closely follows, adopting a cost-effective strategy and focusing on launching entry-level models in the African market. Huawei, ranked fifth, has achieved an annual growth rate of 283%.

With TECNO leading the way and mobile phone brands such as Xiaomi and OPPO entering the market, the African mobile phone market has evolved from a niche market with low electronic product penetration and multiple operators to a new battleground contested by major mobile phone brands today.

02 Why is Xiaomi Increasing Its Investment in Africa at This Time?

From a global market perspective, Xiaomi's smartphone sales are actually growing. According to IDC data, Xiaomi's smartphone shipments reached 40.8 million units in the first quarter of 2024, a year-on-year increase of 33.8%, and its global market share increased to 14.1%.

However, domestically, the maturity of the mobile phone industry has led to a lack of significant technological innovation, and the extended phone replacement cycle has reduced consumer purchasing power, indicating that the mobile phone market has slowed down and entered a period of stock competition.

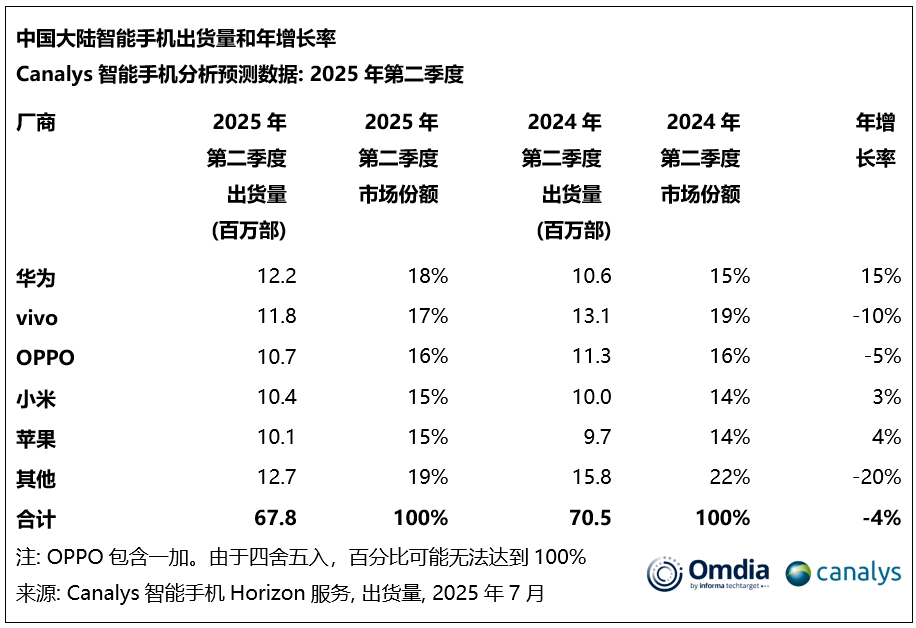

Canalys data shows that in the second quarter of 2025, vivo and OPPO both experienced varying degrees of negative growth compared to the same period last year in the domestic market. Xiaomi, which occupied 15% of the market share, achieved shipments of 10.4 million units but ranked fourth, behind brands such as Huawei, vivo, and OPPO.

At the same time, the increasing consumer demand for comprehensive mobile phone performance has prompted brands such as Huawei, Honor, OPPO, and vivo to continuously increase investment in mobile phone technology innovation, marketing promotion, and consumer experience. Huawei and Honor's deep accumulation in 5G technology and smartphone photography has brought tremendous pressure to Xiaomi, which focuses on cost-effectiveness.

In the 2024 rankings, Xiaomi even fell out of the top five in the market for a time.

In foreign markets, Xiaomi's Q2 2025 financial report shows that it has achieved a 23.4% market share in the European region, ranking second, with extremely limited room for growth.

Africa, often overlooked in the global mobile phone market, boasts a population of over a billion and has one of the fastest-growing mobile internet markets in the world.

Canalys data shows that in the third quarter of 2024, smartphone shipments in the African market reached 18.4 million units, a year-on-year increase of 3%. Market research agency data shows that in the first quarter of 2025, overall smartphone shipments in Africa increased by 6% year-on-year, totaling 19.4 million units.

Against the backdrop of a generally weak global mobile phone market, the African market has demonstrated remarkable resilience.

Another feature of the African market is the highly uneven sales distribution caused by the wealth gap.

Due to localized production policies, Egypt leads the continent with explosive growth of 34%. However, Nigeria, a major African country with a population of 200 million, has only achieved a slight increase of 1% due to currency issues. South Africa and Kenya, which previously had strong growth, both declined by 10%, while Morocco plunged by 24% due to increased import tariffs.

It seems that African consumers are extremely sensitive to price fluctuations. In the third quarter of 2024, the average selling price of smartphones in Africa fell by 6%, and shipments of phones priced below 100 USD surged by 35%, fully illustrating this point.

Simon Baker, Director of the IDC CEMA (Central and Eastern Europe, Middle East, and Africa) Smartphone Program, once said, "African consumers have limited purchasing power, and mid-to-high-end consumers in major city markets have reached saturation."

Even though Africa's internet penetration rate has risen from 2.1% in 2005 to 38% in 2024, most people still pursue cost-effective mid-to-low-end smartphones.

In the first quarter of 2025, Xiaomi achieved shipments of 2.6 million units in the African market, accounting for 13% of the market share and ranking third, thanks to the outstanding performance of its Redmi 14C and A series products. It has become the fastest-growing brand among the top three in the African mobile phone market.

Even when mobile phone manufacturers such as Xiaomi and OPPO enter Africa in a big way, they use a low-price strategy, focusing on the mid-to-low-end market.

Currently, there are only 12,000 5G base stations in Africa, covering core cities in 12 countries. Feature phones, with a penetration rate of 52%, still account for half of the entire mobile phone market in Africa. This also means that Africa, with over 50 countries and a population of over 1.3 billion, still has huge untapped consumer potential.

03 How to Tackle Africa?

However, Xiaomi still needs time to achieve more refined localized operations in mobile phone function development.

Due to infrastructure lag, Africa's communication infrastructure is relatively weak. The mobile phone market has a large number of operators, and the high call tariffs between different operators often lead users to carry multiple SIM cards to meet different call needs.

In addition, unstable power supply, incomplete network coverage, and hot weather—issues that have been resolved in other countries—still challenge mobile phone brands in Africa.

But Lei Jun personally entered the fray, choosing to meticulously cultivate the African market at this time.

To achieve rapid expansion, it is necessary to have employees who fully understand the local customs, political, and economic conditions, relying on the newly appointed localized team in the short term.

Media reports revealed that Xiaomi's mobile phone business tends to recruit mobile phone industry practitioners with African work experience during its recruitment in the African market, such as those who have worked for TECNO, OPPO, vivo, Honor, and other manufacturers.

And how to create a more localized operating model? Xiaomi obviously has experience.

In 2014, Xiaomi officially entered the Indian market, spotting a huge gap in the mid-to-low-end market. With cost-effective products, Xiaomi quickly attracted the attention of Indian consumers and captured 1.5% of the Indian smartphone market share within a year. By the end of 2017, Xiaomi topped the Indian smartphone market with a 26.8% share, winning a remarkable battle in going abroad.

Therefore, in the African market, Xiaomi can also launch more models priced between 100-150 USD, such as the Redmi A series, based on local consumer needs, reinforcing the label of "high configuration at a low price".

Within 3 to 5 years, it aims to achieve ecological synergy and explore, utilizing lower-tier market outlets to build a closed loop of "mobile phones + services".

According to Moroccan media InfoMagazine, in July of this year, Xiaomi opened its own brand and officially established XIAOMI Morocco, a local subsidiary.

The establishment of its own subsidiary has supported the key factor of after-sales service, which has been neglected in the third-party import strategy, boosting Xiaomi to differentiate itself through innovation, price, and closer connections with customers, controlling the entire "import-sales" chain, including marketing and customer service.

If Xiaomi stabilizes its mobile phone market share in the top three in Africa, it can also take advantage of the situation to launch Xiaomi's electric vehicle (SU7) and Xiaomi Home's "people-car-home full ecosystem" model in Africa.

Xiaomi's newly released Q2 2025 financial report shows that revenue from businesses such as smart electric vehicles and AI reached 21.3 billion yuan, nearly half of mobile phone revenue in a short period.

Based on Africa's geographical location, socio-economic structure, and existing infrastructure, the African new energy sector is a new field with great potential for future development.

However, until 2023, among the key countries in Africa, South Africa and Egypt sold 533,000 and 90,000 vehicles respectively; gasoline vehicle sales were 531,000 and 87,000 units, while electric vehicle sales were only 1,000 and 3,000 units, with a penetration rate of only 0.07%, still at a low level. Therefore, the sales market for Xiaomi's electric vehicles and the prospect of electric vehicles replacing gasoline vehicles are both vast.

Regarding marketing and promotion, Xiaomi can directly transfer its domestic promotion experience to the African market.

For instance, when Xiaomi unveiled its first-generation mobile phone in 2011, it was exclusively available on the company's official website. Within a mere 22 hours, the initial batch of 300,000 units was completely sold out, effectively whetting consumers' appetites through a hunger marketing strategy.

Following this success, Xiaomi organized the "Mi Fan Festival" and established the Mi Fan community, positioning extreme cost-effectiveness as its core competitive edge and cultivating a reputation for "high-end specifications at an affordable price." These promotional tactics could be mirrored in the African mobile phone market to solidify Xiaomi's position by fostering a comprehensive "Xiaomi ecosystem."

04 Conclusion

The African mobile phone market presents both a formidable challenge and a promising frontier. Although Xiaomi currently faces stiff competition in this market, as the consumption levels of African consumers rise, their demands will inevitably gravitate towards more sophisticated smart devices. By taking into account local user preferences, Xiaomi is continuously leveraging its brand influence, technological prowess, product uniqueness, and marketing strategies in the African market. The company is engaging in long-term user education and cultivation, poised to capitalize on the impending wave of smartphone upgrades.

* Images are sourced from the internet. Please reach out to us for removal if any infringement is identified.