European Auto Market | Norway in August 2025: Chinese Brands Forge Steady Advances

![]() 09/10 2025

09/10 2025

![]() 567

567

Authored by Zhineng Technology

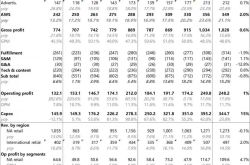

In August 2025, Norway's new car market continued its upward trajectory, with total sales soaring by 25.2% year-on-year to reach 13,915 units. The cumulative sales for the year-to-date stood at 98,996 units, marking a 25.7% increase. Pure electric vehicles (EVs) dominated the market, accounting for 13,482 units and a staggering 96.9% market share, closely mirroring July's record high of 97.2%.

Plug-in hybrid vehicles (PHEVs) contributed a modest 211 units to the tally, while sales of hybrid and gasoline vehicles dwindled to negligible levels, effectively being marginalized.

In terms of brand performance, Tesla reclaimed its leading position, Volkswagen maintained its steady presence, and Chinese brands such as BYD, Leapmotor, and Zeekr exhibited increasing activity, gradually making their way into the mainstream.

01

Overall Market Composition and Vehicle Performance

Norway's electrification journey is now firmly entrenched. In August, the penetration rate of pure electric vehicles neared 97%, while plug-in hybrid vehicles witnessed a 31.1% growth, albeit from a low base of 211 units.

Sales of hybrid, gasoline, and diesel vehicles were extremely limited, with figures of 52, 32, and 138 units respectively, exerting virtually no influence on the market. The Norwegian automotive landscape has become predominantly electric, with traditional powertrains taking a backseat.

Regarding brand rankings:

◎ Tesla led the charge with 3,014 units sold, representing a 21.7% market share, driven by strong sales of the Model Y and Model 3. The Model Y alone accounted for nearly 18% of the market with 2,456 units sold in a single month, maintaining its top-selling status; the Model 3, following its redesign, experienced a significant month-on-month sales increase, entering the top three.

◎ Volkswagen Group held its ground firmly, with the ID.4, ID.3, and ID.7 performing admirably, capturing a 12.8% market share.

◎ Skoda secured the third spot with the Enyaq and the new Elroq, although the Enyaq saw a slight year-on-year decline. Product updates, however, helped stabilize its market position.

Among traditional luxury brands:

◎ BMW and Audi delivered moderate performances, supported by models such as the iX1, i4, and Q6 e-tron;

◎ Volvo experienced a slight decline, primarily due to the EX30, but its overall performance remained robust.

◎ Ford's new Explorer made a strong comeback, with year-on-year growth exceeding 15 times;

◎ Mercedes' EQB also witnessed significant growth, with its new electric vehicle making inroads into the market.

In terms of model rankings:

◎ Tesla's Model Y retained its top position, with the Volkswagen ID.4 and Model 3 hot on its heels.

◎ Models like the Skoda Enyaq, ID.3, and ID.7 contributed to Volkswagen's diversified market presence.

◎ New models such as the Ford Explorer, Audi Q6 e-tron, and Volvo EX90 demonstrated strong momentum.

◎ BYD's Seal 7 made its debut in the top ten, signaling a positive trend for Chinese brands.

02

Progress of Chinese Brands in Norway

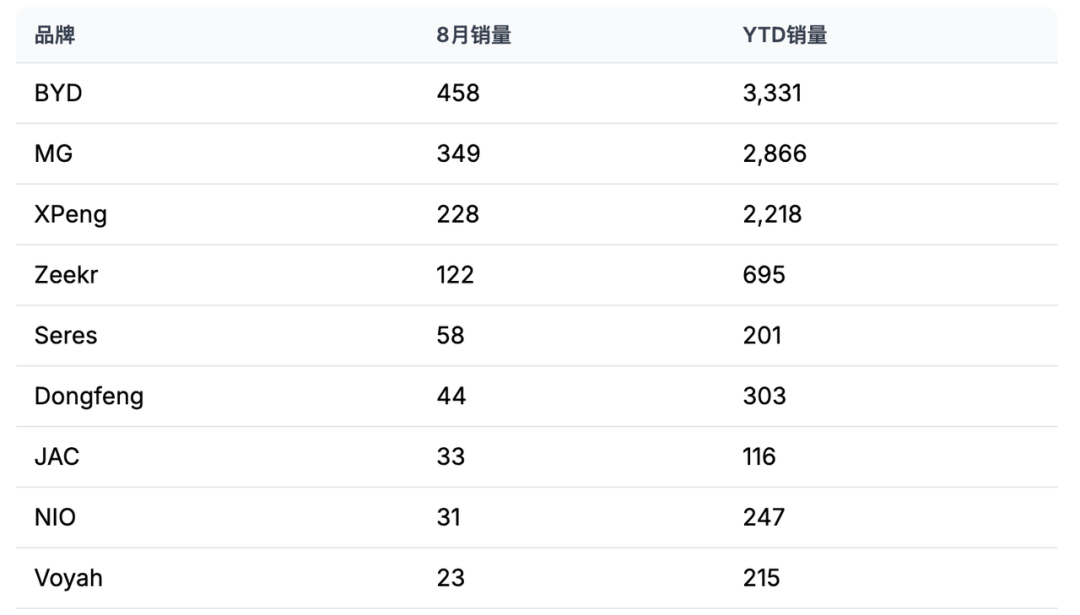

In Norway's nearly all-electric market, Chinese brands are steadily increasing their market share.

◎ BYD sold 458 units in August, ranking 11th, with a remarkable 218.1% year-on-year increase, and a cumulative total of 3,331 units, up 142%. The Seal 7 sold 348 units, entering the top ten, while other Chinese brands are also gaining traction.

◎ Leapmotor sold 128 units, with its design and cost-effectiveness resonating well with the Norwegian market.

◎ Zeekr's 7X sold 90 units, showcasing strong potential in its early stages.

◎ XPeng's G6 sold 168 units in a single month, doubling its sales month-on-month.

◎ NIO, however, faced challenges, selling only 31 units in August, a year-on-year decline of over 60%, with a cumulative total of less than 250 units.

◎ Nevertheless, brands like Voyah, Deepal, and Hongqi, though smaller in scale, are also experiencing growth. For instance, Voyah maintained stability with 23 units sold, while Hongqi's new models drove significant year-on-year growth.

Chinese brands are making a diverse impact in Norway.

◎ BYD focuses on mid-size SUVs and sedans;

◎ XPeng, Zeekr, and Leapmotor stand out with their unique product offerings;

◎ Brands like NIO still have ample room for growth if they adjust their pricing strategies and model portfolios.

Summary

The Norwegian market serves as a beacon for electrification, with pure electric vehicles accounting for nearly 97% of the market. Tesla and Volkswagen Group lead the charge, while BYD heads the Chinese contingent, with Leapmotor, Zeekr, and XPeng growing rapidly and demonstrating excellent product adaptability. For Chinese automakers, Norway provides an invaluable testing ground for brand and technology development.