Lei Jun escalates competition to target Apple, leaving domestic Android brands struggling to keep up

![]() 09/26 2025

09/26 2025

![]() 665

665

Source: Byte

A carefully orchestrated scheme.

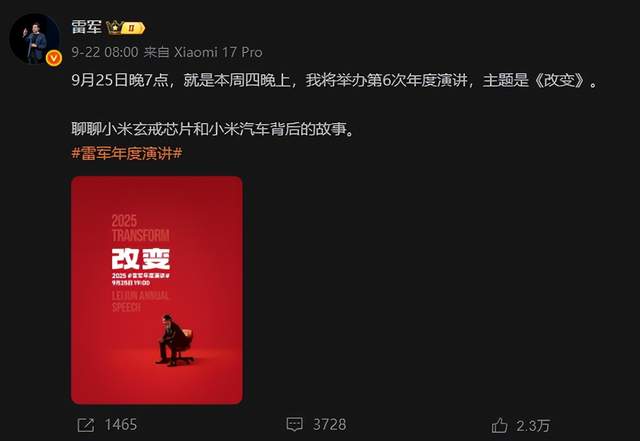

On September 25th, at the China National Convention Center, Xiaomi founder Lei Jun delivered a keynote speech titled 'Transformation'.

Screenshot sourced from Weibo @Lei Jun

When Lei Jun announced the name 'Xiaomi 17', skipping '16' entirely, the audience immediately understood that he was about to showcase some strategic moves.

As early as September 15th, Lei Jun had posted that the Xiaomi 17 series would represent a generational leap in product strength, fully positioning itself against the iPhone and directly engaging in competition.

The atmosphere was set, and a major showdown was about to unfold.

01 The overt 'couple'

Lei Jun is consciously creating a 'couple' dynamic between Xiaomi and Apple.

As the former 'Lei booth ' (a nickname combining Lei Jun and Steve Jobs), no one understands Apple better than him. The narrative of a distant yet connected relationship has run through Xiaomi's entire growth history.

No one can forget that at the launch of the first Xiaomi phone, Lei Jun's appearance in a black T-shirt and blue jeans closely resembled that of Apple co-founder Steve Jobs.

Since then, Xiaomi has maintained an ambiguous distance from Apple. The industry knows Xiaomi is consciously aligning itself with Apple, but no one has directly stated it.

Until 2022, when Xiaomi dropped the pretense and openly declared its intention to 'fully compete with Apple.'

At that time, Apple was riding high, with the iPhone 13 series selling well and the iPhone 14 Pro's unique 'Dynamic Island' design sparking market buzz and imitation by competitors.

Later, Apple's products faced severe reputation differentiation (differentiation), with entry-level models like the iPhone 14 and iPhone 14 Plus suffering significant sales slumps, while the iPhone 14 Pro series was in short supply. The MacBook series was criticized for 'incremental upgrades,' with the M2 chip offering only modest improvements, and the MacBook Air's pricing strategy also questioned.

Subsequently, Xiaomi swiftly adjusted its public messaging. Lei Jun and Xiaomi executives began emphasizing at various occasions that Xiaomi's HyperOS would fully support Apple devices, and that Xiaomi's car infotainment system would deeply integrate with Apple CarPlay, 'allowing Apple users to seamlessly integrate into (integrate) into the Xiaomi ecosystem.'

During that period, Lei Jun focused all his attention on the upcoming Xiaomi car. He intensively updated short videos, live-streamed, attended auto shows, and personally narrated Xiaomi's 'comeback' story in car manufacturing, becoming an absolute top influencer in the automotive circle.

It wasn't until 2025, when the iPhone 17 returned with thunderous momentum, that Xiaomi once again raised the banner of 'direct competition.'

The current showdown has taken this 'bundling' strategy to its extreme. The naming of the Xiaomi 17 directly corresponds to the iPhone 17 in sequence. At the launch event, all core parameters, from the chip to the camera, were compared item by item with the iPhone.

The on-site PPT showed: When the iPhone 17, equipped with an external 5000mA magnetic power bank, runs out of battery, the Xiaomi 17 still has 26% remaining.

Image sourced from Weibo @Xiaomi

It can be said that throughout the speech, Apple was nowhere to be seen, yet everywhere present. Lei Jun masterfully controlled the atmosphere.

In this way, market attention was forcibly shifted from the prolonged, homogeneous melee among Android brands to the absolute mainline of 'Xiaomi vs. Apple.' At least for these past few days, few mobile phone brands have surpassed Xiaomi's 'benchmarking' in terms of buzz.

Lei Jun's rhetoric further amplified the 'frenemy' atmosphere.

'If you're an Apple user and want accessories that Apple doesn't offer, you can come to me to 'make a wish,'' Lei Jun said, highlighting the ultra-thin power bank's perfect compatibility with the iPhone. Meanwhile, the new HyperOS 3 system strengthened ecological interconnection with Apple computers and iPhones, even allowing iPhone notifications to be viewed and replied to directly on Xiaomi phones.

Compared to the series of 'diversionary' tactics by competitors against Apple, only Lei Jun and Xiaomi have put this into practice.

In a video released on September 24th, the day before the speech, Lei Jun offered an official explanation for this strategy: 'I believe that only by benchmarking against the best and learning from the best can we ultimately surpass the best.'

The stage was set, the script written, and every move was calculated.

02 Driving the tiger to swallow the wolf

No one understands Apple better than Lei Jun.

Lei Jun's boldness in staging this drama likely stems from his insight into Apple.

This insight traces back to a manufacturing nightmare in India. The British 'Financial Times' pointed out that at an iPhone parts factory operated by the Tata Group, the yield rate was a mere 50%. This figure means that manufacturing an iPhone 17 Pro in India actually costs 42% more than in China. To fill this disastrous financial hole, Cook 'had no choice but to sell more and more phones in the efficient, high-quality, high-profit Chinese market.'

Thus, the iPhone 17's strength became inevitable.

After years of user criticism, the 60Hz screen on the standard model was finally upgraded to a 120Hz ProMotion high refresh rate. The stingy 128GB base storage jumped to a 256GB starting point. The Pro series featured three rear cameras, all with 48-megapixel sensors.

Ultimately, the market responded authentically to Cook's 'sincerity.' 'iPhone 17 sold out' quickly trended on Weibo, with all channels selling out instantly. Pre-order volumes for the entire series exceeded 7 million before launch.

Screenshot sourced from Weibo

Cook and Apple had not felt such satisfaction in a long time.

Xiaomi President Lu Weibing succinctly evaluated: 'They squeezed too hard.'

Xiaomi's response was to forcibly 'bundle' itself with Apple, creating the impression in consumers' minds that 'the high-end market only has Apple and Xiaomi,' thereby placing other domestic Android manufacturers—those also struggling to break into the high-end market—under the dual pressure of Apple and 'Apple-like Xiaomi.'

The iPhone 17 standard model starts at 5,999 yuan. Xiaomi's pricing was extremely precise: The Xiaomi 17 Pro Max also starts at 5,999 yuan but offers a larger 6.9-inch screen and superior imaging; the Xiaomi 17 Pro starts at 4,999 yuan, and the Xiaomi 17 standard model is as low as 4,499 yuan.

Such precise positioning would be hard to believe without any clever design.

'Apple, Samsung, and Huawei are like insurmountable mountains, with little hope of catching up. Should we give up and accept our fate, or keep fighting?' Lei Jun's words revealed the truth. When Xiaomi decided to go high-end, it never considered non-Huawei domestic Android brands as strategic-level competitors.

Later, as Huawei launched its self-developed pure HarmonyOS system, at least from Lei Jun's perspective, the only competitors were Apple and Huawei, with their proprietary system ecosystems, and Samsung, with its integrated hardware supply chain.

Xiaomi still has a clear understanding of its limitations. HyperOS is currently just a 'fusion' and 'rewrite' based on Android, unable to establish an independent app ecosystem on par with iOS and HarmonyOS in the short term.

'Surpassing Apple' is a slogan to elevate brand positioning and rally internal morale. Using its bind (bundling) relationship with Apple to integrate the fragmented Android camp and become the king of the Android world is its most realistic strategic goal.

03 Apple's boundaries

Lei Jun's strategy of 'driving the tiger to swallow the wolf' and aggressively 'bundling' with Apple is not a suicidal charge because he has calculated that Apple has its own 'boundaries.'

The global smartphone market has entered a Stock competition (stock competition) era, with overall growth slowing or even declining. Apple's main markets, such as North America, Europe, and East Asia, have extremely high penetration rates, with incremental users primarily coming from upgrade demands. Its high pricing naturally positions it in the high-end market, unable to capture the largest market share by covering all price segments like Android manufacturers.

More importantly, a powerful external force is effectively curbing Apple's growth in China: Huawei.

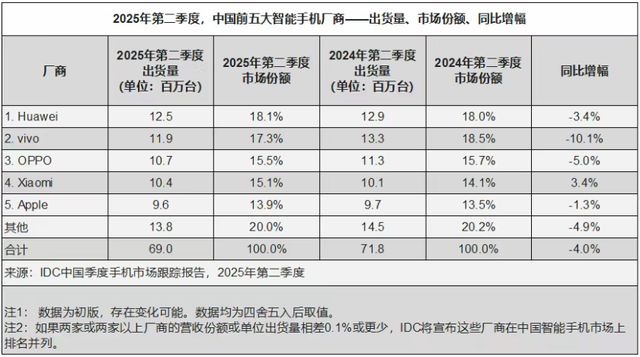

According to IDC data, in the second quarter of 2025, Huawei regained the top spot in China's smartphone shipments with an 18.1% market share, while Apple fell to fifth place with 13.9%. Huawei's strong return marked the end of Apple's 'easy win' era in China's high-end market.

Image sourced from IDC

Huawei's strength is multi-dimensional, not just in sales. The full rollout of HarmonyOS 5.1 brought a seamless cross-device file transfer experience in just 15 milliseconds. The number of HarmonyOS 5 terminals has surpassed 10 million, and 83% of China's top 300 mobile apps have completed native HarmonyOS adaptation.

Once this flywheel starts spinning, it will directly threaten Apple.

The chessboard holds even more variables.

Apple also faces significant supply chain challenges. Samsung successfully struck at BOE (Beijing Oriental Electronics) through a trade secrets lawsuit, threatening Apple's OLED panel supply security and leaving Apple with almost no choice for core components in its next-generation foldable products, effectively being 'choked' by Samsung.

In other words, the market has created a 'dynamic balance' that Lei Jun most hopes to see.

An Apple with boundaries, restrained, and plagued by its own troubles becomes a variable that Xiaomi can exploit. Its strength is sufficient to intimidate and squeeze other Android competitors, yet its boundaries prevent it from posing a lethal threat to Xiaomi.

Xiaomi is walking on a tightrope. On the left is Apple, on the right is Huawei. The wind is strong.

Some images sourced from the internet. Please notify us for removal if there is any infringement.