A Tenfold Difference in Scale, A Thousand-Mile Pursuit: Why Does Insta360 Dare to Take on DJI Head-On?

![]() 10/17 2025

10/17 2025

![]() 574

574

"Should I buy DJI or Insta360?" This has recently become a new dilemma for many young people. The reason behind it is straightforward—these two smart hardware giants are fiercely engaged in a price war.

Shortly after the National Day holiday, DJI took the lead by significantly slashing prices on multiple popular products, including gimbal cameras, action cameras, and aerial drones, with some models seeing price drops exceeding a thousand yuan.

Image Source: Internet

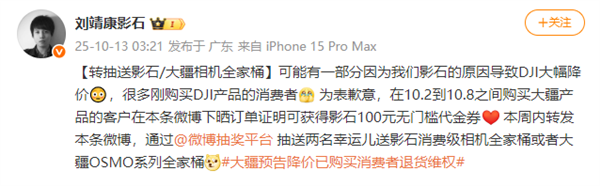

Interestingly, in response to DJI's price cuts, Insta360 founder Liu Jingkang pulled off a "counterintuitive move" on Weibo. He jokingly said, "Perhaps DJI's price reductions are partly due to us at Insta360," and expressed his "apologies."

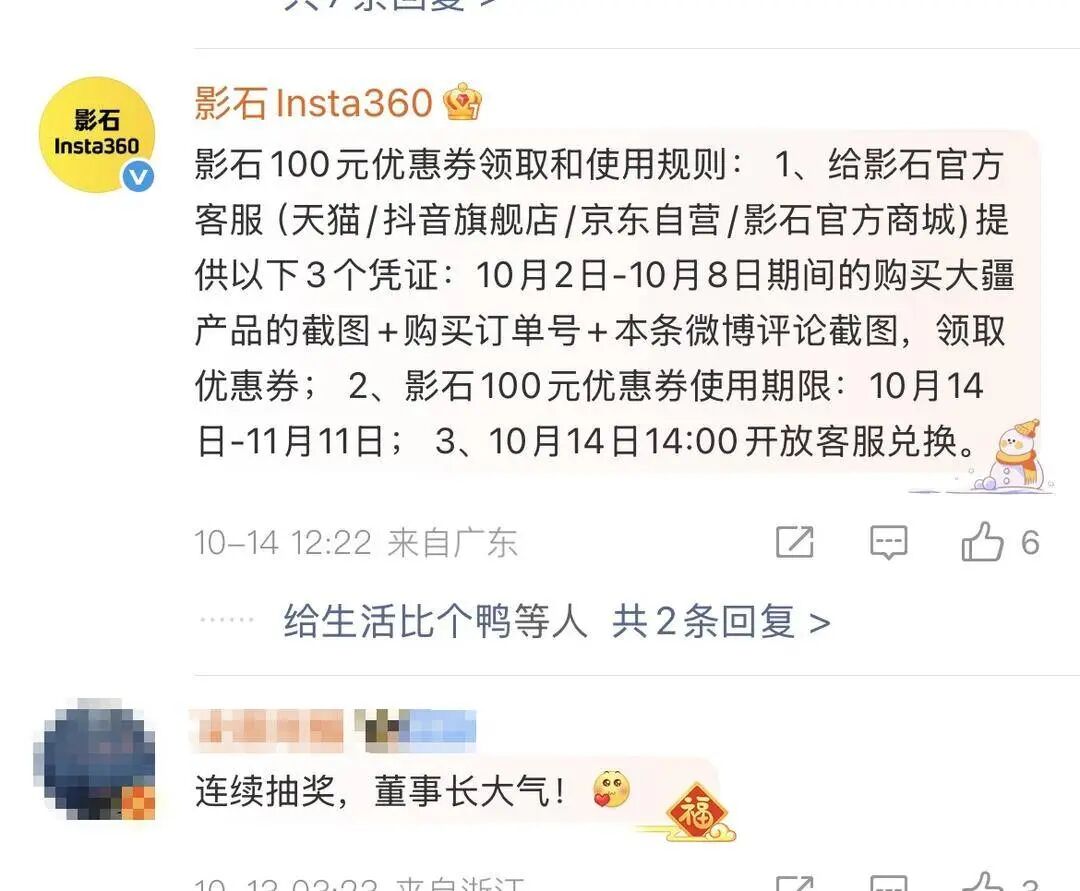

How did he apologize specifically? He announced that users who purchased DJI products between October 2nd and 8th could receive a 100 yuan no-minimum-spend voucher from Insta360 by simply sharing their order. Additionally, users who retweeted this Weibo post could participate in a lucky draw, with prizes including "full product line" bundles from Insta360 or DJI.

Image Source: Weibo

This move was quite clever—Insta360 not only capitalized on the situation for marketing but also successfully gained a wave of goodwill. The comment section quickly lit up, with some saying, "I already have DJI, but I want to try Insta360," others joking, "You can play it like that?" and still others remarking, "Mr. Liu is too humble, but we consumers love it."

However, DJI's sudden price cuts left many users who had just purchased at full price feeling like "big losers," with complaints of "being stabbed in the back by DJI" trending on hot search lists.

In fact, this isn't the first time the two companies have directly clashed. The escalating conflict stems from both companies reaching growth ceilings in their core markets, forcing them to invade each other's "territory" in search of new opportunities. This battle was inevitable.

So, the question arises: Can Insta360 really hold its own against DJI in this head-on collision?

Thousand-Yuan Price Cuts: Has the Price War Gone Crazy?

DJI is serious this time.

Shortly after National Day, the drone giant announced its "largest-ever" price reductions—the Mini 4 Pro dropped by nearly 1,500 yuan, the Action 4 by 950 yuan, and the popular Pocket 3 by 900 yuan. This promotion, running from October 9th to 14th, left many consumers who had just bought at full price feeling "betrayed."

Image Source: Internet

In response, DJI customer service provided tiered replies: Users who purchased at official offline stores enjoy a 7-day price protection guarantee; online e-commerce platform orders can apply for price adjustments; and users from special channels like Sam's Club receive exclusive limited-time subsidy plans.

Interestingly, Insta360, DJI's old rival located just 10 kilometers away, didn't seize the opportunity to attack. Instead, its post-90s CEO Liu Jingkang pulled off another "counterintuitive move" on Weibo.

He publicly stated that DJI's price reductions might be "partly due to us at Insta360" and promised that users who purchased DJI products during this period could receive a 100 yuan voucher from Insta360 by sharing their order. This Weibo post quickly trended, with netizens joking, "This shows great pattern (vision)" and "Mr. Liu knows how to play the game."

Image Source: Weibo

This is indeed Liu Jingkang's style—always playing unconventionally. From hacking Zhou Hongyi's phone number in college to calculating the "average face of Nanjing University" using 7,000 student photos, this young entrepreneur always seems to make unexpected moves at critical moments.

When Insta360 went public in June, his unconventional appearance—wearing a cultural T-shirt and ringing the bell with a panoramic camera—already showcased his unique style to the world.

Image Source: Internet

This unique approach was fully displayed in the subsequent competition with DJI.

On July 23rd, Insta360 announced its entry into the drone market; just 24 hours later, DJI officially announced it would launch a panoramic camera by the end of the month, clearly signaling a head-to-head battle.

The subsequent competition was even more intense—Insta360 released drones starting at 2,999 yuan, and DJI immediately priced its competing product at the same level; when DJI's new product faced "lens fogging" controversies, Liu Jingkang dismissed it as "isolated cases" while announcing a 500 yuan price cut for his own product to keep the pressure on.

In August, the battle escalated further. When Insta360 announced the public beta of its panoramic drone, Liu celebrated by handing out cash red envelopes in the office; in September, the conflict continued: DJI released the Osmo Nano to compete with Insta360's GO Ultra, while Insta360 showcased its panoramic drone at the Berlin Electronics Show.

Image Source: Internet

Currently, the competition between the two giants has expanded from products to all-dimensional confrontations.

DJI is aggressively expanding its market team, competing with Insta360 for top KOL resources; Insta360 is defending its position with a significantly increased advertising budget, covering virtually all traffic channels. Offline, DJI's over 470 stores face rapid pursuit from Insta360—which is accelerating its expansion in Shenzhen, Guangzhou, and other cities, with plans to triple its store count in a new first-tier city compared to last year.

More intriguingly, Insta360 poached Zhang Bo, a senior DJI employee, to serve as its China sales head. This veteran familiar with DJI's sales system is now driving reforms in Insta360's dealer network.

This local derby has evolved into a comprehensive battle involving products, pricing, channels, and talent, with the market competition between these two smart imaging giants continuing to intensify.

Invading Each Other's Core Markets: Insta360's Aggressive Push Against DJI

Since listing on the STAR Market in June, Insta360's market capitalization has been remarkable—soaring from 70 billion yuan to briefly exceed 140 billion yuan within three months, and still hovering around 110 billion yuan as of October.

Image Source: Snowball

Why would this new capital market player choose to confront industry giant DJI head-on right after going public? The answer lies in Insta360's growth bottleneck.

According to Frost & Sullivan data, the global panoramic camera market was worth just 5.03 billion yuan in 2023, with projections suggesting it will only grow to 7.85 billion yuan by 2027.

Image Source: Internet

As the global leader in panoramic cameras, Insta360 currently holds over 80% market share. Even if it achieved 100% global market share, its business would only reach several billion yuan—offering limited growth potential.

Relying solely on existing businesses and short-term stock price surges cannot sustain its long-term valuation logic. Insta360 must explore new growth areas, making the search for a second growth engine imperative.

The drone market presents precisely this opportunity.

MarketsandMarkets predicts the global drone market will reach $26.12 billion by 2025 and grow to $40.56 billion by 2030, with a compound annual growth rate of 9.2%. This sector clearly offers greater imagination space.

In fact, Insta360's drone ambitions have been evident for some time. Its prospectus reveals that since July 2020, the company has continuously registered multiple patents related to "drones" and "panoramic drones," covering core components like structure, propellers, and power systems. The launch of its "Yingling Antigravity A1" panoramic drone represents the culmination of this accumulation.

Yingling Antigravity A1 Image Source: Internet

For Insta360, making drones offers a natural advantage: The core technologies of action cameras focus on imaging systems and intelligent algorithms. Insta360's expertise in stabilization, image stitching, and intelligent tracking can be directly applied to drones without requiring from the beginning (from scratch) development. Its breakthrough doesn't lie in competing with DJI on flight performance but in leveraging its strengths to create differentiated products in panoramic shooting and AI-driven creative features.

Changjiang Securities estimates that under optimistic scenarios, Insta360 could capture 20% of the drone market, translating to approximately 19.2 billion yuan in revenue—equivalent to rebuilding several Insta360s.

The capital market clearly buys this story. After Insta360 announced the public beta of its panoramic drone on August 14th, its stock price hit the daily limit for two consecutive days, boosting its market capitalization by 40 billion yuan and pushing its P/E ratio above 200 times. Such valuation levels cannot be sustained by panoramic or action camera businesses alone, reflecting high market expectations for its challenge to DJI.

On the other side of the battlefield, DJI's pivot into Insta360's core action camera territory after facing overseas resistance makes perfect sense.

According to public data, in the 2024 global action camera market, veteran player GoPro leads with 28.7% market share; Insta360 follows closely at 27.3%; while DJI, in third place, trails by just 1.4 percentage points with 25.8% share.

Image Source: Internet

With such narrow market share differences, DJI can easily wield the price war weapon to launch a direct market share battle in Insta360's strongest arena.

Thus, with one company desperately seeking new growth and the other feeling threatened, these two companies headquartered just 10 kilometers apart Tacitly understanding (tacitly) charged into each other's core territories in the second half of this year.

Mixed Results, But Significant Challenges for Insta360

In the imaging equipment circle, comparisons between DJI and Insta360 remain a hot topic. A veteran photographer admitted, "DJI is like a steady top student, while Insta360 is like an innovator who always has new tricks."

In terms of company scale, the two aren't even close. In 2024, Insta360 reported 5.574 billion yuan in revenue, while DJI reached 80 billion yuan—over 14 times higher. Net profit showed an even larger gap: 995 million yuan for Insta360 versus 12 billion yuan for DJI, exceeding a 12-fold difference. Such scale disparities put greater pressure on Insta360's every move.

From a product perspective, in the panoramic camera segment, DJI's Osmo 360 impresses with its 1-inch square sensor delivering excellent image quality, widely praised night performance, and broad dynamic range. Its strong ecosystem synergy adds icing to the cake—from unified color profiles and universal accessories to seamless hardware-software integration, it creates a complete closed loop for multi-perspective creativity.

Image Source: Internet

However, drawbacks exist. Some professional users report noticeable stitching artifacts and software experience issues, particularly the tendency to overheat during 8K recording.

Insta360's X5 excels in playability, featuring dual-bottom sensors for improved image quality, rich AI editing functions, and practical interchangeable lens design. However, it shows weakness in highlight suppression.

User Zhang Xiaobei, an Insta360 X5 owner, reported that outdoor strong light shooting often results in overexposed skies, and the device's bulkier size compared to competitors makes it less portable.

In the action camera arena, both companies have their strengths. Insta360's Ace Pro 2 boasts impressive specs with a Leica co-developed lens, 8K recording capability, AI dual-core processing for significantly enhanced night performance, and excellent stabilization and waterproofing. DJI's Action 5 Pro maintains its characteristic strengths in portability, premium build quality, low-light performance, and ecosystem integration.

Image source: Internet

This differentiation also extends to consumer choices. Li Chen, a professional photographer, shared, 'If you pursue stable and reliable image quality and a complete ecosystem, DJI is your top choice; but if you enjoy experimenting with new ways of playing, Insta360's creative features will better satisfy you.'

However, when we step outside the realm of consumer-grade products and examine this competition from a broader technological perspective, we find that Insta360 faces even deeper challenges.

Especially in emerging business areas like drones, the existing size gap makes every expansion step by Insta360 particularly challenging.

DJI has been deeply involved in the industry for many years and has built a solid barrier composed of 38,000 patents. Even powerful players like Xiaomi entering the market have failed to shake its market position.

For Insta360, launching products is just the first step. The real test lies in how to bridge the gap in core technologies.

In key technology areas, DJI has achieved full-chain self-research from operating systems to core components like batteries and electric drives. This not only brings cost advantages but also ensures autonomy in technological iteration. In contrast, Insta360 still relies on external suppliers for core components, which not only affects cost control but may also constrain rapid product iteration.

As a latecomer, Insta360 needs to build core capabilities such as flight control and obstacle avoidance algorithms. Details at the user experience level, such as image transmission stability and operational smoothness, will directly impact the market acceptance of its products.

Returning to the competition between the two, the effects of the price war are already reflected in the financial data. In this head-to-head battle, the smaller Insta360 is the first to feel the pressure. In the first half of 2025, the company's revenue grew by 51.17% year-on-year to 3.671 billion yuan, indicating that the price cuts have indeed attracted more customers and increased sales.

However, net profit only increased slightly by 0.25% to 520 million yuan, with the net profit margin declining from 21.35% to 14.16%. This shows that although sales have increased, the profit per item has decreased, and profits have been squeezed by the price war.

Why has the profit increase been small? Because expenses have risen. Apart from product price cuts, Insta360 has also spent money on research and development for new products and advertising and marketing.

To quickly develop drones that can compete with DJI, Insta360's R&D investment doubled in the first half of the year, burning through 562 million yuan. Meanwhile, to seize market attention, advertising and marketing expenses also soared, reaching 628 million yuan, a 75% increase. These two expenditures have acted like two water pumps, nearly draining the increased profits.

Image source: Internet

This battle between giants is triggering an industry shakeout. Consumers can sit back and reap the benefits, buying better products for less money. Meanwhile, smaller brands that lack strength may quietly exit the market in this fierce competition.

Of course, companies will not remain stuck in price wars forever.

Summary

The next phase of competition will escalate to three dimensions: first, ecological layout, enabling intelligent linkage among devices like drones and action cameras, paired with AI-powered one-click video editing, selling not just individual hardware but a complete creative solution; second, AI empowerment, allowing cameras to automatically handle composition, tracking, and other operations that previously required professional knowledge; and finally, returning to the essence of user experience, seeing whose products are easier to use and whose software runs more smoothly.

On the surface, this price war appears to be a mutually destructive battle. But looking deeper, it is forcing companies to transform and break through. Short-term pain is inevitable, especially for challengers like Insta360 under profit pressure. In the long run, such competition will foster better products and more complete service systems.

The ultimate winners may be us consumers, who will enjoy better products and services.

References:

1. 'Insta360 CEO Liu Jingkang Responds to DJI Giveaway: Accepts Criticism but Will Honor Promised Benefits; Previously, DJI Price Cuts, Liu Jingkang Suggested Insta360 May Be Partly Responsible' Xiaoxiang Morning Herald

2. 'DJI Price Cuts, Insta360 Apologizes' Sanyan Pro

3. 'Taking on DJI Head-On, Guangdong's Post-90s Entrepreneur Builds a 120 Billion Yuan Business' Caijing Tianxia

Click 'Recommend' and get blessed by the lucky carp!

END

Contributions and Content Cooperation | editor@chreview.cn Advertising and Business Cooperation | bd@chreview.cn

Contributions and Content Cooperation | editor@chreview.cn Advertising and Business Cooperation | bd@chreview.cn