Can Spotify Embark on Another Upswing in Its New Price Increase Cycle?

![]() 11/05 2025

11/05 2025

![]() 444

444

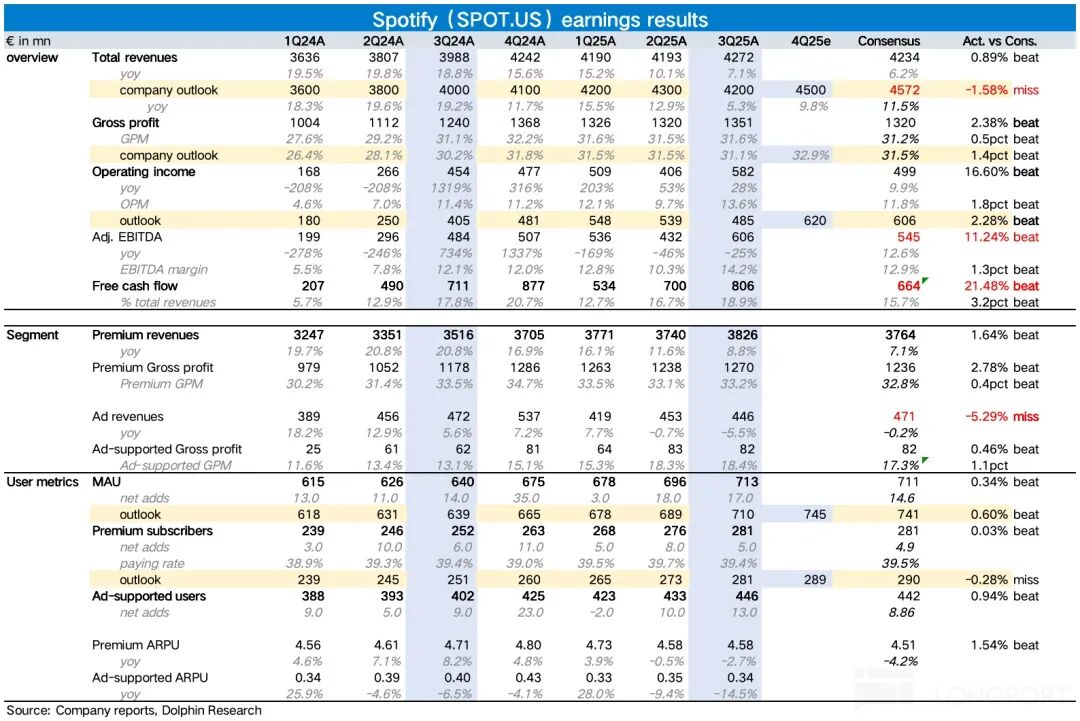

Spotify's earnings report for the third quarter of 2025, unveiled prior to the market opening on November 4, presented a mixed bag of results. However, the focal point of market concern—profit margins—actually surpassed expectations, sparking a mildly positive market response.

Let's delve deeper:

1. Profit Margins Surpass Expectations: Since the third quarter, Spotify has rolled out a plethora of product enhancements (nearly 30 feature updates of varying magnitudes), encompassing lossless audio quality, playlist customization, messaging capabilities, personalized audio settings, and collaborations with ChatGPT and Netflix. A notable shift was transitioning free users from 'shuffle play' to '1-hour on-demand listening'.

The overarching goal is to elevate user experience, foster greater user loyalty, and thereby subtly drive paid conversions.

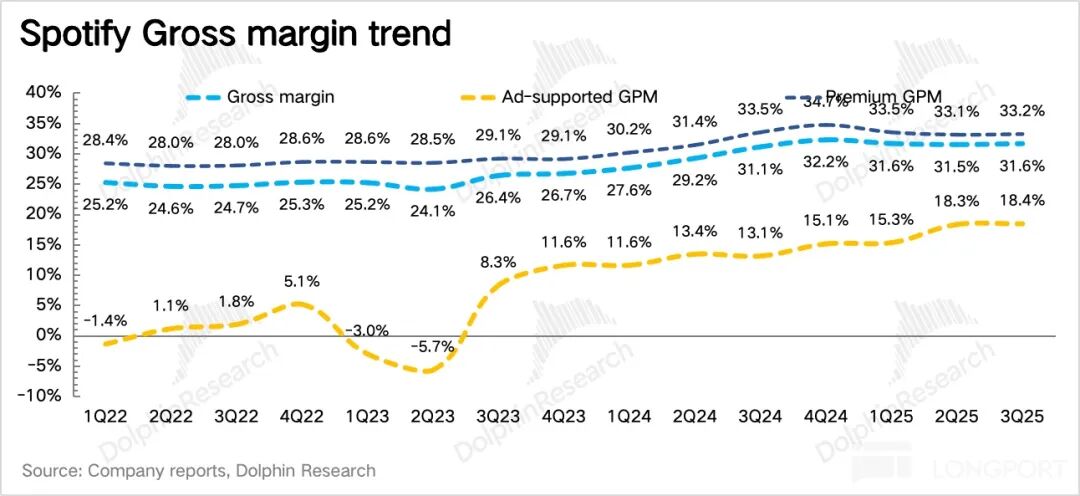

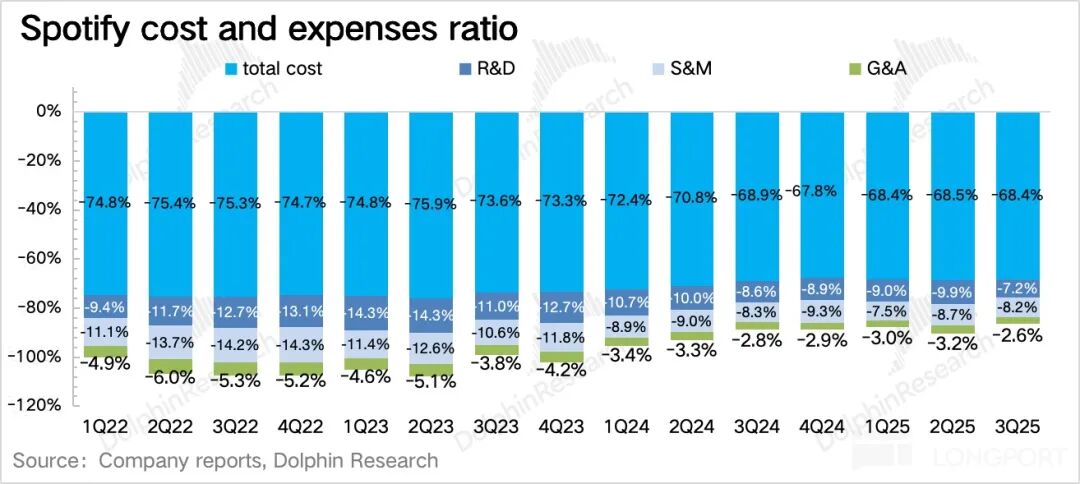

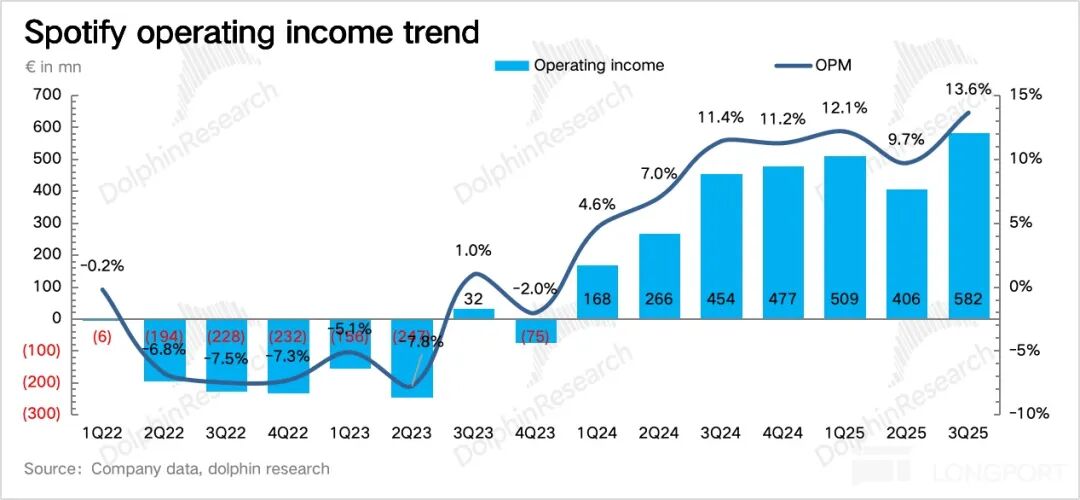

Given the flurry of new feature introductions, the market fully anticipated a spike in current expenses. Yet, in reality, both gross and operating profit margins outperformed expectations in the third quarter. Operating expenses saw a significant contraction, with a marked decrease in Social Charges (which typically ebb and flow with employee benefits, including equity incentives; Spotify's stock price dipped 10% in the third quarter compared to the end of the second quarter). The company also demonstrated tight control over marketing, promotion, and personnel expenditures.

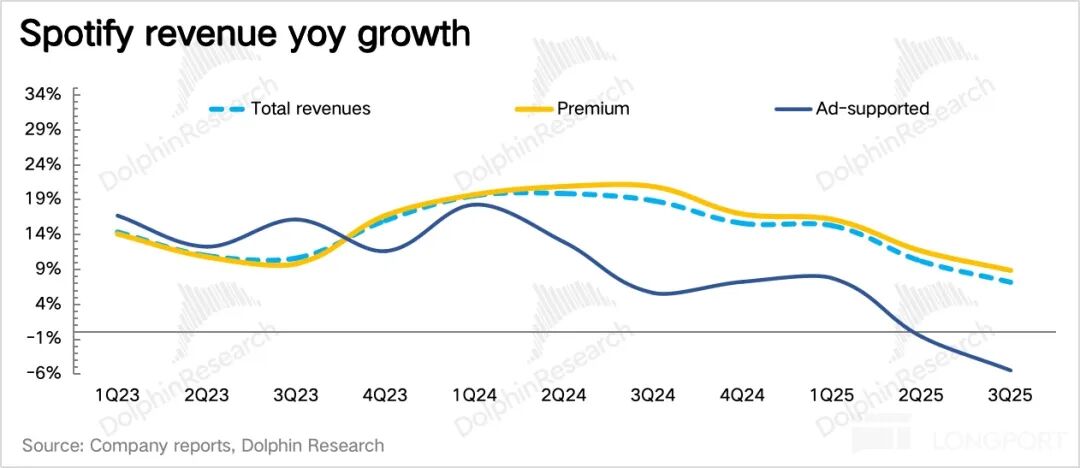

2. Revenue Projections Remain Soft: On the flip side, revenue performance was lackluster. Management projected fourth-quarter revenue at €4.5 billion, marking a 9.8% growth rate, slightly below market expectations of an 11.5% year-over-year increase.

Dolphin Research posits that the expectation gap stems, in part, from the advertising business, where the market may have harbored overly optimistic views on subscription payment rates and ARPU (Average Revenue Per User) recovery.

(1) Advertising: This has been a relatively lackluster segment for Spotify this year, with poor ad conversion rates exacerbated by a downturn in brand advertising. The former head of advertising has departed, and no successor has been announced yet. In the third quarter, Spotify announced collaborations with Amazon and Yahoo's DSP advertising systems, but their true efficacy remains to be seen.

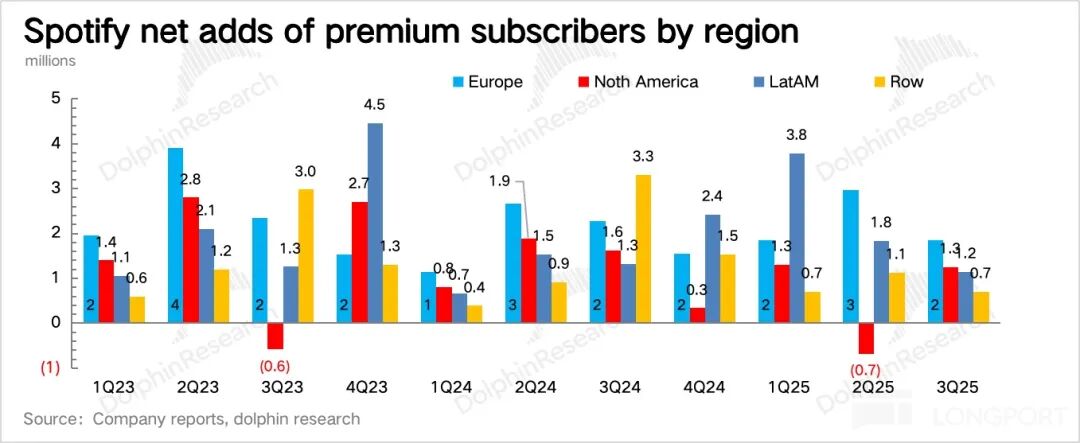

(2) Subscriptions: Paid conversion growth has been sluggish this year. Although Spotify has heavily promoted audiobook content, its allure has been limited (as audiobook users exhibit low overlap with music users). Additionally, the rollout has been gradual, with audiobook content only accessible in a few key regions, yielding minimal returns.

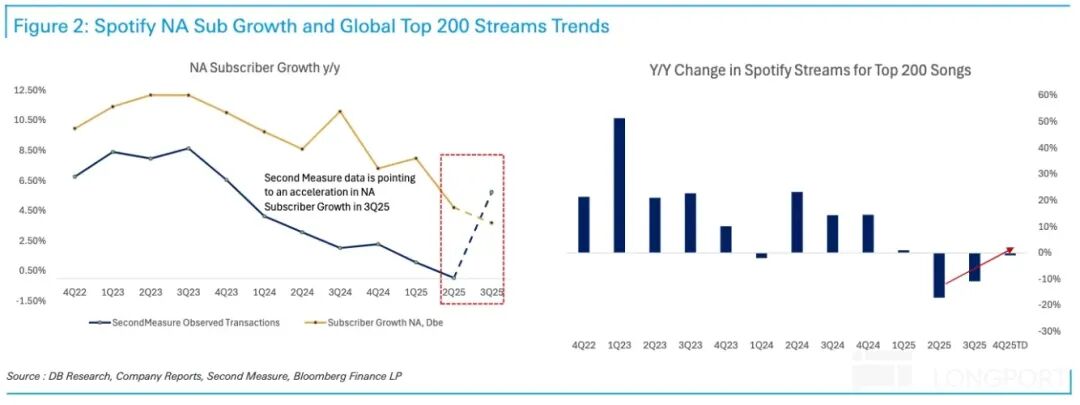

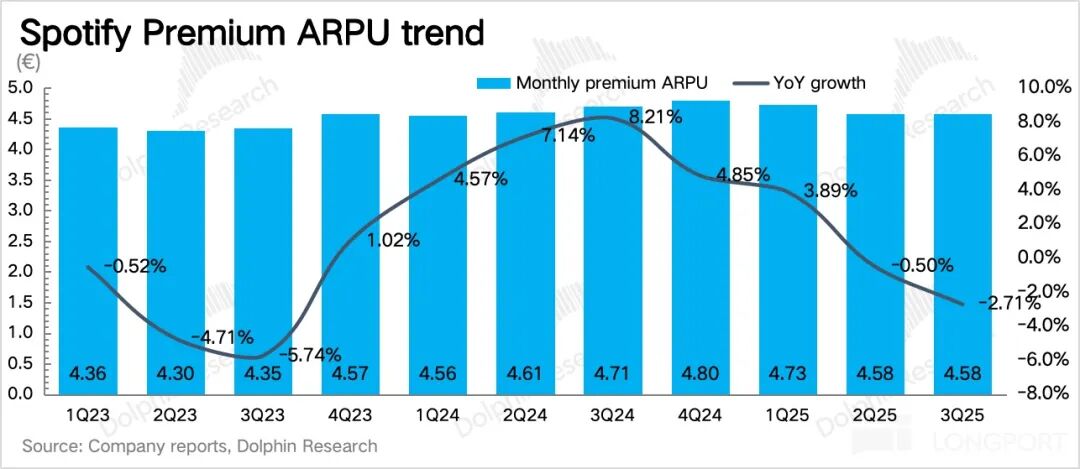

However, according to third-party data, in North America, Spotify capitalized on the Epic vs. Apple lawsuit by directly promoting within the app, leading to a surge in paid conversions. Nonetheless, the depreciation of the US dollar had a pronounced impact, causing ARPPU (Average Revenue Per Paying User) to continue its year-over-year decline due to exchange rate fluctuations.

Although a sweeping price hike was implemented in the third quarter, it primarily took effect after mid-August, making swift reflection in the same quarter challenging. Moreover, the second-largest market, North America, did not witness a concurrent price increase, complicating efforts to offset the impact of USD depreciation.

However, product feature updates targeting pure music users in the third quarter have led Dolphin Research to anticipate a fresh wave of subscription growth. If product innovation and optimization persist in this vein, it could fuel long-term paid conversions and higher-tier monetization among core music users. Coupled with the price hike cycle, this will be a pivotal growth driver for Spotify next year.

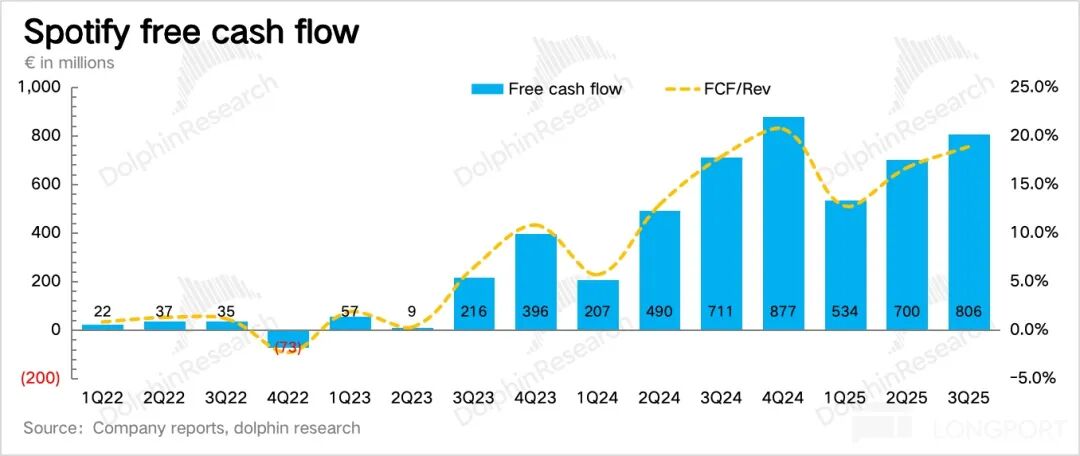

3. Cash Flow Rebounds: Alongside profitability recovery, despite a modest uptick in capital expenditures, third-quarter free cash flow rebounded to €800 million, accounting for 19% of revenue.

As of the end of the third quarter, the company had amassed nearly €9.1 billion in cash and short-term investments. In the third quarter, it spent €77 million on share repurchases. As of November 3, it had repurchased nearly €410 million worth of shares this year. However, relative to its market capitalization of over €130 billion, shareholder returns of less than 0.5% remain largely symbolic.

4. Earnings Overview

Dolphin Research's Perspective

Overall, third-quarter earnings were unremarkable, and the positive market reaction was primarily a relief rally from pre-earnings jitters over profit margins. However, weak guidance remains a concern, especially for Spotify, which is not trading at a discount. Although the price hike cycle is on the horizon, management needs to offer clearer guidance on when ARPPU will bottom out.

Last quarter, the market's initial reaction to second-quarter earnings was negative, not solely due to objective factors like exchange rates, SBC, and social security taxes, but also dissatisfaction with the sluggish pace of Spotify's price hikes. However, a week later, when Spotify announced price increases in multiple markets (primarily non-audiobook markets), the stock price received a boost.

The third quarter did not fully capture the impact of price hikes, and the fourth quarter is expected to show only marginal signs. Nonetheless, two regions warrant attention: the United States and Australia.

(1) The US market, which accounts for one-fourth of users and one-third of revenue, did not undergo a price adjustment in this round of hikes. Therefore, a price increase in the US is a key driver of market expectations for Spotify's growth next year.

(2) Spotify's price hike in Australia is the only one that expanded its audiobook business. Moreover, the hike was not for pure music subscriptions but for audiobook bundle packages. The rationale is to cover the content costs of audiobooks while indirectly adjusting royalty sharing ratios.

Since pure music subscriptions were not hiked, Spotify views the increased portion as a standalone cost for 'audiobooks,' eliminating the need to share the benefits of the price hike with major labels, ultimately bolstering its gross margin. Market expectations suggest that if the Australian trial proves successful, Spotify may replicate this strategy in core regions like North America, the UK, and France.

However, it's worth noting that major labels are not entirely sidelined. The minimum guarantee fees, which vary with subscription numbers, still have a fixed growth rate. Typically around 5%-6%, this is significantly lower than Spotify's average price hike of approximately 15%. This dynamic underscores the long-term trend in the industrial chain's profit distribution as platform bargaining power strengthens. Despite occasional setbacks (last year, Spotify succumbed to pressure from royalty collectives by launching pure music subscriptions and signing new contracts with increased MSD-HSD% guarantees),

From this vantage point, starting in the fourth quarter and into next year, Spotify will begin to reap the benefits of a new round of price hikes, a favored narrative among institutional investors in streaming media. However, this effect will gradually manifest in Spotify's profitability, as short-term headwinds like exchange rate fluctuations, costs from developing and launching multiple new features, and increased social security taxes will initially offset the profit-boosting effects of price hikes.

Driven by the dual positive narratives of price hikes and Apple Store rectifications, although short-term profit improvements may stall due to new investments, Spotify's fundamentals are generally on an upward trajectory. A detailed value analysis has been published in the article of the same name under the "Insights" section of the Longbridge App.

Below are detailed charts:

I. Steady User Penetration

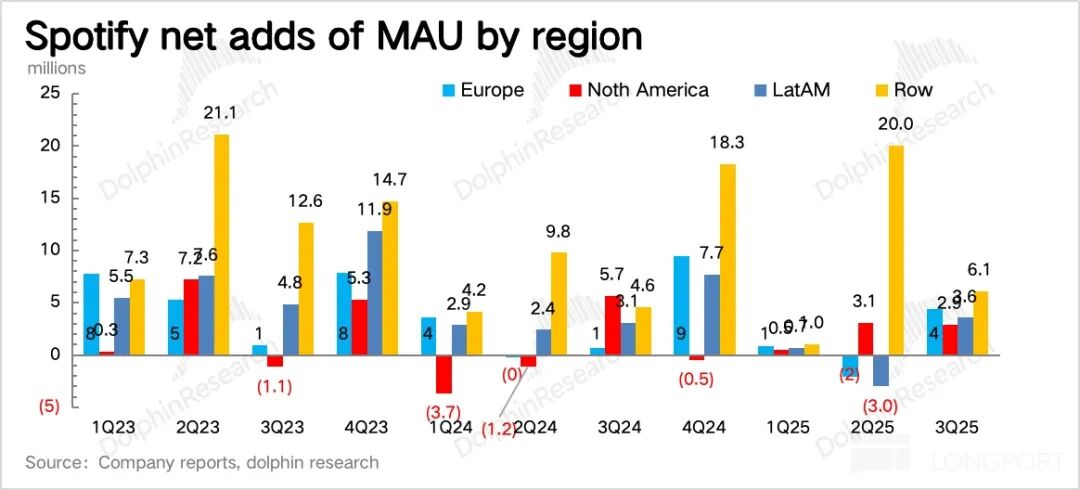

Third-quarter user metrics largely met expectations, but objectively, they were impressive. Monthly active users (MAUs) increased by 17 million, reaching 713 million, with Europe and other regions witnessing higher growth this quarter. Paid subscribers increased by 5 million, with relatively even distribution across regions, though Europe fared slightly better.

For fourth-quarter guidance, MAUs are expected to increase by 35 million, and paid subscribers by 8 million, implying a normal trend of user penetration and expansion.

II. Weak Revenue, Price Hike Effects Yet to Materialize

Second-quarter revenue grew by 7%, with exchange rate headwinds contributing a 5 percentage point impact. Subscription revenue grew by 8%, while advertising declined by 5% year-over-year.

Management projected fourth-quarter revenue at €4.5 billion, representing a 9.8% growth rate, slightly below market expectations of an 11.5% year-over-year increase. Dolphin Research posits that the expectation gap stems, in part, from the advertising business, where the market may have harbored overly optimistic views on subscription payment rates and ARPU recovery.

However, according to third-party data, in North America, Spotify capitalized on the Epic vs. Apple lawsuit (discussed in detail in the Q2 earnings review at the end of this article) by directly promoting within the app, leading to a surge in paid conversions. Nonetheless, the depreciation of the US dollar had a pronounced impact, causing ARPPU to continue its year-over-year decline due to exchange rate fluctuations.

Although many regions (non-audiobook markets) saw price hikes in the third quarter, Dolphin Research estimates that ARPPU will still decline by nearly 2% year-over-year in the fourth quarter, albeit at a slowing rate.

The special price hike in Australia is likely a harbinger of next year's pricing strategy in core regions like North America, primarily aimed at covering audio content costs and slightly reducing the overall royalty sharing ratio.

III. Profit Margins Surpass Expectations

Third-quarter profitability exceeded expectations, which was the primary catalyst for the market's positive reaction. Despite numerous new feature launches, the market fully anticipated increased investments.

However, in reality, both gross and operating profit margins outperformed expectations. Operating expenses saw a significant contraction, with a marked decrease in Social Charges (which typically fluctuate with employee benefits, including equity incentives; Spotify's stock price fell 10% in the third quarter compared to the end of the second quarter, resulting in approximately €37 million in expense reductions). The company also demonstrated tight control over marketing and promotion (potentially benefiting from the Epic vs. Apple lawsuit in North America by directly promoting paid subscriptions within the app, reducing marketing expenses) and personnel costs.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. To reprint, please obtain authorization.