Xiaomi Q1 Performance: 40% Growth in China, 9% Decline Overseas, Overseas Market Share Drops to 68%

![]() 05/05 2025

05/05 2025

![]() 489

489

Recently, Canalys (now merged with Omdia) unveiled insights into the global and Chinese mobile phone markets for the first quarter of 2025.

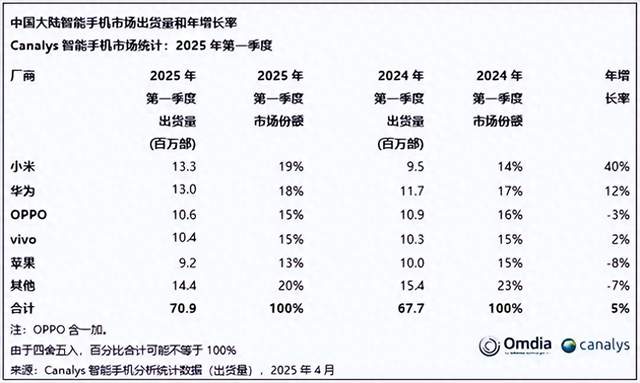

According to Canalys' data, Xiaomi emerged as the frontrunner in the Chinese market during the first quarter, boasting a 40% year-on-year sales increase and a market share hike to 19%. With 13.3 million units sold, Xiaomi secured the top spot.

Trailing Xiaomi were Huawei, OPPO, VIVO, and Apple. Honor, meanwhile, was classified under the 'Others' category.

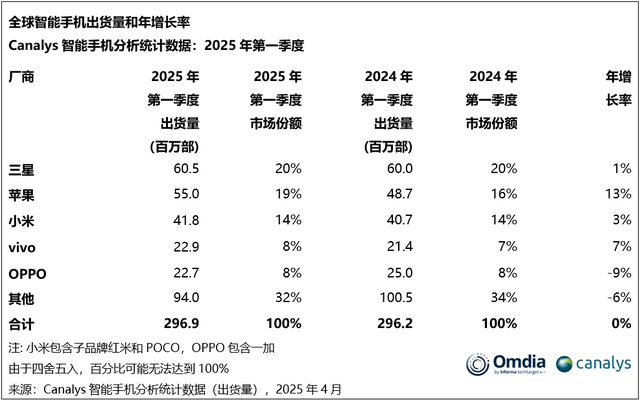

In the global market, Samsung, Apple, Xiaomi, VIVO, and OPPO occupied the top five positions, collectively holding 68% of the market share, indicative of a relatively concentrated market landscape.

Among these major brands, Samsung, Apple, Xiaomi, and VIVO experienced growth, while OPPO saw a decline. Apple recorded the highest growth rate at 13%, followed by Samsung at 1%, Xiaomi at 3%, and VIVO at 7%. OPPO witnessed a 9% decline, with other brands also experiencing a 6% drop.

Analyzing these two sets of data, a notable trend emerges: While Xiaomi maintained growth in both global and Chinese markets this quarter, particularly with a robust 40% increase in China, its overseas sales have slightly declined.

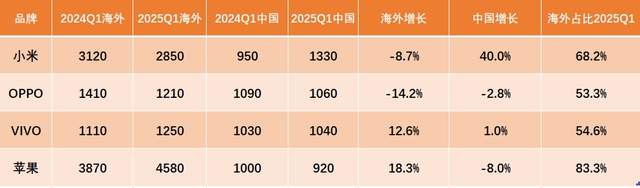

By organizing these figures into tables based on overseas and Chinese sales and calculating the growth rates separately, the picture becomes clearer. Xiaomi's overseas sales declined by 8.7%, whereas its Chinese sales surged by 40%. OPPO experienced declines in both markets. VIVO enjoyed a 12.6% increase in overseas sales and a 2% uptick in China. Apple's overseas sales grew by 18.3%, but its Chinese sales dipped by 8%.

Further, Xiaomi's overseas sales share has dipped below 70%, reaching only 68.2%, compared to previous years when it exceeded 75%.

OPPO's overseas sales share also fell, to 53.3%, while VIVO's share increased to 54.6%, surpassing OPPO.

Apple's sales in China accounted for approximately 17% of its total sales, down from a peak of over 20%.

What do these findings suggest? It appears that with the popularity of the SU7, Xiaomi is thriving in the Chinese market but facing challenges overseas. Conversely, Apple, while underperforming in China, is experiencing significant growth in its overseas sales. Additionally, VIVO is evidently making strides in expanding its overseas market presence, whereas OPPO is witnessing declines in both markets.