Honor Struggles to Survive Beyond Being Huawei's 'Successor'

![]() 05/14 2025

05/14 2025

![]() 723

723

Source | YuanSight

Honor is currently navigating turbulent waters.

On May 13, China Business News reported that Honor has recently completed personnel adjustments for key positions in China, encompassing 38 supervisors who underwent a "re-competition for employment" process. Concurrently, Honor internally established a new AI New Industry Department, classifying AI-related R&D work as a top-tier department.

Meanwhile, Honor's market sales ranking has been in steady decline. In the first quarter of 2024, Honor led the domestic mobile phone market according to some statistics; however, just a year later, it has vanished from mainstream rankings.

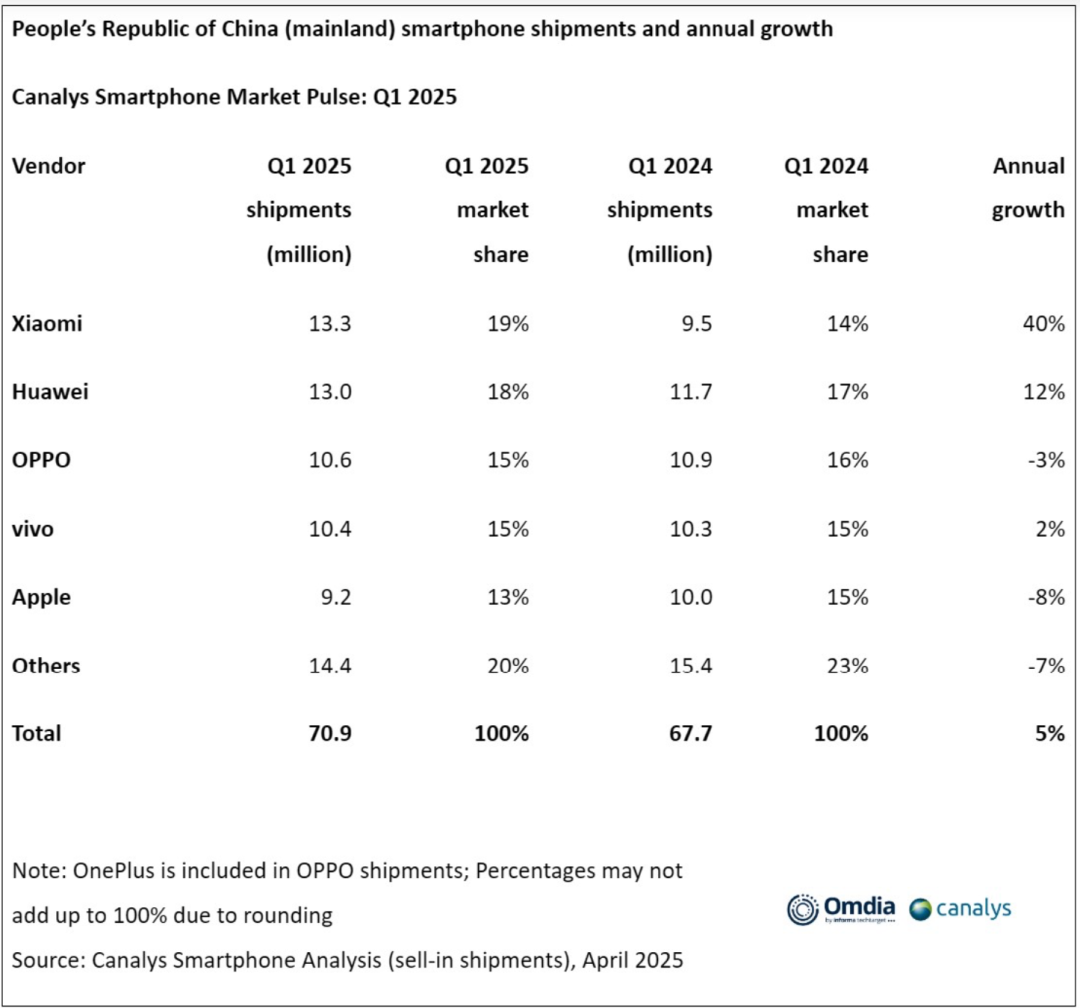

In the first quarter of this year, Counterpoint's statistics revealed that Honor ranked sixth with a market share of 13.7%, experiencing a 12.8% year-on-year decline in shipments. Both IDC and Canalys' statistics placed Honor outside the top five, categorizing it under "Others".

In the second quarter of 2024, TechInsights' global smartphone shipment report showed OPPO (including OnePlus) falling out of the top five and becoming an "other". Now, following OPPO, Honor has also fallen behind.

Currently, Honor's products are still widely available in dealer stores, but consumer purchase intent has weakened; its once-proud channel advantage seems to be losing effectiveness; and products packaged with AI concepts have yet to create a distinct competitive edge...

More crucially, competitors continue to advance. Xiaomi, OPPO, and vivo are fiercely engaged in a price war, Huawei is making a strong comeback with its self-developed chips, and even Apple is participating in the price war. Honor's survival space is being gradually squeezed.

Some attribute the problem to turmoil at the senior management level, while others question the ambiguity of its product positioning. However, what truly warrants consideration is that as the industry reshuffles accelerate, Honor, a once-glorious brand, needs timely change and adjustment.

01

Declining Sales

Honor's start to 2025 has been anything but smooth.

Once considered the brand "least likely to falter," Honor's channel network was deeply intertwined with dealers nationwide, earning it the nickname "king of offline" within the industry. Logically, this close channel relationship should have cushioned market fluctuations, but the reality has been quite the opposite.

In terms of sales strategy, Honor tends to tightly bind the interests of dealers, promoting sales growth through operational subsidies and additional support, thereby achieving a dual benefit of scale and efficiency.

This deeply intertwined model was highly effective in the early days after Honor's independence. Leveraging their extensive offline store networks and sophisticated online e-commerce operation experience, dealers opened a high-speed channel for Honor products from production to consumption, helping Honor mobile phones quickly gain a foothold in the market.

Honor Offline Stores

However, comparing historical data, the speed of Honor's decline has surprised the outside world. At the beginning of 2024, it topped the domestic market, and the industry was still anticipating Honor's strategy to "stabilize its high-end position." But today, one year later, its product line is in an awkward situation—mid-range phones are besieged by Redmi and OnePlus, while it is difficult to penetrate Apple and Huawei's defenses in the high-end market.

The loss of market share is not just a numerical change; dealers' confidence is also beginning to waver.

According to media reports, due to Honor's pressure on dealers to stockpile and bundle products, which severely ties up funds, and the need to offload a large number of inventory phones to secondary market dealers daily, some dealers have closed down Honor offline stores and switched to other mobile phone brands amid continuous losses and profitability challenges.

If dealers reduce purchase volumes and delay payment cycles due to poor product sales, Honor's cash flow recovery speed will significantly slow down, negatively impacting its product iteration, technological innovation, and listing preparations.

02

The 'Substitute' Dividend Is Gone

Honor's predicament began with an anticipated "reunion."

In 2024, Huawei made a comeback with its self-developed chips and HarmonyOS, quickly regaining its once-held market share. This was a script anticipated by the industry, but Honor seemingly underestimated the impact of this return.

At the time, many analysts believed that Huawei would primarily target the high-end market, with limited impact on Honor's mid-range product line. However, the reality is that Huawei's nova series directly entered the 2000-4000 yuan price range, colliding head-on with Honor's Magic series.

Even more challenging is the subtle shift in consumer psychology. In a mobile phone mall in Guangzhou, a shopping guide told YuanSight, "Many customers who were originally hesitant about Honor now directly ask, 'Do you have Huawei?' due to subsidies and other discounts." This return of brand recognition has quickly dimmed Honor's "technological successor" aura, and consumers are more willing to pay for "pure-blooded" Huawei without a significant price advantage.

At the Magic7RSR launch event, Honor directly compared its product parameters with Huawei's Mate70 series and even shouted the slogan "Shining Brightly Ahead," attempting to capture more market share through this aggressive method of close combat.

However, Huawei's position in the high-end market is difficult to shake. According to Counterpoint's list of domestic market shares for phones priced above 600 US dollars in 2024, it is still a duopoly between Apple and Huawei. Apple's share declined year-on-year but still ranked first with a 54% share, while Huawei ranked second with a 29% share.

In addition to Huawei, the siege by other competitors is escalating simultaneously. Xiaomi is no longer satisfied with the label of cost-effectiveness, and its digital series has begun to explore the 4000 yuan price range; vivo has consolidated its position in the high-end market through image collaborations and other measures; and even Apple has begun to actively participate in the price war by lowering the prices of some products and joining the ranks of those vying for "national subsidies".

On May 10, it was reported that Apple had issued a price adjustment notice to channel partners, reducing the price of all capacity versions of the iPhone 16 Pro Max by 160 dollars; the price of the 128GB version of the iPhone 16 Pro was reduced by 176 dollars, and other versions were also reduced by 160 dollars.

03

Breaking the Deadlock

"Either find a new story or become someone else's story." This is not alarmist. When market share slips into the "Others" category, Honor's breakthrough is no longer a choice but a matter of survival.

Technological differentiation may be a way out. Looking back at Honor's golden moments, there is always a standout product: the Honor 50 series in 2021 swept the offline market with its curved screen and Vlog functions; the X40 in 2023 achieved monthly sales of one million units with its "thousand-yuan curved screen." But in the 18 months since then, Honor has not produced another such "flagship product".

Foldable screens were once an opportunity. The lightweight design of the Magic V2 attracted industry attention, but the simultaneous explosion of competitors such as Huawei's Mate X3 eroded Honor's market share.

Currently, the wave of AI mobile phones is reshaping the industry landscape, and Honor is also attempting to break the deadlock and create differentiation from other brands. From the Magic series to the X series, Honor emphasizes AI imaging and AI performance scheduling at almost every new product launch event. However, in reality, these features have already been introduced by other brands, and even earlier.

Screenshot from Honor's official online store

Today, Honor's investment in AI continues. On March 3, Li Jian, the new CEO of Honor, announced at MWC 2025 that over the next five years, Honor will invest 10 billion dollars in the "HONOR ALPHA PLAN," transforming from a smartphone manufacturer to a globally leading AI terminal ecosystem company.

Under former CEO Zhao Ming, Honor was obsessed with comparing hardware parameters and pursuing ultimate product performance, attempting to establish a market foothold through hardware advantages. Li Jian, however, is betting on the construction of an AI ecosystem and internationalization. For example, Honor has actively entered into deep cooperation with international operators such as France Telecom and Vodafone, attempting to leverage these operators' vast sales networks and customer resources to expand Honor products into the European market, broaden its international footprint, and enhance its global influence.

According to media reports, by the end of last year, Honor's overseas sales accounted for more than 50% of its total, and it entered the top five in some markets. Additionally, according to data released by Canalys, Honor's market share in the African market in the first quarter increased by 283% year-on-year.

At the same time, Honor has opened up a 12.4 billion-parameter cloud AI model to developers, hoping to foster a thriving software ecosystem through abundant developer resources, attract more outstanding software developers to create high-quality applications for the Honor platform, and replicate Apple's AppStore success model, creating a comprehensive ecological closed loop integrating hardware, software, and services.

However, currently, Honor's AI business has not yet formed a mature business model, and there is still significant uncertainty within the industry regarding the market acceptance and demand scale for AI mobile phones.

Nonetheless, from the recent establishment of the AI New Industry Department and the "re-competition for employment" signal for key positions in China, it is evident that Honor is determined to regain market advantage. After experiencing a series of personnel and market turbulence, Honor not only needs to stabilize its performance fundamentals and escape the "others" camp but also quickly prove to the market its unique value that distinguishes it from other brands.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.