How Will the Android High-End Smartphone SoC Market Evolve in 2024 Amidst the AI Trend?

![]() 05/14 2025

05/14 2025

![]() 657

657

Produced by Zhineng Zhixin

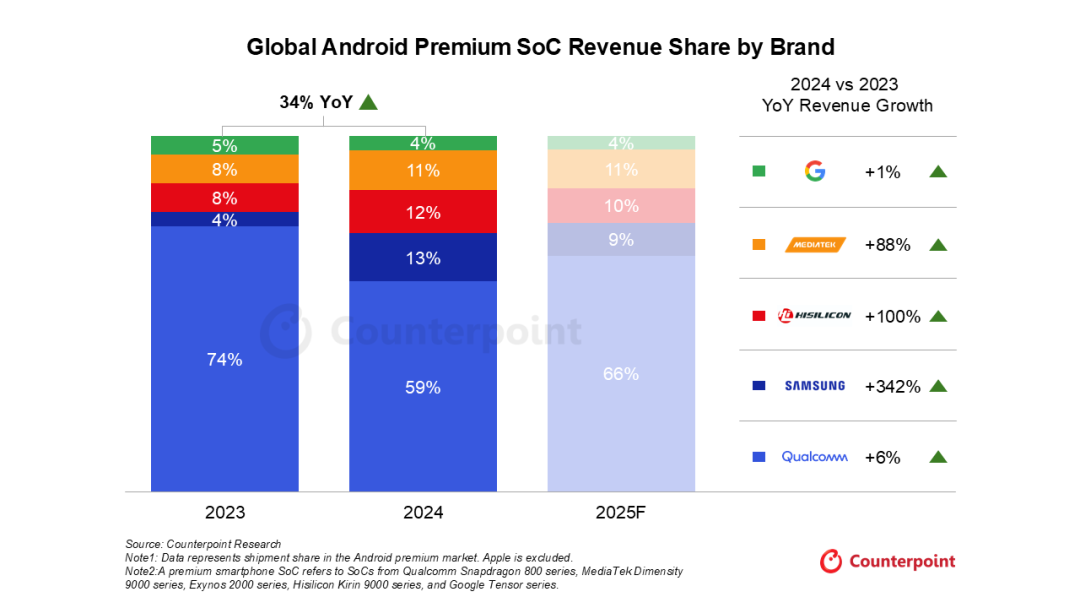

In 2024, the Android high-end smartphone SoC market will undergo a significant structural transformation. The rapid adoption of on-device AI has fueled a surge in market demand, leading to a concurrent rise in the average selling price of SoCs. As a result, full-year revenue is projected to grow by 34% year-on-year, accounting for half of the total revenue generated by Android smartphone SoCs.

Qualcomm, MediaTek, HiSilicon, and Samsung are locked in a fierce competition in the high-end market, with their respective chip roadmaps, ecological integration strategies, and manufacturing chain deployments gradually shaping the competitive landscape of the future. Looking ahead to 2025, the core of this competition is shifting from raw performance to AI capabilities, manufacturing node stability, and system-level collaboration.

Part 1

High-End AI Chips: Driving Performance Leaps and Market Concentration

As we enter 2024, the performance dimensions of SoCs are no longer solely defined by traditional CPUs and GPUs but by the AI computing power centered on NPUs. With the widespread adoption of on-device AI applications, chip manufacturers have accelerated the launch of large-scale, highly integrated SoCs capable of supporting the direct execution of AI models on devices.

◎ Qualcomm has established a lead in low-latency AI processing with the Oryon custom core architecture in the Snapdragon 8 Elite. Its hardware-software co-designed AI stack fosters platform-level stickiness, spanning multiple levels including development tools, inference APIs, and model optimization mechanisms. This reduces the threshold for AI deployment for downstream OEM manufacturers.

◎ In contrast, MediaTek has adopted a breakthrough strategy. The Dimensity 9300 series marks a new chapter in its AI chip layout, compensating for previous shortcomings in AI performance and energy efficiency through an all-big-core design and an improved APU architecture. The Dimensity 9400 further continues this trend, with CPU performance fully benchmarking Qualcomm's flagship models while enhancing its collaborative processing capabilities in imaging and multimodal AI.

Behind this catch-up effort lies a deeper product co-creation model with partners such as vivo, OPPO, and Xiaomi. By jointly researching SoC functional modules and customizing instruction sets to fit each brand's flagship strategies, MediaTek has achieved unprecedented market discourse power.

In terms of market share:

◎ Qualcomm still controls more than half of the revenue from Android high-end SoCs.

◎ However, MediaTek's growth rate has nearly doubled, providing a feasible path to penetrate the mid-to-high-end market.

◎ While Samsung temporarily made a breakthrough with the Exynos 2400 in the Galaxy S24, it is still constrained by structural factors such as unstable yield rates, process bottlenecks, and ecological differences. The sustainability of its high-end route still faces challenges.

Part 2

Rise of Regional Forces and Technology Stack Reconfiguration: HiSilicon's Return

HiSilicon's high-end return is not merely a technical recovery but also a realignment of China's smartphone industry chain. With the strong synergy of the HarmonyOS system, HiSilicon's Pura 70 and Mate 70 series quickly established a clear brand identity and user loyalty in 2024.

These SoCs, mostly based on older nodes, have built an unreplicable closed-loop experience of "software and hardware integration" within the Chinese market. This is achieved through the deep integration of self-developed SoCs, systems, and ecosystems.

In 2024, HiSilicon's revenue share rose to 12%, ranking third among high-end chip brands in the Android camp after Qualcomm and MediaTek. Its impact on the market landscape extends beyond mere numbers, representing a distinct technical organization model from Qualcomm and MediaTek's ecological routes.

By deeply coupling hardware design with system software, Huawei enables the SoC to exceed its surface specifications in terms of overall performance, converting this advantage into an independent high-end brand identity.

However, HiSilicon still faces three major obstacles:

◎ The lack of long-term stable supply of advanced manufacturing nodes limits the pace of chip specification upgrades.

◎ Overseas expansion is restricted due to the unavailability of Google GMS, confining its growth potential to the Chinese domestic market.

◎ The R&D ecosystem has not yet established strong connections with third-party developers, and the deployment efficiency of some AI applications still lags behind. Whether it can complete self-developed AI large model accelerators, a unified programming framework, and more efficient computing scheduling in the next generation of SoCs will be crucial in determining its long-term competitiveness.

Samsung Exynos' performance has been more erratic. Driven by the Galaxy S24, revenue surged several times in 2024, but as the Galaxy S25 returned to Qualcomm exclusivity, its SoC roadmap once again experienced a strategic retreat.

Ultimately, Exynos faces not only the challenge of catching up in performance but also systematic challenges in manufacturing process bottlenecks and ecological integration efficiency.

Samsung's foundry production line's insufficient yield stability at advanced nodes has hindered the large-scale application of Exynos in flagship products. If the 2nm process fails to achieve a balance between cost and yield in the future, Exynos will continue to be marginalized.

Summary

The high-end smartphone SoC market is entering a new era of multi-dimensional competition reshaped by AI. The path of relying solely on performance stacking is no longer viable. The competition among vendors now encompasses not just the number of transistors and peak frequencies but also a full-stack capability comparison, including AI model deployment, system-level collaboration, developer ecosystems, and manufacturing chain layouts.

Qualcomm will continue to dominate the core position with its AI infrastructure from the cloud to the edge, self-developed cores, and deep ties with OEM manufacturers. MediaTek, leveraging the Chinese market as its fulcrum, is increasingly clear about its technological accumulation and global expansion intentions. If it can make breakthroughs in developer ecosystem construction and the North American high-end market, it may become a structural variable.

As a symbol of China's technological autonomy route, HiSilicon has firmly established itself as the third-ranked player in terms of revenue, relying on local ecological synergy and brand stickiness. If it can resolve issues related to advanced processes and ecological expansion in the future, it has the potential to make further breakthroughs.

SoCs are no longer single chips but integrated platforms that fuse AI engines, communication modulation, imaging computation, and system collaboration. Amidst the ongoing turbulence in the global supply chain and rising consumer expectations for AI experiences, whoever can take the lead in completing platform-level leaps will gain true pricing power and ecological dominance in the high-end battlefield after 2025.