Countdown to Huang Zheng's Return? Pinduoduo's Urgent Need to Enter Instant Retail

![]() 05/29 2025

05/29 2025

![]() 742

742

Introduction: When Liu Qiangdong personally delivers takeout and Jack Ma returns to the public eye, Pinduoduo may need more than just tens of billions in profits; it also needs Huang Zheng's 'sense of duty' to return.

We are used to seeing the annual 618 e-commerce battle, but this year it's different.

With JD.com and Taobao successively opening primary entrances for instant retail on their main sites—instant delivery and flash sales—instant retail has become the new favorite of this year's 618 shopping festival.

Taobao's flash sales during 618 sparked a "free milk tea" campaign, JD.com's Seven Fresh intensified its 618 "breakthrough pricing", and Meituan also officially announced its participation in 618 with Meituan Flash Sales coming in strong.

Seeing various e-commerce platforms intensify their focus on instant retail during 618, one can't help but wonder why Pinduoduo, China's top e-commerce platform by user base, hasn't entered the market?

I. Instant Retail is Not Just a Trend, but the Next Big Wave in Retail Development

Instant retail has emerged as a new format for retail development following e-commerce.

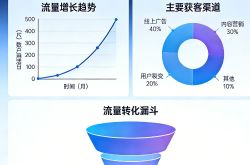

As the scale of e-commerce users gradually reaches its peak and customer acquisition costs gradually increase, the traditional e-commerce model has encountered a penetration bottleneck, prompting retail to seek new increments.

On the one hand, instant retail can leverage the existing scale and compounding effects of e-commerce; on the other hand, it can mobilize the real-time fulfillment capabilities of localized supply, redefining the boundaries of retail.

According to data from the Ministry of Commerce Research Institute, China's instant retail market reached 650 billion yuan in 2023, with a year-on-year growth rate of 29%, and is expected to exceed 2 trillion yuan by 2030.

It is said that when Hema just started, Daniel Zhang once told Hou Yi not to rely on Taobao for empowerment, but for Hema to bring offline traffic back online.

However, during Alibaba's first-quarter 2025 earnings call with analysts, Jiang Fan, CEO of Alibaba's e-commerce business, proposed converting Taobao users into instant retail users.

This starkly different strategic positioning before and after highlights the current importance attached to instant retail by the retail industry.

One of Pinduoduo's significant moves this year has been the "100 billion support" for merchants, proactively supporting the merchant side, which is also a sign of Pinduoduo's desire for change.

Based on this strategic awareness, Pinduoduo will naturally take note of instant retail. Moreover, for Pinduoduo, the current stage of instant retail development is very similar to the initial stage of its rise in e-commerce.

A counterintuitive fact is that instant retail has great potential in the lower-tier markets.

As early as 2023, the State Council's content related to "accelerating the development of modern rural services" first mentioned instant retail, stating that "we will comprehensively promote the construction of the county-level commercial system and vigorously develop new models such as joint distribution and instant retail."

According to the "2025-2026 China Tier-2 and Below Market Instant Delivery Platform Trend Insight Report" released by iiMedia Research, the number of instant logistics users in China will reach 799 million in 2024, with a year-on-year growth rate of 9.1%, and the user base is expected to exceed 1 billion by 2030. The instant delivery service in lower-tier markets may usher in an important period of development opportunities.

Don't these trends resemble the situation when e-commerce was sinking into lower-tier markets? As first- and second-tier cities gradually become saturated, the focus begins to shift to lower-tier markets.

During the era of e-commerce sinking into lower-tier markets, while rural Taobao was still struggling to penetrate these markets, Pinduoduo rose to prominence, using a unique model to deconstruct the lower-tier e-commerce market and successfully entered the top retail market, becoming China's top e-commerce platform by user base.

With the current trend of instant retail gradually sinking into lower-tier markets, will Pinduoduo just watch from the sidelines?

Huang Zheng said in his autobiography, "Pinduoduo focuses on the broadest segment of the Chinese population. Mobile internet is not necessarily about users sinking, but rather users being leveled. It allows the broadest segment of the Chinese population to have the same ability to access information and transact as those in first-tier cities."

Entering the instant retail market at this stage seems to align well with the values of Pinduoduo's founder. So why has Pinduoduo been hesitant to officially announce its entry?

The reason may lie in delivery.

In "Liu Qiangdong and Wang Xing: Not 'Brothers'", Huxiu Business Consumption Group mentioned an interesting incident where Liu Qiangdong invited Cheng Wei, Wang Xing, and Yao Jinbo to dinner in the first quarter of this year, preemptively injecting a dose of competition awareness.

Yes, even 58.com and Didi were on guard, but not Pinduoduo. It is speculated that this is because it is believed that Pinduoduo will find it difficult to quickly assemble an instant delivery team.

This situation is similar to that of Douyin. Previously, Douyin had considered entering the food delivery business. In early 2024, there were frequent rumors that Douyin would acquire Ele.me, although both parties denied them, the rumors persisted. The biggest rumor was that ByteDance only wanted to retain Ele.me's instant delivery team, but Alibaba hoped that ByteDance would take on the entire Ele.me team.

The reason for such rampant rumors is that at that time, Douyin was focusing on the local life sector, and the only way to quickly assemble a delivery team was through Ele.me.

However, Pinduoduo now has some layout in delivery.

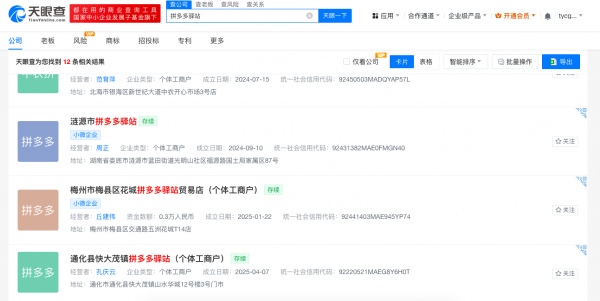

Pinduoduo's express pickup service for its DDMC platform has officially been changed to Pinduoduo Post, supporting 24-hour self-service pickup and door-to-door delivery services. According to data from Tianyancha APP, since last year, Pinduoduo has been testing post services in multiple provinces and cities.

As early as 2022, Pinduoduo was recruiting merchants in Beijing, Shanghai, Guangzhou, and Shenzhen who were capable of delivering within 24 hours, mainly focusing on fruits, flowers, and cakes at that time.

At that time, the community group-buying market was still in a state of chaos, and DDMC cooperated with express delivery companies such as J&T Express, STO Express, YTO Express, and ZTO Express. This reinforcement of Pinduoduo Post, with its door-to-door delivery capability, may also be a signal of gradual penetration into instant retail.

Apart from the platform's own strength, the retail industry's move towards instant retail is also a general trend in economic development.

Previously, we emphasized that the rapid development of e-commerce squeezed the development of offline retail. However, the development of instant retail is actually feeding back offline, which not only aligns with the interests of enterprises but can also empower the recovery of the offline economy.

An interesting case is the reinforcement of instant retail by gas stations.

On May 10, Sinopec's "Yi Jie Su Gou" officially opened at the Nanxinzhuang Energy Station in Jinan. Within 48 hours of adopting the instant retail model, it completed a cumulative 127 deliveries with sales exceeding 2700 yuan. Similarly, Sinopec's "Kunlun Haoke" is also continuously strengthening its instant retail model.

There are also cases like Watson's and Supor, where offline physical stores from various industries are Access the instant retail model. The increment brought by instant retail can drive the recovery of the offline real economy.

The integration of online and offline was a phrase we used for O2O a decade ago, but it is only with today's instant retail that it has truly taken root. For retail platforms like Pinduoduo, instant retail is new soil to be explored. For the development of the real economy, instant retail is also a new opportunity.

II. The Era Needs Entrepreneurs Like Huang Zheng

The recovery of the real economy has been an important theme in the economic market in recent years.

Since the beginning of this year, domestic consumption potential has continued to be unleashed, further consolidating the fundamental role of consumption in economic growth. In the first quarter, final consumption expenditure contributed 2.8% to GDP growth, with retail sales of goods increasing by 4.6% year-on-year, 1.4 percentage points faster than the whole of last year.

For China's economy to continue its positive and sound development, and for the steady recovery of the real economy, it requires not only the support and guidance of the state but also the leadership and exploration of more outstanding enterprises and entrepreneurs.

When the tariff war was intense a while ago, Jack Ma's speech from six years ago went viral on short video platforms. "If trade talks go well, you can do some foreign business. If trade talks don't go well, then do business with 1.4 billion people," he said, giving many consumers confidence.

This year, Liu Qiangdong's strong return, paying social insurance and housing fund for delivery riders, and personally delivering takeout have drawn more attention from all sectors of society to the rider community. His entry into the food delivery business has also fed back to consumers, reminding people of the year 2015.

Just as Zhang Weiying said in "Reunderstanding Entrepreneurship", entrepreneurs can truly drive economic progress.

Entrepreneurs are people who build companies according to their own ideas and are proactive outputters. They may be very imaginative, wanting to do this today and that tomorrow, but they can always accomplish things that others believe are impossible.

The driving force of China's outstanding entrepreneurs on the economy lies not only in the increment of business models but also in stabilizing confidence and growth amidst international economic turmoil.

Just like Kazuo Inamori for the Japanese economy, Kazuo Inamori did not just save Japan Airlines; he also contributed to Japan's economic recovery, bringing excellent management theories to Japan and the world, giving the Japanese economy a shot in the arm.

The reason why everyone is now calling for entrepreneurship and national entrepreneurship is that they understand how to lead industry changes and have their own sense of social responsibility.

Zong Qinghou often emphasizes, "I am not a capitalist; I am an entrepreneur." His annotation of himself and Wahaha is "self-improvement." The more an entrepreneur benefits the people, the more respect others will have for their wealth.

Today's international economic situation is ever-changing, with Donald Trump turning his attention to Europe after just calming down. We need more outstanding entrepreneurs to drive China's economy towards continued positive and sound development. We need these familiar faces of national entrepreneurs to bring confidence and new growth to the Chinese market.

It can be seen that Jack Ma's mere reappearance gave Alibaba great confidence, and Liu Qiangdong's return and personal participation in food delivery made JD.com the hottest company in the first quarter. Outstanding entrepreneurs themselves are a force.

In contrast, Huang Zheng is now in his 40s and has not been embroiled in any public controversies. He is in his prime and has the ability and energy to navigate Pinduoduo and contribute to China's economy.

In his "2021 Annual Letter to Shareholders", Huang Zheng mentioned that he wanted to do some research in the fields of food science and life sciences.

Admittedly, research in the fields of food science and life sciences is also meaningful. However, amidst the unpredictable international economic situation, perhaps Pinduoduo's development needs the leadership of its founder, Huang Zheng.

Whether it's the temporary absence from the instant retail trend or Temu being affected by the tariff war, Pinduoduo's recent development has not been smooth sailing.

On the evening of May 27, Pinduoduo released its first-quarter 2025 financial report. The data showed that the company's operating profit for the quarter was 16.1 billion yuan, down 38% year-on-year; net profit attributable to shareholders was 14.7 billion yuan, down 47% year-on-year; and adjusted net profit was 16.9 billion yuan, down 45% year-on-year.

This is a relatively rare profit decline for Pinduoduo in recent years. If Huang Zheng could return to the spotlight at this time, it would undoubtedly be an encouragement to both the capital market and Pinduoduo employees.

Moreover, academic research and corporate endeavors are not contradictory. Just like Liang Jianzhang, who is also enthusiastic about population research and still shares some research insights on his personal account, Liang's presence still navigates Ctrip's major strategies. The figure of an outstanding entrepreneur is a reassuring pill.

As Huang Zheng said in an interview, "We are all products of our time. The situation is stronger than people. Under the broader environment, we just happen to be here, so we do our duty and do what we should do."

Now that the economic situation demands it and Pinduoduo is on the verge of change, can Huang Zheng return to his familiar position, re-lead Pinduoduo, empower China's economy, and do what he "should do"?

Disclaimer: This article comments based on the company's legally disclosed content and publicly available information, but the author does not guarantee the completeness or timeliness of the information.

Additionally: The stock market is risky, and investors should be cautious. This article does not constitute investment advice, and investors must make their own judgments regarding whether to invest.