"Father of LCD" Wang Dongsheng Aims to Carve Out a Share in the Chip Industry

![]() 06/06 2025

06/06 2025

![]() 575

575

By Leon

Edited by cc Sun Congying

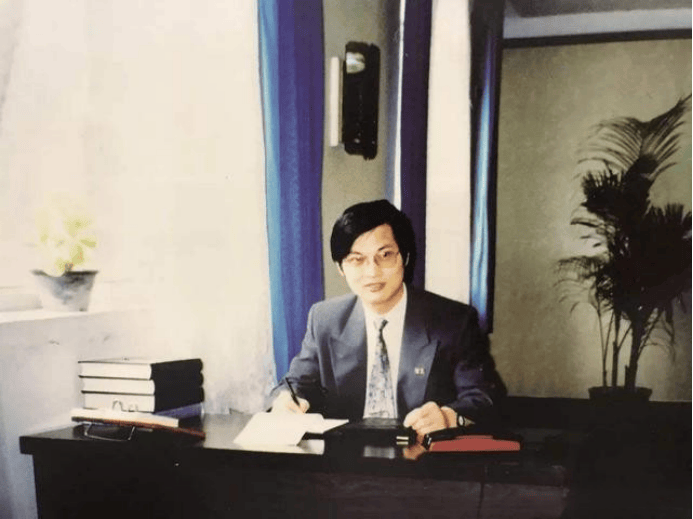

At 68, Wang Dongsheng, unlike retirees like Li Ka Shing and Warren Buffett, is still in his "pioneering" years. Recently, this "Father of China's LCD Industry" and founder of BOE (BOE Technology Group Co., Ltd.) led Beijing ESWIN Computing Technology Co., Ltd. (hereinafter referred to as "ESWIN Computing") to pursue an IPO on the Hong Kong stock exchange.

Founded in 2019, ESWIN Computing specializes in the design and R&D of RISC-V architecture chips, focusing on smart terminals and embodied intelligence markets. Currently, the company has raised funds up to the D round, totaling nearly 9 billion yuan. Founder Wang Dongsheng holds a 17.93% stake, making him the largest shareholder.

It's worth noting that in November 2024, another startup under Wang Dongsheng, Xi'an ESWIN Materials Technology Co., Ltd. (hereinafter referred to as "ESWIN Materials"), plans to list on the Shanghai STAR Market and is currently in the inquiry stage.

Having transitioned from the display industry to the chip and new materials industries, with two companies awaiting listing, Wang Dongsheng's second journey has only just begun.

"Father of LCD" Retires but Doesn't Rest: Seizing the Opportunity to Manufacture Chips

In China's display field, Wang Dongsheng is a legendary figure. In 1992, Wang Dongsheng took over the near-bankrupt Beijing Electron Tube Factory under critical circumstances. The next year, he led employees to raise 6.5 million yuan for share reform, and BOE was established.

While founding BOE was a trend in the early stages of China's reform and opening up, leading the transition from CRT to the LCD liquid crystal industry demonstrated Wang Dongsheng's vision. (For details, see: Achieving Mutual Success with the Times - An Exclusive Dialogue with Wang Dongsheng, the Father of China's LCD Display Industry)

In 2001, BOE entered the liquid crystal market by acquiring Hyundai's STN-LCD business in South Korea and later spent 380 million US dollars to acquire Hyundai's high-end TFI-LCD technology. During this process, BOE continuously accumulated technology and talent, laying the foundation for independent R&D.

In June 2019, Wang Dongsheng stepped down as Chairman of BOE, retreating behind the scenes. However, he didn't truly retire but quietly embarked on his second venture. In 2016, Wang Dongsheng founded Beijing ESWIN Technology Group Co., Ltd., serving as its legal representative and Chairman. Under this group, he controlled two operating entities, ESWIN Computing and ESWIN Materials, to enter the integrated circuit design and new materials industries. (For details, see: 7-Year-Old ESWIN Seeks Listing, Capital "Blindly Investing" in Wang Dongsheng?)

When a tech leader starts a new venture, it naturally garners significant attention from the capital market. After its establishment, ESWIN Computing successively obtained support from established VC firms like IDG Capital, CITIC, and Bohua. Currently, it has raised funds up to the D round, totaling nearly 9 billion yuan. Besides Wang Dongsheng's personal influence, RISC-V is also a crucial factor in capital's favor of ESWIN Computing.

Those familiar with computer hardware know that the key component determining device performance is the system-on-chip (SoC), such as CPUs and SoCs. The construction of SoCs relies on instruction set architectures, which are akin to a building's foundation. Currently, X86 and ARM architectures dominate the market. The former has ruled the PC market for decades, with representative companies like Intel and AMD; the latter is mainly aimed at mobile terminals like phones and tablets. Almost all self-developed SoCs from Apple, Samsung, MediaTek, and Xiaomi are ARM architectures.

In a relatively monopolistic environment, RISC-V, born in 2010, took a different approach and quickly captured the IoT device market with its open-source, streamlined, and low-power consumption characteristics, becoming the third-largest architecture. Its Foundation's premium members include technology giants like Qualcomm, Google, Intel, Alibaba Cloud, Tencent, and Huawei, and it is beginning to extend into fields like AI devices, in-vehicle systems, and robots.

"The fourth industrial revolution and the AI era have arrived, necessitating a rethink of the entire ICT technology and system of computers, communications, and electronics. This is the era background for us to choose RISC-V," Wang Dongsheng once explained his optimism towards the RISC-V architecture.

Despite entering the fast-growing RISC-V market, chip manufacturing is a capital-intensive industry with significant investments and long profit cycles, while also facing fierce market competition. During its five years of development, ESWIN Computing has accumulated technology, released high-performance products, and achieved a respectable market share, but it has yet to overcome profitability challenges.

Loss of 5 Billion Yuan Over Three Years, Excessive Dependence on Major Customers

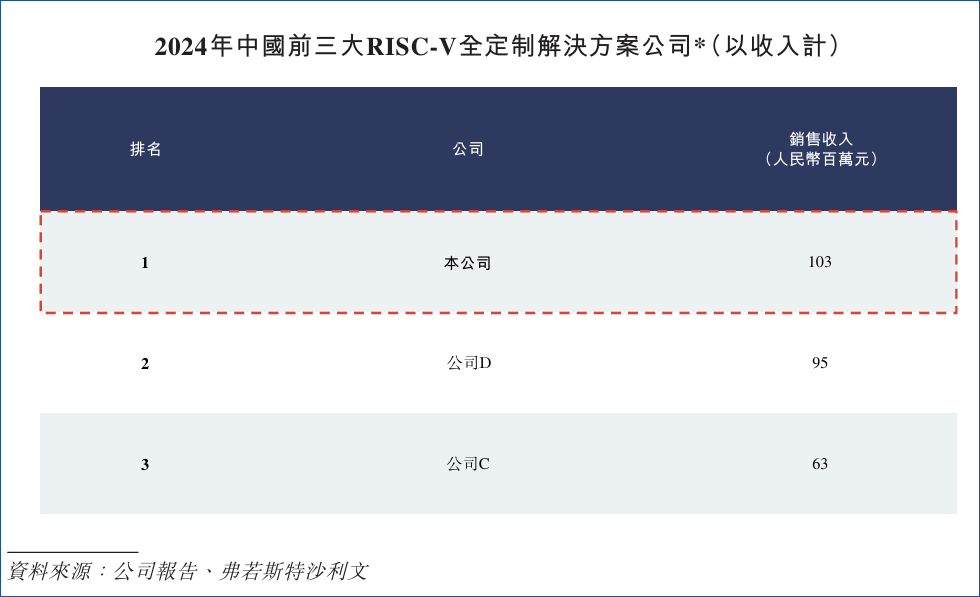

The prospectus shows that, in terms of revenue, ESWIN Computing was the largest RISC-V full-custom solution provider in China in 2024, with a market share of 5.7%. "Full-custom" refers to product lines including SoCs (System-on-Chips), MCUs (Microcontroller Units, mainly used in in-vehicle systems), and display chips.

Currently, ESWIN Computing's core products are primarily display chips. The prospectus lists two industry-leading products: RISC-V Smart Display Solutions and RISC-V Mini-LED Multimedia Processing Solutions. In the main control field, due to a relatively late start, ESWIN Computing ranks fourth with only a 1.0% market share. However, the 401% year-on-year growth in 2024 is still impressive.

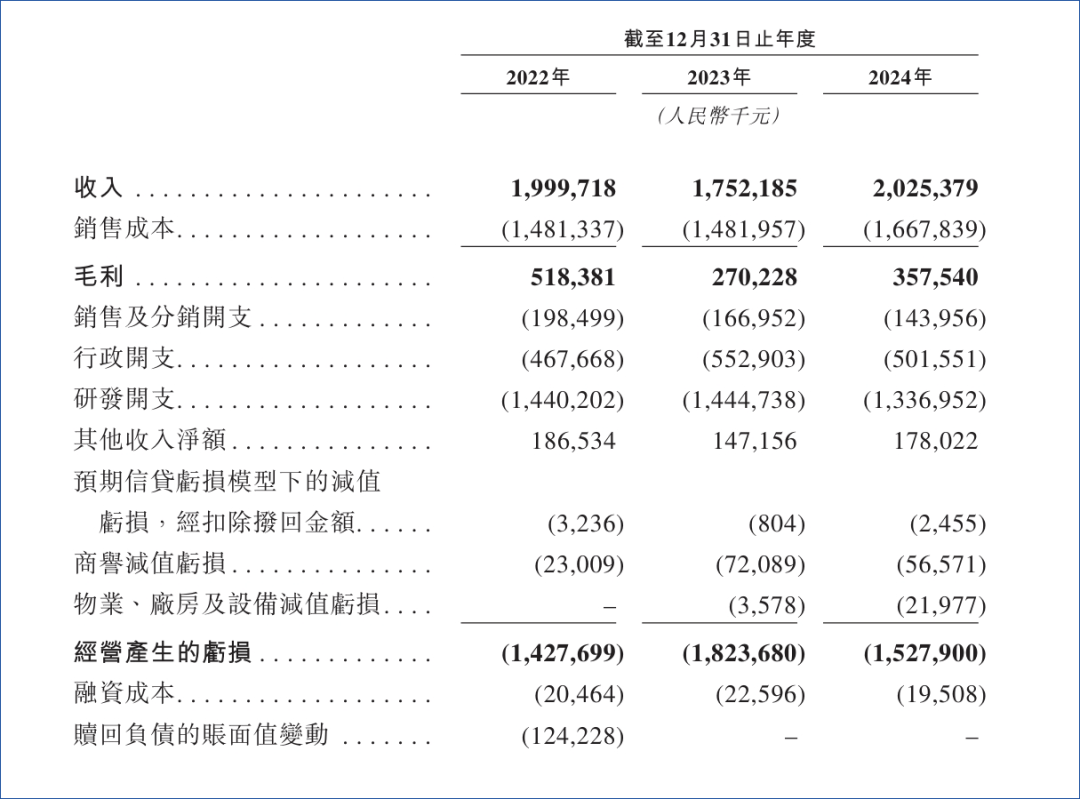

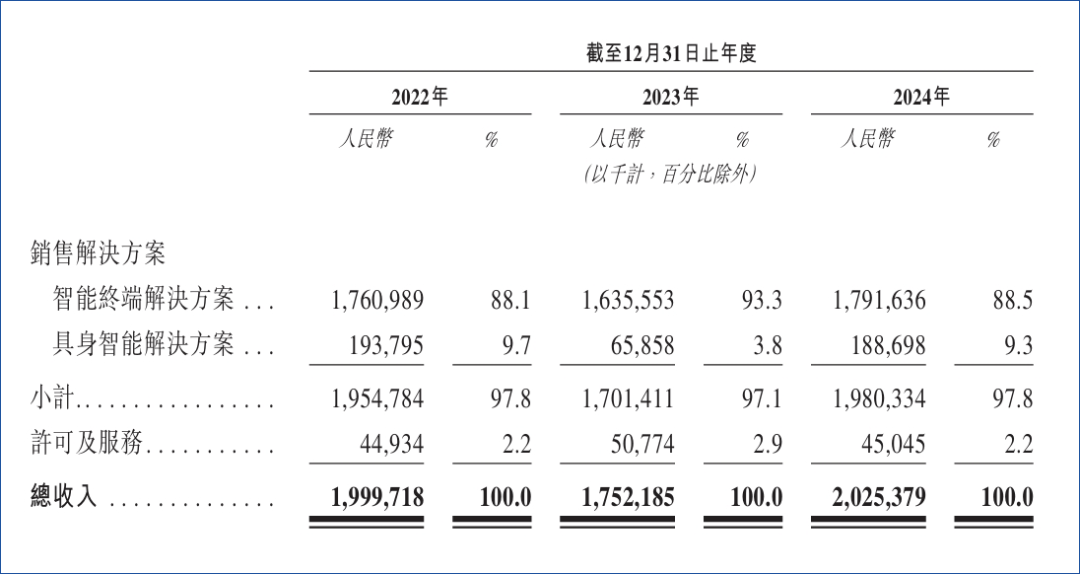

From a financial perspective, ESWIN Computing's revenue from 2022 to 2024 was 1.999 billion yuan, 1.752 billion yuan, and 2.025 billion yuan, respectively, showing stable performance. In terms of gross margin, it was 25.9%, 15.4%, and 17.7% for the three years, displaying a downward trend, which is related to industry competition and increased R&D investment.

For a chip design enterprise, technology is the only competitive advantage, and R&D investment is naturally significant. As of December 31, 2024, ESWIN Computing had nearly 1,300 R&D personnel and had applied for over 1,500 patents. The three-year cumulative R&D expenditure was approximately 4.22 billion yuan, accounting for 73% of the total revenue for those years. With continuous high R&D investment, ESWIN Computing is still in a loss state, with a cumulative operating loss of 4.777 billion yuan over three years.

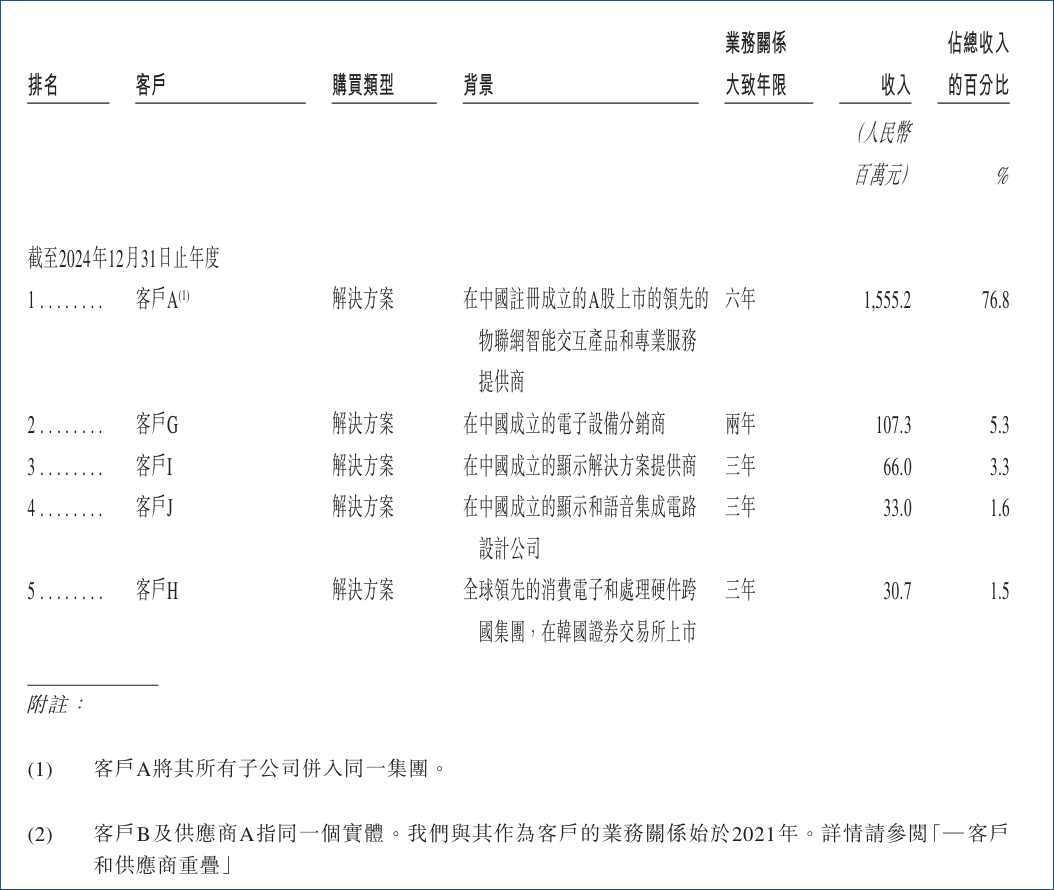

Additionally, what concerns the market more is ESWIN Computing's high dependence on a single customer. The prospectus reveals that among the company's top five customers, the three-year revenue share from Customer A (an A-share listed company incorporated in China, a supplier of IoT intelligent interactive products and professional services) reached 78.9%, 82.1%, and 76.8%, respectively. This has led to the smart terminal business occupying an absolutely dominant position, and the embodied intelligence segment urgently needs to be strengthened.

ESWIN Computing stated that there have been no significant interruptions or disputes in its cooperation with Customer A, but it also pointed out that if Customer A decides to terminate or reduce cooperation, it will significantly adversely impact future business, financial condition, and operating performance.

In response, ESWIN Computing is actively diversifying its customer base, such as establishing a distribution network, which accounted for 8.4% of revenue in 2024, and actively exploring overseas markets. At the product level, ESWIN Computing is beginning to focus on fields like robots, AI all-in-ones, and in-vehicle systems, gradually reducing its dependence on Customer A.

Exploring New Racetracks in the Red Ocean: Focusing on AI and In-Vehicle Systems

In February this year, ESWIN Computing released its self-developed 64-bit RISC-V AI SoC EIC77 series and its supporting development board. The SoC uses a 12nm process, with the CPU featuring an 8-core 64-bit design and built-in GPU, NPU, and DSP. With an AI performance of up to 40 TOPS (under INT8 data format), it is a highly capable and comprehensive main control chip.

According to official data, when running the DeepSeek-distill-qwen model with a parameter scale of 7b, the EIC77 series can achieve a maximum inference speed of 14 tokens/s. Besides being used to build AI PCs and servers, this series can also be applied in numerous scenarios such as autonomous driving, robots, drones, smart transportation, and industrial inspection.

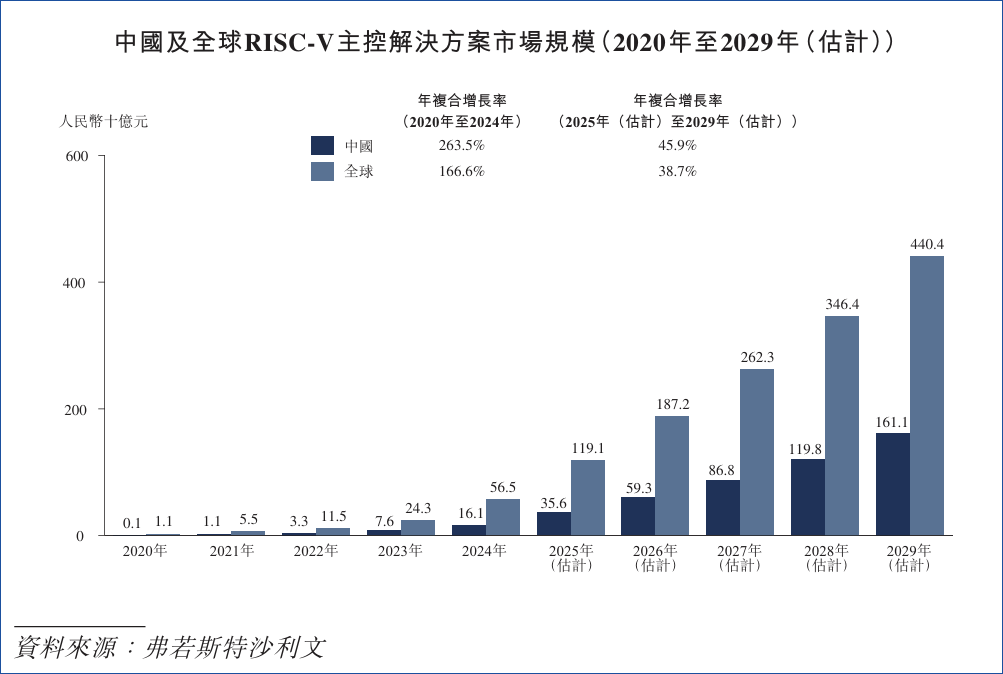

It's evident that RISC-V main control chips have broad market prospects. According to Frost & Sullivan data, by 2029, the global RISC-V main control chip market size will reach 440 billion yuan; the Chinese market will be 161 billion yuan, with a compound annual growth rate of 38.7% from 2025 to 2029. Additionally, SHD Group's report shows that RISC-V MCU in-vehicle chips and AI device chips are growing at the fastest rates and are submarkets requiring focused development.

Returning to ESWIN Computing, the launch of its self-developed killer main control chip has kicked off 2025 on a positive note. Its outstanding performance and wide range of application scenarios will help increase its market share and profit margins in the main control field. However, ESWIN Computing is facing a quasi-red ocean market. In the domestic RISC-V field alone, there are numerous strong competitors like GigaDevice, Alibaba's T-Head Semiconductor, and Core-Based Technology, making competition exceptionally fierce.

As of December 31, 2024, ESWIN Computing's total net assets were 3.627 billion yuan, with reserves (cash and cash equivalents) of 1.607 billion yuan, which is somewhat stretched without new financing. This Hong Kong IPO is undoubtedly aimed at alleviating financing pressure and bringing more confidence to future development.

It's worth noting that in April this year, Wang Dongsheng resigned as Chairman of ESWIN Computing, retaining only his position as a director, with General Manager Mi Peng taking over as Chairman. However, this doesn't mean Wang Dongsheng is truly retiring; he still serves as Chairman of ESWIN's parent company, driving the listing of both companies from behind the scenes.